Digitalization has taken the food industry by storm. Restaurants are now focusing on introducing various modes of payments which can attract the customers increasing their sales. With the younger generations invading the food market, the trend has now shifted from just trying the delicious cuisines. People now seek for experience other than the food and ambiance provided at the restaurant.

Marketing specialists are innovating and coming up with various ways which can gain the loyalty and interest of the customers. Digital payment method is something which the market has come up with involving various payment players of our country. Restaurants have adopted this trend making things simple and interesting for the customers.

Renowned digital payment company PayU India has recently introduced the latest payment method called ‘LazyPay’ which is a payment facility for the consumers involved with a brand on a regular basis which involves small value transactions on various e-commerce portals. The entire idea is to make the checkouts faster reducing the friction of online payments.

LazyPay ensures that while transacting the credit is done in the form of dues during the payment cycle instead of filling the card details in the app for the checkout. It provides the facility of paying later, extending the amount from Rs 3,000 to Rs 10,000 depending upon the previous transaction history of the customer.

“LazyPay option for transaction has certainly attracted many food lovers. Without the stress of paying the amount at the time of ordering food, people can now enjoy the food without paying the money at the time of transaction. Restaurants are slowly and steadily adapting to this transaction idea and is expected that most of the restaurants will soon be having this method under their brand,” says Chef Shah Nawaz Hussain, Director, Al-Nawaz.

It clubs the entire digital transactions available on the websites which is using the PayU gateway which can be further made by the customer after 15 days without any interest rate. It can be said that LazyPay is trying to create a kirana store experience where the shopkeeper allows the customer to take the products home and pay later because of the believe they are having for them.

Helping the customers

LazyPay has partnered with 5 big merchants and 12 smaller ones including Zomato and Swiggy. The company is already claiming 10 million users approximately and is in hope to acquire another 5 millions in the next 2 years. They are having a real time dept write off in place for miscreants.

LazyPay’s idea is attracting a lot of customers which is expected to increase the online purchase for various brands. It is expected that soon this deferred payment method is going to create a lot of buzz in the upcoming time and the process have already started. The key feature makes the transactions smooth and seamless without any transaction failures, no need for passwords etc.

PayU India is planning to invest $50 million in LazyPay over the upcoming 3 years. The company claims to achieve another 5 million users in the upcoming year as it is already creating a sensation of buzz in the market. PayU India being the largest merchant distribution network in the online payment space will be looking to expand their reach using their presence in the market.

Dishant Pritamani is a restaurateur driven by instinct and purpose, not convention. He founded The Daily Bar & Kitchen in Mumbai in 2013, creating a space that blurred the line between neighbourhood bar and cultural hub. Since then, he’s built a portfolio of distinct, experience-led venues from The Daily All Day and Tsuki in Pune to The Second House and Café Lento in Goa, each rooted in creativity, community, and conscious design. He plans to open Café Lento in Mumbai and Pune.

In an exclusive interview with RestaurantIndia, Dishant Pritamani, Founder of Luna Hospitality talks about his journey, AI-based restaurant, customer loyalty, sustainability and much more. Excerpts:

Handling Multi-Brand Venture

I believe work should bring joy and you can’t fake passion,” said Pritamani. “Each brand I’ve created reflects who I was at that point in my life. The goal is to stay authentic to myself and to the guests.”

When launching a new restaurant, he immerses himself in the process by spending over a year on-site to understand operations, team dynamics, and customer expectations. “I work alongside my team to ensure everything runs smoothly. Once they have been part of the journey from day one, they know how to carry it forward.”

While his brother oversees the Pune outlets, Pritamani continues to guide and visit each brand personally. “Being in the restaurants, facing a guest that’s where I find my happiness. If you empower people, you will be shocked to know what they can hold on.”

The Foreseen Challenges

We started with 12 core team members who’ve been with me since the beginning. When we expanded The Daily to Pune, six of them moved there - a decision that made all the difference.

While many chase rapid growth, I focused on growing steadily, which helped us build a stronger brand with a stable, committed team. Most of my senior and middle management have been with us for years, and that continuity shows in everything we do.

Identifying Locations

For me, it’s all about understanding the consumers, their preferences, spending habits and what concept fits the location. Before opening The Second House in Goa, I spent nearly a year living there and researching every detail.

The site we chose was offbeat, and many advised against it, but we saw its potential. The lower rent allowed us to invest more in design and technology, turning the space into a unique strength rather than a challenge. I believe every restaurant should have its own distinct identity, shaped by its surroundings and audience.

The AI Designed Restaurant

For The Second House, Pritamani reunited with Ayaz Basrai of Busride Design Studio, who had earlier designed The Daily All Day in Mumbai, a decade ago.

Basrai, who has designed and teaches “AI Meets Design” across colleges, turned this project into a real-world example of how artificial intelligence can reshape architecture. The team researched the property’s history by studying who lived there and poring over vintage photo albums from 60–80 years ago. Using AI, they extracted architectural details from old images to precisely recreate elements like pillars and facades from the 1940s.

Even the lighting at The Second House was custom designed through AI, refined with multiple prompts to achieve the perfect look. The team is now developing a light-and-smoke installation, set to launch by January 2026, where warm air will suspend smoke at chest level - an experimental fusion of design, technology, and science that defines The Second House’s futuristic spirit.

Interiors & Ambience

When launching a restaurant or café, it’s crucial to have a clear concept that ties together the brand name, menu, interiors, and consumer experience. A well-defined vision ensures long-term relevance, with interiors playing a key role in drawing audiences.

For example, at Café Lento Goa, the design celebrates nature as we are growing trees inside the space instead of cutting them down. The name Lento, meaning “slow” in Portuguese, reflects the idea of slowing down with nature. The next Café Lento will open in Koregaon Park, Pune, where each outlet will have a unique design interpretation by the designer.

Meanwhile, Tsuki, our Pan-Asian Japanese restaurant in Pune, operates on a solar-powered, self-sustained terrace. Rather than following trends, our goal is to set examples combining creativity, sustainability, and thoughtful design.

Nurture Creativity & Innovation in Staff

Allow them to make mistakes, as long as the mistake is new, correct it. If the mistake happens again, be stern and not mean. Involve them in processes so they will understand about the work. Be open to learning from everyone. Appreciating staffs works.

The Sustainability Factor

Chef Jyoti, Culinary Director tells the team to use the skin of fruits and veggies in various items. For Eg: We are using watermelon skin in cocktails/mocktails. We have a small farm outside The Second House, Goa from where we use veggies and fruits for cooking.

In Goa, where water scarcity is common, we have built small but meaningful water conservation systems at The Second House. We recharge our onsite well with rainwater, use purification processes to ensure sustainability and even created a glasshouse water tank that stores purified rainwater. During shortages, this stored water supports our operations making the restaurant both eco-conscious and self-sufficient.

Dining is Growing

Experiential dining is increasing a lot and that people are shifting more towards dine-in.

“We are more focused on dine-in than deliveries. After Covid, people are coming back to experience the dining, and restaurants are making their mark by ensuring that customers keep coming back. It’s all about giving the customers unique lasting experiences which stays for long run.”

Menu Development for Each Brands

New menu is not trending base for us. At Lento, Chef is planning to re-image Besan Chilla. “We are working on things that give us nostalgia. We want people to enjoy the comfort food in a unique way. We are using AI to push flavor combination that doesn’t come to the Indian minds. And we are trying the combinations to ensure which flavor-combos work."

Customer Loyalty

Don’t let your staff keep changing. If a person feels welcome, they will keep coming and be your regular customer or a loyal customer. Customer retention comes from employee retention.

Message for New Restauranteurs

Do for right reasons. It’s not easy if you aren’t crazy. If you don’t take risk, so you will never know.

