Taxes may feel like a never ending maze to most of you. But in general people are not aware of the direct and indirect taxes they pay for while buying a product or a service. And thus, GST is being introduced so that the tax regime stays same for every state of our nation and the consumers get a superior idea of how much they have to pay. The bill is sure to bring transparency and make this ‘one country-one tax’ system. Citing some of the benefits that GST holds some of the leaders spoke on how it is going to help the smooth run of the business.

Single Market: FMCG industry which is one of the major contributors in overall GDP is going to be the topmost industry being benefited from GST. Till now the country has been known as a land of miss managed and unorganised supply network and with GST being implemented the traders can now buy raw material from any part of the country as the tax inflicted would be same overall, thus reducing the latent costs of long transportation. It would make doing business tax neutral in the country, irrespective of the place.“The implementation of GST will positively impact the FMCG industry, which is on a growth trajectory. The sector is sure to avail significant benefits in transport, logistics and warehousing apart from other input costs, “shares Oliver Mirza, Managing Director & CEO, Dr. Oetker India.

Cutting the cost: Edible oil, tea, coffee and spices which are currently taxed 3% - 9% will be dropped to 5% while goods taxed at 9 – 15% at present will be taxed at 12%. Items that presently fall in the 15-21 percent range will drop to 18%, thus affecting the overall food cost. The proposed rate is lesser than the current tax rates with items such as food grains taxed at 5% as opposed to the current 6%, and processed food charged at 12% as opposed to the current 15%. “GST regime will definitely make doing business easier and reduce paper work for hotels, but taxes should be capped at 10%,” adds Bharat Malkani, president, Hotel and Restaurant Association of Western India (HRAWI).

Ease on bills: The GST bill is one step closer to advocating for reduction and simplification of doing business. The removal of multiple taxes is sure to make the restaurant bills lighter. Cheaper bills are sure to attract customers and will result in heavier traffic in restaurant.

Hence, we can say that in long run GST is going to help restaurant and food business with an ease unfolding new avenues and opportunities.

Packaging is the most important form of branding in today’s world. With great packaging, a product can do wonders in the market. It has influenced the choices of many customers across a range of products. The growth of the packaging industry has given way to the ideologies that better the packaging, better the product or brand.

Also Read: Next steps for regenerative packaging

Use of Technology

In terms of technology and design, packaging is an all-encompassing industry that utilizes innovative tech-based solutions for protecting or enclosing different products for storage, shipping and sale. Packaging also takes in the product manufacturer’s marketing efforts. For leading manufacturing companies, the way they package their products signifies their brand and its values. Packaging has now become an essential part of the product business model, right next to producing an excellent product, of course.

Digital printing allows packagers far more latitude in personalization customization for short run options than traditional printing processes. In the past few decades, most packaging companies have developed digital capacities. However, such an addition to systems and processes of a production takes time and effort.

This decade witnessed the rise of the packaging industry, driven single handedly by tech for requirement fulfillment across the globe. Also the use of digital presses has grown, while conventional presses have declined!

In 2018, narrow-web digital presses exceeded the standard flexo presses for the first time. This digital printing technology allows all colors to be printed in a single pass, which has fostered a trend of “printing on-demand” in the industry.

Digital printing has further made it extremely convenient to customize packaging and add a personalized touch to the products. This trend has been building for a few years, and has provided a major boost to the industry. Several brands have been exploring the universe of personalized packaging and found a significant return on investing in innovative marketing techniques such as this.

May Interest: Packaging Innovation to be a major Ingredient in the food industry in 2021

In the past year, we have fostered a greater need for food safety and secure food packaging. So much so that even packaging material manufacturing companies are going the extra mile to create innovative packaging material that will effectively match the visual appeal criteria as well as meet safety norms. Also, with strict government regulations and more awareness towards environmental hazards of plastic etc, the world is moving towards recyclable, biodegradable substances. Materials like bagasse, bamboo, jute, biodegradable plastic, glass etc. are sure to see increased demand in the coming years. Packaging suppliers will have to ensure affordability and availability while also trying to retain or incorporate other sought after features like leak resistance, customizability, etc.

Nowadays everyone is focusing on special menu, zero waste etc. to avoid wastage. One more thing that tends to get overlooked in most of the kitchens is wastage of water, although now people have started taking care of this issue, by moving to water saving drainage systems. Restaurants across the globe are looking at sustainability at their core!

“We have trained our staff as per the industry standards. We are very conscious about all that we do, from supporting local to utilizing everything that is leftover in our kitchen to having organic vegetables in our dishes. All peels and bones are being used for broth or stock,” shared Shaan Sarin, Co-founder and CEO, Teo Lounge and Bar.

Also Read: Starbucks joins Transform to Net Zero, focus on sustainability goals

Not only this, whenever somebody is eating at a restaurant they need to be socially aware about the source of ingredients, the temperature at the plate has been kept, is he being given cotton napkin instead of paper napkin. And, all those things ultimately have a cost, environmental effect wherein sustainability is concerned.

“If there is something to be thankful for during the lockdown, it is the adoption of zero-waste cooking. Zero-waste cooking is the sustainable use of every part of an ingredient used in cooking in order to reduce wastage. Most of the restaurants had borne a huge amount of loss in this lockdown, therefore many restaurants have decided to cut down their expenses as well as trying to get most out of waste,” pointed Harsh Gupta, Owner, Breakin'Brew who shared that the day he opened his restaurant, he decided not to waste anything from his restaurant kitchen, initially they decided to make different soups out of left over of vegetables for their team members which can’t be use for food preparation. Also, they have started decomposing waste vegetables and their peels to use in future for in-house plants. They are also planning to donate the food packages to poor, and are still in conversation with NGO’S who are in this sector.

Also, keeping a track on disposability is very important part of sustainability program. We should be well aware about where does our food waste get disposed and what has happened to the left over foods etc when we are thinking sustainability.

May Interest: How to create a Zero waste kitchen

“Change doesn’t happen in an instant, but by taking many small steps restaurants can strive to reach the goal of zero waste kitchens, we can grow herbs at home, buy only what you need, pickle it preserve it, Donate and recycle. The restaurant industry generates a lot of waste. We use each and every ingredient that received in the kitchen which helps us to keep the cost low and makes zero waste, pickling the vegetables with vinegar to minimize the wastage, Plastic storage replaced with steel containers most people throw outer cabbage leaves away but we make sauerkraut which goes with many dishes as an accompaniment,” added Chef Himanshu Dhondiyal from Sixth Emperica.

HPMF Thnk Tank Member and Freelance Procurement Consultant Apr 27, 2020 / 13 MIN READ

This is a million dollar question. It needs the concerted efforts of the Governments – Central and States, Entrepreneurs, Promoters and the Working Class, both in the organized and the unorganized sectors. Sacrifices need to be made and foregoing present luxuries for long-term stimulus and impetus.

Governments are going to see drastic reduction in Tax collection and revenue from other sources are also bound to dwindle and witness a major slump. At the same time, to keep up demand or help demand to pick up, Governments have to infuse large sums towards investment on one hand and to meet the Social security needs of a larger section of the under privileged on the other. Money has to flow to people’s hands to spend, so that demand kick starts. In this scenario, where are they going to mobilize the funds? They have to resort to deficit financing by going ahead with borrowings. This will lead to an inflationary effect on the economy in the medium and long runs, which is once again detrimental. The job of the Finance Ministers becomes more complicated in balancing liquidity and inflation.

For the entrepreneurs and promoters who are ready to invest will also have to seek the Debt route from Banks and Financial institutions since the Primary Market’s sentiments for IPOs (Initial Public Offer) and retail investors confidence has already taken a beating. They too will be stuck in the quagmire of debt servicing, meeting the Working Capital requirements and Cash Flow position. Flow of funds will stagnate or get staggered as collection from Debtors will be a long drawn process and the same time, there will be pressure from the Creditors to honour the commitments.

