A restaurant in Delhi was recently in a centre of a nine-yard controversy. It turned away a customer at the door for not complying with its 'smart casual’ dress code. The lady turned away was wearing a saree.

A dress code at a private restaurant is not unusual. All or most restaurants have one. And the history of clubs from Lutyens' Delhi to Mayfair London is littered with many offended people turning back for wearing grubby trainers or clothes that didn’t adhere to the dress code. Singer Jess Glynne had to apologise to a restaurant in London for alleging discrimination she was wearing a hoodie when the dress code clearly stated no hoodie.

Unfortunately, saree does not, however, seem to pass the test when it comes to fashion. But before the debate even progresses, the question that has worried many critics is ‘why does a nightclub or a high-end resto-bar need to have a dress code’?

Club owners of upscale nightclubs have long used dress codes to signal status. They set a standard, usually more formal dress, and let potential clientele know who’s welcome and who’s not. The use of dress codes can create an air of exclusivity and make one club seem more desirable than another, an important distinction in a highly competitive, 19.8 billion dollars industry.

Unlike clothing, which is timeless, fashions are current. While the saree remains very much alive as a piece of clothing, what is the evidence that it symbolises a 'smart casual' urban lifestyle fashion, the audience that the restaurant is targeting and wants to attract as a clientele.

“It’s absolutely a very good time to evolve the dress code in nightclubs. We are absolutely okay with women walking at our lounges in nine yards. Saree is our country’s national outfit and yes it’s banned in many nightclubs in and around India. I think we should give more emphasis to this outfit. True - what’s in a dress code?” Sandeep Katiyar, Director, Plutusone Hospitality commented who operates the club brand, Finch.

The Indian attire, while it is very much still a part of the 'business casual' workforce, is restricted to the conservative workforce. Politicians and bureaucrats wear it to work as a norm. It represents the people. In many conservative heartlands, it remains the choice of wear for working women in fields and in the labour force and at home, but this is not the audience the restaurant is trying to reach.

In the more liberal sectors of the workforce, though, the trendy lot that leads fashions, it has shown a steady decline over the decades with western pants-shirt or functional salwar-kameez as the preferred option and has today become an exception rather than the norm as a daily dress code.

It is trendy as 'cocktail wear' and ladies in glittering chiffon sarees holding champagne glasses are often seen in the glamour sections of newspapers attending book launches at five-star hotels. So where is the saree in the 'smart casual' everyday sector in the trendy fashions of today that the restaurant is trying to embody as a brand?

Many critics of the restaurant have linked the non-inclusion of saree or ethenic dresses in its dress code as a 'colonial hangover' and a sign of hatred of one’s own culture.

“Honestly, we as an owner don't have a problem with a dress code. Any attire is and should be welcomed. But before raising a question to the owners and operators, one should also think that what society is promoting as a whole. If I started allowing men with slippers, half pants, or ladies wearing salwar kameez and sarees in my nightclub, will I be able to generate business? Probably no, because the so-called ‘elite class’ will think now the place has become downmarket. This is a harsh reality that the society also needs to rethink,” an owner of Delhi’s popular nightclub said on a request of anonymity.

Club owners, citing safety concerns, point out that banning particular clothes can limit trouble. One owner commented, “We had to institute dress codes because we started having trouble with drugs and stuff.” Others claim they limit what people wear in order to create what they vaguely refer to ‘as a certain atmosphere’.

However, as far as a strict dress code is concerned, maybe it's time to evolve. But, for many, it's a long road ahead. So how do the nightclubs think of dealing with the issues of not rejecting people with certain attire, predominantly the ethnic?

“It is very important in situations like these to work as a team and handle them smartly, rather than panicking and getting stuck,” the partners of newly launched nightclub White commented.

Kabir Talwar (Harpreet Talwar), Suhail Ahmed, Vikas Chauhan and Raj Bhati are confident that the operating management is ‘more than qualified to handle such issues.

In every restaurant’s journey, there’s a moment when a dish rises above the menu becoming not just food, but a promise. It gives guests a reason to visit, remember and return. In hyper-competitive, high-rent metros like Mumbai, Delhi and Bengaluru, a signature dish isn’t creative indulgence, its strategic capital. That’s the economics behind it.

Signature Dishes as Strategic Assets

As diners step out less frequently but spend more per visit, restaurants must give them a compelling reason to choose their brand. Concepts built around strong hero dishes reportedly see 10–20% higher repeat visits than those offering generic, wide-ranging menus—proving that signature-driven identity drives loyalty.

“For us, it’s about how we connect with our customers and how we build a brand with our signature dishes. We do make promotional signature dishes during festive. The taste note should connect with the people. The food cost should be 25-30% where we take the cost of ingredients like raw materials,” shared Chef Vikas Pathak, VP- Culinary of Stories Brewery, MOAI, Macaw by Stories (India & Dubai).

He pointed out that yields vary for every dish they curate—especially signature dishes—which differ across restaurants. Costing, he emphasised, is critical, as it determines the final selling price. “We conduct extensive R&D and trials before finalising a signature dish. Pricing must be carefully structured to appeal to a wide range of clientele,” he added.

A true signature item lowers customer acquisition costs over time like word-of-mouth drives recall, social media amplifies it. But before profitability what comes is precision.

The True Cost of a Dish

The biggest miscalculation in restaurants is rarely the ingredient cost. Chef Durbar Basu Ray, Executive Chef, The Oterra Hotel shared that the cost of a dish is the silent trio of labour, overhead and inconsistency.

In India, target food cost hovers between 28–35% for casual dining and 22–30% for premium formats. But that is only the starting line. If a plate takes 10 minutes to prepare and a chef’s effective hourly cost is Rs.400, labour quietly adds about Rs.67 per serving. Multiply that across hundreds of covers and complexity quickly becomes expensive. The more technical the dish, the harder it is to scale.

The total overhead can climb to 25–35%. Precision is not optional; it is survival.

Pricing Strategy

Guests pay for narrative, craftsmanship, rarity and social currency as much as for ingredients.

Explaining this, Tushar Malkani, Corporate Chef, Le Sutra Hospitality said, “For us, 60-70% of the sales are from our signature items in all our restaurants. We are not calculating deliveries. The pricing differs from location to location as it depends on food cost and manpower as we remove the base cost first and after that we decide a markup of 20-25%.”

Restaurants that price such dishes on value rather than raw cost often report gross margins that are 5–10 percentage points higher than standard menu items.

“There are many ways to look into how the selling prices are fixed. Successful restaurants blend several pricing models like marking the total cost by a fixed margin or pricing based on what customers will pay for uniqueness and experience,” commented Ray.

Helps in High Margins

Signature dishes carry hidden risks. Imported ingredients face price volatility, complex recipes slow kitchen throughout and if guests order only the hero plate, average spends may not rise as expected.

“If the dish doesn’t consistently deliver quality, guests may be disappointed. Also, signature dishes may have premium ingredients that can cause margins to shrink if supply costs fluctuate. Restaurants risk having only one draw — if the trends shift or customer tastes change, restaurant revenues may be impacted,” pointed Ray.

Done right, it drives repeat visits, supports premium pricing and strengthens the brand. Done poorly, it’s just an expensive vanity project.

“Signature dishes are important to sell; it should be highlighted as it represents brand visibility and identity. 25-35% of customers order signature dishes overall as a whole and they are our repeat customers as well,” added Pathak.

