Kenny Rogers was started as an alternate to QSR. And, today it is running 400 outlets in about 14 countries and is expanding aggressively to different parts of the world. Recently, the casual dining chain entered India by opening their first restaurant at Garden Galleria Mall, Noida. KRR which is managed by Malaysia based Berjaya Times Square has joined hands with Troika Hospitality India LLP to expand in India.

Bringing brand to India

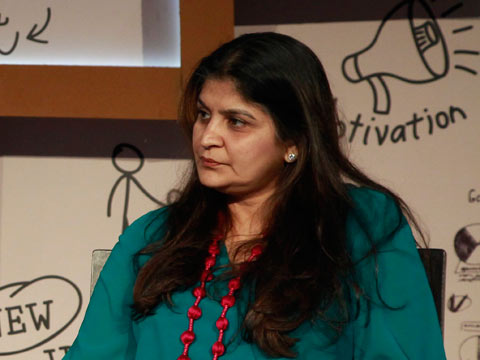

In food and beverages this is our first venture and my partners are based out of Malaysia and I am here looking after Indian operations. Kenny Rogers Roaster is Berjaya Times Square brand and they are also based out of Malaysia. And, since they know us from Malaysia itself they trust that we will do the proper justification with brand.

Partnership

Kenny Rogers Roasters was looking for a partner in India from last five to six years and were in talks with many of the people. They were looking for a partner who can work as per their requirement as this is the franchisor’s system and were looking for someone who was aggressive and has a knowledge of the Indian market well. And, ultimately they decided to go with us.

Entering franchising

It’s a partnership. We have got the master franchising rights for the brand in the country. They are having an experience of 400 outlets globally. We are only replicating their expertise here. So, that’s the way franchisee and franchisor works. We have got quality checks and two team members from Malaysia for two months and we also got eight members trained in Malaysia. In India we are planning to open minimum 10 plus outlets owned by Troika Hospitality and runned by Troika Hospitality and then we will be spreading with sub franchisee system. In that also we will manage the customer experience. It will be FOCO model because we don’t want to dilute the customer experience and change the KRR taste.

On Food

I don’t think there is any competition in the food we serve as it is entirely different to what is served till date in India. Nobody in India is serving rotisserie chicken and there is no brand having no flame kitchen. We are not adding any oil into food; our chicken is marinated and roasted in rotisserie which is made by KRR for all its outlets. The fat available in the chicken helps in getting it roasted and that’s way its tender and succulent because of the quality of the food we are serving.

We have got a huge menu- mock tails and soft drinks, soft drinks, muffins. For the first time in India we are serving muffins with dinner and lunch. We have got proprietary chicken items. We also built some items for Indian market like sauces named Ghost chilly etc. My menu is 70 per cent veg as all muffins, desserts, salads, wraps and drinks are vegetarian. 90 per cent items is original menu and we have added 10 per cent Indianised menu according to the market.

Supplying the right food

Proprietary foods are supplied by the franchisors. Other products are locally sourced and marinated in India.

On pricing

It’s a casual dining restaurant but we are very fairly priced. EPC along with a drink and quarter meal will cost around Rs 500-550.

Target Customer

Our target customers are everyone who is looking for healthy food. Everyone can boost that their food is delicious but nobody boosts that their food is healthy. Our tagline is deliciously healthy- our food is healthy along with delicious.

Expansion Plans

We are looking at opening 8-10 restaurants in coming years spreading all over India. We are planning at least three outlets by April. We have got massive pans and in India alone we will be opening 100 outlets in next 10 years. Our focus is Delhi-NCR for a couple of year’s expanding to Chandigarh and Ludhiana. We will focus on North India for next two years and then we will look for another market.

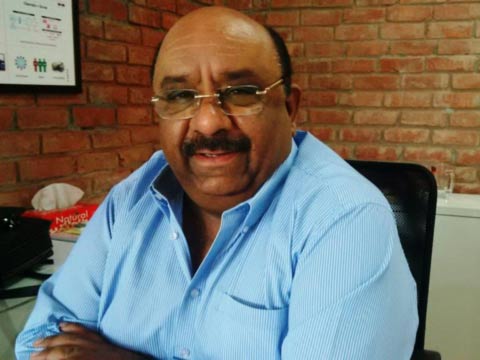

For all street food junkies who love lip-smacking roadside eateries but disgust them too for lack of hygiene, can now relish them fully without regretting over safety issues. India’s food safety regulator Food Safety and Standards Authority of India (FSSAI) has come down hard on street food vendors to sanitize road side snacks through multiple initiatives. Pawan Kumar Agarwal, the man in-charge of quality testing and CEO of FSSAI share the changes underway.

Tell us about your project ‘Clean Street Food’ and how will it help India tackle the hygiene issue?

Through this initiative of capacity building of food vendors we have found a model and we can do it across the country. This will benefit the poorest section of the society and also the citizen and consumers in many ways. As a country, we are not known for good hygiene and particularly there is concern about the basic hygiene. This initiative will help us in coming out of very crucial situation that is prevailing in the country. We are working with Ministry of Skill Development and other tourism and hospitality partners under Pradhanmantri Kaushal Yogna for capacity and skill building of the food vendors.

How does the recently launched FSSAI app empowers consumers?

FSSAI app is a free mobile application developed by FSSAI which would help consumers make informed food choices and bring to light the vendors who are operating without proper licenses and violating the safety norms. The app provides food safety tips, essential information about product and establishment and a hygiene rating for food product and outlet.

Would there be any acknowledgment for these vendors from the government?

Vendors would receive a government recognised certificate that would encourage them to continue upgrading their skills and knowledge through structured training to help them achieve a formal qualification.

Are food brands and restaurants also in the frame of quality testing?

We are working on a plan to bring all the restaurants in the food safety propaganda. We will partner with all food brands and restaurants in the country, train one member from each of them at FSSAI about the basic food safety and hygiene and they will be placed at these restaurants. Hence, it will become easier for both of us to make sure that the food served is meeting the basic hygiene tool and the person looking after it is trained by FSSAI.

How are you executing this initiative of providing safe street food?

We are planning to reach out to the smallest food vendors and see if they adopt the basic hygiene rule. In Phase I of the project, over two lakh street food vendors in identified areas would be taken up including all metropolitan and major cities, pilgrimage and tourist centres. There are 23,000 street food vendors in Delhi alone who are being trained, skilled and educated by our partners on hygiene factors. Based on the results, this would be rolled out in other places in the country. We are also planning to work out for Railways and Ports.

Ishan Grover is an expert in brewing and distilling from Heriot watt university Scotland. He started his career with Franchise of Lemp brewing company from St. Louis, USA in Gurgaon in 2011. At lemp Ishan introduced many unique beer flavours like chocolate beer and American pale ale, and became the first brewery to introduce the authentic lagers which were matured for 41 days. Today, he has set Gurgaon's biggest microbrewery chain “Manhattan Group" which currently have 5 microbreweries in Gurgaon and planning to open few more this year (Manhattan, The craft brewery, Open Tap, Uptown,Bronx). He has also crafted beer for top restaurants in India, including Quaff. Punjabi by nature and Lagom at Sohna Road.

What trend do you see in the industry when it comes to drinking culture?

Gurgaon is an IT hub and majority of people have travelled abroad or are expats. People already have an exposure to Craft beers from USA, Europe and Germany. Ever since microbreweries have opened up, people have stopped drinking the bottled beer and preference have changed towards fresh beer concept. Gurgaon is the only city in India to have 24 operational microbreweries and many more under construction. It is officially the Microbrewery capital of India. People appreciate fresh beer since it is very light on alcohol, even females really like to drink a lot of fresh wheat beer.

