Currently, India does not have its own edition of the celebrated French fine-dining Michelin Guide, which is a notable absence in the country’s gastronomic landscape. Michelin stars, an emblem of culinary excellence, are awarded to restaurants, not to individual chefs. This distinction is crucial as it places the emphasis on the overall dining experience provided by the establishment rather than solely on the person behind the menu. Consequently, without a Michelin Guide dedicated to Indian eateries, it is unlikely that any restaurant in India will secure a Michelin Star in the near future.

Gaining a Michelin star is a dream many restaurant owners and chefs across the globe cherish. This accolade not only signifies the peak of dining excellence but also serves as a testament to the skills and creativity of the teams that drive these esteemed kitchens. However, the lack of a Michelin Guide in India casts a shadow over the possibility of Indian restaurants achieving this prestigious recognition.

The Michelin Guide, which is an integral part of a global restaurant rating system managed by the French tire manufacturer Michelin, evaluates dining establishments based on the quality and consistency of their culinary offerings. Since its inception in 1900, the guide has evolved from a manual offering practical information for motorists—including maps and details on restaurants and fuel stations along their routes—to a comprehensive evaluator of gastronomic quality.

In its current form, the Michelin Guide provides concise and insightful reviews of restaurants, employs unique symbols to denote various levels of service and quality, and ranks establishments with up to three Michelin stars. These stars are highly coveted and are awarded to restaurants demonstrating culinary prowess and consistency that meet stringent standards set by Michelin's anonymous inspectors. The guide currently spans more than 36 culinary hotspots around the world, including regions in North America, South America, Europe, and the Asia Pacific.

Despite its rich and diverse culinary heritage that draws from centuries-old traditions and regional flavours, India is yet to be included in the Michelin Guide's expansive coverage. This exclusion means that India’s myriad gastronomic delights and the chefs who craft them remain unrecognised by one of the world's most prestigious culinary accolades, underscoring a significant gap in the global culinary recognition of Indian cuisine.

Obtaining a Michelin star requires the establishment of a refined dining venue, where the focus is not only on the quality of the food but also on the overall dining experience. Most restaurants that earn a Michelin star tend to be upscale, often becoming more expensive due to their use of premium ingredients and commitment to delivering exceptional hospitality. While top chefs in India regard Michelin stars as the ultimate accolade in the culinary world, it's important to remember that these stars are awarded to restaurants, not individual chefs.

The process for awarding Michelin stars involves multiple visits by anonymous Michelin inspectors who assess each restaurant meticulously. The anonymity of these inspectors is crucial as it ensures that the evaluations are unbiased and genuine, with restaurant staff unaware of the inspector's presence and identity.

The Michelin Guide's selection criteria are rigorous and multifaceted, encompassing:

The quality of the ingredients used,

The mastery of flavor and cooking techniques,

The ability to reflect the chef’s personality within the dining experience,

The harmonious balance and blending of flavors,

Consistency of the dining experience across visits by different inspectors.

Restaurants are evaluated annually, and their star ratings and listings in the guide are updated to reflect current standards. Establishments that do not maintain the requisite level of quality risk being removed from the guide.

Despite the absence of a Michelin Guide in India, Indian chefs globally continue to garner recognition and win Michelin stars, showcasing the appeal and excellence of Indian cuisine on the world stage. Notably, in 2023, several Indian chefs at restaurants in the United States achieved this prestigious honor. Chef Chetan Shetty led Rania in Washington DC, Chef Vijaya Kumar headed Semma in New York City, and Chef Sujan Sarkar ran Indienne in Chicago, each earning a Michelin star for their outstanding culinary contributions. These accolades underline the global stature and adaptability of Indian culinary arts, reflecting the skills of Indian chefs who masterfully present traditional flavors in a manner that resonates with an international audience.

Michelin does not cover the entire globe with its guides. Initially, up until 2006, its coverage was predominantly in Europe, after which it expanded to include New York. Over the years, Michelin has extended its reach to include several key global cities and regions such as Japan, major U.S. cities like New York, Chicago, San Francisco, and Washington DC, as well as Rio de Janeiro/São Paulo, Hong Kong/Macau, Singapore, Seoul, Shanghai, and Bangkok. “As a commercial entity, Michelin's decisions on where to introduce guides are driven by its own commercial interests as part of a marketing strategy for its tire business. This approach has led to the discontinuation of guides that do not meet sales expectations, such as those for Las Vegas and Los Angeles in 2008/2009. Additionally, Michelin has started accepting sponsorship from tourist boards to launch guides in places like Bangkok, Seoul, and Singapore. While there is potential for a future guide in India, possibly sponsored by the Indian Tourist Board, no concrete plans are in place,” as commented by a London based Restaurant Critic, Andy Hayler.

In London, several Indian restaurants, including Jamavar, Tamarind, Benares, Quilon, Trishna, and Gymkhana, have earned Michelin stars, showcasing the global appreciation for Indian cuisine. This recognition extends to other places like Song of India in Singapore and Campton Place in San Francisco.

Jake Kosseff, a Sommelier & Restaurateur from Seattle, notes that Michelin has not yet decided to publish a "green" guide for India or any of its cities. The process of rating restaurants for Michelin is intricate and resource-intensive, hence the limited geographical coverage of the green guides.

A chef from Mumbai, preferring to remain anonymous, pointed out that Michelin (company that hosts Michelin Star) has a minor market share in India's tire industry and has not been among the top ten since 2011. The market dynamics suggest that it's unlikely the Michelin Guide will focus on India soon. The chef further mentioned that the format of authentic Indian cuisine, from its culinary traditions to portion sizes, does not align well with Michelin’s criteria. Except for a few high-end hotel restaurants, standalone Indian eateries have not adopted the global elements that Michelin typically looks for in its star-rated establishments, resulting in only eight Michelin-starred Indian restaurants worldwide.

Michelin's selective geographic expansion is influenced by its commercial interests and market dynamics, which currently exclude India from its prestigious dining guides. However, Indian cuisine continues to gain international acclaim, as evidenced by the Michelin stars awarded to Indian restaurants globally, showcasing its culinary prowess beyond its borders.

As diners crave deeper connection and meaning, forward-thinking brands are redefining hospitality itself, creating experiences that extend far beyond the plate.

A Year of Growth and Transformation

After years of inflation and shifting habits, 2025 marks a phase of steady recovery and reinvention for the global restaurant industry. The global foodservice market is projected to reach USD 4.03 trillion, up from USD 3.48 trillion in 2024, with online food delivery alone valued at USD 173.6 billion.

In India, the sector has rebounded to USD 85–90 billion, driven by growth in both organized dining and delivery-led models. Tier-II and Tier-III cities are now powering expansion, fuelled by rising aspirations and digital reach. Dining is thriving it’s just in new ways.

From Functional to Experiential Dining

Dining today isn’t just about food; it’s about look and feel. Post-pandemic, consumers are craving authenticity, atmosphere, and emotional connection. That has led to a decisive shift from functional eating to experiential dining.

As per reports, experiential dining is projected to grow multi-fold by 2030, as consumers, especially millennials and Gen Z, prioritize experiences over possessions.

Expressing his views, Rishi Chona, CEO of Cream Centre & Director at Ice Cream Works shares, “At Cream Centre, we’ve been proud to be part of this evolution since 1958. This year has been especially exciting for us, with the successful launch of our Bengaluru outlet at Mall of Asia and plans to open 50 Cream centre outlets in the coming year including expansion in Dubai.”

“India’s food-services market has continued to grow this year, with most trackers pointing to high-single-digit momentum and a continued shift to organized formats; sector outlooks peg 2024–28 CAGR around 8% and rising QSR share even as casual dining remains large,” mentions Gaurav Kanwar, Founder & CEO of Harajuku Tokyo Café.

Dining today is about emotion. Commenting on this, Pawan Shahri, Co-Founder and CEO of Chrome Asia Hospitality says, “Guests don’t come just to eat, they come to feel. They want a place that has character, that keeps evolving, and that tells a story every time they walk in. “

Rising Costs and Rising Expectations in Dine-in

For dine-in operators, inflation, rent, and staffing continue to squeeze margins, even as guests expect seamless service, personalisation, and purpose.

“Dining has evolved from “food + seat” to “experience + community”: healthier menus, wellness cues, and theatrical, Instagrammable spaces now anchor demand,” adds Kanwar. Training and technology are being used to improve service efficiency, while menu engineering helps balance food cost with perceived value.

“Dining today is far more experiential and health conscious. Guests look for variety, freshness, and balance and we have responded with new menu additions like healthy brown rice protein bowl with 42 grams protein, wholesome Salad Bowls, and light global-inspired dishes that complement our signature classics while keeping authenticity intact,” points Chona.