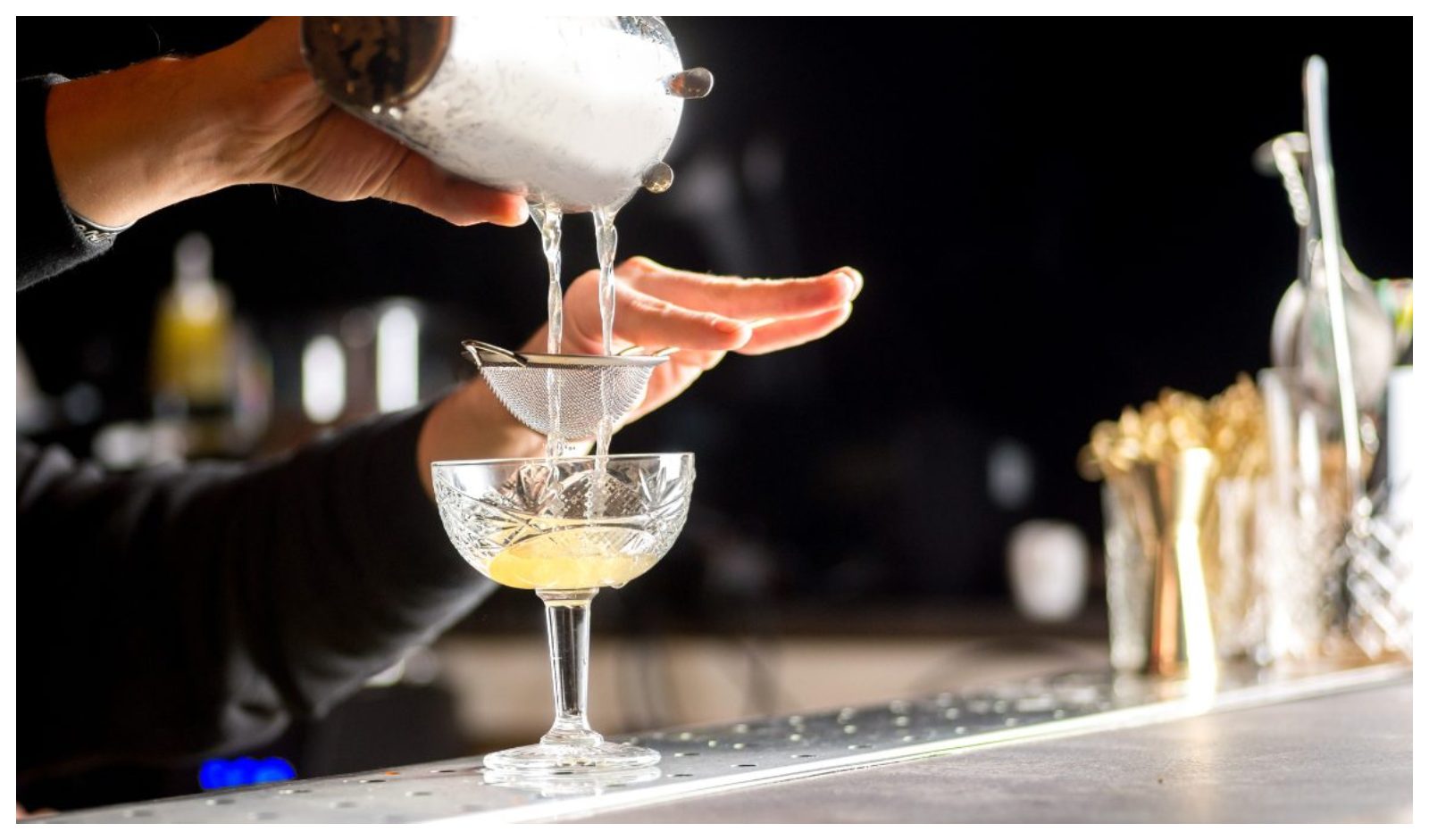

Every year on February 24, the hospitality world raises a toast to World Bartender Day—celebrating the craft, creativity and quiet resilience behind the bar. Once viewed as a service role, bartending has evolved into a dynamic career that blends mixology, storytelling and showmanship. Today’s bartenders are not just drink-makers; they are experience curators, cultural connectors and brand builders shaping the spirit of modern hospitality.

The Evolution

Bartending was once rarely seen as a serious or skill-driven career. That changed with the advent of structured training, global certifications and international competitions backed by industry bodies and premium spirit brands. Today, Indian bartenders are not just participating, they are competing and winning on the global stage.

“Earlier, there were hardly any brand products or flavor or major products available. We didn’t have any equipment and tool to work with. Over a period of time, thing has changed dramatically,” shared Shatbhi Basu, the first female bartender in India since 1981 by adding people use to be dependent on books rather than internet. “We didn’t have good glassware to work with, and nobody knew who we are and what we curate. Today, it has changed.”

Commenting on this, Nikhil K Rochlani, Managing Partner, Butterfly High who closely curate the cocktail menu said, “There is also a strong shift toward experiential drinking where presentation, aroma, storytelling, and glassware play a big role. People are not just ordering a cocktail; they want a memorable experience with it. We see collaborations as a creative exchange that keeps both guests and bartenders inspired.”

Pop-ups bring new styles, new techniques, and new audiences together. It keeps the bar culture fresh and gives guests something exciting and different to look forward to.

Mixology as Profit Engine

Cocktail-focused bars now report 20–35% higher margins on signature drinks compared to regular spirit pours.

Sharing his views, Archit Singhal, President of India Bartender Guild said, “Growth in India’s craft cocktail movement has exposed deep structural gaps. While premium bars are rising, there remains no unified certification system, standardized curriculum, or adequate practical training. This has created a severe talent disparity — where some bartenders earn below minimum wages, while bar owners struggle to find skilled professionals even at ₹1–2 lakh per month”

The impact is measurable: curated cocktail menus can lift average bill value by 15–30%, upselling aged or reserve variants can add ₹500–₹1,500 per guest, and experiential tastings or pairings can extend dwell time by 20–40 minutes directly driving higher per-cover revenue.

Bartending as Career

Training schools in India reportedly train hundreds of bartenders annually; some local institutes have mentioned training hundreds of students a year (e.g., around 450 students in one program).

“We never had the kind of exposure young bartenders have today—traveling abroad for competitions, attending global mixology programs and gaining international experience. Many of the challenges we faced have eased. Today, they can work on cruise ships, consult for restaurants and hotels, become brand ambassadors or build careers in event bartending. Their career choices are far wider than ours ever were,” shared Basu.

Bartenders are also coming up with their own restaurants/bars with someone who is investing in the business.

The Challenges

While visibility and revenue impact have grown, so has the pressure. Bartenders face late-night shifts, physical strain from long hours standing, exposure to alcohol-heavy environments, performance expectations, safety concerns, particularly for women.

Singhal noted, “IBG has initiated mental wellness programs to support members through counseling and structured guidance. Over the next five years, with structured training, global exposure, and stronger welfare systems, India’s bar industry has the potential to become one of the most respected and professionally driven hospitality ecosystems in the world.”

The future isn’t about technology replacing bartenders — it’s about data sharpening their decisions and amplifying their impact.

Scaling a Quick Service Restaurant (QSR) is not just about expanding outlets, it is an art of creating repeatability with efficiency. The Indian QSR market is projected to grow at a CAGR of over 9% to 11% through 2030. Having said that, the sheer diversity of consumer preferences, talent, infrastructure, and geography in India makes operational excellence the biggest differentiator among scaling and sustaining brands.

Scaling QSRs in India

India is one of the fastest-growing QSR markets in the world, fueled by urbanization, increasing disposable incomes, and a growing affinity for convenient and affordable food. But scaling beyond the initial few outlets can often reveal unseen chinks in the armor of systems, people, and consistency. What works in one city or one neighborhood doesn’t necessarily work elsewhere. The first step for all brands is to find the right product-market fit. This was an extremely important phase for the brand, as it allows them to understand consumer preferences, serving sizes, and price sensitivities. Also it should be kept in mind that the Indian consumers are mostly looking for hand-held, filling, and convenient food that complements the fast-paced lifestyle. And this plays an important role in making services quicker and easier.

Consistency in Product Quality Across Cities

In a repeat business model like QSR, consistency in taste is not a luxury, it is a necessity. However, in India, because of the variability of ingredients, vendors, and the skill levels of kitchen staff, this is one of the most challenging operational tasks. For multi-city brands - this might be a challenge but at the same time also non-negotiable. It is important that brands structure their business around the philosophy of standardization rather than individual genius. The basic product offerings should be standardized early on to allow better control over quality. It helps to have the recipes standardized and the kitchens managed with very detailed standard operating procedures (SOPs), which minimized the need for chef-driven decision-making.

The other key lever is Menu discipline. Rather than expanding rapidly into various categories, it is always wise to minimize unnecessary complexity while enabling managed innovation. This ensures operational simplicity without sacrificing consumer delight. The emphasis should be on process-driven cooking versus chef-driven cooking, which was a key shift for a scalable food company.

Creating a Scalable Supply Chain

The supply chain is often underappreciated in the early phases of QSR expansion. However, as the number of outlets increases, small inefficiencies in the supply chain can quietly damage profitability. There is a constant need to treat supply chain maturity as a profitability tool, and not simply a procurement tool. Brands should always pay emphasis to develop long-term partnerships with suppliers based on trust, volume, and quality. A sourcing model based on local procurement ensures that the food quality is not compromised. Also vendor partnership over transactional buying has always proved to be beneficial. Notably, the sourcing of products can be based on unit economics, and not menu pricing. This ensured that the cost structure remained viable even as brands expanded.

The True Growth Engine

Scaling QSRs in India is not just about having expansion strategies. It is about having the discipline to deliver on these strategies, about building systems, and about having the humility to focus on repeatability rather than rapid innovation. The essential operational building blocks – processes, supply chains, and consistency are sacrosanct for any QSR business. In a market as complex as India, brands that have operational excellence not only grow faster but also last longer. And in the long run, the most underappreciated advantage of operational excellence continues to be consistency in the QSR space.

With many brands leading the way, the QSR ecosystem continues to be an integral part of the Indian food industry. And once brands adapt themselves to navigating operational challenges, the sky is the limit. With rising demands for fast food across all Indian cities, it is time that brands grab the opportunity and achieve unprecedented growth.

Authored By: Arjun Toor, Co-Founder, RollsKing

If there was one word to describe 2025, it would be “fast.” It felt like a decade compressed into twelve months. From geopolitical shifts that once took years to unfold, to the explosive acceleration of AI, to the reawakening of commodities like gold and silver — the world didn’t just change; it surged forward.