During peak seasons, AI plays a vital role in streamlining operations and enhancing safety. AI in food safety with predictive analysis helps reduce contamination risks, protecting both consumer health and the brand’s reputation. It also improves efficiency by accurately forecasting demand, which prevents over-ordering and cuts down on food waste benefiting both the business and the environment. Let’s see how AI helps the brands to enhance themselves.

The Peak Season Pressure: Why Food Safety Risks Multiply

Peak seasons always test the limits of brand’s operations from sourcing and storage to kitchen efficiency.

Commenting on this, Hardik Shah, Chief Technology Officer, Impresario Entertainment & Hospitality Pvt. Ltd said, “We use tools that are helping us plan better rather than just react. Even simple pattern recognition like understanding consumption trends or monitoring temperature consistency goes a long way in maintaining food safety.”

The brand is also using data to get more visibility into what’s happening in real time and where potential risks could arise. “It’s less about replacing human judgment and more about giving our teams the right insights at the right time,” he added.

It also helps in improved consumer safety, lower operational costs, quicker decision-making, and stronger compliance.

Significant Impact from AI

AI tools have automated menu digitization and onboarding, enabling restaurants to go live faster, facilitate real-time order matching with delivery partners, and recognize demand patterns for strategic pricing and promotional purposes.

Referring to this, Anirudha Kotgire, Managing Director & Co-Founder of Waayu mentioned, “We utilize AI for faster onboarding, more efficient order matching, and insights that enhance restaurant margins. Waayu enhances restaurant profitability with lower operational overhead, reduced food waste, quicker revenue capture, and higher average order value, all while safeguarding restaurants’ control over pricing and customer data on Waayu’s zero-commission ONDC-native platform.”

Monitoring Real-Time Data

AI supports regulatory compliance by providing real-time, data-backed proof of safety measures and continuously monitoring critical control points. This gives brands and food outlets the confidence to handle peak production periods while maintaining quality, consistency, and cost-effectiveness.

Sharing further, Kotgire noted, “Waayu empowers restaurants to observe order status, kitchen load, and order execution in real time via POS, new POS functionality, and delivery telemetry.”

The quality of service is not affected because the immediate visibility and alerts reduce order delays and cancellations; as a result, customer satisfaction will remain high. Automated quality checks and smart resource allocation help businesses respond faster and more efficiently.

Focus on sustainable operations

AI also supports sustainability by minimizing waste, reducing energy use, promoting traceability, and encouraging circular economy practices and eco-friendly packaging. It’s not just about efficiency; it’s about building responsible, future-ready operations.

Chef Vijay S Sahu, Chef de Cuisine, Courtyard by Marriott Mumbai International Airport added, “AI can help detect potential issues early, provide end-to-end supply chain transparency, and improve traceability. With real-time monitoring, businesses can forecast demand and spoilage more accurately, order ingredients in the right quantities, adjust production schedules, and quickly identify any batches at risk.”

By analyzing supplier histories, delivery patterns, and ingredient shelf life, AI systems can flag batches that have a higher risk of contamination. For example, if a supplier has had previous cold chain issues or delayed deliveries, the AI can recommend closer inspection or alternate sourcing.

The Foreseen Challenges

A key challenge is the heavy reliance on large amounts of data. If the data is limited or inconsistent, AI models may be inaccurate. There’s also a lack of standardization on how data is collected, along with high costs and complex systems, which can make it difficult for smaller food businesses to adopt.

The challenge, of course, is balancing technology with the human element that hospitality thrives on. Shah mentions, “For us, it’s about using tech quietly in the background so that operations feel smoother, safer, and more consistent.”

Commenting on this, Agilesh R, Director F&B, Sheraton Grand Chennai Resort & Spa shared, “While challenges like data integration, high setup costs, and staff resistance exist, they can be overcome through clean data practices, employee training, pilot projects, scalable cloud platforms, and robust cybersecurity.”

The big opportunity lies in shifting from a reactive to a proactive approach. This helps reduce overproduction and food waste, lowering environmental impact while supporting the company’s sustainability goals all with the assurance of strong food safety standards.

Dining today has moved far beyond just taste. It has become a full experience. Across the world, chefs and restaurants are changing the way people eat. They are mixing science, design, and technology to turn a meal into something more. This new style of eating is called immersive or multi‑sensory dining.

In this type of dining, every sense plays a role. The smell of the room, the sound of music, the colours on the plate and even the feel of the table matter. Diners do not just taste food. They see it, hear it, smell it, and touch it before the first bite. Restaurants use light, sound, and scent to build a mood. They use visuals and music to tell a story. Some even use VR or AR to create a place around the food. This way of dining makes a meal personal. It makes people remember not just the dish but the moment. It is food as an experience, and it is becoming a global trend.

Read more: 7 Types of Whiskies Everyone Should Try Once

How Cloud Kitchens are Disrupting the Indian Restaurant Industry

What is Neuro‑Gastronomy?

Neuro‑gastronomy is the study of how our brain understands taste. It explains why food tastes different when you hear music, see certain colors, or even smell something in the air. Our brain mixes information from the eyes, ears, nose, and skin before deciding how food tastes.

For example, a simple dessert can taste sweeter if soft, high‑pitched music is playing. The same dessert can taste less sweet if heavy, low music is used. This is the science behind immersive dining.

The Rise of Multi‑Sensory Dining

A Worldchefs report shows that dining experiences using all five senses have been growing since the 2010s. People no longer want only good food. They want something special that feels personal.

Gen‑Z and millennials are driving this trend. They are looking for new experiences when they eat out. They like to share these moments on social media. For them, a meal is a memory, not just a plate of food.

Know more: Top 7 Food Safety Practices Every Restaurant Should Follow

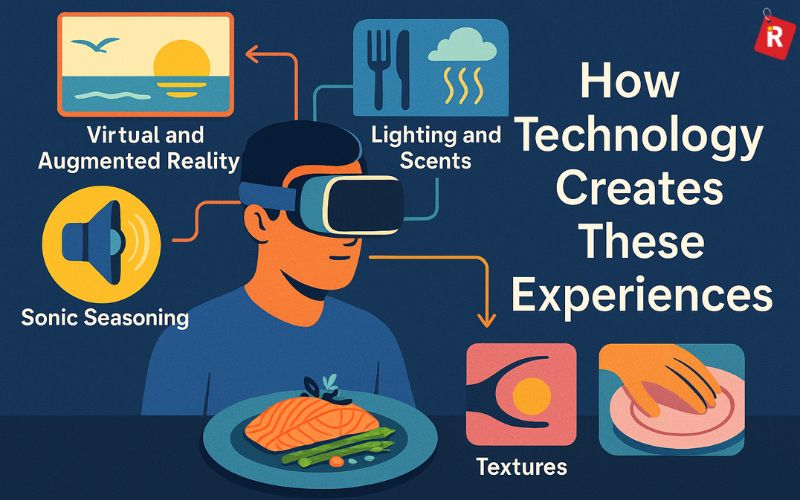

How Technology Creates These Experiences

Technology has become an important part of immersive dining. Many restaurants now use modern tools to make a meal feel like an experience. They bring together sight, sound and smell to make food memorable. This mix of food and technology can be explained in four simple ways:

- Virtual and Augmented Reality: Restaurants use VR and AR to change what people see and hear while they eat. A headset can make a person feel like they are sitting by the sea while enjoying seafood. AR can project moving images on a table to turn a meal into a story.

- Sonic Seasoning: Chefs use sound to guide taste. High‑pitched music can make a dish taste sweeter. Low sounds can make flavours seem deeper and stronger.

- Lighting and Scents: Lights in a room change mood. Soft smells in the air can make a meal more pleasant.

- Textures: Even the feel of the table or plate changes how food is enjoyed.