How are you promoting and creating awareness about brewing?

We conduct brewery walk through and brewing sessions at various breweries, we invite our guests to be a part of the brewing session so that they understand the complexity behind the art of brewing. It is one of the biggest challenges for me to educate people about various beer styles and brewing process, we also conduct one-on-one sessions on special requests.

Which according to you is the finest brewery in the area?

I strongly recommend Quaff at cyber which has opened just 2 months back, we have done innovations with some really unconventional beer styles like IPA (INDIA PALE ALE) Dunkelweizen ( DARK WHEAT BEER). Wheat, Premium lager and dark lager are very regular flavours found almost in all the breweries but Quaff had set new benchmark with its beers.

How do you see beer market growing in India?

Currently, Gurgaon alone is producing more then 2-2.5 Lakhs litres of Craft beer each month. At this moment only few state have allowed Microbrewery license, In 10 years when each state will allow the license for microbreweries, The craft beer revolution will be much bigger than what USA and Europe had seen.

What is your plan growing your own brand?

I am in touch with investors for a funding of Rs 150cr; we are introducing microbrewery chain in small cafe formats like CCD/ Starbucks all across India. Currently we are planning to open the format in Gurgaon and Chandigarh and then we are waiting for Delhi to give permission to microbreweries this year.

Tell us about expansion?

As a Master Brewer we are expanding our service to other cities as well, we have signed brewery in Pune which is going to be India's biggest Microbrewery which will produce 60,000 litres in a month. I am also doing 2 projects in Bangalore and 1 in Kolkata and Chandigarh.

With an indigenous approach to hospitality. He developed an appreciation for fine food because of his extensive exposure to some of the best restaurants in London and New York while working there in private banking and equity trading for a span of nine years. He partnered with Riyaaz Amlani, six years ago and came onboard with Impresario and is extensively involved in every aspects of the brands growth. Recently, Sid, together with Atul Sikand, creator and curator of Facebook’s busiest Indian recipe-sharing group, Sikandalous Cuisine; Tanveer Kwatra, Executive Chef, Le Meridien Gurgaon; and acclaimed restaurant critic and food blogger, Sourish Bhattacharyya has brought to Delhi’s customers’ ‘Asian Hawkers Market’, a three day feast for Asian Cuisine.

As you are the men behind bringing Social to Delhi. How does the response look like?

We had now nine social in total, three in Delhi, two in Bengaluru, and four in Mumbai. We are also planning to open two more Social in Delhi-NCR, one each at Epicuria Mall, Nehru Place and other at CyberHub, Gurgaon.

How does you finalise the locations for your outlets?

We have very strong team on board. My forte is food and Riyaaz forte is to find the best locations. We decide locations on looking at an area, what are people doing around that area and what’s the demand there.

How are you making each of your outlets different from other?

You go to a restaurant which is close to you. Some people go there to drink and some to work. The very important part of social is the workspace and it catches people who are close to that space. We also tweak the decor and design of each of the outlet. So, the CP outlet has a school theme to it. The trophies, the balls, the uniform everything makes it like a school. Also, we try to add some menu changes so that when you are working you try something different. Disco fry dish, clipboard menu. Patties and menu inspired from location of CP is the new addition. What according to you is the major change in F&B industry?

I think people are looking at more cuisine options. Earlier, they were stuck between Indian and Chinese. But, today there is lot more awareness about what people are doing around. Variety and value are two major points now that people are going to start with a restaurant.

What made you come up with another edition in just three months?

We did the first one in October and got phenomenal response. The response was great in terms of getting the catchment and getting restaurants on board. We had great footfall because we were trying to do which was never happened in the market, either bringing restaurants which people were not familiar of, or we have asked restaurants to do something which is typically not in their menu. Giving the customer an experience which never lasts, I think that caught all and we are here. Select CityWalk are actually were keen and we have signed a three years of deal with them to do many Asian Hawkers Market with them. We are planning at doing two in a year. One around October-November and one in February.

What are the criteria to bring restaurants on board?

It’s combination of couple of things- the restaurant should be pioneer of Asian cuisines in India. We also focus on balancing the cuisines- suppose we are having 30 Chinese restaurants and we see that there is underweight in a particular cuisine so we may reach out to a Thai restaurant and say you may fit here. It’s all about balancing the menu and offering it to the customers’.

How and when Twiss came into existence?

Twiss was launched in UK in 2011. It is a combination of two fruits or herbs Complementing each other and giving new twist to its delivery in taste and that’s why we call it as great Twiss. Mango itself is a great testing food, but by adding lime we just made it taste better. This is how the whole idea took place and we launched the brand. The brand is now widely accepted and doing reasonably well in UK.

Tell us about your brand and the flavors it offers?

In the sparkling fruit juice category we have launched four products namely mango with lime, passion with orange, lemon with mint and apple with blackcurrant in 250 ml can priced at Rs 40. The shelf life of our drink is 18 months.

We will not say we are organic. There is a small niche of consumers who are talking of organic, but the mass consumer still consumes the normal products. Our products contain Argentinean lime, it’s not very limy, but it’s a very smooth. We have got our established product range existing in UK. We have got a pipeline of more quirky flavors meeting Indianised requirement.

Who are your target customers?

We probably target 16 to 28 years old. Primarily students from colleges, universities who have certain amount of disposable income or pocket money, which they easily shell out. As per our research the acceptability for our flavor and taste among youth is high.

What inspired you to launch Twisss in India?

We think that the market is much bigger outside in terms of innovation, then we looked at India. We have done lots of research and found that in the sparkling drink category India has colas and flavored carbonates like Mirinda, Coke, Sprite, 7up among others, but the concept of sparkling fruit juice did not exist. There is only brand in the sparkling drink category that is Appy Fizz. This is the reason we thought that in India there is a good opportunity where no one is present and we felt we have something which is really good.

What about producing in India?

The question was where do we get it manufactured, eventually we decided to get it manufactured in India, so that we would have some cost advantages and it would be perfectly fitting with Make In India, Made In India and Made For India concept.

We source our fruits, which are quite global in nature. Mango is very much local product, but passion has grown in many places like Kerala and North-East region and we would like to explore the opportunity of getting it locally, which would save us on a lot of prospects. Around 70 percent of our products are domestically sourced and 30 percent are imported.

How healthy is the drink for diabetic prone Indian consumers?

It is a choice of consumer to drink or not. . Advice is, you drink everything in moderation and then you have your exercise ready to keep sugar in control. It’s refreshment drink.

Which are the cities you are primarily looking to target and what are your future expansion plans?

We are looking at cities like Mumbai, Pune, Bengaluru, Chennai, Hyderabad and Delhi.

We have identified about 50 towns; the metros, tier I, II and III. We would like to tap almost all A and B category of retailers. Also, we are exploring the opportunity to tying up with some of the QSR's and ethnic local food chains where they serve spicy and aromatic food, which needs this kind of sparkling drink to go along with.

Internationally we are looking to venture into Gulf and Middle-East region.

What about your online presence?

We are excited about the big proliferation of e-commerce in India, especially in online grocery. Coming summer we will be dealing with Groffers.com and Bigbasket.com.

Any plan of launching your own e-commerce portal?

No not as of now. We will launch the consumer engagement app, but not the commercial app availing purchase option as we only have soft drink. Consumer engagement app will be launched to gain ideas on how to engage with consumers from a marketing perspective.

How do you see the Indian beverage market three years from now?

The market will get more innovative with appeal by PM Modi to the soft drink players to add two percent of fruit juice. More players will get into the market and will grow the category. There will be place for everyone.