“In one year, we’ve seen what probably used to happen in ten or fifteen. We are in a fast-changing world — and that makes today’s discussion incredibly relevant,” shared Gautam Gupta, Founder and Chief Growth Architect at ConnectIQ Business Services.

With that context, industry leaders gathered to reflect not only on the year gone by, but more importantly, on the big shifts they are making in 2026.

Innovation is about Survival

“In our industry, innovation is table stakes,” shared Gupta. “If you do not innovate, it’s very difficult to succeed.”

Sheetal Patil, CEO, Cream Stone Ice Cream Concept, representing the dessert and ice cream segment, painted a vivid picture of opportunity. “Globally, the ice cream industry is around $113–120 billion. In India, we are just about $4 billion. Our per capita consumption is less than one litre — compared to 28 litres in the US.”

Hence, the gap emphasized is enormous and so is the opportunity. Also, the industry is evolving across three clear segments: Artisanal (about 10%), mass FMCG brands amd emerging premium and health-focused categories. “Rapid urbanisation, rising disposable incomes, better logistics — and above all, premiumisation is driving the growth,” he added.

There’s growing awareness about organic products. Consumers are more health-conscious. There’s demand for sugar-free, low-sugar, and now protein-based desserts. These are the segments where innovation will play a huge role.

From Nostalgia to Now

Building on this, another powerful idea emerged — relevance. “Our generation grew up on nostalgia. We hold fond memories of brands we visited as children. But today’s generation has a very short memory,” pointed chef and restaurateur Shankar Krishnamurthy who has been in the sector for almost four decades now.

The modern consumer wants experience instantly, he added by giving an example that Gen Z footfalls in Las Vegas casinos are dropping. Not because they don’t want to gamble — they’re doing it on their phones at home.

“Convenience, personalization, immediacy — these are the new drivers. And, in food, this translates to; storytelling by chefs, farm-to-plate sourcing, supper clubs, smaller, curated experiences and ingredient transparency.” “Today, chefs want to express themselves — why they cooked something, how they sourced it, what the story is. And the audience is equally willing to learn,” he smiled by adding that scale still exists. But meaning matters more than ever.

Scaling Without Losing the Soul

The next logical question followed; How do you scale an iconic brand without losing authenticity and consistency?

“For me, scale is not speed. Scalability means repeating your values, delivering the same product, and doing it sustainably,” shared Nikita Poojari, Director, Shiv Sagar Group who while expanding her brand from Mumbai to Hyderabad, she kept what she called the “brand soul” intact. For her, 70% of the menu remained unchanged, portioning consistency and same price format were the key measures.

“We increased portion sizes because the market here has more appetite. We also introduced local flavours so we could merge well with the environment,” she added as she always believed in studying the market deeply, ensuring financial strength and and at least a 6–8 months plan before operational profitability.

“If you have enough cash strength, you should wait. You can’t expect capital profit immediately. Operational profit in six months is realistic,” she further mentioned as for her, scaling is disciplined, patient, and data-driven.

Anand Krishnan, representing a 50-year-old Chennai-based brand with 27 restaurants, spoke about operational discipline. Their success formula? “We believe in the centralised kitchen format. All food is prepared in one base kitchen and dispatched session-wise — breakfast, lunch, and dinner,” he shared as each dish is cooked by a trained set of people who have been with the brand for years.

“We have strict SOPs. Even our sambar powder is made from scratch,” added Anand for whom a strong, well-trained team and standardised processes is key to expansion.

In 2025 alone, they opened seven outlets — five in Chennai, plus Kanchipuram and Hosur.

For him, innovation is not just about flavours — it’s about format, logistics, and operational efficiency.

Commenting on the same, Raghuveer Kanakamedala, who built Royal Biryani House in the US in 2017 and is expanding the same in the region, pointed, “In the eight years we’ve expanded across the U.S., every new location has been a surprise — we haven’t been able to simply replicate success. Our flagship store was a huge hit, but when we entered Texas, it took us six months just to break even.”

Also, technology plays an important role in today’s expansion drive. “There’s a popular saying: AI won’t replace your job — but someone using AI will. The same applies to business. In today’s world, true scale is impossible without technology. If you want efficiency and consistency as you expand, tech isn’t optional — it’s essential,” concluded Nikita Seth of TruFrost & Butler.

One message stood above the rest: the pace of change isn’t slowing down. If 2025 tested our speed, 2026 will demand something deeper — clarity of vision, sharper focus, and disciplined execution. The takeaway was simple but powerful: start small, do it well, do it sincerely — and then scale with intention. In a world moving at fast-forward, sustainable success won’t come from chasing everything at once, but from committing to what truly matters and building it right.

India’s pizza market is heating up—not just as a comfort food, but as a major driver of the quick-service restaurant (QSR) sector. Valued at USD 5.81 billion in 2025, the market is projected to more than double to USD 12.49 billion by 2034, fueled by urban consumption, evolving lifestyles, and digital adoption.

Market Leaders & Consumption Trends

Pizza remains one of the most sellable items on platforms like Zomato and Swiggy. Domino’s leads with 2,000+ outlets across 400 cities, followed by PizzaHut, PizzaExpress, US Pizza, Little Caesar’s, and Chicago Pizza.

India’s QSR market is set to reach USD 43.5 billion by 2030 at a CAGR of 9.36%. Health-conscious options, menu customization, diversification, and technology-driven operations are reshaping the pizza segment.

“Consumer preferences are evolving. There’s growing focus on ingredient transparency, longer fermentation, sourdough bases, better fats, and gut-friendly options. Pizza is being reimagined as lighter, cleaner, and more thoughtful—without losing indulgence,” shared Kabir Moorjani, Chef Founder, Hundo’s Pizza.

Pointing this, Vichita Kumar, Co- Founder and Chef, Pizza No Cap said, “We’re seeing a major shift toward ingredient transparency and quality. It’s not just about what goes ON the pizza anymore - it’s about where those ingredients come from. The pizza becomes a vehicle for showcasing exceptional ingredients rather than hiding mediocre ones under cheese.”

Here’s what’s changed: people still want indulgence, but they don’t want the food coma or the regret the next morning. That’s driving the cold fermentation trend - 72, even 96-hour ferments that break down the gluten structure and make the dough genuinely easier to digest.

“It’s a technical work that most customers won’t see, but they’ll feel it. Or rather, they won’t feel weighed down, and that’s the point,” added Kumar.

Technology & Scalability

Pizza’s delivery-first nature, repeat purchase behavior, and standardized production make it highly scalable. Technology enhances this with smarter demand forecasting, centralized dough production, and data-led menu engineering. Local flavors, spice profiles, and fermentation styles are increasingly city specific.

Delivery accounts for ~65% of sales in metros, while dine-in pizza bars (30–60 seats) maintain strong unit economics.

“Technology has amplified this advantage: smarter demand forecasting, centralised dough production, and data-led menu engineering now drive consistency at scale. Localisation is no longer superficial—successful brands adapt toppings, spice profiles, and even fermentation styles to suit city-level palates,” commented Moorjani.

Global Players Eyeing India

Pizza continues to attract international chains. Recent entrants include Gordon Ramsay Street Pizza and Papa John’s, with brands like PizzaExpress entering QSR formats in Jaipur.

“From an economics lens, pizzas offer strong contribution margins when done right—dough, sauce, and cheese form a predictable cost base, while toppings and portioning allow intelligent upsell,” shared Moorjani.

Pizza continues to be a top choice for global chains entering India, with recent entrants including Gordon Ramsay Street Pizza and Papa John’s.

“For TFS, which operates food courts, quick-service restaurants and lounges across India’s leading airports, the launch of Street Pizza is a milestone. Indian travellers today expect global-quality dining that is fast, expressive and elevated. Bringing Gordon Ramsay Street Pizza to India, and into the airport space for the first time, reflects the shift in what airport dining experiences can and should be,” pointed Varun Kapur, MD & CEO, Travel Food Services Limited (TFS).

Challenges & Path Forward

Rising input costs, discount-driven marketplaces, and brand dilution remain key challenges. Successful expansion requires tight SOPs, selective growth, and owning core processes.

But artisanal pizza scales differently - it scales with people, with training, with maintaining standards. Kumar said, “That’s the challenge we’re navigating: how do you grow without losing what makes the pizza worth eating in the first place?”

Premium brands can scale without compromising margins or identity—if growth is deliberate, balancing craft with systems, and emotion with data. The next phase will be about efficiency, premiumisation, and survival of the smartest formats.

Tier 1 cities remain the most competitive and attractive markets for restaurants due to their large consumer base, high footfall, and strong dining-out culture. India’s foodservice industry is growing rapidly and expected to reach $153 billion by 2031 at a 10 percent annual growth rate, attracting lots of consumption from these cities acting as trend incubators where new formats, cuisines and experiences are tested, refined and scaled.

Consumption at Scale

Nearly 70 percent of India’s foodservice spending comes from the top cities like Delhi, Mumbai, Bengaluru, Hyderabad, Pune, Kolkata and Chennai, followed by few tier-2 markets and tourist locations.