In my opinion the working class, whether in the organized or in the unorganized sector will have to bear the major brunt. Across sectors, Layoffs and retrenchment are bound to happen and certainly, the call will be for work force reduction to trim the wage bill. Salary and wage levels increment are not to be contemplated in the near future, as the disruption will consume almost the entire 1st quarter. Incentives and cash bonuses are surely to be postponed and in the most probability, better to be forgotten.

Considering all the above factors, there is more likelihood of disruption in the supply chain. Nevertheless, believe me, public memory is very short and in a couple of month’s time, the festive season will kick start, our affinity for social values and relationships will devour the tentacles of the pandemic.

Monsoon is round the corner in another 45 days. With more hands available due to the reverse migration of the rural population to their homelands, availability of agricultural labor will be high, which was a cause of concern, leading to higher wages and making agriculture non profitable. The conversion of agricultural lands into non-agrarian purpose will reduce, leading to an increase in the area under agriculture and related activities. Agriculture and its allied functions like livestock rearing, dairy, poultry, sheep rearing, etc will get a boost.

Elections are also due in 5 states in early 2021, will certainly have a cascading effect on the economy.

When it comes to Purchasing Management or Procurement, Post COVID – 19, will there be a cautious buying pattern ?

Purchase Management or Procurement should not be viewed in isolation from an organisation’s point of view. Individual or retail procurement should also be taken into account. In the short term, this is certainly going to take a hit, as everyone will be treading with caution on the spending front and will be on shoestring budgets. As I said earlier, with good monsoon and the festive season ahead, average spending will increase. Therefore, the outlook for the medium run is recovery and for the long run, it would be growth, consolidation and development.

Sectors like Information Technology, Communication, Telecom and allied services will boom, with organizations having experienced such seamless connectivity and activity during this lockdown period will look to ramp up infrastructure and upgrade the resources at their premises and even individuals are going to scale up their bandwidth and gadgets. These sectors are going to witness massive investments and demand for new technology will shoot up.

In the Automobile sector, initially the 2-wheeler segment, particularly electric motorcycles will see an upsurge, since the public sentiment is to stay aloof and avoid mingling in the crowded public transportation system. Similar demand surge for the 4-wheel segment will also witness sooner or at a later stage for the same reason. Very sooner newer methods of public transport would emerge.

Food delivery and food processing industries will also see a boost. Banking and Insurance (Life, Health and non life insurance) will see demand as people now realize the need for savings and loss prevention. Banks will have to go on a lending spree to increase liquidity.

Hospitals, medical and allied products and investments in medical research, equipments and infrastructure will see increased activity. Demand for trained personnel worldwide will increase. Agriculture, Animal Husbandry, Fertilizers, Chemicals, and basic utilities will also grow.

Few sectors like Airlines, Commercial Real Estate, and Foreign in bound travel, Hospitality (Room Occupancy) may witness setbacks in the short run but will gain momentum soon.

If the benefits of the fall in crude prices are passed on to the consumers, there will be some easing on the inflationary effect, putting some more money in the people’s hands to spend and also save a part of it.

A concerted effort is required from all the stakeholders with immediate effect. Governments have to kick start massive infrastructure investment and prioritize healthcare, hygiene and sanitation and providing social security as its core function. Entrepreneurs and promoters should look at the working class with empathy and the working class should not shy away from putting in more hours of work with loyalty and integrity.

The dynamics are going to change and in the changed world, we are all going to prosper.

Yes, we humans are resilient.

India is predominantly an agricultural country. However, the emergence and rise of other sectors has led to it no longer having an agriculture driven economy. The food processing industry, for instance, makes up about 32% of the total food industry of India.

India’s digression from being an agrarian society, has given rise to a number of problems which need to be pointed out and resolved. A large portion of the produce is exported, which makes it surprising that the one area in which India seems to be lacking is Cold Chain. Cold Chain is the process of introducing temperature controlled storage and transportation facilities to prevent rotting of easily perishable food produce.

The bottlenecks encountered when looking to improve these processes are large scale wastage of food, inadequate transportation facilities and lack of technical knowledge. With over 50% of the population engaging in farming opportunities, it becomes imperative to provide services and processes that are capable of aiding this sector. The obvious solution to the problems being faced seems to be Cold Chain Management.

So what are some of the challenges being faced by farmers when it comes to the implementation of Cold Chain? The lack of infrastructure allotted to the cold chain sector seems to be the biggest issue. Without the appropriate technical knowledge, farmers are unable to store produce in a manner which keeps it fresh long enough to be exported. Another glaring issue is that the farmers depend heavily on middlemen. This inefficiency of the supply chain makes it near impossible for farmers to access those facilities which can help reduce wastage. At the moment, the Cold Chain Market in India is a niche which assures hygiene, longevity of produce and a boost to the food industry, which will carry it through to the upcoming boom on the global front.

It is important here to note that almost 40% of produce goes to waste due to improper storage and transportation facilities. UK at present stores 70% of its agricultural produce in Cold Chains while India is at only 4%. Implementation of a cold chain management system can reduce food product wastage by almost 75%, thus increasing the capacity to export produce and increasing the overall GDP of India. The advantages of this are manifold – an extended lifecycle for perishable products, reduced wastage of food products and a larger market reach which then leads to a greater customer base.

While the current capacity is nowhere close to being enough to support cold chain management, resolving the issues requires cold storage facilities to be implemented in the supply chain. By cold storage, ISB identifies the following features: Pre-cooling facilities, Refrigerated Carriers, Cold Storages, Warehouse Information Management systems, Financial and Insurance Institutions and Traceability. The fixing of the supply chain also needs to be done in a manner that keeps in mind the requirements of farmers and care should be taken to not hamper their livelihoods. On the one hand, investment by Walmart and other such multinational corporations would lead to development of cold chain management systems, as they would need to transport perishable materials countrywide. However, it should be kept in mind that this does not hamper the jobs presently being created for storeowners or farmers. On the other hand, companies working directly with farmers to implement better supply chain management systems have reported a 25% increase in prices.

Thus, it is clear that there is not one single approach which will improve the condition of the Indian agricultural market. Rather, a combined approach of taking care of the supply chain, as well as investments by MNCs, will on the whole result in a better process which will benefit farmers. The need to implement cold chain to prevent the wastage of perishable goods needs to be realised on a large scale.

Another critical problem being faced by the food industry is climate change. Recent studies have revealed extreme fluctuations in the weather with increased maximum temperatures and lesser rainfall. In order to prevent these extreme climates from having a long lasting effect on the produce, certain processes can be introduced. For instance, proper transportation systems to reduce post-harvest loss. Small landholders are unable to use large scale preservation and processing technologies, thus resulting in a lot of wastage. Middlemen, upon whom farmers are dependent, are also sometimes forced to sell produce at a price lower than the production cost. There needs to be an implementation of better transport systems, which can store produce at required temperatures, and is also available at a local level.

All in all, we can identify an unorganized supply chain as the major problem faced by farmers in India. An appropriate remedy to this situation, as we can see, is maintaining a proper cold chain system. Proper storage facilities, along with appropriate temperature controlled transportation will help to reduce the problems of wastage which occurs most at the post-harvest stage. Efforts also need to be made to educate farmers regarding the proper steps which need to be taken to manage food better and reduce wastage. If all of these processes are taken care of, Cold Chain could soon become a linchpin in the wheel of the agricultural economy in India!

In an interview with Restaurant India, at the Indian Restaurant Congress 2018, Amit Malakar, President & Business Head, Sical Supply Chain Solutions shares the secret of running a successful business by providing the right solutions to the brands.

Tell us about your brand.

Founded in 1955 and with revenues in excess of Rs. 800 Cr, Sical Supply Chain Solutions is India’s leading integrated logistics solutions provider with over five decades of experience in providing end to end logistics solutions. In 2011 Sical was acquired by Coffee Day group, with interests ranging from coffee retail business, stake holdings in leading IT and embedded technology companies, to technology parks and SEZs and hospitality. We are focused in providing supply chain services to our consumers in the retail segment and also to the restaurants, cafes. We are helping brands to serve from bean to cup.

Restaurants and cafes face innumerable challenges related to supply chain. What solutions do you provide to help them grow?