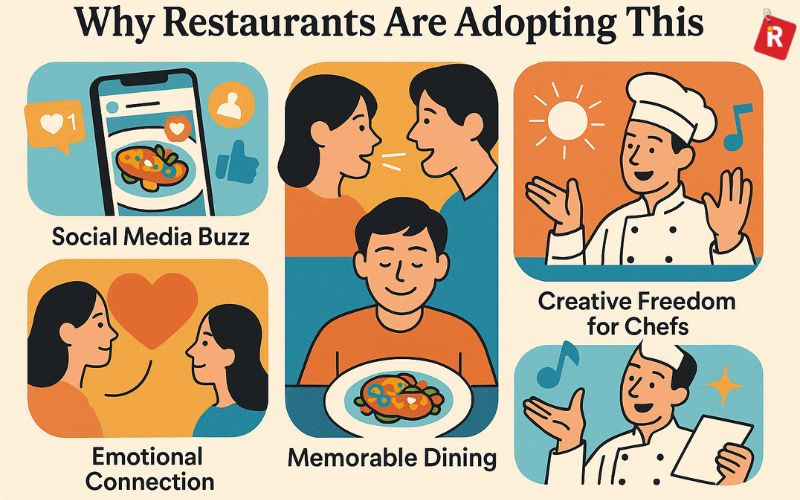

Why Restaurants Are Adopting This

Restaurants that bring immersive dining to guests are different from regular places. These experiences make people curious and excited. They also help restaurants create a strong image. The impact of such dining can be seen in five simple ways:

- Word of Mouth: Guests talk about these places. They share their experience with friends and family. This makes the restaurant popular without extra effort.

- Social Media Buzz: People post photos and videos of these special meals. Every post acts like free publicity. It attracts more people who want to try the same experience.

- Memorable Dining: A unique dining experience stays in the mind. Guests remember not only the food but also the moment. It makes them want to return.

- Emotional Connection: This type of dining builds a bond between the guest and the restaurant. Guests feel connected to the place because of the personal experience.

- Creative Freedom for Chefs: For chefs, this is more than cooking. It gives them a chance to tell a story through food. They can use sound, light and design to express ideas. This makes their work more creative and exciting.

Also check: Best Theme Idea for a Rooftop Restaurant: A Starlit Bohemian Escape

Oats vs. Muesli: Which Breakfast Option Is Better For Weight Loss?

12 Delicious High-Protein Foods to Eat Daily for a Healthier You

Examples Around the World

Some restaurants are already leading this trend. Ultraviolet in Shanghai is one of the first to create a complete sensory dining experience. Guests sit in a private room surrounded by lights, music, and visuals. Every course has its own scene.

In Europe, there are pop‑up dinners where VR headsets take diners to a forest or under the sea while they enjoy food inspired by those places. In India, some luxury restaurants have started adding music, lights, and scents to their meals to make the experience more special. This is still new but growing fast.

The Future of Dining

Immersive dining is growing quickly and will continue to grow in the coming years. Many restaurants are now looking for ways to make every meal feel like an event. In the future, this experience may become even more personal. New systems may be able to choose music, colours and scents to match the taste and mood of every guest.

Dining is no longer just about food on a plate. It has started to feel like a journey. Guests are taken through scenes and moments while they enjoy a meal. Each dish becomes part of a story. For diners, this makes eating out more special. It changes a simple dinner into an event they can remember. For restaurants, it offers a way to stand out. This style of dining is set to shape the future of the food industry worldwide.

Closing Thought

The next time a person steps into a restaurant, there is a new question to think about. Do they only want to eat? Or do they want more than that? Today, food can be more than just taste. It can be an experience. Guests can see, hear, smell, and feel their food before the first bite. The colours, the music, the lights, and even the air around the table change how food feels.

Many restaurants have already started to bring this new way of dining to life. They want guests to enjoy every moment. It is no longer just a plate on a table. It is a full story told through food. This is the future of dining. And it has already begun to change how people enjoy a meal.

The Waffle Co., India’s first dedicated waffle brand launches their official mobile application, The Waffle Co. App, now available on both the Google Play Store and Apple App Store. This marks a significant milestone in the brand’s journey, offering customers a more seamless and rewarding way to connect with The Waffle Co. through its exclusive loyalty program, The Waffle Lovers’ Club.

With the launch of its new app, The Waffle Co. introduces a delightful experience where customers earn 7% back in points on every purchase—each point worth ₹1. These points can be redeemed at any of the brand’s outlets across India, turning every waffle into an opportunity for more.

New users enjoy a warm welcome with 50% off (up to ₹100) on their first order via the app. Members also receive exclusive birthday and anniversary rewards. Best of all, the loyalty points never expire—making it easier than ever to indulge in your favorites, on your terms.

Speaking about the launch, Amar Preet Singh, Co-founder of The Waffle Co. said, “With the launch of The Waffle Co. App and The Waffle Lovers’ Club, we’re taking a significant step forward in how we connect with our customers. We’ve always been committed to delivering not just high-quality waffles, but memorable experiences. This app allows us to reward loyalty in a meaningful way, while also creating opportunities to learn more about our customers’ preferences and personalize our offerings accordingly.”

This initiative positions The Waffle Co. as India’s first waffle brand to introduce a dedicated mobile app with an integrated rewards program, setting a new benchmark in the dessert café segment. It also reflects the brand’s strategic move towards digital transformation, with customer data and analytics playing a vital role in future marketing and engagement plans.

“The launch of our mobile app is a reflection of our commitment to evolving with our customers’ needs. As we scale, it’s essential to stay ahead in how we deliver convenience and value. This app not only rewards loyalty but also strengthens our direct relationship with our patrons making their Waffle Co. experience smoother, smarter, and more satisfying than ever before.” adds Anand Preet Singh, Co-founder of The Waffle Co.

Customers can download The Waffle Co. App by scanning the QR code available in stores or sharing the download link with friends and family. With this launch, The Waffle Co. invites all foodies and waffle lovers to join The Waffle Lovers’ Club and start earning sweet rewards from their very first bite.

Managing a restaurant kitchen is one of the toughest jobs in the business. Orders pour in quickly, staff have to balance several tasks at once, and even a small mistake can lead to wasted food, unhappy customers, and lost revenue. In such a fast-paced environment, staying organized and efficient is essential. That’s where a Kitchen Display System (KDS) comes in.

A KDS helps replace paper tickets and reduces confusion by displaying orders clearly for the entire team to see. It keeps the workflow steady and improves communication between the front and back of the house. But just installing a KDS isn’t enough anymore. To keep up with growing competition and rising customer expectations, even the best systems need to evolve. With the help of modern technologies, restaurants can make their KDS smarter, faster, and more reliable. Here are four practical technologies that can turn a hectic kitchen into a smooth, well-coordinated operation — and help deliver better service that keeps guests coming back.

Read more: Top 7 Food Safety Practices Every Restaurant Should Follow

Mastering the Art of Roasting: Techniques Every Restaurant Chef Should

Why Your Kitchen Needs a Tech Makeover

A KDS is more than just a digital screen that shows orders. It is the heart of your kitchen’s workflow. But many restaurants still use outdated systems or manual processes. This slows down service, confuses staff, and increases errors.

Studies show that restaurants using advanced kitchen technologies reduce ticket times by up to 30%. They also improve order accuracy, cut food waste, and make kitchens less stressful for staff. If you want your kitchen to run like a well-oiled machine, it’s time to embrace these technologies.

Find 4 Technologies to Spice Up Your Kitchen Display System

Below are four proven technologies that integrate with your KDS and improve how your kitchen operates.