Dining out in Tier 1 cities is a daily habit, spanning weekday lunches, coffee meetings, late-night orders, and weekend brunches. This consistent demand attracts more restaurants, expands choice, and drives repeat visits.

Commenting on this, Chef Rahul Punjabi, Founder of Bang Bang Noodle, said, “Many large brands attempted to scale pan-India, but they didn’t see the returns they expected, which led to a sense of disillusionment.”

“Tier 1 cities remain the primary battlefield due to high disposable income and a concentrated "foodie" culture. While competition is fierce, the sheer volume of footfall and the presence of a corporate workforce provide a reliable revenue floor that emerging markets are still developing," added Sibi Kuruvilla, General Manager, Suka Brew and Kitchen.

Visibility at a Cost

With 30–40% of restaurant sales now coming through online delivery platforms, operators are walking a fine line between growth and profitability. And this is also driving expansion at tier 1 market.

Online aggregators are a double-edged sword—they offer reach but squeeze margins. Kuruvilla pointed, “Our strategy is to treat them as marketing channels while incentivizing direct loyalty through our own platforms. To counter rising costs, we are optimising supply chains and implementing data-driven inventory management.”

Talking further, Sharath T. Gowda, Founder of Arena Brew House& Kitchen added, “From data-led menu engineering and inventory optimisation to CRM tools and smarter reservation systems, technology is enabling restaurants to balance operational efficiency with elevated guest experiences.”

Also, there's a much bigger market at a lower price point, and the rentals are better again when you move further away from the main neighborhoods of even the Tier 1 cities. 90% of the restaurants still prefer Tier-1 as the best market to explore.

“So, the biggest market opportunity for me is: when you go to the outskirts of a Tier 1, you get rates that are closer to Tier 2, but you have customers who are exposed to that Tier 1 mindset, they see stuff on Instagram, their colleagues are there who are eating out at fancy places. So, they want fancy experiences, and if it's provided to them again, if it's done tastefully, artfully, within that price point, and you can make money at that price point, then you're really going to kill it,” commented Punjabi.

Success in a crowded market isn't about being everywhere; it’s about being the most authentic choice in a specific category.

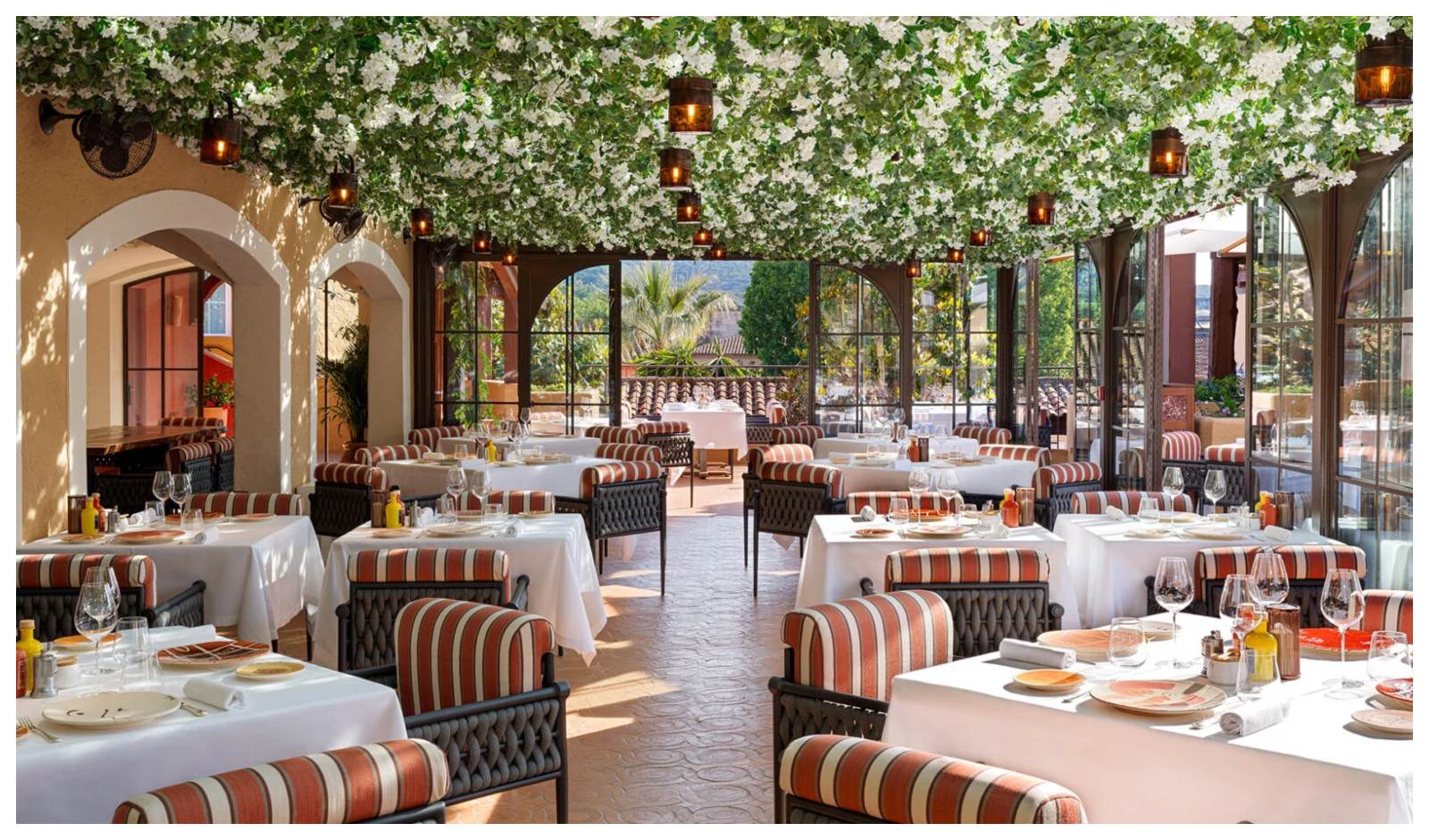

Premium Dining is Driving the Growth

Premium dining is driving expansion in Tier 1 markets as rising disposable incomes, urban lifestyles, and experiential spending fuel demand for high-quality, differentiated concepts. For operators, these markets offer stronger brand visibility, higher average ticket sizes, and a customer base willing to pay for curated dining experiences.

And there is a clear shift toward spaces that offer strong design, layered experiences, well-curated menus and a sense of occasion. Restaurants are responding by investing in immersive environments, premium offerings and limited-edition menus, while also using collaborations and pop-ups to stay culturally relevant.

With this, we can surely say that Tier 1 cities offer unmatched demand density, higher spending power, strong digital adoption, cultural influence, and intense competition. As Tier 2 and Tier 3 cities grow, Tier 1 metros will remain the core testing grounds for India’s restaurant industry, continuing to shape trends and set benchmarks as the country’s most competitive dining markets.

India’s café market is expanding at pace. The branded coffee shop segment reached 5,339 outlets in 2025, growing roughly 12.7 per cent year-on-year as chains and independents deepen their presence across metros and Tier-II cities.

Industry estimates peg the standalone coffee shops market at USD 424–440 million in 2025, with high double-digit growth forecasts over the next decade.

The opportunity is large. But operators say survival is rarely guaranteed. Behind the expansion headlines lies what many call the 18-month “survival window”, the period that determines whether a café stabilises its unit economics or quietly runs out of runway.

When Launch Buzz Fades

Urbanisation, rising disposable incomes, millennial tastes, and the rise of socializing driven by young Indians drive frequency. With one market study noting 24 per cent visit cafés daily and 57 per cent weekly. There’s also a sdden rise in premium coffee space often priced above Rs 200, with projections of 20–25 per cent CAGR through 2028. Yet founders say the real test begins after the Instagram-friendly launch weeks.

Monica Kapoor, Co-Founder and Creative Director of KEFI Cafe, recalls the emotional shift after opening. “The launch buzz disappears faster than you expect. After that, it’s just you, the team, and daily reality. What really surprised me was how long it takes for a café to become part of a neighbourhood’s routine. Growth didn’t come from big ideas, it came from showing up every day and getting the basics right,” she added.

Abhinav Jindal, Founder & CEO of Kimaya Himalayan Beverage and BeeYoung Brewgarden, echoed this pattern of phased evolution. “What stood out was how clearly the business moved through phases. The initial months were driven by curiosity and excitement but excitement is temporary. Stability came only when consistency took over.”

From Optimism to Structure

The café market’s growth narrative is also backed by aggressive expansion from large players. Chains like Tata Starbucks, Barista and Cafe Coffee Day with over 500 outlets continue to anchor the segment, while independent cafes are also gaining popularity.

But expansion is not linear. Even Starbucks has reportedly slowed its rollout in India amid tighter consumer spending and softer footfall.

For first-time founders, break-even expectations are often shaped by optimism. something both operators acknowledge.