Delivery vs Dine-in: The 2025 Reality Check

While experiential dine-in is on the rise, delivery continues to anchor restaurant profitability. Industry splits vary by format and city but dine-in still leads nationally while delivery is the growth engine; a practical working range many chains report is roughly 60:40 dine-in to delivery for casual/QSR, with dine-in the leading “service type” and delivery expanding at double-digit rates.

“For Roll Baby Roll, this has helped in increasing retail and deliveries. Currently, we have 55% deliveries and 45% retail; we have maintained this for quite some time now. As we are expanding, we would like to increase the ratio by 60:40 for retail and deliveries,” shares Gandharv Dhingra, Founder, Roll Baby Roll.

While, at Cream Centre the dine-in experience contributes to nearly 80% of their total sales while the remaining 20% comes from delivery.

Challenges in dine-in

Maintaining consistency and high service standards across locations is the biggest challenge. Dine-in challenges are occupancy costs, staffing, and sustained footfall, delivery fights unit economics, platform dependence, and rider attrition.

“The challenge for dine-in concepts like ours isn’t scale — it’s staying relevant. You have to reinvent yourself every month. Guests today are curious and exposed to the best of the world through social media,” comments Shahri.

As 2025 unfolds, dining is becoming a form of self-expression where food, design, and digital touchpoints converge to create moments of connection. The next era of restaurants won’t just serve meals they’ll serve meaning.

No longer just about convenience, casual restaurants are redefining the standards of experience, innovation, and comfort. A key driver of this shift is the emergence of Experiential Dining—where meals are elevated into immersive social events. From themed environments to live entertainment, dining out has become a high-value, memorable destination. As consumer preferences lean towards more engaging and personalized experiences, casual dining continues to grow as one of the most dynamic and promising segments in the industry.

As per reports, the global casual dining market is estimated around US $333 billion in 2025 and is expected to reach US $575 billion by 2035, growing steadily at about 5.5% annually.

Focus on Experience, Not Formality

Today’s diners don’t look for stiff formality or multi-course meals. They want comfort, style, and authenticity. The diner today is informed, vocal and experience-driven. They don’t just dine; they participate through reviews, reels and real-time feedback. Their choices are guided by purpose, storytelling and authenticity.

Restaurateurs must stay agile by refreshing menus more frequently, building stronger digital communities, and creating reasons to revisit beyond occasions.

“At ABNAH, we constantly adapt through data-backed insights and localised campaigns. Whether it’s Waarsa’s regional festivals, Nara Thai’s community previews, or Supa San’s corporate outreach in BKC, our focus remains on staying culturally relevant while never losing our brand’s soul,” shares Udai Pinnali, CEO, Aditya Birla New Age Hospitality.

Casual dining is evolving, with guests seeking memorable experiences, innovative menus, and health-conscious choices. Shobhit Aggarwal, Co-founder, Koca says, “We’ve responded by curating dishes that blend global techniques with local flavours, catering to diverse palates while keeping wellness at the forefront.”

Menu Innovations & Global flavours

Casual dining in India is evolving from “just eating out” to immersive cultural experiences. Guests are looking for places that tell stories through food, design, music and community. People are also focusing on global flavours and menu innovations.

“At ABNAH, we see this every day across our brands: Supa San celebrates the playfulness of Japanese izakaya culture with anime-inspired experiences and bento lunches designed for the corporate crowd; Waarsa brings forgotten Awadhi recipes to life through chef-led storytelling; while our other restaurants also focus on storytelling and creating unique dining experiences,” he adds.

The larger trend is clear; dining is becoming a medium of connection and discovery. Guests want authenticity, comfort and a sense of belonging more than formality.

Shifting Consumer Preferences

Around 65% of diners prefer healthier menu options, and more than half of restaurants now offer vegetarian, vegan, or gluten-free choices. Sustainability is no longer a buzzword but a business strategy, with many outlets sourcing local ingredients and minimizing waste.

With the shifting consumer preferences, restaurants need to upgrade themselves with what’s trending and what’s not. As per reports, 69% of consumers now choose to eat at casual dining restaurants which was 63% last year. More diners are also returning to in-restaurant experiences and 65% now prefer dining in, compared to 43% in 2024.

“As consumer behaviour evolves, we’re reimagining our bar program too. Our cocktails use in-house, preservative-free concoctions instead of unhealthy syrups – keeping them fresh, flavourful, & health-forward. Our handcrafted cocktails & flavorful brews – served during LIIT Fest & Brewfest – celebrate the spirit of innovation across all our Taprooms–merging craft, technology, & hospitality to meet evolving expectations & redefine what modern casual dining means,” mentions Rahul Singh, Sr. Vice President, Bira 91.

Tech-Driven Experiences

Technology is reshaping how guests interact with restaurants. Nearly 83% of casual dining outlets in India are using digital ordering, delivery platforms, or app-based loyalty programs. This digital shift helps restaurants stay connected to customers beyond their tables.

For Pinnali, the digital transformation starts with the guest. “We're focused on using AI-driven CRM and intelligent feedback systems, alongside data from our loyalty programmes, to understand rich consumer insights and gauge guest sentiment in real-time. This allows us to personalise every interaction.”

Aggarwal poins, “Digital transformation is integral to our operations, from seamless app-based ordering and contactless payments to active engagement on social media, ensuring convenience and personalised experiences.”

By fully integrating this data across advanced POS systems and empowered staff technology, brands can gain the operational agility to deliver a truly seamless, customised and magical dining experience and that’s the future.

As the sector grows, hospitality brands that combine good food, relaxed ambience and smart tech are redefining what modern dining feels like.

Data-

- Global casual dining market is estimated around US $333 billion in 2025

- Expected to reach US $575 billion by 2035

- Growing steadily at about 5.5% annually.

- Around 65% of diners prefer healthier menu options

- 69% of consumers now choose to eat at casual dining

Over the last decade the culinary scene in our country has witnessed a remarkable shift. Eating is no longer about filling an empty stomach with “Whatever is available.” Instead, the conversation is focused around on what we eat and when we eat. Those people who even prefer to eat out quite frequently these days have increasingly become mindful, choosing nourishment and sustainability over convenience. The philosophy is now finding its way into restaurants where chef-driven concepts, farm-to-table dining, and curated menus cater to the conscious eater.

Restaurant owners and chefs play a pivotal role in shaping this change. Here’s how they inspire conscious dining:

Through Personal Leadership: Leading by example many chefs and owners adopt conscious lifestyles themselves, showcasing the discipline behind their choices. Sharing their journeys by openly discussing struggles and challenges on social media or in interviews, the restaurant owners make mindful living more relatable. And, when leaders set the tone, staff and customers often follow, adopting mindful habits naturally. This helps make a mindful effort to lead by example.

Through Ingredients & Sourcing: Prioritizing seasonal vegetables, organic ingredients, and ethically sourced raw material supports both health and the environment. And, collaborating with farmers, fisherfolk, and ethical suppliers strengthens the farm-to-fork chain. This helps in the long run, economically supporting the farmers. Also, through storytelling, by highlighting the origin of ingredients on menus, restaurants connect diners with the journey of their food, thereby building consumer trust.

Through Menu Design: I’ve seen a larger audience shifting to vegan food options and offering plant-based dishes will reduce environmental impact while enriching dining experiences. Also, flexible portion sizes or smaller plates help curb food waste without compromising satisfaction. But yes, the portion sizes should justify the price as well. Also, many chefs craft menus that bring attention to “ugly” produce or overlooked ingredients, redefining what’s desirable.

Through Dining Experience: Staff are trained to share the sustainability story behind each dish in a conversational, inspiring way. This way, the staff translates the dish to the diner, making the overall experience more convenient for them. Slower service and thoughtfully curated courses encourage diners to savor every bite. Also, farm-to-table dinners, chef talks, and workshops engage customers in the philosophy of conscious dining. This can help your restaurant stand out in an overcrowded market.

Through Community & Culture: Restaurants play an active role in educating diners about conscious eating without being preachy. Dropping subtle hints here and there, in the menu, in the restaurant interior, or on the tableware can organically bring a lot of attention. From urban farming initiatives to food sustainability campaigns, many establishments are strengthening community ties.

Despite India consuming over 1 billion kilograms of tea a year, more than ten times its coffee consumption of about 91 million kg, organised tea cafés still account for less than 5 per cent of the out-of-home café market. Industry estimates place the formal tea-café segment at USD 100-140 million in 2024, a small share considering the country’s deeply rooted tea culture.