Beverage market has grown by almost 14 to 15 percent since last three to four years. I expect that the growth will continue with more players coming in.The market is around Rs 14000 cr to Rs 15000 cr in India.

What is the target revenue?

On an average we are targeting Rs 20 cr of turnover by the end of the year.

What is the training given to the EWD to bring them to work?

LTH believes that the brand should stand for more than ‘just profit’ and we are driving the brand to become truly Indian and trusted. In order for us to make these values a part of our DNA, we have focused our efforts on creating a socially inclusive work environment.

Our Employees With Disability (EWD) are often trained by the NGO/training company (through whom we source them) in soft skills and life skills and maybe hospitality skills too. These training modules can be anywhere from 1 to 3 months and in some cases 1 year. Once EWD join Lemon Tree Hotels, we then train them to do the tasks in their specific work areas, e.g. Housekeeping, Food & Beverage Service, etc.

What is the procedure of preparing them?

We believe that people with disabilities (which can be physical, social or economic disabilities leading to an opportunity deprivation) must be provided the same opportunities as others to realize their full potential and allow them to live with dignity. By creating a supportive environment in the organization that allows them to deliver their best, we are able to play a part, however small, in social inclusiveness, opportunity/livelihood creation and therefore nation building.

It is important to first brief and sensitizes the entire employee team at Lemon Tree and then welcome EWDs on board. This ensures they are made to feel comfortable and welcomed as part of the team. We have set up a ‘buddy’ system in the company where an existing employee is assigned as a buddy to the new EWD who helps him/her understand and learn his/her job and also helps with explaining processes and norms in the company.

What is the salary offered to them? Is it the same as others?

Yes, salary and benefits are the same as employees without disabilities and they work the same 9 hour shift.. Our policy of hiring EWD is a part of our business model and central to the way we work.

What are some of the morale boosting measures taken at the workplace for EWD??

The idea that we are welcoming them to be an important part of our company is the biggest morale boosting factor. This means they are being treated equally as others and with respect. Something which all persons with disability (PwD) consider very important for themselves.

As part of our regular HR processes, EWD also get a chance to have regular Engagement Chats with the Hotel General Manager, participate in all team activities, get the opportunity to win recognition and reward and are a central part of our monthly town halls. Even when the team does fun activities (inside or outside the hotel) they ensure the participation of all EWD.

How many employees are presently disabled at Lemon Tree?

We currently have ~400 EWDs in the employee base, who are Speech & Hearing Impaired (SHI), Orthopaedically Handicapped (OH) and Down syndrome or Autistic. They work across Housekeeping, Kitchen Stewarding, Food & Beverage Service and Finance/Stores. This is 13% of our total staffing at 27 hotels owned/operated across 16 cities in India.

How does their growth look like?

Our goal is to take this to 460-470 EWDs or ~15% by end March 2016. And then to 25% of the employee base by 2025.

Over the years CCD has grown as one of the preferred hangout joints for youth.. With approximately 1500 outlets in India, the cafe chain has recently raised its IPO.

As CCD has brought a menu revamping after ages what is your expectation from it?

We started this process of restructuring our food and beverages in 2011. And, as we have grown in almost 235 cities in India, it is very difficult for us to serve our customer in the same way. We have done a lot of restructuring at the backend to make sure we are consistent. We need to have a process control to make sure it happens. Being one of the leading F&B retail in the market we need to be very consistent about whatever we do. Hence, it did take us lot of time to bring out the powerful menu.

Do you think it’s an innovational step, looking at company’s growth?

This is one of the biggest initiatives we have taken so far.. If you look at the list of items included, it was not easy for us to ensure the standard operating process at the backend.

How much research went into launching this menu?

We do lots of consumer research on a regular basis with focus on youth. We focus on their inspirations and needs. We are also doing meetings in tier II cities to understand what people look for while eating out.

What were the two major picks in the menu that came from the customers’?

Two major things that were observed as a result were a) Youth demanded something international, trendy with bright colours and b) Something which meet their taste.

What changes did you observe depending on the regions?

Cities like Hyderabad and Chennai are not much transformed but the IT Hubs in such places are also changing. Every time we go for a research we find something different. When we were launching smokey chicken, the result was not good, consumer didn’t like it. That means Indian consumer don’t like the smokey products as they said it’s too strong. They want their meal to be more flavourful and simple.

Is the supermenu a new additionto the healthy food choice?

I will say it is a mix. I have a belief that when we go out we want to indulge. I think we as people have to balance ourselves, but as a brand one has to give some offerings which are healthy- no preservative, no cream, which reduces sugar level. We may launch salad next summer.

What percentage of cities is covered under the newly launched menu?

We have covered almost 80 per cent of all cities.

What is the training given to the disabled people to bring them to work?

Yum!’s mission is ‘Growth with a big heart’ which translates into our strong belief of giving back to the communities in which we work and live, making a positive difference in the lives of all stakeholders. One of the initiatives undertaken to bring alive this mission is to serve the community in a meaningful manner by providing employment to the specially-abled (hearing and speech impaired) which is imperative for their empowerment. This programme was launched in the country through our flagship brand – KFC. To achieve the desired goal of growth of such employees, we have worked a 360-degree approach which works right through hiring to the career progression – through training, enabling work environment, engaging with them and assisting their development for growth.

How is the response so far?

As a testimony to our achievements in this regard, KFC was awarded with the prestigious National Award for the Empowerment of Persons with Dissabilities-2014 by the Ministry of Social Justice and Empowerment, Department of Disability Affairs, Government of India. The award recognized our contribution as an employer of people with disabilities providing them the opportunity to harness their professional aspirations and potential.

How are they hired?

We work very closely with NGO’s like DEF Hyderabad & VRC Hyderabad, Silence Kolkata, Traain Mumbai in their respective cities to build up this noble cause. We use their expertise to recruit & sensitize our store teams. We also have an internal team that supervises and closely manages the entire program.

What is the procedure of getting them ready?

We have a detailed orientation program for our specially-abled employees. It incorporates the use of visual training aids and technology to induct them into the system. We also have an internal team that supervises and closely manages the entire program. Moreover, we have also partnered with different organizations in different cities, who train our managers and interpreters in specially-abled KFC outlets. In addition, we have instituted a special curriculum at our Yum! Academy and since its inception in November 2012, it has completed 2 batches and facilitated the training of 54 specially-abled youth.

What is the salary offered to them? Is it the same as others?

We believe in creating equal opportunities for all our employees. The pay-scale is therefore same for all. Through our initiatives we have instilled a sense of faith and belief in them, making them feel same as other employees.

What is the hiring process?

We have tied up with NGO’s like DEF Hyderabad & VRC Hyderabad, Silence Kolkata and Traain Mumbai in respective cities to build up this noble cause. We use their expertise to recruit & sensitize our store teams. We also use channels likeadvertising, pamphlets, word of mouth, database SMSing etc. to source employees. To induct them into the system, we work on a 360-degree approach which works right through hiring to the career progression. We train, engage, assist and enable a sound work environment for them to achieve desired goal of growth.

How many employees are presently disabled at KFC?

The Yum! Academy works in line with our commitment to ‘Growth with a Big Heart’ and since the inception of this program in November 2012, Yum! Academy has completed 12 batches and facilitated the training of 250 specially-abled youth. The Special KFC initiative provides employment to the deaf community and the Yum Academy provides skills to persons in the deaf community who are interested in seeking jobs in the retail hospitality sector. From having started this programme with one KFC store, it is now running successfully across 19 stores. We plan to open 1 specially-abled store for every 10 stores we have.

How does their growth look like?