1. Cloud-Based KDS Solutions

A cloud-based Kitchen Display System (KDS) securely stores all kitchen data on remote servers instead of relying only on a local device. This setup allows restaurant owners and managers to access critical information anytime and from anywhere — whether they are visiting another branch, working from home, or traveling. Unlike traditional systems that can fail if the device crashes, a cloud-based KDS keeps data safe and backed up, reducing the risk of loss. It also makes it easier to update menus, monitor kitchen performance, and track orders across multiple locations in real time. This flexibility and reliability help restaurants maintain control over operations, even when they are not physically present in the kitchen

With cloud-based systems, you can:

- Monitor orders in real time across all outlets.

- Make updates to menus instantly.

- See detailed reports about performance and sales trends.

2. IoT-Enabled Kitchen Equipment

The Internet of Things (IoT) introduces smart, connected equipment into the restaurant kitchen. With IoT, devices like ovens, fryers, and refrigerators can communicate directly with the Kitchen Display System (KDS), creating a more efficient workflow. For example, an oven can notify the KDS when a dish is cooked, or a fryer can adjust its temperature and time based on the order details received. Sensors in refrigerators can also track and report temperature, helping maintain food safety standards. This seamless interaction between equipment and the KDS reduces errors, saves time, and ensures consistency in preparation. By integrating IoT, a kitchen becomes more responsive and better prepared to handle busy service hours.

Here’s how it helps:

- Ovens can notify the KDS when a dish is ready.

- Sensors track temperatures to avoid overcooking or spoiling.

- Fryers adjust cooking times based on the order size.

Know more: Everything You Need to Know About Soft Openings for Restaurants

3. AI-Powered Predictive Analytics

Analyzing order history allows restaurants to work more intelligently and efficiently. By studying patterns over time, technology can predict peak hours, helping staff prepare in advance for busy periods. It can also recommend the best times to start cooking specific dishes so they are ready exactly when needed, avoiding delays or cold plates. These insights help managers schedule staff more effectively, stock ingredients in the right quantities, and reduce waste. Such data-driven decisions not only improve the kitchen’s speed and accuracy but also ease the pressure on staff during rush hours. With these predictive tools, a restaurant can deliver faster, more consistent service while keeping both customers and employees satisfied.

Benefits include:

- Faster prep during peak hours.

- Better inventory management.

- Improved staff scheduling.

4. Voice-Activated Command Systems

In a busy kitchen, where hands are often occupied, a voice-activated Kitchen Display System (KDS) offers a practical solution. Cooks and servers can speak commands aloud, and the system responds instantly, eliminating the need to touch a screen or press buttons. This hands-free operation is especially valuable during peak hours when every second counts. It also promotes better hygiene, as staff don’t have to handle the screen with food-covered or wet hands. Voice commands make it easier to move through tasks quickly and keep the workflow uninterrupted. For kitchens looking to improve both efficiency and cleanliness, a voice-activated KDS brings noticeable improvements to daily operations and staff productivity.

For example:

- “Show next ticket” displays the next order.

- “Mark order complete” updates the system hands-free.

Also check: What Is an Angel Shot? Everything You Need to Know (and Why It’s MoreThan Just a Drink)

Don’t Let Your Tickets Burn—Why Speed Matters

Every minute matters in a kitchen. When orders get delayed, it not only frustrates customers but also adds stress to the team. The right technology helps keep things moving, preventing tickets from piling up and ensuring smooth, fast service. A busy kitchen often feels like chaos, but with smart tools, it starts to feel more like a well-coordinated team, where every station works in sync. Mistakes become fewer, the shouting quiets down, and the staff feels more at ease. Voice-activated systems aren’t just a clever feature — they’re genuinely useful. They let chefs and servers keep their focus on cooking and plating, without wasting time tapping screens or searching through menus. These changes make the kitchen a calmer, more efficient place to work.

Check more: What Is Restaurant Profit Margin And How To Improve It? Your Ultimate Guide

How Bars & Restaurants Can Protect Themselves Amid Heightened Violence

Data is the Secret Sauce

The power of data in a restaurant kitchen cannot be underestimated. Analytics provides clear insights into operations, helping owners and managers identify what’s working and where improvements are needed. By examining patterns and numbers, restaurants can streamline their workflow and enhance the customer experience.

- Track Popular Dishes: Detailed reports highlight which menu items sell the most, allowing chefs to focus on what customers truly enjoy and adjust the menu accordingly.

- Monitor Peak Hours: Analytics reveals the busiest times of day or week, enabling managers to schedule staff efficiently and prepare the kitchen for high demand.

- Reduce Waste: By understanding trends and demand, restaurants can better manage inventory, order the right quantities, and minimize food waste.

With the right data in hand, restaurant kitchens make smarter decisions that save money and deliver better service.

Final Thoughts

The kitchen is the heart of every restaurant, keeping the entire operation alive and thriving. Like any heart, it needs proper care and the right tools to stay strong and efficient. Upgrading the kitchen display system (KDS) with modern technologies such as cloud-based solutions, IoT-enabled equipment, predictive analytics, and voice commands can completely transform how a kitchen performs. These innovations help improve speed, accuracy, and coordination, allowing staff to work more confidently and serve customers better. In a competitive restaurant business, every advantage counts, and these tools provide just that — an edge to stand out. For any restaurant that aims to deliver quicker, smarter, and more reliable service, investing in these technologies is not just an option but a necessity for long-term success.

India is currently witnessing a tremendous boom in restaurant segment. With this rapid expansion, comes several industry-wide challenges. From staffing and training to supply chain inefficiencies and the ever-evolving preferences of today’s diner. So, navigating operational challenges is no small feat—at every step, there’s a challenge waiting for you.

The Indian restaurant industry is currently valued at 85.19 billion dollars in 2025, and it is reported to grow at a compound rate of 15%. This shows that market is set to grow, so let’s focus on the key operational challenges.

Changing Customer Preferences

Customer preferences are also evolving. People want healthier options; more transparency, convenience, and a seamless experience across dine-in, delivery, and digital platforms.

Lalitha Dutta, Managing Partner, Firewater Neo Kitchen & Bar, Hyderabad said, “Restaurants need to stay on their feet—updating menus, experimenting with formats, and being present across platforms. At the same time, basics like cleanliness, food safety, and handling feedback well are non-negotiables.

Commenting on the same, Hanumanth Rao Naineni, Founder, Roast Café, Hyderabad shared, “To stay aligned with evolving consumer preferences, we’ve expanded our menu across cuisines and dietary needs - but without losing focus. Our kitchens are structured with dedicated sections for each cuisine, led by chefs who bring both discipline and expertise.”

However, for AB Gupta, Co-Founder, Smash Guys, these are all because of the fast-evolving customer need, health-conscious eating, sustainability, digital convenience - demanding constant reinvention etc.

Staffing & Managing Labor costs

One of the biggest hurdles is staffing. It’s difficult to find skilled workers, and once they are molded to the restaurant liking, keeping them motivated and managing labor costs without compromising on service are the next set of challenges.

“We’ve chosen to face these challenges head-on by investing deeply in our people, processes, and product. For staffing and training, we bring in talent from the most respected establishments, as well as trainers who align with the growth story we’re building,” added Naineni.

With high attrition rates and rising wage expectations, building and retaining a reliable team is harder than ever.

Hurdles in Inventory & Supply-chain

Inventory and supply are the biggest challenges one has to face on ground. Whether its delays, inconsistent quality, or rising costs, sourcing reliable ingredients consistently is tough. “On the supply chain front, we’ve built a robust and sustainable backend through Halcyon, an F&B supply company I personally partner with. This ensures our systems are in place well before an outlet opens, allowing growth to be seamless and supported,” highlighted Rao.

While, Gupta said, “When you work with fresh ingredients and prep everything from scratch, even minor disruptions can impact the entire service. We’ve learned to work closely with suppliers, forecast demand better, and stay agile - especially when availability becomes unpredictable.”

Maintaining Relationships

Building strong relationships with trusted suppliers becomes essential. While, providing customer satisfaction play a major role in boosting the relationships. This helps in gaining profit margins and building the loyal set of customers helps in the long run.