When we talk about supply chain in cafes, we only think of food but then most importantly, supply chain encompasses everything you see in a restaurant, right from the setup to the furnitures, and most importantly to the food getting delivered at the right time and right place to give a complete seamless experience. As far as procurement is concerned, it should be at a right price, at the right time and stored at the right place.

How do you bridge the gap within the sector?

We have been developing the solutions for Café Coffee Day, and have established ourselves in this space, with 1200 cities in the country which is by far the largest footprint by any service provider. We are bridging the gap in terms of geography, so not just few cities; we are catering pan India. We understand the business, so we know what the food industry needs. When you make a delivery to a café, be it peak hours or off hours, we absolutely make sure that we are non intrusive to their business.

How do you manage the inventory in the business?

Major part of the inventory is food which is perishable, as they have a shelf life. On one hand, some amount of it can be increased by putting it in the freezer while some amount has to be consumed the same day. We keep track of inventory of different shelf lives in our system. With technology we are keeping track of when, where and how much to physically deliver and store.

How brands can maintain their value by cutting the costs with the Supply Chain?

For brands, it is the value which they have created and the quality which they have promised to their customers. Some of these brands are not looking at pure cost cutting. They are looking at premium quality being delivered in the right manner. Typically, in the industry, there is a lot of wastage and to make sure that the food is fresh and wasted as little as possible helps in cutting the cost but not quality.

The Indian Hotels and Restaurants Association has issued a circular to its members asking them to use reusable and recyclable containers for their parcel service. The ban may reduce environmental destruction or clogging of the drains, but the bill for home-delivered food is sure to increase. The government's ban on one-time used plastics has put home delivery businesses in soup. On the other hand, restaurateurs admitted the fact that plastic was the easiest and cheapest way to carry food especially liquid items such as curry and soup. With the ban, restaurant owners are looking for an alternative which they said might not be cost-effective.

At the restaurant front where the consumption of plastic is fairly huge like garbage bags, butchery bags, straws, take away containers etc, replacing them with reusable material will be a significant shift. A few restaurants have switched to steel clay pots and tiffin boxes in order to counter major losses on home delivery. In order to minimize the costs, one needs to keep a container ready at the doorstep with a serving bowl as the delivery boy will pour out the gravy items from his steel container into it.

“Many shopkeepers have started charging the customers for the poly-bags in order to commercially discourage them. I ensure that my food is delivered in cloth bags; packing material we use is of paper, we avoid using plastic bags for our garbage too. We as individuals can make a lot of difference in our respective ways. As plastic is a serious issue in our country so corrective measures should be taken to protect the environment,” says Poonam Bhandari, owner of Cafe 96 Square.

While several restaurants have shifted to paper, cardboard, silver foils, aluminum boxes and cane-based packaging to deliver food, some have discontinued parcel services until viable alternatives are found, in the wake of the statewide plastic ban. In case of a takeaway order, some eateries are even contemplating to keep monetary deposits, which would be refunded when the steel container is returned. As food items with curry or gravy remain a challenge in takeaway orders, there is a rise in demand for biryani delivered in eco-friendly clay pots.

“This is a welcome step and keeping in mind the destruction caused by plastic, we have created a green zone in our hotel where we strictly keep in mind that no plastic containers, glasses or spoons are used in any form. We have trained our staff also about the evils of using plastics and we encourage them to forbid the usage at their personal levels as well,” shares Snehdeep Natt, Managing Director of Gagan group of hotels.

It is not just the takeaways and deliveries that are the victims of the plastic ban. Most kitchen employees wear plastic gloves while preparing food. Plastic gloves in restaurants are mandatory to maintain basic hygiene levels. The ban extended to all these necessary plastic products have put restaurateurs in a fix. Even within the restaurant space, the worst hit is smaller chains and dhabas. Neither small chains nor dhabas can easily accommodate the cost of newer alternatives which are projected to be higher than plastics and will ultimately lead to the decrease of profit margins. More than 20 states in India have banned plastic including the capital city of Delhi. It will be interesting to see how the restaurants are bringing in innovative ideas and acting upon the ban!

Sourcing ingredients are one of the top priorities for any successful food business. Choosing the right food supplier is a critical business decision, as one has to guarantee the quality, safety, and value of the food offered. It’s a restaurateur’s responsibility to cater to customer and client needs. This has to comply with government regulations and quality standards, and provide quality meals, all while keeping the budget under control. As government and industry put a stronger emphasis on food safety and quality; so, evaluating and selecting the right supplier today has become even more complex.

Manish Tandon, CEO, au bon pain & Sagar Daryani, Co-Founder, WOW MOMO spoke candidly about best practices in working with suppliers to drive brand sales and profits, as well as the importance of cutting ties and moving to other vendors when the time is right.

How do you find the best suppliers for your brands?

Your relationship with your vendor is like a marriage: you should be able to complain or argue with your best supplier, and at the end of the day, you will have hopefully corrected any problems and made up. Before you commit to a vendor, you have to shop around. Make sure that your vendor has outstanding references by asking them what restaurants they serve and contact those restaurants directly.

au bon pain- Manish Tandon says,” The process of identifying a supplier is a step by step process. Firstly, we identify the products for which we need a supplier and establish a set of product specifications. Then we ask the available/reputed suppliers to provide us with samples. Basis the product quality check and price quote, we negotiate on the price for our volume. Then our team does a vendor facility audit for quality and hygiene and cross check all legal requirements. Based on the audit report, we finalize the best vendor/supplier.”

WOW Momo- Sagar Daryani says,” What you put into the food, that’s what comes out of it. A quality product will always ensure that you have repeated customers which make your quality brand. When it comes to suppliers or raw materials, this entire ecosystem goes by the word of mouth. All our food ingredients for our packaged foods, we have one single vendor with whom we operate nationally, with a direct tie-up with the brand. We ensure that we get the required quantity in the right quality to maintain the consistency of our brand. When fresh food is concerned, we look for vendors supplying to other big chains, say the best chicken vendor in Delhi or Mumbai and accordingly we get the samples.

How does the supplier's performance ultimately impact the brand?

Your customers love your food and the service, but it’s a delicate thread that binds them to you. All it takes is one or two disappointing meals, or their favorite menu item is sold out; or, the food is not as fresh as it could be… and one day you realize that you haven’t seen that family in a while.

au bon pain- Tandon says,” Restaurant business is very unpredictable because we deal in a lot of perishable ingredients, hence supplier performance plays a very crucial role in building a brand image. Some of the key areas of supplier performance affecting the brand image are: timely delivery, quality as per desired specs, Emergency support in case of urgent requirement.”

WOW Momo- Daryani opines,” If there is marginal complacency from the suppliers, with sluggish service or problems with the delivery of the product; it hampers the entire supply chain logistics. Brands like us who are producing and selling on a daily basis, suppliers have to consistent with their efforts. Suppliers are indeed very important stakeholders in your business and with that both the brand and the supplier has to cooperate to take the game further.”

How can suppliers make or break a brand?

Your approach to suppliers needs to be part of your strategic plan since almost every company, whether product- or service-oriented, is dependent on suppliers. Many business owners seem to get this supplier issue backwards. They think that because they write the order, they're in the dominant position and can exploit it with unreasonable demands, including personal perks.

au bon pain- “Supplies are at the core of any restaurants business. If there is any compromise on the quality specifications or a delay in supplies, it can lead to significant impact on the quality of output to the customers. A single bad review on any digital media platform and word of mouth can tarnish the brand image, and this multiplies very fast. So the supplier has to adhere to quality specifications and delivery in a timely manner as agreed with the brand”, said Tandon.

WOW Momo- “Today, the entire manufacturing and production cycle can get disrupted if suppliers don’t give the products on time. You have to ensure the supplier’s performance in terms of their quality consistency and product service timings etc. with other brands from the industry. We are paying for the fresh materials and we expect the same from our suppliers. Quality assurance is our key concern when it comes to building our brand”, said Daryani.

Let's get this right--you need good and reliable suppliers!