However, founders in the budding tea-room and café ecosystem say the category is poised for change, but only if brands get product, people and processes right.

“Tea has moved far beyond the idea of a simple everyday beverage. Today’s consumers, especially younger audiences, want flavours that tell a story, ingredients that feel good for the body, and experiences that feel personal,” shared Samantha Kochharr, Founder, The Tea Room in Delhi’s Hauz Khas area.

While chai has long dominated India’s beverage landscape, a new wave of water-based teas is steadily gaining traction among younger consumers. Floral blends, cold brews and wellness-driven infusions are becoming mainstream, and ambience and storytelling are now part of the proposition.

Gaurav Saria, Founder and Chef at Infinitea, believed this emerging demand is being driven by 15–25 year-olds embracing matcha, bubble tea and water-based teas, segments that are “exploding and growing exponentially,” even if the base remains small today.

A Familiar Drink, an Untapped Market

Café owners say the cultural familiarity of tea makes scaling intuitive. “Tea already lives in the heart of every Indian home, which makes it an incredibly intuitive category to scale,” shared Kochharr.

Vineeth Nelakuduru, Founder, Teatings, said the brand emerged after identifying “underserved potential” in metro markets. He noted that in their outlets, chai accounts for half of beverage sales, while other tea formats make up the rest, signaling broader demand beyond milk-based chai. With only a few meaningful organised tea players in the country, he sees strong headroom for growth.

“Almost 70-80 per cent of organised cafés are focused on coffee. There are chai-focused brands like Chai Point, but they are limited to chai. Tea is a significant market. Month on month we’ve grown at least 5 per cent organically,” he said.

As the wider café market expands at double-digit CAGRs through 2030, the opportunity for tea cafés is less about creating demand and more about organising it.

Simpler, Cheaper Business

Tea’s lower capex and simpler operations are clear advantages. Nelakuduru compares equipment costs: a kettle or boiler at INR 3,000-5,000 versus espresso machines at INR 3-15 lakh. Staff can be trained faster, SOPs are easier to standardise, and, as he noted, “operational cost is lower, and profit per cup can be higher for tea-focused businesses.”

“Our average order value (AOV) moved from around INR 220 in the first quarter to about INR 880 now. We realised that long-term value comes from product quality rather than initial pricing. So we adjusted our brand strategy to focus on value in product rather than just low price,” he added.

Saria, who has been building Infinitea for 22 years added, “It all boils down to the product development. If your product is not good enough, no marketing or digital influencer can bring sales.”

Kochharr mentioned that while scaling, the biggest challenge is guaranteeing the same taste and quality everywhere, citing variables like water, sourcing and local preferences.

Hence, there’s no denying that the category can scale meaningfully if execution is disciplined. While India has long been the largest tea manufacturer and consumer globally, it is finally time for tea to enter the organised dining landscape, if brands can align quality, storytelling and operational rigour.

Asian flavours have been dominating the food menus in Indian restaurants for years, but now they have taken over beverages too. Cafe menus once defined by cappuccinos and cold brews are now filled with matcha lattes, hojicha drinks, vietnamese coffee and bubble tea. And this shift is being led by younger Indian consumers, Gen Z.

Swiggy’s How India Eats 2025 report shows the scale of this shift: Korean cuisine is growing 17x, Vietnamese 6x and Japanese 2.8x. These numbers are reshaping what young consumers expect to find in their neighbourhood cafes. Searches reflect this curiosity too, with matcha growing 4x over five years and boba searches rising 11x.

What’s Leading the Asian-Beverage Boom

India’s evolving palate and rising preference for cold beverages have created fertile ground for new beverage categories. Cold beverages today are growing 60 per cent faster than hot beverages, widening the runway for everything from iced matcha to fruit-forward boba teas.

For Suhas R, founder of Matcha & Mocha Cafe, this shift became obvious almost immediately. “When we started, matcha was mildly popular but as the trend picked up, we began getting search traffic from Instagram. Matcha became viral, and people randomly wanted to try it,” he recalled.

The cafe began with three matcha flavours; it now has 11 to 12, driven entirely by demand. Weekend matcha sales today equal his entire daily sales from a year ago, he shared, a sign of how rapidly consumer preferences are shifting. And, today, 60 per cent of his revenue comes from matcha-based drinks.

Similarly, Boba Bhai, a QSR chain focused on boba tea and Korean food, scaled rapidly because India was primed for a refreshing, customisable drink. As founder Dhruv Kohli pointed “Weather plays a part too. India is tropical and until now there wasn’t much innovation in cold beverages. Bubble tea arrived at the right time.”

What Gen Z Want

Gen Z’s influence is unmistakable: they experiment more, transact more digitally and explore cafés as social spaces. Their dining-out cohort is growing 3x faster than older age groups, and restaurants now spend nearly 75 per cent of marketing budgets on digital channels to capture their attention, shared the Swiggy report.

Harika Ganeshni Bommana, founder of Grumpy Girl Coffee, sees this behaviour daily. “Asian-inspired flavours aren’t just a trend anymore, they’re becoming part of the everyday Indian palate,” she said. Young customers often seek out the cafe specifically to try her miso caramel latte, shoyu latte or spicy guava espresso tonic. The experience is interactive: they come to experiment and return with friends to share discoveries.

Boba Bhai’s Dhruv Kohli sees similar patterns across cities. “Tier-2 and tier-3 consumers have increased appetite for spending and more time to explore,” he shared emphasizing that the curiosity is no longer metro-specific. In fact, Boba Bhai is now active in 179 cities on Blinkit alone and sells 80,000 to 100,000 cans a month on quick-commerce platforms.

Travel exposure has also widened palates. As Kohli pointed out, “Asian flavours adapt well to Indian palates as they use ginger, garlic and spice similar to Indian curries.” This makes the transition feel familiar rather than foreign, even in cities just beginning their cafe evolution.

Innovation and Experimentation

While the demand is high, cafe owners aren’t simply riding the trend; they are adapting these drinks for Indian palates.

At Grumpy Girl Coffee, experimentation is constant. Harika explained, “Honestly, many ideas start as my midnight notes,” but every drink goes through customer tasting, feedback rounds and careful balancing.

Boba Bhai, meanwhile, has leaned into novelty and scale simultaneously. They launched India’s first domestically produced bubble tea in a can, designed for q-commerce. They also broke category conventions by pairing bubble tea with Indian foods. As Kohli said, “Everybody else was selling bubble tea alone; pairing it with Indian food attracted Gen Z and millennials.”

Future of Asian Beverages

Despite the buzz, India is still early in its Asian-beverage journey. Bubble tea in India is projected to grow from USD 450 million in 2024 to nearly USD 930 million by 2033. Matcha, now an INR 870 crore market, is expected to grow to INR 1,400 crore by 2030. This aligns with Suhas’s belief that matcha will become “the next big beverage category” and eventually a default order, the way coffee is today.

As Harika observed, India is moving towards deeper, layered flavours like sesame, yuzu, hojicha and fermented beverages, echoing global wellness trends. Kohli sees the same wave: hojicha is picking up, and nostalgia-driven Indian flavours like kala khatta are entering premium beverage menus.

With organised food service projected to cross USD 125 billion by 2030, cafes have every incentive to experiment. And Asian flavours being vibrant, versatile and social-media friendly are perfectly positioned to ride that growth curve.

Airports have become the first chapter of a journey, not just the lobby to a flight. India’s terminals are busier than ever, and that scale matters for food choices. As per the Airports Authority of India, in FY24, domestic air passenger traffic rose to about 30.6 crore, up 13 percent from the previous year. When millions pass through a space built for waiting and wandering, the most memorable offer is not a generic snack; it is a plate that tastes like the city outside the glass.

What today’s traveller looks for

The post-pandemic flyer is more selective and more experience led. Hygiene cues, open kitchens, clear labelling and transparent sourcing have become default expectations, not premium features. Contactless payment and pre-order within the terminal are now common behaviour. At the same time, there is a greater appetite for discovery. Government tourism data shows domestic visits concentrated at large scale across key states, with Uttar Pradesh alone recording 478.5 million visits in 2023. That movement has widened palates and built confidence to try regional specials at the airport, not just familiar global menus. A well-run regional counter turns the wait before boarding into a short, safe tasting session of the city.

Gen Z and millennial travellers are amplifying this shift. Food discovery now starts on phones before it reaches the counter. Short videos and reels, map-based recommendations and creator lists push demand toward specific dishes and small brands. This cohort looks for provenance, plant-forward options, millets, low-waste packaging and stories they can share. If a terminal offers a Kolhapurimisal that tastes right, a Kumaonibhattkichurkani with smart plating, or a fresh toddy-shop style prawn curry at Kochi, it will find its way onto social feeds before the aircraft blocks out. Word of mouth becomes a repeat driver, especially on busy metro routes.