Handling Peak hours

And let’s not forget peak hours—that crazy dinner rush or packed Sunday brunch/holidays and festivals. Peak-hour management is another beast. During peak hours or festivals, brands can easily gain 30-40% more profits in a single day.

“You don’t get a second chance during a Friday night rush. It’s about designing efficient kitchen flows, pacing dine-in and delivery,” pointed Rao who said empowering the team to make decisions under pressure paves the way.

Similarly, managing wait times, keeping staff calm, and ensuring a great customer experience during those windows can be tough.

Use of Technology

Technology has helped, but it’s not a silver bullet. POS systems, online platforms, inventory tools—they all need to talk to each other, and to your team. Tech without adoption is just another cost. Cyber security and data protection are the major emerging concerns these days.

“Technology really helps—online reservations, digital ordering, and real-time data tools can smooth things out. Then there’s inventory—keeping ingredients fresh, minimizing waste, and making sure you’re not overstocked or underprepared,” added Dutta.

Balancing Dine-ins and Delivery

Sometimes, packaging and the quality of food during delivery may differ. So, balancing dine-ins and deliveries are equally demanding considering the operational efficiency. Brands have to ensure things are running smoothly in both ends to avoid negative reviews by the consumers. While the ratio of dine-ins and deliveries by restaurants and cafes are 70:30.

Conclusion

The future will be focused on AI-driven operations like smart kitchens, dynamic pricing, voice ordering and AR Menus. While sustainability will play a standard role in carbon footprint tracking, local sourcing and zero waste kitchens. Rise of cloud kitchens and immersive dining experiences will be on trend.

McDonald’s has introduced a new digital feedback platform, making it simpler and faster for customers to share their thoughts after a visit at one of their U.S. and Australian restaurants. Designed to replace the traditional paper-based process, the new system offers a more accessible and streamlined way for people to communicate with the Golden Arches.

From Paper to Pixels: The Evolution of Customer Feedback

Previously, guests had to manually enter a long URL from their paper receipts into a browser after visiting the restaurant. This new system eliminates that hassle by offering a more seamless and user-friendly experience. The fresh approach leverages advanced technology to collect, analyze, and implement customer feedback in real-time, ensuring that McDonald's can respond swiftly to guest needs and preferences.

How Does McDonald's Digital Feedback Platform Work?

The digital feedback platform is seamlessly integrated into McDonald's existing digital ecosystem, including the mobile app. About an hour after an order is placed in the app, a notification prompts feedback, from food quality to service efficiency. The team behind this model aimed to move away from only asking “Yes” and “No” questions and toward prompts that gleaned deeper insights into the restaurant experience.

Once submitted, responses are analyzed using data tools that sort insights by relevance and urgency. This will make it easier for our teams to spot trends, act quickly, and make meaningful improvements. With our new platform, roughly 20 responses are now collected for every 1,000 guests. That’s a major leap from before, when only 1 in every 1,000 people were expected to respond.

Delivering Innovation to Benefit Customers and McDonald's

For guests, the refreshed forum offers a convenient and efficient way to collaborate with McDonald’s and maintain strong, positive connections. For McDonald's, it provides valuable insights into people’s preferences and potential areas of improvement. By implementing changes based on real-time feedback, we can enhance our overall restaurant experience.

A Step Towards a Digital Future

Technology plays a key role in helping McDonald’s stay responsive to evolving guest needs and better achieve our goals––to feed and foster our communities. Through the new digital feedback platform, it’s easier than ever for people to share what’s on their minds. By offering a more accessible and efficient way to share responses, McDonald's is not only enhancing its customer experience but is also paving the way for future innovations.

As we all know restaurant industry continues to evolve with technology playing a major role in improving customer experience, operational efficiency, and profitability. Restaurant tech is booming with trends like AI & automation, contactless payments, cloud kitchens, smart POS, AR/VR, IoT, and sustainability tech leading the way.

Use of Smart POS & Integrated Systems

Cloud-based POS systems enable in centralized control across outlets managing inventory, loyalty, and CRM seamlessly. Paired with real-time data analytics, they provide insights into sales trends, customer behavior, and staff performance for smarter decision making.

Chef Balaji Balachander, Founder and Director at Salt Restaurants said, “Technology is a very important ingredient in our success. In a competitive hospitality space, technology helps us not only operate efficiently but also connect meaningfully with our guests.”

The restaurant has integrated cloud-based POS systems, smart inventory tools, and feedback mechanisms to streamline backend processes and maintain consistency across all outlets. “This ensures that every biryani, kebab, or dal makhani served is true to SALT’s standard no matter the city,” pointed Chef Balaji.

AI and Automation

Voice and chatbot ordering streamlines service across apps, websites, and kiosks. AI-powered kitchens optimize prep time, while robots add efficiency in guest service.

Commenting on this, Zorawar Kalra, Restaurateur & Founder of Massive Restaurants Pvt. Ltd said, “We’ve implemented AI-based CRM systems that go beyond basic preferences. They help us truly understand our guests—so if someone loves a particular dish or dines a certain way; we tailor their experience the next time, often without them even realizing it.” The group has got their kitchens semi-automated to ensure consistency without compromising on soul.

Use of Digital Sanitation

Technology plays a pivotal role in streamlining safety protocols. Sandeep Salian, Co-Founder of Jugnu Goa added, “We’ve adopted digital sanitation schedules with automated alerts, real-time logging, and verification tools to ensure critical surfaces and utensils are sanitized effectively. This not only helps us stay compliant but also creates an audit-ready ecosystem.”

Online Reservation & Personalization

Around 40-60% of the restaurant bookings are made online using different apps. AI is reshaping dining by recommending dishes based on order history, weather, and time of day. Nearly 50–60% of brands now prioritize personalization, offering tailored experiences and exclusive deals via apps and CRMs driven by customer behavior.

Use of Augmented Reality (AR) & Virtual Reality (VR)

AR menus help the guests to visualize the dishes on their table through their smartphones, while VR experiences offer immersive dining journeys or behind-the-scenes kitchen tours.

Elaborating on this, Kalra said, “On the guest-facing front, we’ve leaned into interactive digital menus, AR-led storytelling, and mobile-first ordering systems, especially in experiential spaces like Farzi Café, Mamma Killa, or Bo Tai. Technology becomes part of the drama—it enhances the experience without overwhelming it.”

Reduction of Food Wastage

With technology, brands can track and reduce the kitchen wastage along with the wastage in the restaurant. Sherry Sebastian, Managing Director, The IBNII Coorg who believes in reducing wastage explained, “At Ibnii, we observed that every day the food waste was piling up and our composting units were overworked with fourteen large bins collecting food waste. We came up with the idea of weighing the waste and charging a fee for the food wasted. This fee would go into a donation box.”

Restaurants these days allocate 7–10% of their capital expenditure towards tech. And, we can surely say that technology isn’t about replacing the warmth of Indian hospitality it’s all about enhancing it.

As the restaurant industry is booming in India, there is a huge consumer shift seen among the customers. India's restaurant industry is growing rapidly, driven by rising incomes, evolving consumer tastes, and the expansion of food delivery platforms. The market is expected to reach ₹9–10 lakh crore by 2030, with a projected CAGR of 11.19% through 2028, hitting $79.65 billion.

What’s pushing the growth?

With the influence of social media, Millennials and Gen-Z are actively seeking healthier food options as there is a growing awareness of dietary preferences like keto, vegan, and gluten-free. Along with this, Quick Service Restaurant (QSR) chains are expanding across India, with brands exploring diverse business models to boost profits with minimal investments and higher footfall. Additionally, increased cultural exposure among the consumers has fueled a rising demand for experiential dining experiences.