Kapoor puts it simply, “The first outlet teaches you humility. Break-even takes time and is usually longer than planned.” With subsequent outlets, she said, the approach became more practical: tighter capex, more realistic timelines, and planning for real-world delays rather than chasing ideal projections.

Jindal echoed that early optimism. Break-even, he shared, was initially an estimate shaped by ambition but once the outlet went live, real cost and operational complexities surfaced. Over time, that approach evolved into a more structured framework: breaking break-even into fixed costs, contribution margins, realistic footfall, and ramp-up timelines, with a clear shift in mindset from scaling fast to building a format that can be repeated sustainably.

What Decides Survival?

With premiumisation on the rise and younger consumers visiting frequently, footfall may appear strong. But operators insist that what matters is not a packed weekend, it is weekday discipline.

Kapoor added, “I focus on daily sales consistency, food and staff costs, wastage, and repeat customers. One busy weekend doesn’t mean much steady weekdays do. If operations are tight, the numbers eventually follow.”

Jindal tracked a similarly focused set of indicators. “Financially, contribution margins across food and beverages, labour costs, and fixed cost coverage are tracked closely. These indicators tell us whether the business is structurally healthy.”

What Cafe Owners Underestimate

India’s café sector may be expanding at double-digit growth rates, but founders warn that the glamour fades quickly, especially in year two. Kapoor is candid about the strain that follows the first-year excitement. “The excitement is gone, but the costs don’t stop. A lot of founders don’t plan for heavy opex for at least a year, and that’s where things get tough,” she added by pointing that many cafés don’t fail because the concept is weak but because exhaustion sets in and funds dry up before stability kicks in.

In an industry once driven by rapid expansion, profitability and operational stability have emerged as the true measures of success. For years, restaurant growth followed a simple formula—opens more outlets, enter new cities, and scale quickly, often at the expense of margins. That mindset is now shifting. Across India, restaurant operators are slowing expansion, consolidating their footprint, and rethinking what sustainable growth really looks like.

Rising Costs and Tight Margins

The Indian food services sector is valued at over ₹5.7 lakh crore in 2025 and is expected to reach ₹7.76 lakh crore by 2028, growing at around 8% annually.

Despite scale, profitability is tight. Most restaurants operate on net margins of just 3–6%, while casual and full-service formats face high labour, rent, and food costs. Even QSRs typically deliver net margins of only 6–9% under ideal condition. Rent and utilities, which account for about 5% of earnings globally, rise to 20–25% in India due to expensive urban real estate. 40% of the brands, who expand their business within a year of their launch, end up closing due to the heavy losses.

“When you are building culture, not just covers, growth have to protect community. Rising costs and unstable footfalls make reckless expansion risky, especially for venues that prioritise live music, safety, and inclusivity,” shared Vikas Narula, Co-Founder, Depot 48.

Labour costs add further pressure, typically making up 25–35% of revenue, depending on the format. As a result, restaurants have little buffer to absorb cost or demand fluctuations.

Eesha Sukhi, Founder, The Bluebop Cafe said, “Over the last few years, the restaurant industry has been forced to reset its priorities. With rising food costs, rentals, manpower challenges, and unpredictable consumer demand, many restaurants are focusing on survival before expansion. Growth without profitability is no longer aspirational, it’s risky.”

No more Number Game

Many founders admit that opening a second or third location too quickly strained their businesses more than it strengthened them. With average net profit margins tight, longevity is increasingly valued over scale. The era of “more outlets = more success” has quietly ended.

Narula pointed, “Cultural venues learnt the hard way that clout doesn’t pay artists or staff. Most restaurateurs are focusing on unit economics, repeat customers and profitability per square foot. Fewer spaces with full rooms, strong bar economics and a loyal, diverse audience matter more than logos on a map.”

“Instead of chasing store counts, brands are measuring cash flow, unit economics, repeat customers, and operational efficiency,” noted Sukhi by adding that the obsession with rapid expansion has faded because scale without stability exposed weaknesses during downturns.

Cash Flow is the New Valuation

Growth-at-all-costs models have fallen out of favour and is replaced by a focus on unit economics, break-even timelines, and cash flow sustainability. Operators are now judged by how quickly an outlet turns profitable and how resilient it is during slow periods.

Adding to this, Pawan Shahri, Co-founder, Chrome Asia Hospitality said, “What we are seeing is a shift towards fewer but stronger business concept that can absorb shocks, adapt formats, and remain culturally relevant without burning capital. This approach has a direct business impact: healthier margins, better talent retention, sharper brand identity, and long-term scalability.”

Redefining Expansion

Around 80% of the restaurateurs believe in having stability in the current outlet and plan for a bigger expansion. Growth hasn’t disappeared—it’s being redefined. Expansion is being redefined from ‘how many outlets’ to ‘how resilient each outlet is.’

“Expansion today isn’t limited to opening more outlets. It’s also about building recognition beyond your physical space through pop-ups, collaborations, takeovers, and community-led experiences. These allow brands to grow visibility and test ideas without losing focus or overextending,” said Avinash Kapoli, Co-Founder, Kompany Hospitality.

It’s not Just about Survival

Today’s consumer knows what they want and has likely experienced similar concepts before. What they’re really looking for now is innovation. Restaurants with a clear speciality or USP helpsrather than copying what’s already out.

“We have focused on staying culturally and commercially relevant by evolving the global cultural experiences. That approach has resulted in a stronger, more defensible business, the brand stays fresh and top-of-mind without relying on constant expansion and helps us grow steadily, protect margins, and scale thoughtfully when the timing is right,” commented Shahri.

Kapoli shared, “For us, every project begins with how the consumer should feel. At SOKA, the team and the customer journey were in place before we opened, every drink on the menu has been tasted with real time feedback from consumers before it makes it on the menu. At Kalpaney, every dish went through repeated testing to ensure it delivered the nostalgia we wanted.”

Survival is no longer viewed as settling; it is a strategic choice. Expansion hasn’t stopped; it’s become steadier and more thoughtful.

The global restaurant industry is witnessing a notable shift in diner preferences: comfort food is outselling experimental cuisine across segments from casual diners to fine dining. In an uncertain world, diners are seeking emotional reassurance as much as flavour. Familiar dishes offer predictability, nostalgia, and trust, qualities that increasingly influence where and how often people dine out.

As per Swiggy 2025 report, Biryani led orders with about 93 million orders, followed by burgers (44.2 million), pizzas (40.1 million), and even traditional Indian items like veg dosa (26.2 million).

Comfort Food = Familiarity

One of the most powerful forces driving dining choices is a fundamental emotional need: comfort and familiarity.

“In India, food has always been a form of inheritance, carried forward by karigars whose craft is shaped by generations of lived experience. At The Bombay Chapter 003, our role is not to reinterpret that legacy, but to honour it,” shared Arpitha Rai, Co-Founder and Vibe Architect, The Bombay Chapter 003.

For decades, dining was about 'performance'—molecular gastronomy and theatrics. “Consumers are trading the unpredictability of experimental cuisine for the emotional safety of comfort food. However, this isn't a regression; it’s an evolution. The modern makeover of comfort food is what I call 'Elevated Familiarity.' We aren't seeing a return to basic recipes, but rather a structural upgrade of them,” added Anirudh Kheny, Owner, SuzyQ.

The Emotional Connection

There is definitely an element of emotional connection but emotional connection only lasts so long. There are some outlets that survive because of emotional connection.

Adding further, Suraj Gupta, Co-Founder of Fiori added, “Comfort food works well today because you’re plugging it with modern elements. It’s truly difficult for only comfort food, in its most conventional or traditional sense to survive. You have to understand that people are looking for comfort, but they’re also paying for innovation.”

“We witnessed this shift early through our supper clubs in Bangalore, where strangers gathered over traditional meals and left feeling like family. That same emotional connection now plays out daily in the restaurant,” shared Rai who also noted that guests returning for the flavours they grew up with and bringing others along.

Around 70-75% chefs are trying to bring back the nostalgic recipes and food by connecting customers to the roots.

Cultural Shift in Dining Behavior

What works in Bombay v/s Bangalore is different, but today even what works in Bandra can be very different from what works in Fort or Juhu. These micro-markets express different traits and different preferences in food.

“In terms of degrees of experimentation, I cannot become super experimental in Fortbecause it is very family-led and the demographics there are not super pro-experimentation. Even the most successful outlets in Fort, like places such as In Americano and others, do the basics very well and have very strong foundations,” added Gupta.

Predictability Drives Sales

From a business perspective, predictable sales are invaluable. When restaurants know which dishes move consistently, forecasting becomes tighter, wastage reduces, and cash flow stabilizes.

Gagan Agarwal, Co-Founder & Creative Director, Dramqiue, The Grand, Vasant Kunj, New Delhi said, “Comfort food also allows operators to engineer better margins through ingredient control. These dishes typically rely on fewer, more versatile components that can be cross-utilised across the menu, improving inventory efficiency and negotiating power with suppliers.”