Their growth looks extremely promising. Our recent achievement in this regard has been the six speech and hearing impaired Shift Managers who successfully cleared our internal process to rise through the ranks and very soon we will have our first specially-abled Restaurant General Manager soon. We have come across so many instances that accentuate the amount of affirmative change these specially-abled employees witnessed in their lives after their employment with KFC. We have witnessed an increased sense of pride not in just the specially-abled working at KFCs but also their family and peers. With this initiative, we want to give these specially-abled employees the same platform as anyone else who wants to grow in KFC’s fold.

K Hospitality Corp was founded over 40 years ago in Mumbai. Since its launch, Copper Chimney has been considered a pioneer in the Indian restaurant space, with a live open kitchen, one of the first in India, along with superlative tasty Indian food served in a high-end ambience.

Bombay Brasserie is a brand from the house of the ‘Legendary Copper Chimney’. The Brasserie, has been conceptualized and created to have a niche of its own and celebrate the Flavours of India. Years of research and development have resulted in a culinary journey that takes you from traditional royal kitchens, to the secret recipes from a mother’s kitchen.

Coming from the family of Copper Chimney. How was Bombay Brasserie born?

Bombay Brasserie was launched two years back in Coimbatore, which is a small city, as we wanted to test the brand in tier II cities. Being, a part of Copper chimney family, we have expertise in Indian Cuisine who have given a contemporary touch to the resaturant menu.

What quality makes Bombay Brasserie a part of Copper Chimney group?

Bombay Brasserie is a traditional Indian restaurant presented in a contemporary manner. It is a fresh new take on Indian cuisine. We have given a Bombay touch to the environment. We have some interesting food items which appeals to all generation. And the restaurant is a bigger spectrum of Indian cuisine. We have also focused on location by opening three outlets at the Bungalow. We also have Indian artwork to bring in the essence into the environment. Our presentation is unique, lighter.

What are the design elements incorporated in the outlets?

Bombay Brasserie is the culmination of that long and priceless process – a unique bouquet of flavours. All this is rendered in a smart and youthful, yet warm and simplistic style. The restaurants are contemporary with a touch of lovely white, fresh blue colours and some ancient features like old cupboards to give the ancient touch to it. So, the feel is very fresh.

How do you view franchising as a business model?

Franchising is a set system and procedure. So, we have fundamental systems, procedures which we train to the franchisee and also monitor them, hold them. We prefer owner operator, where they are present for day to day business and is also passionate about business.

What are the criteria that you look into a franchisee partner?

We want to expand with entrepreneurs who can run the business on their own. We are looking for single unit operator also. But, the person should have a passion and love for driving the bsuiness.

How many outlets you are operating today? And what is the expansion plan?

At present, we are operating in cities like, Coimbatore, Chennai and Kolkata. We are also planning to enter cities like Delhi, Gurgaon, Noida, Bengaluru and Kochi in the near future.

What is your view on the current food trend in India?

Indian food is there to stay. Other cuisines are also making a way into the Indian market, but I think Indian cuisine has to come forward in more smarter, lighter and fresh format.

What is the business format for operating a Subway franchisee outlet in India?

Subway is a privately held company and the world’s largest restaurant chain. All Subway restaurants are individually owned and operated by independent franchisees and there are no company-owned stores. The brand operates globally on a franchise-based business model. It offers great franchise opportunities to entrepreneurs who believe in the Subway brand and desire to be a part of its success story. The low start-up cost, simple operation and flexible floor plans make the chain appealing to potential franchisees. Besides traditional restaurant formats, Subway franchisees can also opt for non-traditional restaurant locations like airport terminals, hospitals and universities.

What are the supports Subway provide to its franchisees?

The company provides training and support to franchisees through its world headquarters in Milford, Connecticut, USA; five regional offices and various country offices across the globe. This facilitates seamless integration of franchisees into Subway family. Franchisees are supported by dedicated locally based Development Agents and their staff that provide additional business expertise.

What are the elements that one needs to keep in mind while choosing a Master franchisee and a Sub-franchisee?

All Subway restaurants are individually owned and operated by independent franchisees. We do not have Master franchisees in our system but many of our franchisees are multiple unit operators. The main consideration would be investment followed by management bandwidth to operate multiple outlets.

Facts about Subway franchise:

| Investment Required | Rs 45-66 Lakh

|

| Area | 250-2000 sq ft/restaurant

|

| Licensing Fee | Rs 6,00,000 |

How does one decide on locations? Is the franchisor or the franchisee responsible for taking such decisions?

Given Subway’s flexible floor plans almost any site could be utilized to open a Subway restaurant. If any entrepreneur is keen to become a Subway franchisee and has a property that could make for a great Subway restaurant location, he/she can submit their location to the development agent for review.

All real estate selections for Subway restaurants begin with a proposal to a local Development Agent submitted as described above. The initial draft of the lease for desired locations is sent to a representative of Subway Real Estate LLC. (SRE) SRE then negotiates provisions with the landlord and arrives at a lease that meets both the landlord’s and tenant’s needs. The final decision to open a Subway restaurant at a location is taken by the development agent.

What is the Revenue Sharing model between the two?

Subway has a royalty of eight per cent and marketing fund contribution of 4.5 per cent

What is the Growth Prospects and Future agenda for the segments in India? Who is your top selling franchisee?

It was in 2001 that Subway opened its first store in the Indian market. Today, Subway has 500 plus restaurants in more than 70 Indian cities and expects to add 100 more restaurants by the end of this year.

Barbeque Nation is one of the first restaurants to start the concept of Do It Yourself, backed by CX Partners which has a 25 per cent stake in the company, the restaurant chain today has minimum attrition rate of about 39 per cent as compared to the industry where it touches approximately 70-80per cent or more in a month. With a plan to open about 100 restaurants in next two years, Barbeque Nation has average strength of 4.7 customers per table. Here is the excerpt from the interview:

What’s keeping you busy these days?

We are busy doing our expansion. Our plan is to sit at 100 restaurants from two years from now which means we will be doubling the store count from now which is 52. From the industry perspective you can see that there are lots of food aggregators today in the metros and they are providing you the dining option at the comfort of your home or office.

Are you planning to go the online way as other restaurants are keen on sharing online space?

We have so far resisted the temptation to go that way because we think that the experience we give is very typical to having dining experience in restaurants. We want our customers to come, enjoy, and feel free at the long 130 minutes which we give. It is not only value for money that they realise but also value for their time that they are spending. It is going to be very difficult to replicate that experience that we give, unlimited stuff at limited price. And we are not very sure that this something we want to do and our customers will be content and delighted by this. So, once we arrive at some sort of conclusion about the right business model for us we might think about it.

What is your view on the current trend that is backed by the food aggregators?

Food aggregators’ have taken the market by storm, I myself is their customer. I order my food from Freshmenu where they deliver within 45 minutes which is a reasonable period of time. They have a fresh and new menu every day and they deliver fresh so I like the way these concept are growing and they will have bright future as their market is growing.

Why investors are tempted to invest in the casual dining format?

Casual dining has the brands which is for the masses rather than for classes which means that your break even or future growth is more and fast paced and there is the flexibility because if you go to a fine-dine concept you have to stick to it or otherwise you have to kill the brand and do something else. Meanwhile customer’s sentiments are also a major point because casual dining segment is giving them the run for their money. Every day we are bombarded with food suggestions including and not limiting to the Masterchef Australia and shows that are there because every day there is bombardment on your senses, Fox Life is mostly about food and they present it in such a way that they show it as a way of life and not just recipe which is cooked in the world. It is connection to the daily life that breeds life into that food.

How is casual dining different from that of a fine dine model?