Healthy, Simple Food is in Demand:

Health and well-being are becoming more and more important to consumers, driving the demand for healthier alternatives in restaurants and an emphasis on mindful eating techniques. This trend includes a desire for more sustainably and ethically sourced food, as well as a rise in interest in vegan, vegetarian, and gluten-free options. Around 50-60% of restaurants in India do offer a healthy menu option which clearly shows the shift in consumers.

“Healthy food, Asian, millets and Japanese are a trend seen in the industry. People are more health conscious and are responsible in what they eat. Sustainable food has become a trend in moving forward and it’s going to stay. Zero-waste cooking is one of the major things in which everybody is focused on and ensures there is less wastage of the product we use in the kitchen,” added Chef Vikas, Executive chef, The Westin.

The main factors driving this trend are consumers as they are well-travelled and they are curious to know about what they are consuming, the ingredients used and the calorie-deficit per servings. It’s all about consuming quality food while focusing on health.

Smaller Portions is a Key Trend:

Consumers prefer smaller portions as they like to try different dishes focusing on mindful eating. There are restaurants in India who charge people for wastage by weighing the waste in weighing machine. On an average, restaurants can save 30-40% on total food costs through portioned servings, primarily by reducing wastage and optimizing inventory and this helps in increasing profits.

Expressing his views, Rahul Shetty, MD, The Stables and Peninsula Hospitality Group shared, “As people are becoming health conscious, healthy food will be trending. Smaller portions will be a must.”

For restaurants, this often means faster table turnover, improved inventory management, and the flexibility to showcase a broader range of dishes without raising food costs. It also promotes a community dining experience, encouraging sharing and enriching the overall ambiance.

Technology will lead:

Personalized promotions, AI-powered recommendations, digital menus, and online ordering are just a few examples of how restaurants are using technology to improve the dining experience. This trend makes it possible to customize experiences according to personal tastes, which increases pleasure and engagement.

Commenting on this, Aksha Kamboj, Executive Chairperson, Aspect Global Ventures Pvt Ltd that has recently launched 25 QSR chain of Nom Nom Express said, “Contactless ordering to customizable meals will be on trend, the goal is to be responsive as possible. Technology will play an important role in restaurant business.”

At the same time, growing awareness of climate impact and ethical sourcing is influencing consumer choices—diners increasingly value how and where their food is sourced.

Sustainability is becoming a key differentiator. While, these trends are shaping the future, restaurants need to rethink about their supply chains, minimize the plastic usage, and clearly demonstrate the ethical practices to build a lasting customer loyalty.

When it comes to creating, growing and sustaining a successful restaurant business in this era, brands will have to tap AI to drive expansion, success and establish strong leadership to survive difficult times.

Over the last 2-3 years, AI has not just helped enhance the customer experience but has also reduced operational costs for some of the top global chains that have adopted AI and Emotional Intelligence early into their business.

“AI over the recent few months has significantly helped GOPIZZA to reduce its operational costs by helping us with innovative solutions across departments. From tracking inventory for timely shipment, automated POS systems for taking orders and understanding customer order pattern, AI driven GOVEN and GOBOT which helped us with training and SOPs to ensure consistent taste of our pizzas, effective manpower shift planning so that our team is not overburdened to accurate sales forecasting for reducing food wastage and efficient use of resources,” shared Mahesh Reddy, CEO, GoPizza India by adding that AI is playing a very important role in the restaurant industry today.

Not only this, restaurants are heavily investing in technology and hiring people to look after the same. And, these teams are adopting tools rooted in artificial intelligence to better control their operating costs, undertaking initiatives that will continue to pay benefits no matter how economic conditions unfold.

From automating work, to helping in understanding the customer mind better and driving growth, AI is helping saving the costs associated with the inventories and labor.

“AI has unlimited potential to automate tasks across industries, and while we’re in the early stages of its integration, its impact is already evident. The computing power exists, but customized applications are still evolving. At Burger Singh, AI is enhancing efficiency and cutting costs,” pointed Rahul Seth, Co-founder, Burger Singh.

One major development in AI is the emotional intelligence via chatbots and voicebots that manages customer query by eliminating the extra workforce that earlier use to manage and look after the data that came from the customers.

“Chatbots and voicebots manage customer queries and franchise leads, reducing manual effort. AI-driven analytics optimize call-center performance, improving conversions and sales. Additionally, AI streamlines operations and enables smarter, data-backed decisions,” added Seth by mentioning that though the full-scale automation is still ahead, but AI is already transforming the food industry, driving productivity and cost efficiency.

Similarly, Blue Tokai has partnered with Umwelt.AI’s intelligent platform for deeper workforce insights, enabling timely actions based on employee feedback. By streamlining HR processes, measuring engagement more effectively, and personalizing employee interactions, the collaboration aligns with Blue Tokai’s commitment to building a high-performance, people-first work environment.

“Our vision has always been to create a workplace that fosters growth, inclusivity, and well-being. Partnering with Umwelt.AI gives us the opportunity to take a much more proactive and tech-driven approach to employee experience, ensuring our teams really feel valued and empowered. This will reflect our commitment to innovation not only in coffee but also in our workplace culture,” said Sujit Bose, Chief Human Resources Officer at Blue Tokai.

And, hence, restaurant operators should view today’s inflationary habitat as an opportunity to pause and take a closer look at their operating costs to identify areas to reduce expenditure. Meanwhile, restaurant that will adopt AI technology to reduce their operational costs rather than investing heavily will definitely grow and position themselves as one of the top brands getting loyal and regular customers.

Technology plays an important role in our lives. It has not only changed the taste buds, but also how we have been ordering food at home. From the online delivery numbers in just single digit, today most of the restaurants are depended on 20-25 per cent of the business done online. And, the idea of omni-channel shopping emerged, where each digital touchpoint functions as a stand-alone business. The connective power of social media in various platforms unified the chef population and influencers as they share the restaurant reviews, dining experiences and much more. Here are the key points to note down:

Leveraging the unified commerce platform:

“Unified Commerce is leveraging all channels of revenue means right from e-Commerce, which includes the merchandise sales, to aggregators, which become celebrity sales, walk-in sales, which we have leveraged through application-based, tech-enabled takeaway, application-based process. And other thing to focus on is supply chain because we face the challenge of having small units across the city or country and then it needs to be optimized using technology that the distribution looks more of like an FMCG in the back end than like an F&B considering the space constraints we have in the front end. So what we have done is we have combined all of these factors together to one particular technology solution at the outlet,” shared Abhijeet Anand, Founder & CEO, abCoffee that started from an online space, has now entered by opening its kiosk cafes.

Increasing Efficiency

“At Burgrill, we have understood that we have to coexist with the third party aggregators for that we have Zomato and Swiggy. Having a better flow in the kitchen, that any person who is actually working is not moving anything other than two to three feet and that he is not crushing into each other while they are working together. And then we are also doing automated machineries. We need to create a lot of checkpoints. There were a lot of missing items with the deliveries. We have created stickers which have QR codes wherein one can scan those QR codes and it will automatically mark the Mark FoodReady, which is a compliance of Zomato and Swiggy. The customer service is all about providing consistent food. That's the only thing that we do to make sure that our customers go happy. We have printing labels so that the QR code tells us that this is done or not,” added Shreh Madan, Co-Founder, CMO, Burgrill that has become one of the favourite burger chain in the Delhi-NCR region.

Focusing on Consistency by using Technology

“In the kitchen, we work on a lot of machinery. To automate the processes in the kitchen, we have certain companies that we work with so that we can increase the quality of the product but also reduce the cooking time so that the same chef has to work for a lesser amount of time on the range but he's able to give out the same quality, he's able to give out the same consistency every day. Technology only goes so far in terms of creating consistency. It can create efficiency but it can never improve the taste or the consistency of the product. It can fasten the process. And it is a very thin line between having a consistent product and being extremely efficient,” pointed Mohit Dang, Co-Founder, CurryNama by Seven Seas.