Predictable sales enable tighter control over inventory, portioning, and procurement. “Comfort food menus rely on fewer, well-established ingredients that reduces wastage, improve kitchen efficiency, and allow better margin management through supplier negotiations and standardized recipes,” pointed Divya Kadam, Founder of Bodega39.

The Major Challenges

The challenges are the same as the cultural shift — lack of micro-market understanding, inability to explain food properly, and not investing enough in training and resources for front-of-house teams.

The future of the sector lies in accessible luxury. It’s about taking a dish the customer has known since childhood and executing it better than they have ever tasted.

The hospitality and food services industry welcomed the Union Budget 2026–27 for its clear thrust on tourism, infrastructure-led growth and skill development, even as long-standing concerns around taxation and industry status remain unaddressed.

While the Budget stopped short of granting comprehensive infrastructure status to hospitality—a long-pending demand—the sector views the broader policy direction as growth-oriented, particularly for tourism, travel connectivity and expansion beyond metros.

Restaurants Welcome Skill Push, Seek Tax Relief

Restaurant operators broadly welcomed the focus on talent creation and tourism readiness but flagged unresolved structural challenges.

“The Union Budget 2026 reflects a strong commitment to sustainable growth, infrastructure-led development, and ease of doing business. For the QSR industry, the focus on Tier 2 and Tier 3 cities, logistics efficiency, and skilling creates a powerful foundation for the next phase of expansion,” shared Aayush Madhusudan Agrawal, Founder and Director, Lenexis Foodworks.

Pranav Rungta, Co-founder & Director, Nksha Restaurant and Vice President, NRAI Mumbai, described the budget as a positive step for hospitality capacity building.

“Announcements like the first-ever National Institute of Hospitality and structured skill development for tourist guides will strengthen service standards and prepare our workforce to meet growing domestic and international demand,” Rungta said.

However, he pointed out that cost pressures remain a concern for restaurants.

“At the same time, restaurants continue to face structural challenges such as GST on commercial leases, lack of access to export incentives like SEIS, and the need for easier SME support. Addressing these alongside rising tourism and dining demand is key to building a resilient, sustainable and globally competitive hospitality sector.”

Preparing for a More Competitive Future

From the alcobev industry’s standpoint, the budget signals continuity rather than disruption, especially with alcoholic liquor remaining outside the GST framework.

Vidhatha Annamaneni, Co-founder, Ironhill, said the real message lies in India’s increasing global alignment rather than domestic tax reform.

“From the alcobev industry perspective, this budget reinforces a reality the industry understands well—that structural reform in alcohol will continue to be gradual, not dramatic. Keeping alcoholic liquor outside GST maintains the status quo, but the real signal lies elsewhere,” he added.

According to Annamaneni, the India–EU Free Trade Agreement and phased tariff reductions across spirits, wine and beer will steadily reshape the competitive landscape.

“These changes point to a more competitive, globally aligned market over the next decade. For Indian brands, this is both an opportunity and a wake-up call. Lower duties will raise the bar on quality, consistency and brand-building, especially as premiumisation accelerates.”

Also, players believed that reduction in TCS is a practical move that eases working capital pressures across the value chain. What the industry needs next is predictability—rationalised customs structures and faster resolution of legacy disputes.

Tier 2 and Tier 3 Cities Emerge as Growth Engines

The budget’s emphasis on connectivity, regional development and tourism infrastructure is expected to unlock demand in emerging markets beyond major cities.

Shakir Haq, CEO, NKP Empire, said the policy direction creates new opportunities for organised dining brands.

“The budget sends a clear signal that growth over the next few years will be driven by better infrastructure, stronger tourism and deeper development across Tier 2 and Tier 3 cities,” Haq mentioned by adding that as connectivity improves and more destinations open up, travel and local consumption will naturally rise, creating new demand for food and hospitality businesses beyond the metros.

For restaurant groups like NKP Empire, he noted, this shift enables expansion into underpenetrated markets.

Hotels See a Future-Ready Tourism Blueprint

Hotel operators see budget 2026 as a comprehensive policy framework that integrates talent, technology, sustainability and connectivity.

Sarbendra Sarkar, Managing Director & Founder, Cygnett Hotels & Resorts, said the budget places India firmly on a high-growth tourism trajectory.

“Budget 2026 presents a comprehensive and future-ready vision for tourism and hospitality. The focus on building a world-class hospitality talent hub and professional guide training will significantly raise service standards and create a globally benchmarked workforce.”

He highlighted the importance of digital destination platforms and creator-led tourism promotion.

“This modern, data-driven approach will enhance visibility and demand across regions.”

Sarkar also welcomed the reduction of TCS on overseas tour packages to 2 percent and major mobility initiatives.

In an era defined by rising costs, fickle customer expectations, and technological disruption, the walls of the traditional “big menu” are being knocked down. Across the global restaurant landscape, operators are increasingly trimming menu offerings to focus on a smaller, sharper, more profitable selection. This isn’t just a fad; it’s a strategic response to some of the toughest challenges the industry has faced in decades. In cities like Mumbai, Pune, New Delhi and Bengaluru, restaurants are opting for focused menus.

Limited is the New Go

The modern diner is increasingly looking for expertise rather than variety. In an era where guests are spoiled for choice, a "winning formula" is a concise menu that is exceptionally high in quality.

“By narrowing the focus, we eliminate "decision fatigue" for the guest and ensure that every dish hitting the table is world-class,” said Sundheep Reddy, Co-Founder, Mirth Cocktail Conservatory.

Concise menus showcase chef-curated specialties with greater pride. Most restaurants offer 40–60 core dishes, and 70–80% rotate seasonal menus based on ingredient availability.

Focusing on this, Sumit Gambhir, Co-founder, Woodside Inn added, “Fewer dishes improve consistency, boost staff confidence in recommendations, reduce ingredient waste, and ensure fresher food—while also strengthening inventory control and cost efficiency.”

Improved Experience

A smaller menu allows for greater agility. We can adapt to seasonal produce or food trends much faster than a restaurant tethered to a massive, static menu.

Khalid Ansari, Founder, Kojak mentioned that they deliver a personalized service to guests making them feel more special. Such experiences reduce the gap between the diners & kitchen.

Reddy noted, “For guests, the experience becomes more intentional as they believe that as there are fewer options, each dish has been perfected.”

Also, menu engineering uses sales and profitability data to evaluate every dish. Modern pricing strategies like dynamic or time-based pricing help restaurants actively manage demand offering lower prices during slow periods and higher prices during peak times to maximize revenue.

Commenting on this, Sneha Upadhya Chef and Founder, Lygon St. said, “We use menu engineering to understand demand and seasonality, and price accordingly. Dynamic pricing helps us balance value for the guest while keeping the business sustainable. We are cutting inventory by designing menus around overlapping ingredients and versatile prep.”

The Business Impact

While a curated menu often leads to better margins through reduced wastage. Restaurants are saving a lot with staffing, food costs and ingredients by 40-45% with limited menu serving. This not only improves the business but also helps in scalability.

“The impact at a high-end bar like Mirth is also reflected in the synergy between food and drink. At a cocktail conservatory, food typically accounts for less than 20% of total sales, but its role is vital,” shared Reddy.

A limited, high-quality food menu ensures that the culinary offerings complement, rather than overshadow, our primary craft: the beverage program.

Gambhir said that this is still an early experience for them, but they see the benefits in the confidence gained by their ops teams.

However, the future is hyper-specialization. Restaurants expect to see more "micro-menus" that change almost weekly based on market availability. The "everything-under-one-roof" model is fading; the future belongs to brands that do one or two things better than anyone else in the city.

Hosts are moving away from large buffets toward curated, meaningful dining. This shift is reflected in strong growth where contract catering is projected to reach $4.25B by 2033, wedding catering $28.63B by 2032, inflight catering $382.9M by 2029, and the Indian catering industry $7.7B by 2034. As of October 2025, Mumbai alone has 3,353 caterers, largely focused on weddings.

Customisation is the New Standard

Customization has moved from being a luxury to an expectation. Every event has its own purpose, and catering should reflect that. Around 60-70% of the brands focus on customization and personalization.

Mayank Prasad, Founder & CEO, Curated Catering By Design, emphasizes that menu design to service style, personalization allow them to create experiences that feel authentic and memorable.

“We spend time interviewing clients to understand their personal tastes, guest preferences, and religious or cultural sentiments. This allows us to curate menus that respect traditions while still feeling exciting and modern,” shares Chef Harsh Shodhan, Founder of The Gourmet Kitchen and Studio.

There’s also a rise in restaurant-style à la carte menus at events, where guests can order their choices and receive freshly prepared plates, bringing both quality and personalization into large-scale catering.

“We are seeing fewer buffets and more live stations with thoughtfully portioned small plates, allowing guests to experience freshness, interaction, and variety without excess,” adds Shodhan.

Focus on Health & Wellness

Health and wellness have become central to menu planning. As per reports, 40-50% of the consumers prefer health & wellness even on luxury and premium caterings.