Fine dining concept is driven by a very specific theme of food and you employ specialist to deliver that kind of food and you stick to it. So, if there is a Punjab Grill you pretty much know what they are going to give and if there is a theme restaurant you know what you are going to get there because they have very specific cuisine to offer. You don’t find any influences there. Whereas for a casual dining brand it is more flexible to incorporate more elements of culinary experience among the chefs, use those abilities in the menu and give a wider selection to customers and satisfy your guest in more ways than one. So, casual dining chain is now flavour of the season in terms of food brands going further. Having said that fine dining space will remain there because there will be some set of people who will go there to experience and enjoy the culinary aspects where the food is the king. In casual dining food is not the king, experience is the king. For us it is an unlimited indulgence.

How has technology impacted your business?

Technology powers everything. We constantly have to see what the cutting edge of technology is. Few years back Face Book impact wasn’t so much but today they are an influencer. They won’t take the decision but they will help you take the decision. There are some reviewers on Zomato who are very famous on their own because they have a huge following which means people actually follow what they say and it helps in making the decision. So, Eight years back when we started the business there was nothing like that but today we are effectively tied up with Zomato, Evening Flavours and Just Dial. We are constantly updating, what is the impact of these online media, how can it affect our business.

Being a global brand, how do you decide on your partners?

We are a highly reputed and global brand and this calls for two things- one we are of a scale, so we have to choose partners who can give us scale which means they have capital to invest and they have very strong organisation culture to give similar values and the work culture we talk about. So we need partners who can build such type of organisation- build team, sustain team and grow the business. Second, we look for partners who are committed to the long-term call and are about food safety aspects that we follow in the whole world.

Who is responsible for choosing the right locations when it comes to opening of stores?

In our case, the franchisee partners runs the business so they are responsible for building up the organisation and searching for location. They build partnerships with the retailer, mall developer, builder or a developer. One very strong criterion that we believe in is what should be the location for different kinds of towns. And we have certain parameters on approving this.

How many restaurants Pizza Hut you are planning to open in India?

India is going to be the largest market for consumer in terms of consumption by 2030. We believe that we are sitting on a national opportunity. And we see a potential of 1,000 of restaurants in India.

At Pizza Hut, we have grown to about 400 stores so far in last 15 years. But now, we are planning to double the stores in next 5 years opening around 800-1,000 stores by 2020.

How difficult or easy it is maintaining cordial relations with your partners?

If your selection criteria is very strong and you have taken time to choose the right partner, then running the business is less challenging. I think in that we are fortunate, we have fantastic franchising partners who are very strategic. So, we don’t discuss and debate much on the relationship aspect.

On the other hand, if you have a concept where you have a multiple number of small franchisees and with the diversity of the franchisee partners, that’s where you need to focus more time on building relations.

Which are the cities where we can see Pizza Hut growing?

We are growing in Delhi, Bengaluru, Mumbai, Hyderabad and we are also getting into state capitals and beyond. In the last three months, we have opened outlets at Gaya, Alwar, Silchar, Malda and any city which has a population of about 3-5 lakh will have a Pizza Hut store.

As you are the largest providers of F&B services for travelers. What growth can we see in India?

As I said before I have seen that the growth is growing 20 percent in India. And our sale continuously going to increase and even Lite bite Foods has said that we want to target around 500 crores in 4-5 years from now. The real potential can’t be estimated. Airports are easier but railways have more potential. Even nobody is in highway, nobody know what sales will it bring. So, we want to take the first part of the call.

Which according to you is the best revenue generating location when it comes to travel?

Airports are the best location. Even in airports you have to see different sectors. I see mainly three sectors i.e. Location, location and location. We look at low fare airports, leisure airports and business airports.

Tell us something about your partnership with Lite Bite Foods. What all locations are you targeting in India?

We have many partnerships outside. Partnerships are always very existing part. We always team up with local partner, with family companies to marketise.

For example, two years back in Vietnam we started, now we are 6 airports and planning more outlets. We have three airports in Indonesia, all are local partners. We are targeting especially three sections i.e. airports, train stations and highways. Our primes focus will be airports. Second will be railway stations, if government does some changes, railway stations will have more potential than airports.

Which are some of the brands who are your biggest partners? Which according to you is the traveler’s choice?

I had just said that we have a very old concept for our company. I am reluctant to talk about any brands. Globally we have relationship with major brands like pizza, KFC etc. We look at market, democracy, consumers and then we decide what fit best for that.

Our company is in this business for more than 150 years. We see reliable partners and where we can see to extend our partnership, we do so. Travelers are of different types. There are travelers who travel twice or thrice in a week, for them it is natural. But when they travel with family, they make different choices. And the choice depends on different occasion and purpose of travel.

What are the unique experiences that make HMS Host different from any other service providers?

“We are seen global but act local”. Our company is known for the good management. We are also business provider, Food & beverages, hospitality and our biggest assets is our people our staff. We spend lot of time in interacting, training and educating our people. We also promote our people in turnover. We are unique because of our operational skills which focus expertise, right time, right number of staff, right concepts, right opening hours etc.

We also development skills, analyze airports, understand the need of the travelers, which concept should be use and where. 900 million people come every year in our restaurant. We understand the need of our customers.

What is your expansion plans?

We want our market share in Europe and in America. And internationally, China, Southeast Asia, India, UAE and Middle East.

Are you planning to sign any franchisee deal?

We have some plans of franchise in future. We are working on Italian concepts; Italian food and we are even doing some tests on them. I won’t exclude that opportunity.

Tell us about your operations in India. How is the response so far?

Johnny Rocket as a brand has done well for a year and half in India and even the response is also good. Now we are looking at pan India expansion, but not an aggressive expansion because our focuses is getting the right location and working on outlet and making it profitable. Unlike other chains that grow aggressively, we grow slowly and our location should be ideal. We want the restaurant to be profitable and we are working on that and other aspects like product or service delivery. We are happy with all our developments.

We have seen lots of food brands entering under the same segment. Do you see any threat from any of the brand?

When a brand enters any market, there is competition, and we are under casual dinning segment. I don’t see any threat because I am very confident about our product which we are selling. It has an edge over others on which we have really worked hard. All the products and even the menu are American but at the same time it is developed with 100 percent local ingredients. There are just one or two sauces which we have imported but now I am working on it. I have been a part of this restaurant as an operator for two years.

What are the legalities involved in bringing a global brand to the Indian market?

When you bring a brand in a country, you have to look into a number of things. From legal aspect, I really don’t think the local authorities have any issue of brining a brand into but legalities in terms of company, will it invest with you or not. In India, this company is owned by us. The three partners Vishal Chawdhary, Sachin Goyal, Gurav Sharma, owned the brand and they tied up and brought it here.

You have to pay royalties, new store opening free etc. We also compile to all legal laws which are associated in operating a restaurant.

What according to you, the contribution of a good menu in a restaurant business?

This is one of the most important aspects to bring a menu which connects with the people according to their palates and a good mix of varieties. Menu is very American in our case. It has developed a lot of vegetarian options keeping the taste profile in mind with original taste. We tried to bring specific dishes of Indian taste like Tandori Flavor or Indian in nature but have not done well in our menu.

If you go to Johnny Rockets, you will want to experience it, a new image American operation. We call it “American express”, typical American operation and that we have managed.

As you are operating under the casual dining segment. What is your view on the current trends in restaurant industry? Which trend is getting hot these days?

If u looks around, lot of non industry people entering the market and that in a way is very good as they are coming with a very fresh perspective and approach. It is a very nice work and they want to do in a specialized line and give you vibrancy and the music is contemporary. They are contributing a lot in the overall development of the restaurant industry. Seasoned players are also opening with new concepts.