The Online to Offline Transition

Highlighting his views on seamless transitions, Amit Sarda, Chief Operating Officer, Prologic First said, “Implementing an omni-channel strategy, starting from ordering the food till we get the food from mobile to website to the point of sale system that are installed in the restaurants. The promotions that you see online are different than the promotions which are given to the guests when they come in for dine-in restaurants. There has to be some parity around there and if we can connect all the systems together and if we can have a price parity and can get same kind of offers for dine-in it can definitely connect the systems together and restaurants can benefit having guests over to their restaurants instead of ordering food online. There is a personalization of guest data that is available from online channels.”

Focusing on the restaurant point of view from a coffee on the go, Abhijeet added, “The product has to be constant. When a consumer first walks into our store the first thing that we promise to them is great coffee, quality, consistent and then fast service because there is a grab and go coffee chain.”

Head of Brand and Marketing, Mirah Hospitality Sep 24, 2024 / 7 MIN READ

Over the past decade, dining has been transformed by technology, revolutionizing everything from reservations to payments. The shift from paper menus to digital formats, accelerated by post-COVID safety standards and customer preferences, has streamlined operations and enhanced the dining experience. Digital menus now offer guests instant access to detailed descriptions, images, and allergen information through a simple QR code scan, enabling direct ordering and easy digital payments—all from their smartphones.

This shift towards transparency and convenience has empowered customers to make informed choices, enhancing overall satisfaction. Additionally, the adoption of digital menus has proven cost-effective for restaurants, reducing the need for printing and reprinting physical menus and promoting hygiene by minimizing contact points. The environmental benefits are equally significant; the reduction in paper usage aligns with the growing emphasis on sustainability within the hospitality industry.

The rise of delivery apps has further revolutionized the dining experience. Technology now places the best restaurants in the city right in the palm of your hand. Whether you’re craving a wood-fired pizza or a flavourful biryani, these apps deliver piping hot meals from your favourite establishments directly to your home. They also cater to late-night cravings, ensuring access to delicious food without stepping outside your house.

While technology has undoubtedly enhanced the dining and delivery experience for customers, it has also significantly improved operational efficiency for restaurants. Running a restaurant involves managing a multitude of tasks, from finances and inventory to overhead costs and employee satisfaction. Technology has become an invaluable asset in this regard, simplifying complex processes and enabling smoother operations. Imagine smart refrigerators that alert chefs when ingredients are running low or need to be discarded, or intelligent ovens that adjust temperatures based on the specific dish being prepared. From multi-functional cooking appliances to automated, AI-powered kitchen equipment, modern technology has made restaurant kitchens smarter, allowing restaurateurs to deliver quality service more efficiently.

Technology also plays a crucial role in customer engagement, helping restaurants identify and respond to customer preferences. Through data analytics, restaurants can track peak times, popular dishes, and loyal customers, allowing them to tailor dining experiences and foster customer loyalty.

Training and development have also benefited from technological advancements. Virtual reality (VR) and augmented reality (AR) technologies enable chefs to teach new culinary techniques and provide comprehensive kitchen training remotely. These technologies can also be used to create immersive dining experiences, allowing customers to feel as if they’re dining in Madrid while seated in Mumbai.

Looking ahead, technology promises to further enhance the dining experience. Innovations such as 3D food printing are already a reality and could soon become commonplace in restaurants. With advancements in robotics, we might see a future where restaurants resemble a scene from a science fiction movie, although the human touch will remain irreplaceable. Self-order kiosks are increasingly prevalent in quick-service restaurants (QSRs) like McDonald’s and Taco Bell, reducing the need for queues and enhancing the efficiency of service. The ongoing AI boom is also driving sustainable practices, with innovations like hydroponic gardens allowing restaurants to grow fresh herbs right in their kitchens.

In conclusion, the future of dining looks incredibly promising, not just because of the food but because of the technological innovations that continue to redefine our culinary experiences. The next time you dine out, take a moment to observe the subtle yet profound ways in which technology is reshaping the dining landscape, offering a glimpse into the future of gastronomy.

In recent years, how we view restaurant menus in India has undergone a significant shift. What was once a physical booklet handed out by waitstaff is now often accessed digitally through QR codes and apps. While the COVID-19 pandemic accelerated this change, it has proven to be more than just a temporary solution. As restaurants and diners alike embrace the convenience and efficiency of digital menus, it’s clear that this transformation is here to stay.

In urban hubs like Delhi, Mumbai, and Bangalore, where technology adoption is swift, QR codes have almost entirely replaced physical menus. Restaurants have even integrated QR codes into their dining experience, allowing customers to not only view the menu but also place orders directly from their phones. This seamless process reduces wait times and enhances the overall dining experience, catering to a tech-savvy clientele that values efficiency.

While QR codes are revolutionizing the way we view menus, restaurant-specific apps are taking things a step further. Apps like Zomato and Swiggy, which initially started as food delivery platforms, now offer dine-in services, allowing users to browse menus, place orders, and even pay through the app. This integration of services under one digital roof is particularly appealing in a country where convenience and speed are paramount. Some apps also integrate loyalty programs within these apps and this is a level of personalization that physical menus simply cannot offer. It’s a small touch, but it makes a big difference in a competitive market where customer retention is key.

The digital transformation of menus is not just about technology; it’s about enhancing the customer experience. For consumers, especially the younger demographic, the ability to browse through an extensive menu at their own pace, without feeling pressured by a waiter standing by, is a significant advantage. This digital autonomy allows diners to make informed choices, often leading to higher satisfaction and, in many cases, increased spending.

Moreover, digital menus can be updated in real-time, reflecting seasonal changes, availability of ingredients, or special promotions instantly. Several restaurants have leveraged this feature to keep their offerings fresh and exciting. Furthermore, digital menus allow restaurants to experiment with pricing and promotions more dynamically, by introducing limited-time offers that are immediately reflected on their digital menu. This kind of flexibility is harder to achieve with physical menus, which require time and money to update.

In addition to this, digital menus are also more eco-friendly as compared to traditional paper menus. By reducing paper usage, restaurants are not only cutting down on waste but also saving on the costs associated with printing and reprinting menus. This is particularly beneficial for smaller establishments, where every rupee counts.

While the benefits of digital menus are clear, their adoption is not without challenges. For many diners, especially older generations or those in rural areas, the shift from physical to digital menus can be intimidating. There’s also the issue of smartphone penetration and internet connectivity, which, although rapidly improving, is still inconsistent in certain parts of the country. Restaurants are addressing these challenges through hybrid models, offering both digital and physical menus, or by providing staff assistance to help less tech-savvy customers navigate the digital interface. This approach ensures that no customer feels left out in the transition, making the dining experience inclusive for all.

The shift from physical to digital menus is not just a passing trend. As India continues to digitize at an unprecedented pace, the digital transformation of menus is likely to become more widespread. The convenience, efficiency, and cost-effectiveness of QR codes and apps make them an attractive option for both restaurants and diners. QR codes and apps have proven their worth in enhancing customer experience, promoting sustainability, and providing restaurants with the flexibility they need to thrive in a competitive market.

In India, the shift in the dynamics of word-of-mouth marketing didn't necessarily stem from a global crisis. The core principle of this marketing strategy remains constant: consumers continue to value others' opinions before spending their time and money. What has notably evolved, however, are the platforms of communication and exchange. The pandemic served as a significant catalyst in this transformation, compelling even the most traditional diners to adapt to new, digital channels of connection.