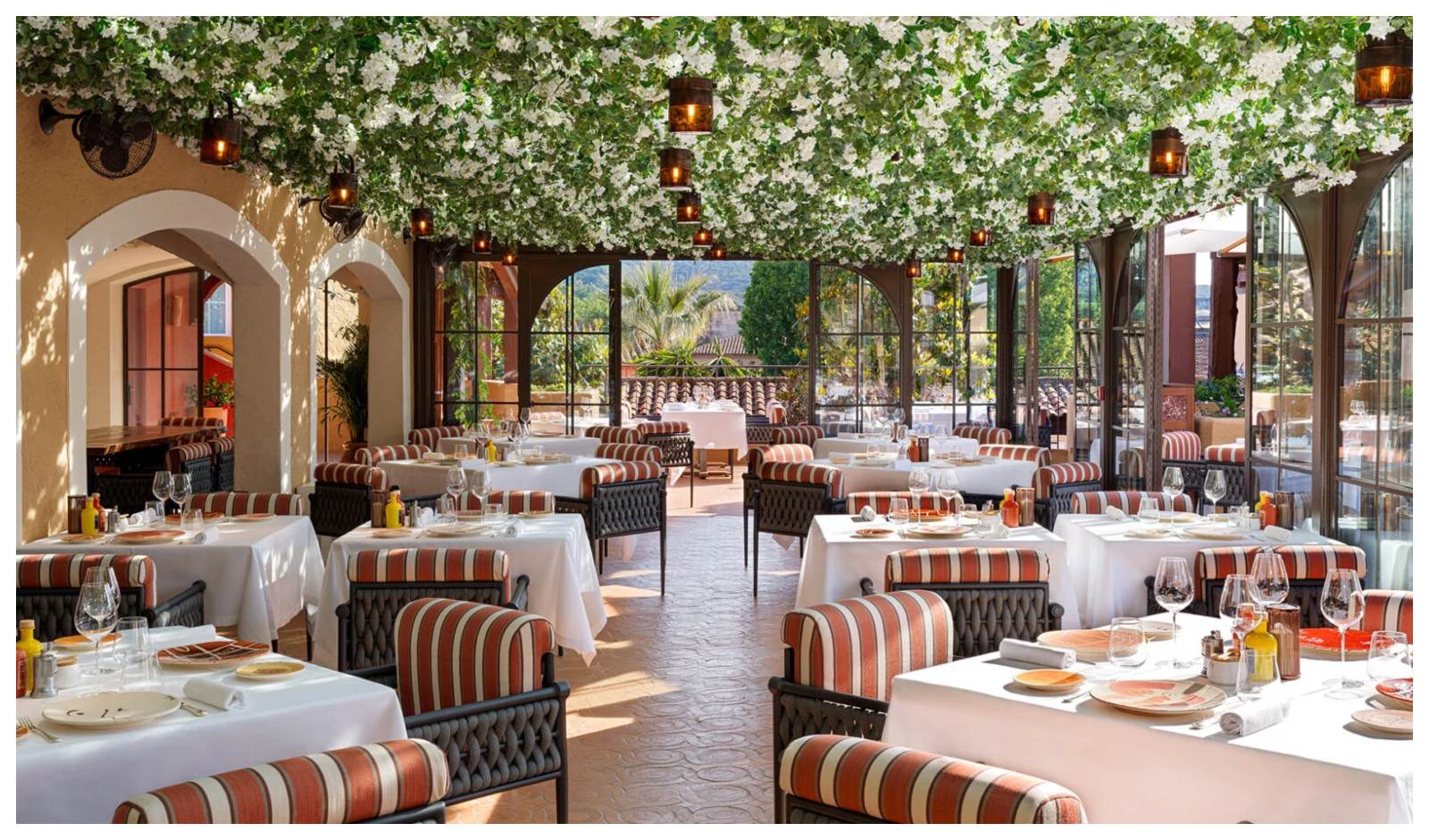

Catering as a segment refers to creating a special experience for clients/diners, wherein they visit a restaurant to relish specialties of a particular food concept in a pre-defined set ambience. Therefore, catering represents the art of bringing a unique food concept to the table. Today, caterers have become very experimental with the food choices that they promise to offer, coupled with innovative presentations that speak volume of their expertise in food business. On the other hand, restaurants offer a permanent aesthetics that cannot be customised.

Few years ago, restaurants used to be the trendsetters in dining concepts, driving the quality, consistency and swag quotients of cuisines. However, today, the situation has completely reversed. Now, catering industry is flourishing and defining trends, and driving the product and consistency factors.

Ankur Jain, Director, The Indian Catering Company said,” Earlier there used to no focus on the layout but now the clients gives equal importance to the setup layout & taste. With a lot of things changing in the catering business, challenges are ever increasing in the F& B industry.”

Hence, catering is adversely affecting the restaurant business. Following are the some of the reasons for this development:

Generating Higher Volumes:

In the catering industry, as you deal in larger volumes, the scope for financial gain increases. When you serve a large number of people, it yields higher margins. On the other hand, a restaurant is not equipped to generate high revenues due to restricted customers, menu and space.

Room for Variety:

A caterer delivers myriad choices and spends high to be able to churn high profitability, which in turn gives a free spending hand to him/her.

Trading on Revenues:

A restaurant generates lesser revenues on everyday basis under the same condition vis-a-vis a caterer. A caterer puts into constant efforts under different circumstances with every single event—from selecting a menu, choosing a set-up to handpicking ingredients and allocating manpower. It is a difficult task at each stage, but brings in an element of surprise as diners get the opportunity to see and explore something unique for the first time.

Upcoming Trends

The catering industry in India is worth INR 200 billion and the majority proportion of the business herein is unorganized. The business gives high returns, and hence becoming a very lucrative opportunity for today’s generation who want to delve in food business. Chefs are coming up with new strategies and concepts that are creating a buzz in the market with each occasion with the freedom to tweak a concept to serve to clients’ (read customers’) needs. This way they are able to explore more opportunities of showing their talent.

The latest trends in the catering market are that how you present you buffet and food. Nowadays, a restaurant with specialized cuisine is in high demand amongst clients. Fusion food is the preferred choice of younger generation and they always want to try new things in food.

Commenting on the same, Jain said,” We believe that we have to provide something new and different for each of our clients whether in terms of food or setting up the buffet.”

Hurdles on the Way

When a restaurant starts getting more and more popular, it’s natural for management to start thinking of options for expansion. For some it’s a food truck. For others, it’s a second brick-and-mortar location. But for many, it’s expanding their service to catering.

As every positive comes with a rider, the opportunities of making easy money in the catering industry come with some challenges, which are as follows:

- The competition has started mushrooming, and hence giving rise to buyers’ market.

- When the scope is with the buyer, he takes the liberty to reap maximum benefits from the seller, leaving less room for the latter to gain profits.

- The customer gets into details and the menu items keep adding up, with high demands for best quality food. This leads to the need for specialist chefs for each cuisine or even sub-cuisines, which increases the cost.

- The arrangement of a set-up is another big ticket. The investment that a caterer has to do in a fancy set-up is very high and is getting dearer with each passing day.

Each and every cuisine is handled with kids gloves and the buffet space is set up like a five-star specialty restaurant. In any luxury catering set-up, there are at least six international and four–six local cuisines or sub-cuisines.

Owing to customers’ demands, caterers are forced to get the best team members (right talents and hence the human resource expense is very high.

The difference between ‘good’ and ‘great’ has always been attention given to details in whatever you do. In catering business, attention becomes a priority—a necessity that cannot be ignored if you wish to succeed.

Globally there is change in how people have been dining in all these years. Restaurant brands like KFC, McDonald’s among others are going green by adopting natural and healthier measures to serve food. Countries like the US, Singapore, Kenya, UK, Australia, Canada and some cities in India including Mumbai, Delhi and parts of South India are banning the use of single-used plastic to bring this natural change.

With a consumption of about 13 Mn Tonnes Per year, India generates 9 MN tones plastic waste per year. As the plastic waste menace increases in scale around the world, scientists, entrepreneurs and engineers have begun to come up with solutions that help to reduce it. Some are developing methods for recycling plastics, while others are developing products that are safe and biodegradeable. Some companies are beginning to develop products that are better suited for recycling.