Why regional works for business, not just nostalgia

Regional cuisine is a practical differentiator. It helps airports avoid menu sameness while supporting local micro and small enterprises that are already organized at scale on the Udyam portal. Shorter supply lines improve freshness and reduce stock-outs. Central prep with regional recipes keeps consistency high even during peaks. For concessionaires, a tight core of always-on hero dishes anchored to the catchment area can be priced across tiers, from quick entry-point snacks to premium plates that justify a small uplift through provenance and portion.

Airports can borrow that playbook to curate “carry-on friendly” assortments: vacuum-sealed mithai, GI-linked spices and teas, ready-to-drink filter coffee, artisanal crisps and condiments. Done right, takeaway turns a last-minute browse into a premium basket.

The post-pandemic reset also favors regional supply. Disruptions made large chains rethink long logistics. Local producers and MSMEs proved more resilient for staples and fresh components. Bringing them into airport contracts creates dependable offtake for the region and builds a stable farm-to-terminal chain that can flex in peak seasons and festivals. Measured well, this becomes a local development lever that still meets the operational standards of a national hub.

How to make it work

Success depends on discipline, not just romance. Start with dishes that truly define the first ring of the airport’s catchment and travel well from kitchen to counter. Build a compact menu with clear day-part cues so training sticks and service stays quick. Keep hygiene signals visible and FSSAI labelling consistent to reassure first-time tasters. Price for breadth, with one honest entry option and one flagship plate in each category. Use data to tune the offer: attach rates by hour, repeat purchase by route, waste reduction from local sourcing, and social mentions that tie the dish to the terminal by name. As volumes stabilize, extend regional items into lounges, forecourts and pre-order, and rotate seasonal pop-ups for return flyers.

The biggest mindset shift is to see food as identity, not just inventory. A terminal that serves a real taste of its city earns higher recall and stronger spend without adding heavy capex. It supports local producers, gives younger travellers something they want to share and gifts departing passengers a way to take the region along. With domestic aviation on a steady upswing and tourism patterns deepening across states, regional cuisine is the rare idea that satisfies travellers, strengthens local economies and improves operating metrics. The next phase of airport F&B in India will belong to terminals that taste like where they stand—and package that taste so it can travel.

With India’s fast-changing restaurant landscape, guest experience and brand identity are emerging as the real drivers of success. Dining is no longer about just good food, it’s about emotion, memory, and trust. Today’s guests want more than well-cooked dishes; they want an experience that resonates. While great service wins hearts, a strong brand identity secures long-term loyalty.

Local Ingredients as the Heartbeat of Brand Identity

For Chef Vividh Patil, Executive Chef at Sofitel Mumbai BKC, culinary identity is deeply rooted in a sense of place. “We promote local food and keep evolving our menus with global trends. At Sofitel Mumbai BKC, menus are not just collections of dishes, they are narratives that celebrate India’s micro-regions through seasonal produce and meticulous technique.”

This approach allows the brand to stay contemporary without losing cultural depth. Guests recognise authenticity in flavour, yet appreciate the global finesse in presentation and method, a duality that brands like Sofitel have mastered.

Chef Altamash Patel, Director of Culinary at Hilton Mumbai expanded this philosophy, framing sustainability not as an optional element but as a brand commitment. “We use cage-free eggs, sustainable seafood, and have substituted charcoal tandoors with electric ones.”

When Sustainability Becomes Culture, Not Campaign

For Sumit Govind Sharma, Founder-Director at Monarch Liberty Hospitality, sustainability is not a marketing slogan but a daily operational discipline. He pointed a series of initiatives within his restaurants that are small in action but transformational in outcome. From the replacement of paper and plastic with rice straws, the conversion of used oil into biofuel, and channeling of wet waste into fertilizer.

He emphasized a shift toward “almost zero-waste cooking”, a concept that demands creativity and accountability from chefs and managers alike. The practice is not merely cost-efficient as it defines the character of a brand.

Chef Paul Noronha, Executive Chef at ITC Maratha added a valuable perspective, noting that ITC Hotels have eliminated plastic entirely, demonstrating how institutional decisions can reinforce both brand values and guest expectations.

Making Meal an Emotional Journey

While food is undeniably the centerpiece of dining, but its memorable experiences are based on how guests are made to feel rather than what they are served.

Sharma illustrated this with a meaningful moment from Eve Powai. He said, “A guest was visibly unhappy with a dish, and before the situation could escalate, a server replaced the dish without hesitation with a complimentary dessert. Guest experience is everything. People remember how you made them feel. This philosophy reveals the power of frontline employees and how the smallest gestures can create lasting brand recall.”

Signature Dishes and Family Traditions

Food also binds people emotionally, and for Chef Patel, this connection runs deep, “Any celebration in my family includes ITC’s dal makhani. The dish serves not only as a culinary symbol but as an emotional anchor across generations.”

“For us, it’s not just a meal served, it’s a memory served. It’s all about storytelling. Sofitel’s signature dishes such as the Nalli Nihari, Dal Makhani, and his own Kolhapuri Mutton have remained unchanged for 13 years, because consistency itself can be a tradition. These dishes become a promise guests rely upon, a culinary time capsule that never disappoints,” commented Chef Patil.

Human Connection is a Brand Asset

Chef Patel offered a striking insight into loyalty, “When a chef moves hotels, regular banquet clients often move with them. The statement underscored the irreplaceable value of personal connection in hospitality like a business built as much on relationships as on recipes.”

Chef Noronha added that ITC ensures servers participate in daily tastings, empowering them to confidently recommend dishes they have personally tasted. This strengthens both guest trust and staff ownership.

Hence, we can say that Sustainability is no longer a differentiator; it is a requirement for relevance.In an era where trends come and go, this timeless philosophy may very well define the next generation of dining in India.

India’s food and beverage sector is undergoing its most significant transformation in decades. With investors chasing category leaders, consumer expectations shifting from mere consumption to emotional resonance and brands rethinking scale models, the business of dining is no longer just about good food. This brings perspectives from investors, homegrown QSR founders, legacy restaurateurs and new-age community-driven café creators to decode the trends shaping India’s next decade of F&B growth.

The Investor Lens: India’s Appetite for Category Leaders

India is not one market; it is a continent. Twice the size of Europe in cultural and culinary diversity, the country offers deep opportunities but demands equally deep conviction.

“Are you in a category where you can lead or at least be top three? Do you have the team and bandwidth to scale across the country? And most importantly, can we exit are few questions that investors have in mind,” shared Hari Balasubramanian, Angel Investor.

Highlighting further, Balasubramanian said, “The exit question via IPOs, strategic buyouts or global F&B majors acquiring stakes is no longer an afterthought. Because institutional investors deploy other people’s money, a clear 7–12-year exit pathway determines whether they will write the cheque in the first place. This shift has created a more disciplined landscape.”

A brand can have great food, a great story, even a great following, but without a replicable model and scalable operations, it cannot attract serious capital.

Company Owned Company Operated

For decades, scaling in India meant one thing: franchising. It was fast, often capital-light, and allowed founders to grow without immediate corporate infrastructure. But the era of blind franchising is over.

Good Flipping Burgers chose the opposite strategy, and they have company-owned, company-operated (COCO) stores. Initially seen as capital inefficient, the logic was deliberate.

VirenDsilva, Co-founder, Good Flippin Burger added, “Franchisees expect returns quickly; brands may compromise on quality to satisfy them. While sharing revenue dilutes long-term enterprise value. India’s legal enforcement of franchising standards remains weak. Brand integrity, customer-first decisions, and patience come before speed.”

Franchisee-Invested, Company-Operated (FICO)

Amit Bagga, CEO & Co-Founder, Daryaganj Hospitality argues that franchising in India is evolving rather than disappearing. He pointed, “The new emerging trend is Franchisee-invested, brand-operated models where investors pay for infrastructure, but the brand runs the entire outlet. This model solves India’s biggest franchising problem. The brand owns the P&L, retains standard, and the franchisee becomes an investor rather than an operator.”

The revival of the Daryaganj brand, built on the legacy of the inventor of butter chicken and dal makhani, showcases another defining trend: heritage storytelling as a scalable asset. The founders resisted the temptation of 377+ franchise requests after their Shark Tank success.

Instead, Bagga said, “We strengthened corporate infrastructure in NCR, proved success internationally (Bangkok) and focused on consistency and experience before expansion. We believe that brand equity is easier to destroy than build.”