“Clients want food that feels indulgent yet balanced—lighter preparations, cleaner ingredients and inclusive menus that cater to diverse dietary preferences without compromising on taste or presentation,” points Prasad.

Explaining further, Rusheel Dadu, Founder & Managing Director of Dadu's Sweet Emporio mentioned, “At Dadu’s Pune, we’re seeing catering in 2026 move decisively towards mindful consumption, experiential dining, and intentional design. Health and wellness are now baseline expectations, clients increasingly ask for cleaner ingredient profiles such as organic dry fruits, natural sweeteners, millet-based menus, gluten-free options and portions-controlled indulgences that balance taste with nutrition.”

Beyond the Plate

Guests are increasingly moving away from pretentious or disconnected cuisines and gravitating toward global and regional flavors that feel familiar, comforting, and meaningful.

“We’re also seeing a renewed love for flavours that tell a story. Global cuisines continue to excite, but regional Indian food—reimagined with finesse and modern techniques creates an emotional connect that guests truly appreciate,” expresses Prasad.

While Shodhan notes that they are diving deep into regional food cultures, especially traditional recipes that may have faded over time but are still fondly remembered.

From table landscaping to projection mapping, brands are now dishing out experiential experiences for the guests to have a personalized experience.

Small-plate menus are gaining popularity as interactive dining experiences take center stage. Chef-led live stations and food storytelling are adding theatre and engagement to events. Reports suggest that 40–50% of diners now prefer small plates, as they allow guests to sample a wider variety of dishes across restaurant and catering formats.

“Another clear shift is from large, repetitive spreads to fewer, well-executed offerings. Hosts today prefer depth over volume. Live plating, modular stations, and made-to-order formats help maintain quality while enhancing the guest experience,” says Dadu.

Catering has evolved from a supporting detail to a defining event experience. As hosts choose intention over excess, the industry is embracing customization, wellness-led menus, regional storytelling, and immersive formats that engage the senses.

With strong market growth and rising expectations, premium catering is entering a conscious, design-driven era where those who balance creativity, authenticity, and personalization will create moments that last far beyond the meal.

From ramen bars to specialist pizzerias, India’s urban dining landscape is increasingly being shaped by restaurants that are choosing depth over breadth. The once-dominant multi-cuisine model, built on variety as a proxy for value, is steadily giving way to cuisine-led and micro-cuisine restaurants that operate with tighter menus, clearer narratives, and stronger operational discipline.

This shift is unfolding against the backdrop of a rapidly growing yet increasingly competitive food services market. India’s food-services sector is valued at nearly INR 5.7 lakh crore and is projected to cross INR 7.7 lakh crore by 2028, with organised formats, delivery-led models and casual dining driving much of the growth. As costs rise and consumers become more intentional, operators are rethinking whether breadth still makes business sense.

Increasingly, restaurants are responding by narrowing their offerings. Industry operators say focused menus, often limited to 10–25 core items, allow for better cost control, faster kitchen training and stronger consistency, compared to multi-cuisine menus that can run into 40–50 dishes and strain operations.

Consumers are No Longer Browsing

Across cities, restaurant owners say the modern Indian diner arrives with intent. Discovery still happens online and on social media, but the decision-making is sharper than it was a decade ago.

“Indian diners today are far more decisive and informed than they used to be. They’re no longer stepping out to see what’s available. They’re stepping out knowing exactly what they want to eat,” said Yash Bhatia, Founder of Mai Mai, Bengaluru.

At Mai Mai, which focuses on Southeast Asian flavours, menu restraint is central to the brand’s positioning. “Guests don’t want twelve cuisines done reasonably well. They want one cuisine done with clarity, depth, and confidence,” Bhatia added as this clarity of intent is echoed by newer-format QSR and casual dining brands as well.

For Ritik Goker Choudhary, Co-Founder of Tosi in Thane, the move towards a micro-cuisine format wasn’t driven by trend-spotting, but by an unmet everyday need.

“We were looking for a place that did a good dosa consistently, in a clean, comfortable setting, and realised how rare that actually was,” he said, adding, “We made a conscious decision to centre the brand around the Benne Dosa and build everything around doing that exceptionally well.”

Why Focus Works Operationally

From a business standpoint, cuisine-focused formats offer tangible operational advantages, particularly in an environment where margins are under pressure. Industry benchmarks show food costs typically account for 25–35 per cent of revenue, labour another 20–30 per cent, while delivery commissions can take away up to 30 per cent of order value.

Against this backdrop, operational efficiency has become critical.

“From a business perspective, cuisine-led restaurants are simpler to execute and easier to scale, but only when the focus is honest and disciplined,” said Bhatia.

Choudhary echoed this view from a QSR lens. “When you are not stretched across multiple cuisines, everything becomes sharper from sourcing, kitchen training, prep processes, and quality checks. Our teams understand the product better, wastage is lower, and consistency becomes easier to maintain,” he said.

However, this operational clarity comes with its own pressures.

“The biggest challenge with a cuisine-focused format is that there’s nowhere to hide. dish has to earn its place. You can’t rely on variety to cover up weaknesses,” Bhatia added.

Heritage Cuisines Find New Relevance

Beyond global cuisines, focused formats are also helping underrepresented Indian and colonial-era cuisines find renewed relevance with urban audiences.

“At Maize & Malt, we have chosen to focus on Anglo-Indian cuisine, a heritage cuisine rooted in Kolkata with strong colonial influences,” said Keshav Keshu, General Manager, Maize & Malt.

He pointed that dishes such as butter garlic prawns, railway mutton curry and pepper chicken balance familiarity with discovery. “From a business perspective, a tight, cuisine-led menu improves consistency, sourcing efficiency, and operational control, while also helping build a strong and differentiated brand identity,” Keshu pointed.

But here too, discipline is non-negotiable. “Quality and execution must be flawless every day, as there is no room to hide behind variety,” he added.

Who Will Scale

Looking ahead, operators agree that cuisine-led restaurants are unlikely to broaden their menus. Instead, they will narrow further.

“Cuisine-led restaurants in India aren’t going to get broader. They’re going to get sharper,” said Bhatia. “We don’t see cuisine-led formats as a trend but rather a correction.”

According to founders and operators, three factors will determine long-term success:

Bhatia said success comes down to clarity and discipline. Restaurants that know exactly what they are and stand out more easily, but that focus only works when strong operations and training back it. In the long run, he adds, it is consistency, not constant reinvention, that keeps customers coming back.

Hyderabad has long been a city that understands scale—of flavour, of ambition, and of celebration. On 19th January at Trident Hyderabad, the city once again proved why it sits at the heart of India’s food and hospitality evolution as it hosted the 22nd Edition of the Restaurant India Conference and Awards 2026 – Telangana & Andhra Pradesh Edition.

Organised by the Indian Restaurant Congress, the event brought together the country’s most influential restaurateurs, chefs, policymakers, consultants, and foodservice innovators under one roof. The conference was not just a gathering—it was a mirror to an industry in transition, one that is reimagining growth while holding on to its cultural soul.

Innovation with Meaning, Not Just Novelty

While innovation has become a buzzword across food and beverage, the conversations in Hyderabad moved beyond surface-level trends. The focus was on innovation that is relevant, contextual, and rooted in storytelling.

Speaking on the untapped potential of India’s frozen dessert market, Sheetal Patil, CEO, Cream Stone Ice Cream Concepts pointed out a telling statistic. “Innovation has always driven food, but in ice cream, India is still at just ~1 litre per capita consumption that’s far lower than global markets,” he shared.

With urbanisation accelerating, logistics improving, and disposable incomes rising, the opportunity today lies in premiumisation, where experience and quality take precedence over volume.

Adding depth to the discussion, Chef Shankar Krishnamurthy of Voila F9 Gourmet, framed innovation through the lens of nostalgia and locality.

“We grow with nostalgia. Today, everything is about being personal, relevant, and small—stories behind food and the relevance of local sourcing matter more than ever.”

Scaling Without Losing the Soul

As Indian restaurant brands expand beyond home markets, the challenge is no longer just growth—but growing without dilution. Nikita Poojari, Director, Shiv Sagar Group shared a lesson many brands are learning in real time.

“When we scale, we keep the brand soul the same. Our positioning, consistency, and price format remain unchanged. What changes are portioning and the inclusion of local flavours when we enter a new city like Hyderabad,” she shared.

From an operational perspective, longevity and discipline emerged as key enablers of scale. Anand Krishnan, 3rd Gen from the famous Namma Veedu Vasanta Bhavan of Chennai whose brand has operated out of Chennai for nearly five decades, reinforced the importance of structure.

“We believe in a centralised kitchen format supported by a strong team. That’s the foundation for any sustainable expansion,” he added.

Technology: The Silent Growth Partner

If there was one unanimous takeaway, it was this-technology is no longer optional. From smart kitchens to data-driven consistency, the modern restaurant ecosystem is being built on tech. Nikita Seth, Sales Head, South India and Srilanka, Trufrost & Butler put it succinctly.

“It’s impossible to scale today without technology. If you want consistency, premiumisation, and growth, you need smart equipment and strong tech partners,” she pointed.