Adopting Biodegradable Alternatives

Hardcastle Restaurants Pvt Ltd, the Master Franchisee for McDonald’s restaurants in West and South India, has successfully transitioned from plastic to eco-friendly and biodegradable alternatives for items used for guest packaging. The Group has already moved away from plastic in Maharashtra and key cities in Karnataka and is working on a plan for a market-wide change over the coming months.

“As the leader in the Quick Service Restaurant space in India, we are committed to using our scale for good and working towards finding sustainable solutions across our business. This is in line with McDonald’s global vision of building a responsible business,” said Ranjit Paliath, Senior Vice President, Business Operations & Restaurant Enablement while commenting on the initiative.

The burger chain is now giving customers wooden cutlery (spoons, stirrers, knives, and forks) instead of plastic ones. The plastic cups have been replaced by superior quality paper cups. The straws are either made of paper or other biodegradable materials that are derived from corn starch.

Likewise, KFC the fried chicken chain is ditching plastic straw and lids and is replacing it with paper straw in the India, Singapore and few other International markets.

Delhi based, Mother India- a fine dine restaurant situated in the heart of Connaught Place, has also bid goodbye to plastic straws and opted for a green route via using Paper straws. The restaurant is going green to bring in a small change by #refusetheplasticstraw and aims to spread awareness about the effects of plastic straws.

“We are happy and proud to take this pledge #refusetheplasticstraw at our restaurant. By taking this initiative, it’s our small contribution towards a greener world. Plastic straws are particularly dangerous because they are too small to be recycled. Instead of these, using and giving paper straw that are easy to recycle”, shared Nandini Nneeraj, owner, Mother India.

The Game Changers

According to a report, in Kerala 3.3 million plastic straws are used every day. It is 500 million daily in the U.S. So billions of these straws, by implication, are thrown away around the planet. The initiative against the plastic straw had started a little earlier, but it was about two years ago that the campaign took off really well in India including in mainly metro cities like Delhi, Mumbai, Bangalore etc.

Mumbai-based Reefwatch Marine Conservation has tied up with startups from Bengaluru and Mumbai in an attempt to bring about the shift away from plastic among coconut water vendors in Chennai. The organisation, though optimistic, acknowledges that they have a long way to go before that change takes effect.

Similarly, Faizabad based Chuk is using compostable materials like sugarcane waste to make microwable, ovenable and freezeable cutlery’s and we are trying to provide this to companies in India including the institutional caterers and QSRs. “It is very important that we are not reactive in terms of these bans that happens. We need to become pro-active in today’s time. The idea is to keep moving in right direction and fulfill the need,” added Sumant Pai, Business Head, Yash Compostables Ltd.

To go with the customers demand and need, a group of packaging industry veterans in the UK are preparing to open a dedicated paper straw production line in Ebbw Vale, Wales, making hundreds of millions of straws a year for McDonald’s and other food companies as they prepare for a ban on plastic straws in the UK.

“We spotted a huge opportunity, and we went for it,” said Mark Varney, sales and marketing director of the newly created paper straw manufacturer Transcend Packaging. “When the BBC’s Blue Planet II was on the telly and the government started talking about the dangers of plastic straws, we saw a niche in the market,” shared Varney to the Guardian.

Supply chain remains an important issue in the restaurant and food business. Supply is all about meeting the need; from understanding the need to fulfilling the need. And, over the years restaurant and food players are working hard on getting the supplies at the best possible values; sourcing locally to tying up with farmers for the fresh produce and getting them delivered at the proposed time.

“Our mission is to make Coca Cola available at arm’s reached of length. We have process in both warehousing and transportation on delivery of our products across. We do lots of planning in terms of beforehand forecasting on a weekly bucket as well as monthly bucket of estimating the demand; not only in-house demand but also collaborating with modern trade to capture trends on a pack analysis as well as new products and basis that we try and design our supply chain in not only cater to bulk but also manage niche and small product deliveries,” shares Umesh Madhyan, National Head - Infrastructure & Logistics, Hindustan Coca-Cola Beverages Pvt. Ltd which is one of the largest supplier to the food and restaurant businesses in India.

Fresh is the New Selling Point

One critical challenge that restaurants and food businesses are facing these days is that consumers are getting more and more aware and there is lots of awareness which is pushing organisations and supply chain players to meet all the kinds of demand in terms of delivering the freshest ingredients and raw materials in the best possible ways. “Our endeavour is to uncomplicated the backend operations as far as possible. We try to get the insights of the backend operations of restaurant operators and we do a lot of networking with these restaurant operators and try to understand their challenges and need and that’s how we have been able to get very deep inside their backend operations and based on those insights we come up with products.,” says Sumant Vikas, Corporate Chef of Cremica Foods which is working on making the kitchen work easy by coming up with convenience products which eases restaurant operations so that they do not depend a lot on skilled labour which is very hard to come these days. “We are more than willing to customise the products as per their needs as per the minimum volume is met.,” adds Sumant.

Hence, we can say that restaurant and suppliers both are looking at customising the products according to the need of the market and demand set by the consumer. Fresher the product, better for the growth of the restaurant and customer.

When it comes to an experience at restaurant it includes everything from plate to palate. It sometimes becomes a big deal to serve best of the both worlds to the customer. Also at the same time, restaurateurs need to meet customer’s aspiration to have most fresh, healthiest and organic food which is served usually in their grandma’s kitchen which is only possible with a fair supply chain.

Reach is the most critical part with supply chains as consumer now days are more aware which is pushing organizations to meet their expectations. “We try to give our customers the best experience by providing them the most hygienic product in a challenging environment like India”, says Umesh Madhyan, National Head - Infrastructure & Logistics, Hindustan Coca-Cola Beverages Pvt. Ltd. (HCCB).

Overcoming Challenge

In India issues with supply chains are massive. Losses at storage and transportation is a continuous problem which is hampering the growth of fast evolving food business leading to a poor inventory control due to poor supply chain. And this is making the logistics and supply chain companies to come up with facilities so that they could centralize the procurement at top hotels and restaurant chains based on their demand forecast. This also help the restaurant majors decide on how much inventory to hold at what location and thus plan their logistic. This helps them save both their logistic costs as well as inventory holding space. “The operations should not be complicated. Vendors should try to gain inputs from restaurateurs on back end operations and do a lot of networking with them to understand their challenges”, says Chef Sumant Vikas, Corporate Chef, Cremica Food Industries Limited.

Consumers today are tech savvy so restaurateur do not need to educate them on these basic grounds. People are aware that they need a system to run their business. It’s just to decide which system they want. Education and optimization of technology always help everybody in the long run. They would be able to maximize the quality which they are offering which in turn will maximize the profit and benefit the operators. “Once a vehicle has left the factory and started moving towards the destination, the real drudgery starts. Operators have to call the truck several times for confirming the locations. On the other hand, Coca-Cola is using GPS enabled trucks which automatically send a message that vehicle is about to arrive which is the perfect implementation of technology”, Chef Sumant points.

Healthy is the New Green

The fresher, the better is the quote for Indians as they like fresh food only. Fresh products could be generated by working closely with the farmers. “Supply chain is a huge issue when it comes to India and especially the cold chain. All the vendors and restaurateurs should come together and work towards building a successful cold chain supply model”, adds Chef Sumant.

Sky is the limit when it comes to the scope of improvement. In supply chains, currently which actually needs to be improved is transportation. It’s not about only picking up fresh items but how fast it can be served fresh on the table. There is lot of work which needs to be done by the government to increase supply chain efficiency.

Hotels are self-marketing entities. They are physically present and stand stunning for everyone to see. This doesn’t discount the fact that they need to go out there and increase their visibility as much as they can. The competition is thick and there is no reason to be laid back. In today’s digital age, every business is pumping up its online marketing strategy. Hotels are doing the same but mere online presence is not what will get people walking in.

There is a lot that the online world has to offer and there is a lot that you need to do in order exploit these offerings. Let’s find out, what all can be done to optimize a hotel’s online presence.