How Community is the New Competitive Advantage

While QSR brands focus on operational scale, new-age café and lifestyle brands like Blondie by Bastian are building something very different: community-led experiential ecosystems.

Natasha Hemani, Co-Founder & Brand Director of Blondie by Bastian explained how their approach created true resonance. “We hosted cross-discipline events (wellness, fashion, art) and used a WhatsApp broadcast group that grew into a 2000-member active tribe. Our followers participated in the brand’s journey construction updates, menu testingand design decisions. By the time Blondie opened, its customers felt like we had co-created the space,” commented Hemani.

Experience is no longer just ambience or service as it’s about identity, belonging, and participation.

The Five Senses Rule

Every restaurateur agrees that in hospitality, the product is the entire experience. Taste, Touch (service, warmth, and tableware), Smell (aroma of the space), Sight (design, lighting, presentation) and Sound (music, acoustics, energy) play an important role.

Bagga calls this the five-sense experience, where food is just one element of a much larger emotional offering.

In a world where multiple food brands can deliver great dishes, what keeps people returning is the feeling the brand evokes.

What Investors Really Want

Balasubramanian noted, “Fine dining is almost impossible to scale. Casual dining has potential. QSR is king offering predictable margins and operational uniformity.”

Also, delivery platforms create back-end scale without proportionate capex. Cloud kitchens allow multi-brand ecosystems within the same kitchen. Some cloud kitchen players in India today are clocking ₹100 crore+ monthly revenues, a scale that physical restaurants would take years to achieve.

DSilva revealed a fundamental truth: India does not lack good products; it lacks consistent and scalable products. “We focus on building for scale from day one. SOPs that work in one store must work in 100.Supply chains must be designed for national distribution. Training must be structured, standardized, and replicable,” he added.

No brand can scale beyond the founder’s personal capacity unless middle management, training teams, and operations team mature alongside. A hero product gives a brand instant recall.

The Venture Capital Journey

Raising capital is not a one-time pitch; it is a multi-stage demonstration of capability.

Bagga shared, “When we raised money from investors what we saw is early-stage investors look for proof of demand. Mid-stage investors look for execution capability. Late-stage investors look for market size, defensibility, and scale. Every round requires answering the same question differently. Can this company become big enough to create a disproportionate outcome?”

There’s no denying that good investors add value in what you do. They bring in lot of connections; you will not make mistakes when they are with you.

The next decade in India will own a category, not just a cuisine, build systems, not just stores, invest in community, not just marketing, scale patiently, not recklessly, protect brand integrity at all costs and most importantly deliver consistency at scale. It will decide which of today’s challengers will become tomorrow’s giants.

As India’s café market races ahead, most of the growth story is still being written by independent cafés rather than big chains. Industry estimates put India’s café market in 2024 at roughly USD 340–440 million, with double-digit growth (about 11 per cent) projected through 2030.

While branded chains are expanding aggressively, independents still make up the bulk of outlets in most Indian cities, and that is where much of the new consumer demand appears.

Domestic coffee consumption has inched up over the past decade to about 91,000 tonnes in 2023, driven by urbanisation, premiumisation, and a visible café culture. For standalone operators, that translates into larger, more curious audiences, especially in metros and fast-growing neighbourhoods.

Bengaluru-based entrepreneur Prarthana Prasad, founder of Beku café, bakery and bookstore, has watched this play out. “Honestly, it feels like there are a lot of cafés opening in Bangalore, but statistically speaking, when you compare this to slightly more global cities in other continents, the population-to-café ratio there is massive. Bangalore, by comparison, might have 500 to 2,000 cafés. So, while social media noise makes it feel like there are a lot of new spaces, I do think that the number of people interested in visiting cafés is growing massively every day because of how much Bangalore is expanding,” she said.

For her, the surge in new cafés is driven by genuinely strong consumer demand.

Experiences over Convenience

Independent cafés are betting on experience over pure convenience. Chains win on predictability and reach, but standalone spaces are often the first choice for a unique experience.

“A lot of chains have become just a back-of-the-mind option when you need to get some work done or you want the most convenient space for a quick meeting. But there is definitely interest from people who want to try something new or experiential. There’s also a group of people who seem to have made it their hobby to visit every new F&B establishment; it’s almost their weekend activity,” Prarthana shared.

At Dolci Cafe, Executive Director and CEO Balaji M has seen a similar shift. Younger diners, he said, want authenticity and Instagram-ready ambiance.

“There is a rise in adventurous, globally curious palates, especially among younger customers. Millennials and Gen Z in particular are looking for cafés that offer both quality and experience. They want a place where the food is authentic and the ambiance is Instagram-worthy,” he explained.

Storytelling and Specialisation

If chains are about scale, independents trade in soul and story. Beanlore Coffee Roasters co-founder Prasanna Kumar said guests are far more intentional now.

“People are seeking more meaningful, slower, and quality-driven experiences, which has translated into higher interest in artisanal beverages, seasonal menus, and transparency about sourcing. Digital influence has also played a major role. Customers now arrive more informed about beans, roasting profiles, sustainability, and brewing techniques,” he mentioned.

Being independent give teams the agility to innovate and respond quickly. Prarthana expects specialisation to become a key survival strategy.

“I think the most benefit in the future will go to people who specialise in something unique. Cafes that focus on smaller menus, high-quality food, and specific cuisines in a casual seating will benefit more,” she further added.

Challenges: Digital squeeze and Rising Costs

However, for independent players, growth brings fresh pressures.

“A fairly new challenge for the industry is the lack of autonomy we now have because of social media and online restaurant aggregators. When you’re trying to bring in new footfall, the only real ways to do that now are social media or signing up with a massive delivery aggregator like Zomato or Swiggy, and that comes with many challenges,” worried Prarthana.

Influencer marketing and aggregator commissions have skewed economics.

“If all the competitors around us are spending two or three lakh a month on influencers to bring in footfall, and I don’t want to or don’t have the budget to do that, it becomes a huge setback,” she pointed.

Rising rents, raw material costs, and talent retention add to the pressure. Balaji warned that scaling while preserving quality is hard.

“Maintaining consistently high standards of food quality, service, and overall experience while scaling across multiple outlets is a significant challenge. Competition is intensifying not only from major chains but also from boutique cafés, mobile cafés, and ghost kitchens,” he shared.

As the café market expands and consumption rises, standalone cafés are the laboratories where trends like specialty brews, experiential menus, and place-based identity are invented and refined.

India is no longer an emerging opportunity — it is the opportunity. With one of the world’s fastest-growing consumer bases, a middle class projected to nearly double by 2047, and rapid urbanization reshaping lifestyles, India now offers global-scale demand in a single market. Its young, upwardly mobile consumers are spending more, seeking convenience, and gravitating toward aspirational global experiences making India one of the most attractive destinations for international QSR and café brands today.

Domestic players like Jubilant FoodWorks, Devyani International and Westlife Foodworld already have local know-how, distribution network, real estate strength and capital crucial for scaling globally founded brands in India. From sushi and frozen yogurt to QSR, coffee culture and bakery cafés, the world’s most diverse brands are now converging on the Indian market not just to expand, but to transform themselves through franchising.

How Franchising is Becoming a Global Magnet

When Tony White, Co-Founder, White Stone Capital first arrived in India in 2001, he spent his days explaining what franchising meant. “Back in early 2000s, international brands came in with arrogance replicating what worked in Dallas or Melbourne assuming it would work in Delhi or Mumbai. India proved them wrong. None of these brands were eager to study about the Indian market because of which they failed. Indian market is different from that of other markets,” he shared by adding that India is a market of markets within the market. “What works in International brands will not work in India as they need to change their model while venturing into Indian market,” he pointed.

The early 2000s saw the rise of the brand graveyard big names that entered with confidence but exited quietly, unwilling to adapt menus, pricing, formats or strategy to a country that is.

“Today, the shift is unmistakable as global brands now arrive asking: What must we change to succeed in India?And that humility is unlocking unprecedented success,” he smiled while sharing this.

India’s Franchise Operators Are No Longer Followers

Twenty-five years ago, Indian franchisees sought expertise from foreign brands. Today, the equation has flipped.

“Indian partners bring capital, operational talent, strategic knowhow and deep consumer understanding of how to adapt the brand to fit the Indian market. What brands need now are strategic partners, not master-servant relationships,” White emphasized.

Digital payments systems that have leapfrogged the West and also a consumer base that is young, aspirational and experimental. India isn’t just a market anymore; it’s a test bed for brand reinvention.

Why India, Why Now?