What is the contemporary food you make, especially for Delhites?

The word contemporary has many interpretations. So when we say contemporary, we don’t do. We work on aspects like making it healthier like using natural flavors and use 100 percent meat. Most of the company who are in this trade can sell a burger much cheaper than us because the protein they use is only 30-40 percent and rest other things is only fillers. So they can sell cheaper. Our protein or shakes are 100 percent pure.

It is said “Quality comes with price”. The entire cooking medium in our organization is all Trans fat free and that comes 30 percent more expensive than the regular brands in the market. These initiatives which we have taken up will carry us further.

What is your expansion plan, as we can see that Johnny Rockets is going very slow when it comes to throwing number of outlets?

Like earlier I said, we want to go really slow and cautious and make sure that in each outlet we put enough effort to enhance everything that we want to create till we reach 100 percent.

Along with that we are working on cost down and brand specific equipments which we have to procure from US. The amount of taxation and import duty is very high and we are also exploring as of now. Currently initial development is in mall only and then we would like to go high street and restaurants.

As per your observation and experience, how international cuisines are helping the Indian restaurants to grow manifolds?

Beauty of this well established concept from developed countries is very well formatted; right from their supply chain is formatted. The operation, the way they run operation is well documented and everything is defined. When they want to enter in the market like India or countries which are not developed that much, it helps us to format ourselves. The children or people, who will work with us, will get the exposure.

Shawarma Xpress, is a Quick Service Restaurant concept that began operations with its first outlet in 2001, the first Drive thru in 2006 and establishing presence in the Prestigious Bahrain City Centre Mall in 2008. Founded by two brothers- Saleh and Firas Al Khor, this innovative concept was developed after careful planning, intensive market research and valuable experience gathered within the Quick Service Industry. Being passionate about the Shawarma, they identified the niche market for the Launch of Shawarma Xpress.

You are operating five outlets in India. How has been the journey so far and what is you expansion plan?

The brand is gradually growing in India. We are operating five restaurants of which we have opened three in last couple of months which are successfully running now. We will move from master franchise model to sub franchise where the people with less capital can also work with us supported by our India-based master franchise one. Our plan is to get around 50 restaurants opened in the next five years in the north-eastern region of India. Moreover, we are planning to move to the southern and western region.

Who are your targeted customers in all the regions of India?

The customers we are looking at are the broad and mid range of income group. We have increased our range so that we have a lot more vegetable product. We have now a 50-50 range of vegetable and non-vegetable products. Predominantly, the targeted age group is 18-45 years.

You mentioned that you want to expand your business in the north-eastern region of India. Can you name some cities?

We want to enter various regions of north India. We will probably move out from the centre, which is Delhi, and will try to move out in the nearest region to Delhi expanding further to other cities and states.

As the real estate or property prices are on a great hike day by day. What is your target location, the mall or the high street?

We will probably look for the mixed location. We would normally look at the broad spread of the mall and the high street. The mall has an advantage in some ways that it is has a smaller unit with a concentrated customer flow; however, it has also a restricted customer flow because malls close early. In the right high street at right prices it can be more profitable as it trades later than the mall so it has high potential. So we will look for the broad spread of areas.

What is your unique marketing strategy to place your brand in the Indian market?

As everybody knows that the Shawarma product is an Arabian product with a little difference. It is a ham product which one can eat in the restaurant as well as on the go. We have certain different products, which we put into it and that is where we are different. We are not a burger chain, not even a chicken chain, we are totally a different product and this is our only marketing strategy.

Who do you see as your competitor in the Indian market?

Today, there are a number of Shawarma restaurants in India. We don’t take any other restaurant or restaurant chains as our competitor, instead we concentrate very strongly to sell our product through counter system. Certainly the Shawarma business has a bad reputation worldwide in terms of hygiene, but we strongly concentrate on high levels of customer service and hygiene. We create the best possible hygiene standards and thus we sell the best quality product.

From where do you get the best quality supply of the ingredients and other products you need?

We buy all our products from the Indian market. Logistically, it is not possible to bring product from abroad, moreover, our idea is to try and support the economy of the country where we are in. Some products are made from the center kitchen of our master franchise while others are from some reputed food companies. Everything we buy is certified with an ISO and other higher standards.

Would you like to share some numbers about the total business done so far by all the five outlets together?

The business is growing day by day. It is a bit difficult for me to get them in numbers.

Considering the global trend, don't you think you are entering India a bit late? Or do you think it is the right time?

We don't believe we are late. India is a very big and very deep market. The level of penetration in India is low when you talk of international food chains, and other consumption led brands. The market is far more mature today than it was a decade ago and there is so much ground to be covered here.

Brands like McDonald's, Burger King, Johhny Rockets and Dunkin' Donuts are already here. What strategies you are likely to pursue to get a share in a tough competitive market?

India is a very price conscious market, very competitive and sensitive. We try to stand with few legs here which really are the differentiators for us.

We have a menu unlike any other brand. We have a very large range of vegetarian offerings, most of our menu is culinary driven and is not coming straight from the factory. We’ve worked hard to create an ambience which is seen a notch above what the market has seen so far from QSRs. We’ve focused on things like different seating formats, the music we play, lighting etc. to ensure we offer a better food experience. We serve our food in proper crockery along with table service and all our food is cooked only when you order it. So, there are several differentiators which will make us stand out.

How much time have you taken to sign the deal and introduce Wendy's to Indian market?

We have taken a lot of time; and done so consciously and deliberately. We have been working with Wendy's US for almost two years to bring them to Indian market and it's almost one and half years since we have signed the agreement with them. We’ve spent a lot of time on working out on what will be our product offerings, what will be our service module, what will be the customer experience etc. All this has taken time but has helped us transform from the conventional and traditional QSR to what we are calling a QSR Plus.

What is your expansion plan, cities in your radar? Are you planning to tap tier-II cities as well?

We are planning to open over 20 outlets in first two years. Initially we will focus on NCR and North India, of course we will be going out of the capital region and covering the full country but for the first two years North India will be the focus.

What segment of market you are focusing most in India and why?

Frankly speaking I would say, every segment is our target segment. We are placing our offering in front of consumers who are looking for quality products, who prefer good service and who realize the difference between what fresh produce and products are. If I have to define our target segment, its people who want to have a differentiated food experience rather than defining it just by an age group.

What are you doing to make your product suitable for local customers?

We have spent over a year on product development to ensure our products are relevant to the Indian consumer. We’ve worked out an extensive vegetarian menu to suit the Indian palette. So, yes I would say we have tailor-made the menu. We have engaged a culinary team which has worked with us in different capacities in our restaurants in our food businesses. It's a team of chefs who have worked with various casual dining chains. And there was very active participation from US Wendy's team to help us develop the same.

How do you view the competition from local entrepreneurs as you have also acquired brand like Barista and Kylin in India and you are also in talks to bring Jamie's Oliver to India?

India is at the cusp of the food retail explosion today, the consumer is far more mature, aware and therefore we see a lot of potential for different cuisines, formats that can come to India. We are bringing Jamie's Italian in a different format to India and we feel that it fits into a different space or mindset as compared to Wendy's and so does our cafe chain Barista and Pan-Asian chain Kylin.

How has been the response so far?

The market has received us very warmly. We are extremely excited and are planning to roll out 10 more restaurants this year and another 10 next year. While we have aggressive growth plans, we want to continue keeping the focus on our product quality and experience and don’t want to jeopardize the same for the sake of numbers.