Trust is the foundation of every customer relationship: If you want your existing customers and potential customers to trust you, you will need to be empathetic and quick in your responses online. You will receive a lot of hate comments from dissatisfied customers but you are not supposed to ignore these either. When you address these online and respond to your customers, they feel important and it is there for all to see. This puts you in a good light and your hotel will be regarded as the one that puts customer service above everything else.

Website makeovers: If your website is old and hasn’t been updated in a long time, you need to do it now. Freshen it up, add blog posts and be regular with it. People love to read travel tips and blogs on hotels and food and culture of the place you are in. You need to keep up with the latest trends and attract people to your website. Ensure that the website is responsive and easy to navigate. Anything complex and slow loading is a complete no-no. Keep the galleries updated and let the best reviews and testimonials shine through.

SEO: If you want your rankings to go up in search engines, you can’t discount the need for SEO. Search engine optimization is not a fancy addition to your online strategy but a necessity. Competition is way higher than you think it is and if you wish to make it to the eyeballs of prospective customers ensure that the SEO of your website is in good hands. A mobile optimized website is a great way to go up on the rankings and get more traffic.

Social Media: Of course, there is no way this was not going to be a part of this list. Social media is inevitable. Everyone knows it is the ultimate platform for direct engagement with customers and your target audience. It helps you reach out to a global target audience and you can build trust and curiosity with various campaigns on social media. However, you need to ensure your campaigns are attractive enough.

Seasonal Discounts: You could offer some seasonal discounts for your hotel or run a contest to engage the audience. You could also talk about any special events that happen in and around your hotel. This is a great way to let people know that you are always up to something interesting. Not to forget, social media is one of the most effective tools of customer service. Talk to your customers, respond to them and get the interaction going!

Travel forums: Look for local forums surrounding travel where you will be able to answer people’s queries specific to your industry or hotel. Forums are a great way to interact and build online reputation. It is a platform to show your customers and prospects that you are always on top of industry news and can share any kind of knowledge with them regarding your domain. Write an answer that is detailed and helps the user find the information that he or she is looking for. Reddit and Quora are two such amazing platforms where you can indulge in such interactions.

Keep an eye on your online presence: Monitoring your online presence is important so that you are aware of what people are talking about you at all times. You can use Google alerts, which is a great tool for web monitoring. You will get quick updates via email and RSS which will help you keep track of your online reputation.

Online presence isn’t just about being visible on social media platforms and having your own website. It is about maintaining them and preparing solid marketing strategies to extract the potential of these platforms to the fullest. Your hotel business is in the hands of customers. Always remember, the customer’s perception is your reality.

Trying out a new cuisine and exploring food seems at the top of the priority list for most foodies. The exposure to different cultures and cuisines through frequent travelling, media and the internet has fuelled an interest in regional and ethnic cuisines. People are now obsessed with the idea of exploring the gastronomical journey. This makes them curious and open to new options then the same old delights. This nature is great influencing factor in predicting the food trends of 2017.

Our country has witnessed a drastic change in food trends, beyond just basic mainstream cuisine, which has been a welcome change for restaurateurs giving them a chance to experiment. Previously any restaurant that served food outside mainstream Indian, Italian or Chinese was not immediately well received. The old rule of sticking to these mainstream cuisines to be safe and ensure your food establishment works is slowly changing. We can see many restaurants which are opting to serve cuisines like Lebanese, Greek, Mexican and a host of other types of food too.

Rise of offbeat Mediterranean cuisine - We have been quite familiar with the flavors and the delicacies of Middle Eastern cuisine but Mediterranean is giving a tough fight through its sublime and zesty flavors. It is not just Hummus, Falafel and Caesar salad any more. Food mongers have shown an interest to try authentic dishes such as Moussakka, Moroccan Tagine, Greek specialty Tzatziki, Jordon Mansaf, etc. This roots towards having an enhanced taste of palate. Our Mediterranean restaurant, Aqaba, provides our customers the delights of the Mediterranean lands transporting them to the lands of Jordon, Lebanon, Persia, Greece, Isreal and Morocco.

Everyone is getting health conscious. Eating healthy yet delicious food is the requirement of every age group now. Being into fitness is not just a trend or phase but a way of life. For now there are only few such places which serve a healthy alternative. With an increasing number of households opting to eat out or order, the potential of healthy yet tasty cuisine is tremendous. This is one the only factor which healthy cuisine in the QSR segment could be the rival to current mainstream categories. Restaurants like Paninaro serve up a range of healthy yet appetizingsalads, soups, wraps and sandwiches to your doorstep. Innovative delicacies like Masala Omelette Bagel, Hummus and Avocado Bagel are a popular choice.

Country Ethnic Cuisine: Sushi from Japan, Pizza from Italy andSzechwan from China are few items most commonly known by people. Now, because of the great effects of globalization people are looking for country specific cuisine. They want to try beyond the common choices and even explore. Ethiopian, Moroccan, Polynesian, South African and Peruvian cuisines are likely gear to up to charm your taste buds in the coming year!

Fusion Delights: Because we Indian have always had our love towards spiced up hot cuisine, they are various trends which glorify the idea of fusion food. Fusion food can have the underlying taste of our traditional dishes, adding a twist of continental flavors or vice-versa. A sandwich with the combination of roasted chicken and mango ‘Chutney’ and or a fancy very of mango ‘Chunda’ or even a simple Chai latte makes fusion sound exciting. The twist of daring flavors are in high demand.

Lastly, in recent times we have seen the popularity of presenting food in unique ways with over the top milk shapes in mason jars or black burgers. Presentation, plating and flavours acquire the utmost importance now and are likely to continue in 2017. People are more clear of what they want and its flavours. There is always a need of adding zealous X factor to the cuisine to make it a trending concept.

In retrospect, food trends are very quick to get popular and even forgotten, but few stay on. The events that have taken place in the current year are the major trigger factors in setting future trends. From the business perspective of the food industry, we can see trends like digitization of bills and technology replacing manpower thriving over the course of next year. The future trends have great potential but only time can tell which will one lasts the longest.

Gaining popularity as the healthiest cuisine worldwide the Mediterranean food is an amalgamation of tastes meet wellbeing in the best way. The Mediterranean platter is filled with the finest of vegetables and fruits from the food pyramid. Focusing on the maximised intake of fresh produces such as herbs and leafy greens to dry fruits, essential olive oils to beans and legumes the diet comprises of ingredients that can be easily sourced and prepared at home. Olives, Wheat and Grape which is known as the holy trinity of the Mediterranean cuisine are all excellent sources of varied nutrients. The recent innovations in cookery have busted the myths around Olive oil, its varieties and popular Mediterranean ingredients like pasta and bread.

With the telecast of foreign cookery shows and opening of several food chains, India has also shown keen interest in the Mediterranean cuisine. Figures also show the active response of the Indian consumer towards the consumption of Mediterranean food products such as variety of Olive oils, Pastas, Nuts and Table Olives. The inclination towards H&W food products is also a result of today’ s consumer’s will to stay fit and maintain a diet that shuns anything that is unhealthy. With the easy availability of the Mediterranean food in super markets and stores one can now prepare authentic Mediterranean food at home.

Since the diet primarily focuses on plant based and healthy fat intake it can be easily made at home and savoured without compromising on the health factor. Authentic Mediterranean is surely a step towards maintaining a well balanced health regimen as studies have shown that regular consumption of Olive oil wards off cardiovascular diseases and encourages longevity of the life span. The dry fruits and legumes together are responsible for a healthy brain. Benefits of preparing authentic Mediterranean cuisine at home with the products available are plenty as:

Mediterranean cuisine is plant based

Almost all the foods in a Mediterranean diet are procured from plants. Be it the whole grains, fruits, vegetables, herbs and spices, beans, nuts, seeds, and olive oil are all foods that are included every day. Also three is a lot of emphasize on including seasonal fresh fruits and vegetables.

Uses herbs and spices to season foods

Mediterranean cuisine focuses on the powerful use of many flavourful herbs and spices to season foods. Regular usage of herbs and spices allows one to cut back on added salt, sugar, and fat when cooking. It not only helps cutting down on the extras but also enhances the taste factor.