With 200 stores and 25 years of leadership in Australian Japanese cuisine, Sushi Sushi (Australia) sees India as the same cultural inflection point Australia once experienced.

“Japanese cuisine is exploding in India from fine dining to casual concepts. But there’s no successful sushi QSR brand yet. That’s our sweet spot,” added Katie Mcnamara, Chief Customer Officer, Sushi Sushi as India’s young population, growing mall culture, openness to new flavours, and hunger for convenience all point to a massive first-mover advantage.

But the brand is realistic that menu will be hyper-regionally customized. Formats will shrink for Indian malls and models will adapt to new consumer behaviours.

On the other hand, Christian Jordon Mailoa, Head of International Franchise Development, Sour Sally (Indonesia) is reimagining India’s Love for Yogurt. For Sour Sally, a 17-year-old frozen yogurt brand with 140+ Indonesian outlets, India offers something few markets can match: a deep, generational familiarity with yogurt.

“India understands yogurt. We just want to bring a new twist. The biggest differentiator is Black Sakura, a charcoal-infused frozen yogurt that’s already a hit in Southeast Asia. Since, we are expanding and we are in the market for a longtime, this new twist is huge deal which we can offer to the Indian market,” mentioned Mailoa.

Having navigated the complexities of islands, logistics and climate in Indonesia, the brand felt prepared until its Dubai expansion revealed new challenges like extreme heat reshaped logistics, product integrity required entirely new protocols and customer expectations shifted dramatically. “We thought we were ready. Then we learned adaptation is a continuous process,” she pointed.

A Spice-Led Brand Designed for India

Represented by Rollout Partner, Sandeep Alexander, Cinnzeo Bakery Cafe sees India not just as a market, but as a natural extension of its flavour DNA. “Cinnamon is everywhere in India from biryani to masala chai to rituals. The flavour profile is our common meeting point to accelerate all across India.”

With 30 years behind them, their India strategy rests on flavour familiarity an approach likely to resonate deeply across metros and Tier-II cities.

Similarly, Matthew Smith, VP Franchising, Blenz Coffee (Canada) witnesses a great opportunity in the market with the growth of café business. “Since 1992, Blenz Coffee has grown by rooting itself in local communities. In India, we see a thriving coffee culture but not one that is yet saturated. Understanding what the market and where it is heading to be important. Our menu is a suggestion. Guests craft their own palate.The diversity within India is incredible. We see ourselves adapting city by city,” he said by adding that to prepare themselves for Indian market, the Blenz team has spent time speaking to local baristas, understanding local preferences and observing café culture across cities. Their goal isn’t to transplant Canadian coffee culture; it’s to blend it with India’s evolving taste.

QSR Biz is here to Stay

Gabriel Melniciuc, Founder and CEO, Spartan said, “In 13 years, Spartan has become Europe’s largest Greek QSR chain, serving over 2,000 dishes per store per day.”

Their confidence in India is rooted in flavour affinity. “Greek spices meet Indian spices beautifully. And Indians love speed, quality and bold flavours,” he shared by adding that Indian market inspired us to try different cuisines. “I think our concept will be perfect for Indian markets and we invest a lot on quality and trainings.”

But what sets Spartan apart is its philosophy, “When you sign with us, you become family. We train, support, and even argue with you if you don’t respect the guest. That’s our responsibility.”

The India Advantage: A Blank Canvas for Reinvention

White summarized the opportunity perfectly, “When a brand enters India, it gets a fresh canvas. It can protect its core but reinvent its model completely.”

Unlike Western markets where legacy systems slow transformation, India allows brands to reimagine formats, overhaul menus, introduce new service models, build digital-first operations and redefine brand positioning. It’s why brands like Stellarossa Café (Australia) known for world-class café culture are entering India with tailored strategies.

A new success equation has emerged: Brand DNA + Local Customisation + Strong Partners + Adaptable Systems + On-ground Involvement. Ultimately, the brands that will win in India are the ones that treat the market not as a challenge to overcome, but as a collaborator to learn from and grow with.

India’s dining landscape has quietly but decisively changed. What was once a planned weekend outing has become a daily ritual, with national spending on eating out now estimated at INR 1,056 crore every single day in the first half of this fiscal, as per NRAI report. Combined with a 34 per cent surge in UPI transactions at restaurants, it's clear that eating out is no longer an occasional indulgence for urban Indians.

Restaurateurs say this shift goes beyond frequency. It reflects a cultural shift in how Indians, especially young urban families and professionals, perceive dining out. As Priyesh Busetty, Co-founder of Yuki, Bangalore, said, “People no longer look at dining out as a treat, but as a way to live, connect, and experience the world.”

And India’s restaurants are responding with a sweeping reinvention of discovery, payment, experience and design.

Digital Discovery, Seamless Payments

If eating out has become effortless, it is largely because digital discovery has taken over the decision-making process. In Bengaluru, this shift is most visible.

“Discovery is now almost entirely digital,” shared Thejus Shivarama, Founder of Juliet and 2Moons, adding, “Guests choose restaurants through Instagram, reels, reviews and UPI-friendly convenience.”

UPI sits at the heart of this new behaviour. Restaurateurs across the board describe it as more than just a payment method. With instant, invisible transactions, diners hesitate less, order more freely and return more often. Shivarama noted that UPI has made dining “seamless and spontaneous,” reducing wait times and encouraging guests to try new dishes because there’s no friction at the end of the meal.

Busetty echoed this from a cultural standpoint, observing how frictionless payments create a “relaxed, impulsive, and repeat-driven dining culture” where attention stays fully on the experience, not the bill.

Even emerging brands are feeling the impact. At Gladia Brewery & Kitchen, Co-founder Fino Frangline mentioned digital payments have “definitely” boosted footfall by making transactions smoother and faster for guests.

Evolving Menus

The rise in repeat visits has forced restaurants to rethink how they design and refresh their menus. Innovation in food and beverage offerings is now expected every few weeks.

Busetty describes a new era of diners who crave novelty, like matcha-infused cocktails, yuzu-driven mains, playful experimentation, yet still expect price points to remain accessible.

“But behind that creativity lies strategy: ingredient imports fluctuate, but pricing must remain approachable, meaning thoughtful portioning, sourcing, and operational balance have become just as important as flavour,” he added.

Shivarama noted that menus are becoming “dynamic, seasonal and intentional,” built to engage a guest who might visit midweek as casually as they might on a weekend. Leaner, more purposeful menus are replacing sprawling lists, with restaurants focusing on cohesion between food, drink and the overall storytelling of the space.

Experience, Ambience and Community

Dining out today is shaped as much by experience as by appetite. Restaurateurs say that guests want to feel rooted in a space, familiar faces, thoughtful service, and the comfort of returning to a place that recognises them. The future, as Busetty said, belongs to restaurants that “build a nuanced culture around dining,” where craftsmanship, sourcing and storytelling matter as much as the food itself.

Shivarama sees loyalty shifting away from discounts and toward sincerity. In competitive cities like Bengaluru, he added consistency, warmth and small personalised touches are what keep guests returning.

Frangline shared a similar outlook. “With cut-throat competition, our goal is to focus on customer loyalty and community building. Thus, the focus will be on this for the next couple of years, which is important for the brand in the long term,” he added.

As dining becomes habitual, the emotional quality of a restaurant, its design, energy, music, and warmth, often carries as much weight as its menu.

The distinction between eating in and eating out has also thinned. Restaurants are investing in thoughtful packaging, premium delivery menus and faster dispatch systems. Busetty explained this shift simply, saying, “Delivery packaging today is as thoughtful as dine-in plating, it carries identity, sustainability and care.”

For restaurants, this dual expectation means crafting experiences for two parallel customers: the one who comes in looking for ambience and the one who wants the brand’s touch at home.

Growing Market

India’s food services sector is expanding in step with this behavioural shift. NRAI values the industry at INR 5.69 lakh crore with steady growth projected through 2030. Cloud kitchens, multi-brand operators, and rapid Tier-2 adoption are pushing expansion deeper into the country, while digital platforms like Swiggy Dineout and Zomato are shaping demand.

But restaurateurs caution that the next phase is not about scaling quickly. It is about scaling purposefully. Shivarama believed the future belongs to neighbourhood-first spaces. “This shift is shaping how we grow. We’re focusing on neighbourhood spots, warm social spaces, and menus that keep guests coming back during the week, not just on weekends. Competition is getting stronger, so building real loyalty through consistent service, familiar faces and small personalised touches is becoming more important,” he concluded.

Frangline echoed the mood on the ground: long-term success will hinge on loyalty, consistency and community, not speed of expansion.