The conversation made it clear—technology is not replacing craft, but enabling it at scale.

Modern Palates, Timeless Roots

Chefs on stage reminded the audience that progression doesn’t mean abandoning heritage. Instead, it calls for balance. Chef Suresh DC of award-winning Tuya, captured this philosophy when he said, “Progression is not just in food, but across the sector. We need to be modern, but we must remain true to our roots and soul.”

Echoing this, Chef Amey Marathe spoke about the responsibility that comes with reinterpretation.

“As chefs, it’s important to understand where a dish comes from and preserve its originality even when we’re experimenting,” he added.

Hyderabad’s Rise as a Nightlife Powerhouse

Beyond food, Hyderabad’s transformation into an experiential dining and nightlife hub emerged as a defining narrative.

Hemender Reddy traced the city’s evolution from modest cafés to destination-driven venues.

“I started with a small café, which later became a club. Post-2014, people began investing in larger, music-led spaces. That’s when bars transitioned from family formats to nightlife destinations,” he said.

Rehan Guha of Oxymoron went a step further, positioning Hyderabad as a benchmark city. “Very few Indian cities can match Hyderabad when it comes to scale and dreaming larger-than-life in the nightlife space.”

A Night of Applause and Achievement

As conversations gave way to celebration, the evening culminated in the Restaurant India Awards, honouring brands and individuals who are shaping the future of Indian hospitality.

The awards night saw the presence of industry leaders such as Gautam Gupta (Ex-CEO Paradise Biryani), Syed Irfan (Subhan Bakery), and Mohammed Abdul Majeed of the Iconic Pista House, alongside dignitaries including top chefs and industry leaders. Presented by RestaurantIndia.in and Franchise India, the event was supported by Title Partner: Ohri’s; Co-Title Partner: Miar; Powered by Cremica; and Official Tabulators: EY.

Over the years, the Restaurant India Conference and Awards has evolved into the definitive voice of India’s food and beverage sector. The Hyderabad edition reaffirmed a powerful truth: the future belongs to brands that innovate with relevance, scale with discipline, embrace technology, and remain deeply connected to their cultural roots.

In a city that thrives on bold flavours and bigger dreams, the conference didn’t just reflect the industry’s present—it offered a compelling glimpse into what lies ahead.

Today, restaurant scalability is less about opening new outlets and more about building repeatable, tech-enabled, and financially resilient brand.

Scalability means a restaurant’s ability to replicate success across units, deliver consistent quality, and grow in revenue without proportionally increasing costs. This includes standardized operations, strong systems, consistent culture, and measurable performance tracking. India’s restaurant market is projected to reach over $100 billion by 2030.

As per the reports, 1,000-2,000 restaurants open every month in India, but also there is a large number of closures due to high costs and competition. Here’s how leading restaurant brands are achieving scale today:

Cultural Relevance and Experience-led recall

In 2026, scalability for restaurants will be defined by how strongly a brand can build cultural relevance and experience-led recall, rather than just focusing on numbers.

“Our focus has been on creating formats that brands, consumers, and collaborators instinctively benchmark against when they think of experiential nightlife and bar culture—and we are now extending this vision through our newest cocktail bar, Late Checkout,” shared Pawan Shahri, CEO & Co-Founder Chrome Asia Hospitality by adding that even ahead of completing their first year of operations at Late Checkout, they have already executed 10+ bar takeovers across domestic and international markets.

Scaling Globally

In 2026, scalability for Massive Restaurants is rooted in the perfect balance between culinary creativity and operational discipline. Around 25-30% of the brands from India has scaled globally and made their mark in the US, UAE, UK and Saudi Arabia.

“For us, scaling a brand globally - from Farsi Café to Pa PaYa - means ensuring that the guest experience remains consistent, whether they are dining in London or Mumbai,” mentioned Zorawar Kalra, Founder & Managing Director of Massive Restaurants Pvt Ltd.

Standardized Operations

The foundation of the growth is a highly systematized kitchen hierarchy. 25-30% of the focus should be on standardizing the operations.

Highlighting his views, Timanshu Mokal, Co-founder Amelia, One BKC said, “One early learning was that standardised systems are essential, but only when they’re shaped around real, on-ground realities. For instance, tightening kitchen prep flows and service handovers didn’t just improve efficiency; it reduced stress during peak hours and delivered a more consistent guest experience.”

Diversifying Revenue Streams

Diversifying revenue streams is equally important. For Fino Frangline, Co-Founder, Mykos Craft Kitchen & Bar, it’s beyond core food and beverage sales, additional offerings such as in-house dessert cafés, experiential elements like photobooths, and event-led activations help generate incremental monthly revenue and strengthen unit economics.

While revenue across Chrome Asia Hospitality continues to be driven by core food and beverage operations, initiatives such as global bar takeovers are conceived as strategic brand-building levers rather than direct revenue drivers. “Through Late Checkout, we have built a platform for global exchange, collaboration, and innovation within nightlife and bar culture,” noted Shahri.

Not Racing Towards Scaling

Beyond metrics, scalability today depends on audience alignment, flexible formats, strong beverage programs, and culturally relevant storytelling. Around 55-65% of the brands scale after one year of the business, while 10-15% of the brands expand within one year, with 50% of them focusing on Tier-1 cities. At present, there is an exponential growth in Tier-2, Tier-3 and Tier-4 cities (as 30-35% of the brands are focusing in these cities).

Shahri believed that restaurants that scale successfully will be those that operate not just as venues, but as experience-led brands with a clear point of view. While 10-15% who expand within one year of the business, from that very few attain sustainability and stability as some ends in failure.

Staffing & Culture

Brands true engine for growth is the people. “We cultivate a culture of "Culinary Excellence," where every team member is trained to be a custodian of the brand’s standards,” said Kalra who noted that by providing clear growth paths and a structured environment, we motivate our employees to take pride in precision.

A strong, disciplined culture ensures that as brands expand, the team remains the strongest pillar of the success. The restaurant industry faces high employee attrition, which directly impacts operations and guest satisfaction.

While Frangline stressed upon creating a positive, growth-oriented work culture—through training, empowerment, and recognition helps retain talent and build stable teams, which is essential for sustainable scale.

Power of Technology

As per reports, restaurants invest 25-30% on technology to make their work easier as it reduces time consumption. Technology acts as a strong enabler of growth. Frangline added, “Restaurants are increasingly investing in POS systems, inventory management, data analytics, and automation to improve decision-making and reduce manual errors.”

“Restaurants are investing heavily—nearly 60-70% of their resources—into tools like cloud-based POS systems, AI-driven customer service platforms, and smart kitchen management tools,” shared Amit Goel, Founder and Managing Director, Tokki& Tora who explained further that these technologies streamline operations, enhance customer experience, and optimise inventory management, ultimately increasing profitability.

While Mokal draw attention to an important detail. “A dashboard can highlight trends, but it’s the floor manager who knows when to hold a table a little longer or pace service differently.”

Hence, scalability requires strategic growth planning and financial readiness, with a clear understanding of costs, profitability, and return on investment to ensure sustainable expansion.

For consumers today, desserts are no longer a footnote on the menu. Dessert-only formats, including bakeries, ice-cream parlours and sweet-focused cafés, are now among the fastest-growing segments in India’s organised food services market, expanding at 14-16 per cent, even as they account for just about 3 per cent of total market share.

High growth on a relatively small base suggests the category is still in an early phase of expansion. What was once an occasional indulgence is increasingly becoming a standalone consumption category, driven by late-night demand, delivery-led impulse ordering and changing ideas of everyday indulgence.

From Post-Meal Indulgence To All-Day Treat

Dessert consumption is no longer limited to celebrations or the end of a meal. Orders now span the entire day, from midday pick-me-ups and post-work rewards to late-night comfort cravings. Data from Swiggy’s How India Eats 2025 report shows that late-night consumption between 11 pm and 6 am is the fastest-growing food occasion, expanding nearly 2.8 times faster than dinner, with cakes and desserts outperforming even staple categories during these hours.

Gouri Koushik, Founder of Bengaluru-based Pibbles, sees this shift as structural rather than cyclical. “Desserts have always been comforting, something people look forward to at the end of a meal, or even as an emotional reward. What has changed is consumer awareness,” she shared, adding, “People are rethinking what dessert actually means to them. It’s no longer just about indulgence, but something that can be enjoyed more regularly when made with thoughtful ingredients.”

Dietary consciousness is also shaping this change. Growing demand for plant-based and lactose-free options, driven by intolerance and lifestyle choices, is pushing brands to innovate beyond traditional formats.

Gen Z, Quick Commerce and Impulse Behaviour

Beyond consumption patterns, desserts are proving to be structurally attractive from a business perspective. Compared to hot food, dessert components often have longer shelf lives, reducing wastage and improving predictability.

“From a business-model perspective, desserts are more viable because many of the components used have longer shelf lives compared to hot food,” shared Koushik. “The process is methodical and precise, which builds consumer trust and leads to higher repeat orders.”