Olive oil: The staple fat

The cuisine largely centres on the usage of different verities of Olive oil, (Virgin, Pure, and Extra Light) and Olives. Unhealthy fats such as Butter, margarine, and other solid fats are very rarely used in cooking. Thus helps in improving one’s health. Olive oil is a good source of monounsaturated fats, which are a type of healthy fat that can help lower cholesterol levels when you use them instead of saturated fats. Solid fats are high in saturated and trans fats, which damage your arteries and can increase your cholesterol levels. These days the markets have a plethora of Olives and Olive oils to choose from. A quick pasta salad with combination of Olive oils and herbs and boiled potatoes cut in chunks can be whipped up quickly and enjoyed as a lunch time snack.

Everyday staples: Beans, nuts, legumes, and whole grains

Dishes having Beans and whole grains which are healthy forms of carbohydrate can be cooked at home. These legumes can be worked into your diabetes meal plan in appropriate portion sizes. Nuts are also a source of healthy unsaturated fats that are an important part of a Mediterranean meal plan. The use of almonds and pistachios in any meal will give it an extra crunch also increasing on the nutrient factor of any dish. Instead of deep fried snacks, healthy and quick alternatives like a bean and olive salad can be prepared. The dish can be prepared my throwing in some beans, with a dressing made by Extra Virgin olive oil, a dash of lemon juice, pepper and salt with handful of chopped pitted olives. Snacks like these are not only easy to make but they are fully rich in nutrients.

Proteins: Lean Meats and fish

The main source of animal protein in the, Mediterranean diet is the intake of fish. Fishes like salmon, halibut, herring, sardines, mackerel, and trout contain omega-3 fatty acids, which promote heart and brain health. Chicken, low-fat dairy, eggs, and cheese are included in smaller portions daily or a few times per week.

A Good Choice for People with diabetes and other disease

Many studies have shown that a Mediterranean inspired diet is responsible for lowering the risk of cardiovascular diseases. The diet which includes everything in proportion like vegetables, poultry and grains can only be a promoter of good health. All the ingredients are readily available in the markets and online stores and authentic Mediterranean cuisine can be enjoyed by the family anytime they want.

Challenges Faced

In this era of connected technologies and dynamic consumer purchasing behavior, there was a serious issue of last minute booking and distribution challenges. Major hotel chains have been facing this issue from last few years and in order to overcome the same they were looking for a technology partner. However, adopting a real-time distribution model across multiple hotels is a challenging task.

Solution

Today, there are many platforms which provide a comprehensive solution that addresses all needs in the hotel distribution function from a 360-degree perspective. The solution suite includes the following products- Intelligent distribution platform that helps hoteliers manage their distribution plans strategically with inbuilt revenue recommendations, intuitive booking engine to help hotels grow their share of direct bookings, advanced rate shopper that helps hotels understand their price positioning in the market as compared to competition, reputation management solution that not only gives hotels a summary of their reviews- positive and negative and the ability to respond, but also helps hotels drill down into reviews to address the issue in operations, revenue management solution to adopt proactive market focused revenue strategy, central reservation solution for managing end to end reservation operations, mobile application for distribution management on the move, 360 degree business intelligence solution, and our GDS solution. In addition to this product, Reznext, which is among one such platforms also have their consulting division for revenue, OTA management and digital marketing services.

Total investment required

Generally all such products have a subscription charge. Clients have several flexible payment options from monthly to quarterly to yearly payment schedule. “Our products are all cloud based and hence requires no additional infrastructure. Hotels can save on setting up the technology architecture at their premises,” shares Reznext Spokesperson. Clients can opt to buy the individual products or can subscribe to the complete solutions suite. The pay as you go model also allows hotels to upgrade or make additional purchases online, based on their usage pattern.

Top Clients

Reznext caters to all segments of hotels, from large chains to independent hotels and budget properties. Large groups like Golden Tulip, Clarks Inn, Chocolate Group, leading independent hotels like the Manohar in Hyderabad, JRD Exotica in New Delhi are some of our key clientele.

Do you still believe in visiting a restaurant? Or are you the one who believes in taking food at ease? If you’re one of those people, have you ever thought of the challenges faced by the restaurant owners and food delivery players while delivering your favourite food at your doorstep.

Also, the love for food is universal and it comes with the promise of instant delivery. You may be able to apply that math to online shopping for apparels and other items, but certainly not food.

Building an integrated supply chain

With food business expanding multi-dimensionally it is making a way forward to invite global investments in India and with this growth the food sector is expected to undergo a major revolution over the next few years. The emergence of super consumers, who are vulnerable to price points and fulfilment and delivery of their orders, has shifted the focus of top restaurants and food platforms in the country streamlining the cost of operation without tampering quality and service of the raw materials.

“The idea of integrated supply chain especially in food was to control quality as well as bring in efficiency. Most importantly it is inventory control,” said, Manish Aggarwal, VP, Gati Kausar.

Losses at storage and while transportation is a continuous problem in India which is hampering the growth of fast evolving food business in India leading to a poor inventory control due to poor supply chain. And, this is making the logistics and supply chain companies to come up with facilities so that they could centralise the procurement at top hotels and restaurant chains based on their demand forecast. This also help the restaurant majors decide on how much inventory to hold at what location and thus plan their logistic. This helps them save both their logistic costs as well as inventory holding space.

Challenges faced

When the restaurants start off their volume is not large enough to fill the entire truck load and therefore they hire service providers to cater to their needs. And, with big supply chain providers like Gati Kausar, Snowman and ColdEx today they may scale up from small operations to large.

Not only this, one of the major challenges in logistics is of trained man power. Other challenges happens when restaurant professionals are dealing with companies and they have logistic teams that is bifurcated into primary, secondary distribution and storage and it’s difficult for them to sometime co-ordinate with all three.

“We are building a professional and next generation logistics team which is both tech savvy and consumer responsive. Recruiting and training such manpower is our biggest priority,” shared Rajesh Sawhney, Co-Founder, InnerChef who has given his customers choice of selecting hourly delivery slots, seven days in advance. “This helps us in planning our deliveries well. We have our own delivery teams, but we also work with external delivery organizations,” added Sawhney.

What’s catching up?

Not only logistics but delivery of the raw materials and food items at a very competitive duration is making wave in the industry. Inspired by McDonalds which has set the tone for 30 minutes delivery many food start ups are eyeing new customers with promising delivery timing, all thanks to the growing demands.

Breakfast 7-11 a Gurgaon based start-up which is only catering to the breakfast customers has done a fairly good job of meeting delivery time (45 mins) 85 per cent of the time.

“Occasionally we do increase expected delivery time if we expect delays due to traffic/rain or distance. However there are occasional unexpected delays as well- Gurgaon's roads and infrastructure leaves a lot to be desired plus the temperament of the riders,” added Manshu, Co-Founder at Breakfast 7-11.

And, as food delivery has two peaks, one in the afternoon and second during the dinner time managing peak time load efficiently remains major challenge. But, with quality and timeliness of traffic and infrastructure the logistics and delivery scenario in India may disrupt the fast evolving food business scenario.

What’s the idea behind this start-up?

The genesis of this business idea was simply the glaring supply chain gaps in the fresh food categories (especially fruits and vegetables). We knew that retail prices of fresh products have a 100 per cent mark-up on wholesale cost and probably 150-200 per cent mark-up on production cost, still it is not a case of super-normal profits for either the wholesaler or the retailer. Majority of this margin got eroded within the supply chain due to the perishable nature of the products. Hence, we saw an opportunity to plug the gaps in the supply chain by getting products from farm to kitchen in 12 hours, avoiding wastage and pilferage which would allow us to make decent margins while offering a fair price to the end consumer.

What’s the initial investment made to launch the venture? Where did you spend the money?

Together with friends and family we initially raised over US$ 10,000, which was spent primarily on building a robust technology platform including the Android and iOS Apps. After launching the business we received seed funding from known contacts for another US$ 100,000 before we raised our Series A funding in July’15.

You are following the similar idea as floated before. How is it different from other similar platforms?