“The restaurants that nurture belonging, not just discounts or gimmicks, will define what comes next,” Busetty pointed.

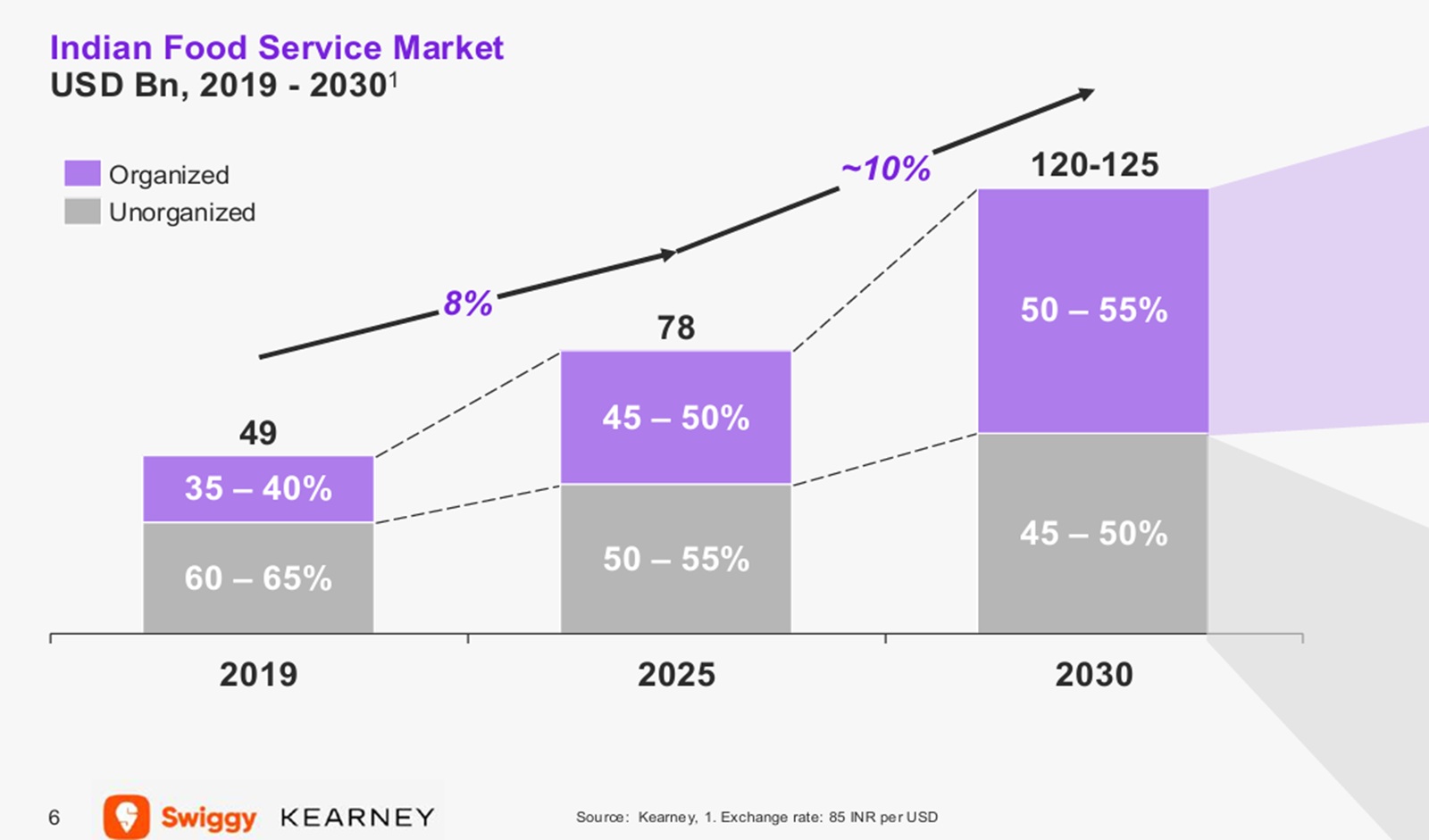

India’s food services market will cross US$ 125 bn by 2030, with the organized segment growing at 2x that of the unorganized segment, shared a report by Swiggy.

Swiggy in partnership with Kearney has launched the 2025 edition of its annual report titled “How India Eats”, reflecting the Indian consumer’s evolving food habits, and this is its second edition.

As per the report, the organized segment will drive over 60% of the overall growth in food services, and overtake the unorganized segment.

Not just this, food services presents a massive headroom for growth with contribution of 1.9% to GDP in India, vs. 5% in China and 6% in Brazil. While rising incomes, digital adoption and growing appetite for convenience will comprise the macro story behind this growth, it is the shape of this growth that is most interesting.

“The Indian consumer is experimenting more: 20% growth in unique cuisines ordered per customer, and 30% growth in restaurants ordered from per customer,” added the report by pointing that indulgence and health are seemingly dichotomous, yet simultaneous, trends.

Rohit Kapoor, CEO at Swiggy Food Marketplace said, “In a span of just over a decade, the industry has seen disproportionate evolution. Expectations on speed are being shaped by quick commerce; for instance, our 10-minute food delivery service Bolt contributes over 10% of platform orders. On one hand, consumers are demanding affordability in familiar cuisines like Indian and Italian, and on the other hand, adopting Matcha and Boba Tea like never before. And our restaurant partners are keeping pace, with QSRs and cloud kitchens projected to grow at a CAGR of 17%+, nearly 1.5x of organized food services growth. I am really excited to see what the next decade has in store for all the stakeholders in this dynamic space.”

It also mentioned that late night meals are growing ~3x that of dinner, with pizzas, cakes and soft drinks seeing the highest growth in consumption beyond 11PM.

“Healthy and better-for-you meals are growing at 2.3x of overall orders, focused on increasing protein intake, watching calories and cutting down on added sugar,” it added.

The report also points to how India is seeing two exciting frontiers of growth in food services - rediscovering India’s rich culinary heritage.

● India is rediscovering its hyper-regional cuisines like Goan, Bihari and Pahari, which are growing at 2-8x of mainstream cuisines.

● Local Indian beverages like Buttermilk and Sharbat are growing at over 4-6x of overall beverages. pushing global QSRs to innovate for India - think Kala Khatta cold brew at a Starbucks, or a Chilli Guava drink at a McDonald’s.

● With tea growing at more than 3x of overall beverages, even the humble roadside stall break is being facilitated by digital channels

… while also embracing global culinary diversity like never before:

● Korean, Vietnamese and Mexican cuisines are becoming mainstream with growth indices of 17x, 6x and 3.7x. Even Peruvian and Ethiopian food have made their debut.

● Boba Tea and Matcha Tea have seen an 11x and 4x surge in search volumes, respectively, in the last five years.

● For the well-travelled and social media savvy urban Indian consumer, sushi, tacos and Korean BBQ are no longer niche and fast becoming weeknight staples.

“What we are witnessing is a fundamental broadening of India’s food economy. Growth is no longer concentrated in a few metros; dining-out growth beyond top 8 cities is 2x that of top 8 cities, with corporate, industrial, education and tourist hubs leading the charge. GenZ offers high promise, growing 3x of other cohorts in the dining-out segment while demanding innovations like coffee raves and Instagram-worthy locations and menus. The next wave of leadership in food services will come from players who understand these new markets and consumers. Additionally, in food delivery, packaging innovation will substitute for format in dining-out,” added Rajat Tuli, Partner, F&B Lead, QSR Asia Lead at Kearney.

To effectively address these trends, food services players will need to balance multiple priorities and deliver, focusing on speed, affordability and experience:

● Restaurants are spending 75%+ of their marketing budgets on digital channels especially to tap younger consumers

● Pre-booking in dining-out is growing at 7x of walk in orders

● Familiar cuisines like North Indian and Italian are seeing 10-40% higher indexation on growth across lower price points

● The e-commerce unboxing experience is being replicated in food delivery: think butterfly burger boxes unfolding into plates, and slow-cooked dum biryani brought to you in earthen handis

India’s delivery economy is expanding at its fastest pace yet, fuelled by double-digit annual growth in online food orders and a consumer base that now prefers the comfort of home over the bustle of dining rooms. The industry is projected to grow over $140 billion by 2030, at a CAGR of around 28.17%.

When Disruptions Becomes Destiny

“Delivery has become the forefront of our business right now. A few years back that was not the case. The market has evolved fast and caught us by surprise,” stated Rohan Mehrotra, Founding Member, Charcoal Eats by adding that the shift is no longer optional; it is existential.