Café Coffee Day (CCD) has grown as a youth centric brand over the last 18 years. From offering a cup of Cappuccino to giving an overall experience, where customers can spend some time with their family and friends, the brand is looking forward to lure younger crowd at its outlets.

How the drinking habits of people have changed over the years?

When we started 18 years back, consumers used to visit our place, browse internet and have a cup of Cappuccino. Over the years, we realised that people are coming there to hang out, have conversation, meet people, and not just for Cappuccino. 18 years back, they did not have place to go and that was the need that CCD was fulfilling and that’s how over the years, we have moved just from an internet café to a complete experience café.

What are you doing at CCD to make it an experience café rather than bracketing yourself to a coffee café?

When we look at experience, food and beverage is part of the same. We knew that large group of youth come together, so we have large youth table. Depending on the type of conversation they would like to have, one can come and choose the sitting. So, food & beverage, types of furniture, sitting layout, and music and colour in the cafes all form part of experience. My team is trying to give customers an overall experience. You can walk in any of the CCD outlet with a pair of sleepers and nobody would look at you surprisingly. So, it’s a place where nobody judges you with types of cloth you wear. It lets you celebrate who you are.

How do you engage customers at your café?

We engage customers both inside and outside the café. We have mobile app and a lot of things on digital platform outside the cafes. We recently launched six different summer drinks and played a little game with the customers on the digital platform. It’s almost like the rulers game, where whatever number you stop at, you can go to the café and ask for the discount. We got them to engage with the brand, play a game and come to the café.

And once they come back to the café, we engage customers through the type of music we play. Whatever food and beverage we have launched in the café is very well researched, we test it with consumers and if they don’t like it, we don’t launch it. We also have a complete bunch of merchandising items like cups, cookies, coffee machines and we demonstrate them as well.

As this is your second stint with CCD, how has the market evolved over the years?

I have joined back the company after five years and I think, a lot has changed in the market and consumer sight. In the market sight, today there are a lot of choices for consumers, lot of vibrant brands in the market. It’s good because it is increasing width of the capital. Consumers today have so many choices that they are not being loyal to any one brand; they are continuously seeking more experiences, and new tastes.

Do you see any competition from brands like Starbucks?

We did a survey many years back, which gives us an indication that for a country like India, we can have close to 5000-6000 cafes. At present, we have around 1500 cafes and the next competitors are 40-50. So, there is a long room for growth. Starbucks are looking out to a slightly different segment, value proposition is different. So, I don’t think there is a direct conflict between our target audiences because we are operating at two different price segments.

Tell us about the story of ‘Keventers‘ in India?

The company got established in 1922 by Edward Keventer, which had four factories in Delhi, Calcutta, Aligarh and Darjeeling. In 1940, he sold all his factories to three owners. The Delhi and Aligarh factory was sold to Ram Krishna Dalmiya who is the grandfather of my partner. From 1940-1980s, we were basically the manufacturers of milk, milk powders, biscuits, ice creams etc. The factory was in Malcha Marg, Chanakyapuri. Unfortunately, the factory got shut down in 80s as Malcha Marg got converted into a diplomatic zone. For the last 10-15 years, we weren’t operating at all and the business was run by distributors and franchisees only. This year, we have made a comeback, but we have not made any factories, we are starting as a retail food outlet.

How did the idea of relaunching your brand come in your mind?

Keventers is a very strong brand name with high nostalgic value in New Delhi. People of Delhi are very familiar with this brand; even I used to go there when I was a kid. If we would not have taken this initiative, the Keventers name would have been lost. So, last year, we decided to make a comeback.

We also see that the people are focused more on drinks and shakes. What is the reason behind it?

Juices and milk shakes have always been popular. People are now focused on diet products basically and they are looking for health options too, so they find drinks and shakes healthy that fits in their menu.

You have two partners together on board. How is it helping in bringing restaurateurs like Sohrab Sitaram into Keventers?

We started as two partners, but now we are three. We have been joined by one more partner who is Sohrab Sitaram. As we are very young in this industry, we thought of taking somebody with the experience and Sohrab has 18 years of experience in the same, and that has helped us to take this to a higher level.

How many varieties of milk shakes you are introducing? How do you maintain the quality of milk shakes you serve?

Currently, we have three categories; one is the classic milk shake for all. Second is flavoured shake for the new generation like tutti frutti, mint oreo etc. The third one is anti gravity, which is very much similar to the mcflurry. We have F&B managers and quality control departments, which work on doing research and help us in serving the best to our customers.

Who are some of the suppliers with whom you have partnered with?

We have no partners currently, we are doing it directly. We have just one outlet at Select Citywalk, Saket, but as we expand, we will get in touch with some of them.

You have opened your first outlet at Select Citywalk. Why?

Select Citywalk is by far the best mall in Delhi in terms of footfall and it gets you people from all over the city. You can see people from different ages, groups, and places, so it’s the best place for us to begin with.

You are also planning to develop a franchisee model for expansion. Are you in talks with the industry for expansion?

Eventually we will go for the franchisee model after we are done with opening 5-6 outlets of our own. We are not in talk with a third party as we have our partners who help us to expand our business in the right direction.

You are planning to target the young and experienced customers. What are some of the activities you are doing to involve your customers?

We are involving a lot on digital media through Facebook, Twitter, Instagram, apart from this, we are trying to attract customers through campaigns, which we will do in the first week of June, where we will invite people to make their own milkshakes. For the youth, we are planning newer shakes and some new flavours.

What is your expansion plan?

We currently want to run 6-7 outlets after that we will plan to move outside Delhi and will work to open around 15-20 more outlets.

Are you looking for any external accruals at present?

At present, we are not looking for any external investments.

Who do you see as your major competitor? What are you doing to tap the larger slice of the market?

In the milkshake category, there are not too many competitors, and our model is a bit different, so comparing with big chains will not be fair. To tap the larger slice of the market, we decided to choose the right locations, so all our locations are probably the best in Delhi right now. We have entirely changed the shape of the bottle, packaging and all such aspects.

You have opened 14 outlets in four months. What is your next big plan for Indian market?

We will continue to build outlets in Delhi-NCR, Mumbai and Pune and we are already building it. But our next big plan in India is to enter Punjab and Bengaluru market by entering cities like Chandigarh, Amritsar, Jalandhar and Ludhiana. We have restaurants in Delhi which are under construction; we are going into a pipeline of restaurants which will continue to grow in Mumbai, Delhi and Pune in the months to come.

What is the number of outlets that you will be opening at these locations?

One of the things that I don’t do is throw out numbers; more important is to build good restaurants, the restaurant needs to be convenient to people, the rents too need to be convenient, and the economies need to be in place that helps it to grow properly rather than be just growing. So, for me, the definition of growth is growth that is profitable. And we will build as many restaurants as we can. People have already seen what we have done in the last 90 days, so we do not need to give numbers to show our growth.

Are you planning to enter other markets as well?

First, we will grow in these markets and then we will tap other markets to grow like in Chennai, Hyderabad, Kolkata, Kochi, Kerala and Ahmedabad and into the eastern market and also open our outlets at airports. We are in talks with different markets; the concrete plan is really Punjab and Bengaluru. But we will continue to talk with other areas as well as we want to build a pipeline. Whether it will be the end of this year or the beginning of next year will be determined as we grow.

Are you facing any price war from players like McDonald’s, KFC and Dunkin’ Donuts operating in the same segment?