What makes iOrderFresh unique and a safe option is that we do not believe in night inventories and have only two delivery slots a day to ensure the freshest produce is being sent to consumers day after day.

How big this segment is? How many players are working out there?

It is one of the biggest consumer segments in the country currently valued at US$ 330 billion with expected market size of US$ 1 trillion by 2020. It’s difficult to know that how many players are in the market right now but the important thing to remember here is that there will always be room for more players in this market.

What’s the revenue model of your platform?

All sellers on our platform pay us a listing fee, which is a per cent of their gross revenue.

What’s the annual turnover? What's the growth of your venture?

We serviced over 1000 orders a day in Sept 2015 and are looking at a quarterly growth of 20-25 per cent for the next 12 months.

In this segment, many online players have recently raised huge amount of funding. Are you looking forward to raise any funding for your venture?

We are focusing on unit economics and making the business self-sustainable. However, further capital will be required and we are looking to raise another round of funding in Q1 2016.

What’s the growth prospect of your venture?

We have over 100k customer registrations and repeat customers account for over 55 per cent of our daily orders. We hope to cross 250k customer registrations by March 2016 in Delhi NCR only. There are no plans to expand to another city for the next 12 months. We want to consolidate our base in NCR and become the biggest player in our segment.

What lies on the product roadmap?

Currently, iOrderFresh offers an array of fresh products like fruits, vegetables, fresh organic cow milk, fresh meats, fresh poultry, fresh bakery and confectionary etc. We also want to offer iconic brands/products to our customers by forging exclusive partnerships on the same lines as Natural Ice Cream. We want to be the vendor of choice for premium quality and hard to find food and grocery items online.

What all things come along in designing your restaurant menu?

While designing a restaurant menu, culture, taste of people and availability of ingredients play a vital role. Any good menu should be able to deliver something exciting yet authentic meal experience to guests.

What menu tweaks are you planning to introduce to stand out from the crowd?

This is the only hotel in Thimphu with a Pan Asian restaurant.With our carefully curated and authentic Pan Asian flavours and savoury South East Asian cuisines to tempt the palate, SeseShamu presents an inspirational dining experience. Bhutan being a country which attracts lot of Asian tourists, we are planning to introduce a Bento box style lunch menu.

How is the food palate different in Bhutan as compared to India?

Bhutanese food has a very distinct flavor and most dishes tend to incorporate cheese and chili. This is the only country in the world where chili is not used as a seasoning but a vegetable. Some of the favourites include soups and stews of meat, lentils, dried vegetables, spiced with chili peppers and cheese. The cuisine in India differs from region to region. There are a lot of religious and cultural influences in the Indian Cuisine. It also varies seasonally, depending on which fruits and vegetables are available. It is very diverse- Southern spices and ways of cooking is very different from North or East. India is a real pot pourri of flavours, yet each region stands out as unique.

Tell us something about the supply chain management in your hotel. Who are the suppliers? Can you name some?

Bhutan being a landlocked kingdom,it is still developing its supplier and vendor management. For our hotel we do buy vegetables and fruits from the local vegetable market to support local vendor. We also buy our imported and Asian ingredients imported by local importers. To name few “My Mart” and “Eight Eleven” are the biggest importers we are currently dealing with. For our imported meats and sea food we rely on our vendors in Singapore or Thailand.

Comment something on the involvement of senses in the restaurant?

An exceptional and satisfying dining experience is also a sensory experience. Today there are restaurants which are moving forward and breaking traditional norms, whereby they are experimenting with food and using senses to give a wow effect to guests. Use of molecular gastronomy is one such example. What you see on your plate, what you can smell and what you can taste are all important aspects of good dining. The textures, presentation and food design are also key elements.

What are the different types of cuisines served at your restaurant?

We satisfy every craving with the global flavours and artful presentation of our two fine restaurants and Lounge bar. Our signature all day dining restaurant, Latest Recipe has a mix of local and international cuisine, including the signature Le Meridien breakfast. Our stylish speciality restaurant, SeseShamu serves authentic flavours from across South East Asia.

Latitude 27 complements the creative atmosphere of the Le Meridien Hub by drawing guests in with the sights, sounds, and smells of a coffee bar by day and a cocktail bar at night, showcasing our brand’s sparkling program.

What is the contribution of good menu in restaurant business? How are new techniques in food helping the restaurant grow?

A good food menu plays an integral part in a success of any restaurant. Technically without a good menu and tasty food no restaurant can survive. Innovative food offerings, attractive description of your dishes that also generate curiosity while at the same time whet your appetite, are all qualities of a good menu.

Menus should be easy to read and understand. It should have the right amount of information, yet encourage some ‘conversation’ points with the servers or even amongst the guests ordering. All this, it is found, sets the tone for a good dining experience. It really starts with your menu.

An ideal menu should always have ‘chefs specials’ or the restaurant’s signature dishes mentioned. A menu should also keep changing even if some ‘favourites’ are kept the same.

What inspired you to become a chef? Tell something about your journey in the world of food.

I belong to the family of chefs and so you can say it’s in my DNA. I started my career with Taj hotels as management trainee under Taj’s veteran chef Arvind Saraswat. I have been and trained in Traditional European, European fusion and Lebanese cuisine. I have worked or trained in very exclusive and respected restaurants like Orient Express, Patio, Macchan, Chambers, Trattoria and Mynt.

In my 13 years culinary journey I have worked with Taj hotels, Millennium Hotels, Ista Hotels, Hyatt Hotels before joining Starwood Hotels and Resorts. I can proudly say that I have learnt from the best in the field.

How familiar are you with the legalities involved in opening a restaurant? Are you planning to open up your own restaurant?

We all have to know the regulations and licences needed for restaurants as we are in a very professional industry and an international hotel chain. Licences range from food safety licences to pollution, health and fire safety licences. At present I enjoy being part of Le Meridien. Cuisine is one of the signature elements of the brand and that gives me a lot of opportunities to innovate and try out new things. I feel i am still learning and am enjoying the process. Who knows, later on in life I might start something of my own. Right now I am happy to hone my skill and just make good food for people seeking unique dining experiences.

What all things come along in designing your restaurant menu?

The menu has to be designed keeping in mind the taste and preference of the well-travelled guests of today. I consider clientele, theme and décor of restaurant, seasonal famous dishes, availability of raw material and fresh and healthy components as the important factors for designing a menu.

What menu tweaks are you planning to introduce to stand out from the crowd?

Innovation is the key to success in the hospitality industry today and it is important to woo the evolving tastes of the consumer. Our team of chefs are constantly creating out of the box dishes keeping in mind its nutritional value and presentation. Recently, we did a Beer & Burger promotion where we presented some innovative burgers. For example, we served Savory Red Doughnut in which the patty was made using beetroot, cottage cheese, hung curd, mango relish and was stacked between savory doughnuts.

Tell us about the supply chain management in your hotel. Who are the suppliers?

We have suppliers on yearly contract basis who provide the best quality food products which are certified under food acts to ensure safety.

Comment on the involvement of senses in a restaurant?

The restaurant has to ensure great taste, aroma, visual appeal, ambience and texture/consistency. Thus, it becomes essential to focus on all the elements to ensure guest delight. We at Courtyard by Marriott, Gurgaon, lay a lot of emphasis on fostering great guest relations through our food and hospitality.

What are the different types of cuisines served at your restaurant?

We are a multi-cuisine restaurant and we serve Indian, Western and Oriental cuisines in our restaurant.

What is the contribution of good menus in restaurant business? How are new techniques in food helping the restaurant grow?

Great food is the main contributor to the success of any restaurant. If the menu is good and attractive, it will contribute to good business for the restaurant. We have an elaborate menu to cater to the diverse palate of our guests, be it the delectable spread of salads, appetizers, main course and desserts. We also have a section in the menu dedicated to kids featuring burgers, pizzas and sundaes.

It is said that “sales in Indian restaurants are dropping.” What are the reasons for this?

Sales in Indian restaurants are dropping because of the high level of competition in the market and introduction of international food and brands in India. The consumer is spoilt for choice and it is a situation of supply being more than the demand.