Sahil Vora, Chief Eating Officer, MousseStruck, recalls that his dessert brand was born into this disruption rather than adapting to it. “We were born in a situation where we had to come up with products that can stay in a certain temperature for a certain period of time. So, coming up with solutions for this became one of our SOPs.”

MousseStruck emerged during Mumbai’s early delivery surge in 2018–19, when Swiggy and Zomato turned food into a button-tap utility. For Vora, innovation wasn’t a choice as it was about survival.

The Dine-in Awakening

While MousseStruck grew from delivery-first roots, others entered the space with traditional expectations and were quickly humbled.

Aayush Sahani, Founder, Ministry of Naan, admitted, “I thought delivery would be easy… but it’s a very difficult space to be in. Delivery has become part of our life, so I decided to take it as a challenge.”

With years of dine-in experience behind him, his biggest shock wasn’t the operations, it was the margins. “think the rent is low and salaries are fewer, so margins will be good. But delivery margins are really narrow.” As a result, Sahani has restructured his entire restaurant strategy.

“Now, whenever we plan a new dine-in outlet, we give serious thought to the delivery division. It has become essential.”

Bringing the Restaurant Experience Home

For Sandeep Singh, CEO of Aspect Hospitality, known for beloved dining destinations such as Radiobar, OPA, and Akina, the challenge is redefining hospitality without the physical restaurant. “Today want a similar experience at home. They want quality cuisine in quality packaging and delivered in specific amount of time like 15-20min.”

It doesn’t end here; the experience also includes the sensory cues once only found in well-designed dining rooms. Innovation plays an important role. “When the box opens, there has to be steam coming out. Food has to be warm enough to be eaten directly. Boxes need to be as comfortable as plates,” he pointed by adding that Aspect's answer was building scalable delivery-first brands like Nom Nom Express across 50 outlets proof that restaurant craftsmanship can coexist with logistics precision.

Mastering the Multi-Brand Machine

If Aspect represents the dine-in evolution, Rebel Foods represents the delivery revolution.

Paras Gori, Business Head, Delivery and Franchising, Rebel Foods explained their multi-brand model. “We built brands around different cuisines like Faasos, Behrouz Biryani, Oven Story Pizza, Lunchbox, Sweet Truth. We are a book-of-brands company.”

Their product innovation pipeline is an industrial process like data-driven, benchmark-driven, and ruthlessly tested. “A product that doesn’t hit our benchmarks doesn’t scale. If it still doesn’t hit it after a certain time, it gets discontinued. Food is an evolving market,” noted Gori.

Delivery may have begun as a convenience, but for Rebel, it's an engine of constant experimentation. “This industry keeps you on your toes. You must always be visible, always experimenting, always innovating. We are in the business before Zomato came in.”

The Invisible Backbone: Rethinking Kitchens and Supply Chains

The rise of delivery has also redefined the physical backbone of the restaurant i.e. the kitchen.

Singh described the operational pivot, “When we open a restaurant, we ensure there is self-sufficient kitchen which is formed. The moment you think of scaling, you have to focus on consistency. The customer is testing you every day. So, to scale with consistency, you need a central kitchen, a quality control center, innovations, R&D everything running simultaneously. We have to ensure that the right product with right temperature reaches the customer on right time. There has to be no additional preservatives which spoil the food.”

“If the central kitchen is fully equipped and you are prepared at your restaurants with smaller formats where it has potential for growth, where new equipment's can be fitted in or certain equipment's can be utilized for multiple products, those are the best scenarios and this is where you need to work with right kitchen vendors,” highlighted Singh.

Restaurant kitchens, once built for plating, now require optimal storage, multi-functional equipment, and seamless integration with data systems that track inventory, prep volumes, and demand cycles.

“Every inch of space must be optimally used. With multiple brands in one kitchen, cross-utilization of equipment becomes essential. All decisions are data-driven now and taken into consideration of what can be done.” noted Gori.

From multi-brand prep zones to compact high-output equipment, India’s kitchens are becoming tech-enabled production lines hybrids of craft and engineering. From tech adoption to kitchen redesign, from multi-brand ecosystems to packaging that doubles as plating, India’s restaurant industry is undergoing its most transformative era.

From its modest beginning, Hatti Kaapi has expanded into a 110-outlet network across India and overseas, including its first international store in London. The timing aligns with a broader consumer shift: India’s domestic coffee consumption touched approximately 91,000 tonnes in 2023, and the café market, valued at USD 380.8 million in 2024, continues to grow at double-digit rates. “When we opened in Bengaluru’s Gandhi Bazaar in 2009, it was a 30-square-foot shop serving 3,000 cups a day,” recalled US Mahender, Founder, Director and CEO of Hatti Kaapi. “That little store propelled us to scale, and we didn’t look back.”

Sixteen years later, the South Indian filter coffee, has become a global talking point. And one of the brands most responsible for taking filter coffee into the mainstream café market. “For Hatti Kaapi, the timing couldn’t be better,” Mahender shared. Excerpts:

How it Began

Mahender credits his coffee instincts to his roots. “We come from Hassan, a coffee-growing region in Karnataka, and coffee is in our DNA,” he said. He and co-founder ML Gowdaji hail from families deeply tied to the Western Ghats plantation belt, like Coorg, Chikkamagaluru, and Hassan, regions that produce nearly 90 per cent of India’s coffee.

After years spent trading coffee, Mahender felt the need to build something of his own and for his late VG Siddhartha, the visionary behind Café Coffee Day was the inspiration. “He brought change to the Indian coffee industry. But Café Coffee Day focused on the western version of coffee. I grew up with filter coffee. So, we thought, let us offer something affordable and true to our palate,” he added.

That decision to make an authentic, milk-based South Indian filter coffee scalable shaped the brand.

Hatti Kaapi’s Growth Story

The next turning point came when Bengaluru Airport offered them a space. The store became a landmark. Today, Hatti Kaapi brews 2,000-2,500 cups a day at the Bengaluru airport alone. With Kempegowda Airport crossing 31.9 million passengers in FY23, this strategic placement amplified brand visibility exponentially. The airport model was soon replicated in Chennai, Hyderabad, Kolkata, Delhi, and Mumbai. Hatti Kaapi intentionally adopted a multi-touchpoint model, ensuring consumers encounter the brand across daily routines at airports, IT parks, malls, hospitals, hotels, and corporate events. While the brand stays loyal to filter coffee as its identity, Hatti Kaapi has expanded its café format.

“We’ve learned from global formats: while Starbucks sells an Americano, we focus on offering the best Indian coffee experience. We use quality machines and techniques, but the heart of our menu is true Indian filter coffee,” he pointed.

With growing demand, the brand’s model has also evolved its food menu, including mini idlis, Maddur vadas, rice rotis, upmas, croissants, vada pavs, and more. This positioning resonates in cosmopolitan cities where consumers expect native flavours alongside café culture. In line with this growth, the brand is also expanding into major metro markets, with new stores opening soon in Delhi, Chandigarh, Mumbai, Pune, and Hyderabad.

Rising Coffee Demand

India may be a traditionally tea-dominant country, but the coffee wave is rising, particularly among Gen Z and millennials.

“Earlier, coffee was a luxury. Now it’s a statement,” said Mahender, adding, “Today’s generation prefers coffee destinations to work from Café as the new workspace.” South Indian filter coffee recently secured the No. 2 position on TasteAtlas’ list of the ‘Top 38 Coffees in the World’, an acknowledgment that mirrors the rising popularity of India’s homegrown brew.

Global supply disruptions in Brazil and Vietnam have raised prices internationally, indirectly boosting Indian growers, who are now earning their best rates in recent years. Meanwhile, India’s annual coffee exports continue to stay strong between USD 1–1.2 billion.

“Looking ahead five years, every year is exciting. If domestic consumption rises from 40% to even 60%, it will be a great win,” Mahender mentioned for whom the next goal is to expand its presence into Tier-2 and 3 cities across India. “We want to move into tier-three towns and villages, put up small touch shops, give people a job or a franchise. They deserve a quality cup of coffee, too,” Mahender pointed.

Growing Global Presence

Hatti Kaapi already brews in London, and upcoming locations include Amsterdam, the United States, Dubai, and other parts of Europe. “The brand of Karnataka started from serving Rs 5 filter coffee at 5 AM, and now we have touchpoints across cities and countries. It’s a proud moment for us,” Mahender proudly shared by adding that he believe Indian coffee has a unique flavour that isn’t always claimed on the global stage, even though many international brands buy Indian beans.

"The time has come to say Indian coffee is among the best. We’re seeing international interest, brands coming to India and opening stores here, which shows strong potential for coffee. “Our mission is to offer true Indian filter coffee, everywhere,” he asserted.