Our strategy is about everyday value pricing, so if you look at our stunner menu, a complete veg combo is for Rs 69 and we have non veg combo at Rs 79 and the sandwich alone is for Rs 35 and non-veg sandwich is Rs 49. We have cravers starting at Rs 25 and we have good pricing of all our premium products. We have the stunner menu and the cravers menu. So, we have items that we are selling at every price points. However, competition is there all around the world. We are all working in the same sector and everyone has a USP for the business that they sell. There is enough business in India for all of us (QSR players). If one looks at global markets, there the trend is much more penetrated. But here, there are a few McDonald’s and KFC outlets, but for us the penetration has not yet been started. And we all will be fighting in the same race because that is the nature of the business and we all are in the same area. And, I think, we are in at the best of the times, as the infrastructure is strongly set up and the clients are well versed on QSR formats now.

You have done a lot of research before entering into the Indian market. Why so?

We came here and started from scratch. All the 13 sandwiches and cravers and all other offerings have been done from scratch over here. So, it is very home built, all are suppliers are Indians, all our food is not imported it is from Indian market. There is some equipment that we buy from abroad because it is not manufactured here in the country. We are buying from McCain, Vista Foods, Venky’s, FieldFresh amongst others to keep our products fresh and of high quality.

You have opened 10 restaurants in 52 days. Was it the BK brand that made it possible or the team effort?

Last year we started on November 9 and opened 10 outlets by December 31st. It is always everyone put together. We work with Ever Stone Capitals, which is one of the top companies in Asia. We have a very strong team. My team is made of the cream of the crop with top professionals in India. We had great support from the Burger King brand in APEAC. But in the end, it comes down to the energy level.

Which according to you is the best item in your menu?

I am biased towards a lot of products, but my top picks are Tandoor Grill, mutton whopper and then the burger which is not talked a lot but is a favourite of mine, in our Royale series.

We have seen negative as well as positive vibes on Social Media. What is your view?

Most of the negative comments that we are getting through social media are from people who want the beef and pork item that Burger King sells out of India. We have decided not to sell beef and pork in any of our restaurants in India. The qualities of all the products are of BK standards as we have pushed the standard that Burger King has laid out in its global markets. We have also no-trans fat in any of the products or the cooking oil. We have low MSD products and that was the conscious choice that we made. And the work that India has done in building these products has been recognised by the Burger King system all across the world and these products are now going to grow in other countries. And this is for the first time in sixty years of history of this brand and they have never done the kind of research which is done in India.

Started as a small firm in the year 1948, Pastonji Brands & Holdings Pvt Ltd, Mumbai, went on to establish itself as a brand in 1989 with ice cream as its first product. And today, the company offers a huge pool of products like ice creams, frozen desserts, flavoured milk, mango-based drinks and packaged drinking water.

Being in the family business, Naim Hafizi, the young entrepreneur spotted the new potential product in the dairy industry and with the knowledge in this field, successfully launched ‘GoSip’ flavoured milk in amazing flavours like Kesar Elaichi, Pista, Strawberry, Chocolate, Coffee, Mango and Butterscotch.

‘Milk is our base but flavours are our fun’ shares, Maaz Mutvali, Marketing Head, Beverage Division, Pastonji Ice cream.

Today, the brand is spread across Maharashtra and recently started their operations in Gujarat. The company also offers crunchy waffle cone, ice cream cups, bars and candies, an all time favourite with kids.

Pastonji identifies the consumer’s changing habits towards healthy beverages. It is looking forward to build similar alliances in near future, which will increase their reach. “There is always competition and challenge in every industry, but perceiving the competition and beverage industry is to improve our product and provide the consumer’s best taste as possible,” thinks Mutvali.

And according to them, consumers today are more interested than ever in eating a healthy and varied diet. And they’re also on the lookout for special moments of indulgence and new, unusual taste experiences.

With availability of GoSip in online platforms like Bigbasket.com, the Group is also aiming at a business of Rs 400 crore for flavoured milk in India with a growth of CAGR of 21 per cent by 2016.

GoSip is also targeting to capture 9 per cent of the market share in Maharashtra by March 2016.

What all things come along in designing your restaurant menu?

While designing a restaurant menu one has to take care of multiple parameters such as category of the hotel, type of restaurant – specialty or all day dining, Cuisine and its sub cuisines, Mix of vegetarian and non vegetarian dishes.

However, menu price factor, its acceptability and affordability, current local competition, geographical location – location in the city, local accessibility and eating habits of locales – dominance of vegetarian or non vegetarian, specific cuisines are some of other preferences.

Tell us something about the supply chain management in your hotel. Who are the suppliers?

Supply chain management plays a vital role in the smooth operations of any hotel. With thousands of ingredient on the list, all are grouped and sourced through established companies and suppliers of repute. Our hotels use products from various brands and companies, to name a few Dabur, Coco Cola, Unilever, Mother Dairy, Pepsico, etc.

Whether cold chain or dry chain supplies, utmost care is taken to deliver the supplies from the source to the hotel without affecting the keeping quality of the goods. The hotel after receiving the goods, stores as per the requirements of the products – frozen, chilled or dry conditions. Every week an updated list for the date of expiry of the goods batch is circulated to the various departments of the hotel by the central store so to eliminate any usage of expired products. A certain par stock is maintained, reorder levels and delivery time is taken into consideration when maintaining the par stock levels.

What are the different types of cuisines served at your restaurant?

We serve variety of cuisines at our restaurants including Indian, Italian, Chinese, Thai, Lebanese, Japanese and American amongst other.

What is the contribution of good menu in restaurant business? How are new techniques in food helping the restaurant grow?

People go to a restaurant for food and a good menu can make the restaurant the talk of the town. It not only helps in increasing the sales and revenue generation, also does the marketing automatically by the word of mouth. With the increasing guest demands for a “something new and different”, newer techniques and methods have been adopted by chefs to promote the cuisines and their restaurants. It can be molecular gastronomy or an old cooking technique which had faded with time, but then these are the new tools to the growth of restaurant business. These new techniques not only form the part of marketing gimmicks, but their representation on the plate fascinates the customers and acts as an attraction.

What inspired you to become a chef? Tell something about your journey in the world of food.

Food had always fascinated me since the childhood and still I love food. My mother’s cooking was one major factor that I became a chef as we enjoyed her cooked delights every now and then at social get-togethers and still relish her cooking till date. Also, the exposure to the hotels and hotel culture from a very small age because of my father’s hotelier career brought me closer to the food. I was destined to pursue a career as a chef.

The journey in the world of food as a career started 20 years back after graduating from the Institute of Hotel Management, Bombay in the year 1994 and has been a very satisfying learning till now. Presently at the given role of Director of Food & Beverage with Louvre Hotels Group in India operating hotels under the brand of Golden Tulip Hotels, involves opening of new hotels, their food and beverage avenues and elevation of the operations and services of the established hotels with the award of Silver Hat for the year 2014 by Indian Culinary Forum accredited the contribution in the field of culinary.

How familiar are you with the legalities involved in opening a restaurant? Are you planning to open up your own restaurant?

Opening any food outlet involves to comply with the local rules and regulations. To start up a restaurant one requires a lot of licenses, certificates and NOCs form various government bodies and departments. Starting from Shops and Establishment Act, Fire Department NOC, Food Safety License, Eating House Certificate, Pollution Control Board NOC, etc. Approximately 15 to 20 licenses are required.

Opening up my own restaurant has been always a plan, but when it is executed or comes through is not yet decided. Yes, I do dream of opening my own restaurant - big or small, casual or fine dining, and will happen at the right moment of time.

How is the eating habit of Indian consumer changing?

There was a time when healthy food was a matter of choice. Today, with increased awareness about the ill effects of an unhealthy lifestyle along with the newer options available in the market, eating healthy is becoming a way of life. Consumers are shying away from high carb, high fat fast food and willing to experiment with other concepts.