Recognizing these shifts, Deliverect, a global scale-up company, delineates this evolution into four pivotal areas: discover, delivery, delight, and drive. This approach guides Indian restaurants in understanding the contemporary customer journey. It involves grasping how today’s consumers discover and select dining establishments, exploring the changing preferences and modalities in online ordering and dining experiences, creating a compelling digital brand identity that fosters customer loyalty beyond just transactions, and utilizing data-driven insights to enhance operational efficiencies and customer engagement.

The Digital Shift in India’s Restaurant Industry

India, a burgeoning tech powerhouse, is experiencing an unprecedented digital revolution, particularly in its restaurant sector. As of 2023, India boasts over 700 million internet users, with smartphone penetration exceeding 50 percent of its population. This widespread digital access has laid the foundation for a transformative journey in the food and beverage sector.

Indian restaurants, from local eateries to high-end establishments, are increasingly adopting digital platforms for a wider reach and enhanced customer engagement. For instance, cloud kitchens and virtual restaurants are becoming a staple in urban areas, catering to the tech-savvy population. Data from the National Restaurant Association of India (NRAI) indicates that online food delivery witnessed a 150 percent growth in the last two years, a testament to the digital adoption among consumers.

Rajesh Kumar, Owner of Nukkad Cafe in Lucknow stated,"Embracing digital technology in our humble chai corner has been a game-changer. We're now reaching more tea lovers than ever before through online deliveries. Just by going digital, we are now three outlet strong and are ready to expand more even beyond this city"

The integration of AI and data analytics is empowering restaurateurs to understand consumer preferences better, customize menus, and optimize operations. Restaurants are also leveraging social media platforms for marketing, with Instagram and Facebook becoming vital tools for customer interaction and brand building.

Consumer Behavior: From Traditional to Digital

The Indian consumer's journey in the culinary world has dramatically evolved, transitioning from traditional dine-in experiences to embracing digital avenues. This shift is not merely about convenience; it's a reflection of a deeper change in lifestyle and preferences.

A significant factor driving this transformation is the role of third-party apps. Platforms like Zomato and Swiggy have revolutionized food delivery in India, making a diverse range of cuisines accessible with just a few taps. Their user-friendly interfaces, coupled with aggressive marketing strategies, have made them household names. According to a report by RedSeer, food delivery platforms in India are expected to grow at a CAGR of 25 to 30 percent by 2025, reaching a market size of $8 billion.

However, it's crucial to note that while these third-party platforms are effective in reaching new guests, a substantial amount of discovery is happening through direct channels. Restaurants are increasingly realizing the importance of having their digital presence beyond aggregators. Many are investing in their websites and mobile applications, offering personalized experiences, loyalty programs, and exclusive deals. This approach not only helps in building a direct relationship with customers but also reduces dependency on third-party platforms, which often charge significant commissions.

Digital Platforms Leading the Way

In India’s rapidly evolving restaurant industry, several digital platforms are at the forefront, reshaping how consumers interact with food services. Key players in this domain have not only simplified food ordering but also revolutionized the entire dining experience.

Platforms like Zomato and Swiggy dominate the food delivery market, offering a plethora of options from local street food to gourmet dishes. Their impact is profound; according to a FICCI report, the online food delivery segment in India is expected to grow to $12 billion by 2026. These platforms have become more than just delivery services; they are crucial marketing tools for restaurants to increase visibility and reach.

Reservation and table management platforms like EazyDiner and Dineout are also gaining traction. They provide a seamless experience for diners to book tables, avail offers, and read reviews, all in one place. These platforms have been instrumental in bringing back diners to restaurants post the pandemic, with a focus on safety and convenience.

Anita Singh, Co-founder of Green Bites, a health-centric café in Bengaluru stated that "For us at Green Bites, going digital meant more than just online visibility. It's about creating an experience that starts from a smartphone screen and extends to the last bite of a healthy meal. Leveraging AI to personalize our menu recommendations has not only delighted our customers but also helped us stay true to our mission of promoting wellness through food. I am sure AI will be soon an integrated part of aggregators as well."

However, the story doesn't end with third-party platforms. Many restaurants in India are creating their digital ecosystems, offering direct ordering through their websites and apps. This strategy not only enhances customer loyalty but also provides restaurants with valuable data to personalize their services.

Challenges and Opportunities

While the digitalization of India's restaurant industry presents numerous opportunities, it also brings with it a set of challenges that need to be navigated. High competition is a significant challenge; with the ease of online access, restaurants face intense competition, not just locally but also from a wider range of eateries within the delivery radius. Standing out in a crowded digital space requires innovative strategies and consistent quality. Another major challenge is the dependency on third-party platforms.

Many restaurants heavily rely on food delivery apps, which can be a double-edged sword. These platforms charge significant commissions, which can impact the profitability of the restaurants. Moreover, there remains a digital divide in semi-urban and rural areas. While urban areas are rapidly adapting to digital trends, restaurants in less urbanized regions might find it challenging to adopt and benefit from digital platforms.

On the flip side, the digital shift offers expansive opportunities. Digital platforms enable restaurants to reach a broader audience, transcending geographical limitations. Digitalization also offers access to customer data and analytics, empowering restaurants to make informed decisions and tailor their offerings to consumer preferences. Vikram Mehta, Executive Chef and Owner of The Melting Pot, a fine dining restaurant in Delhi commented that the digital transformation in the restaurant industry isn't just a trend; it's a journey towards excellence. “And what we used to think that digital world and AI is just for QSRs, Small Outlets, Cafes and Kiosks, is a passe now. Many fine dine restaurants are leveraging the upgradation. We are integrating augmented reality into our menu presentation and it has revolutionized the dining experience. It's not just dining anymore; it's an immersive journey where each dish tells its unique story, blending flavors with technology."

The shift towards digital platforms is profoundly influencing how customers discover and interact with restaurants. The increasing prevalence of online searches, third-party delivery apps, and social media recommendations is reshaping the dining industry. Restaurants must adapt to these trends by enhancing their digital presence and engaging customers through these channels. This digital transformation is essential for growth and customer retention in the rapidly evolving restaurant landscape.

QSR or Quick Service Restaurants are the fine dining options for the Gen Z—who are always on the move – be it with career or food, thus creating a multi-million-dollar business opportunity. According to credit rating agency ICRA, the industry is expected to grow by 20-25% in FY2024 in India, on account of steady demand uptick and increasing penetration driven by a rapid expansion of stores. India currently has 428 functioning QSR brands, and in the last two years, this segment has attracted investments worth $1.3 billion through 64 deals. As QSR the industry charts out its growth path, technology is slated to create a 360-degree impact on the way this industry operates.

Traditionally built on a strong technology foothold, the QSR industry is intensive users of tech-powered production techniques, information and communication resources, smart logistics, marketing avenues, and sound e-commerce technologies. Separately to manage the backend integration of accounts and frontend vendors, technology is the only way that offers affordable solutions to the QSR outlets.

Where is QSR using the Tech

The tech-savvy users have created a demand for the most recent technologies to be adapted for raising footfalls, creating campaigns, and raising the firm’s profitability. Today tech-equipped fast-food facilities likes enhanced services, tech-driven food ordering, and traceable food delivery.

QSR owners are looking for new and innovative ways to deal with the waste product generated out of the outlets to managing the supply chain. Speed, convenience, and value are the three points that are driving the tech adaptation and demand for more.

Moreover, Generation Z and Millennials –both groups are now craving and demanding technology-centric dining experiences--both groups expect technology to be a part of their dining experience, even if it is something as basic as free wi-fi. The basic function of technology in QSR is to improve the customer experience along with increasing operational efficiency. Thus, the technologies being pursued could be considered more evolutionary rather than revolutionary.

Emerging Usages

Voice Ordering- in line with Amazon Echo and Google Home is the next big thing to impact QSR segment. Robotics like Chatbot Sally, the Salad Robot are expected to be the future whereas Artificial Intelligence rightly deployed, is an anticipated tool that will help businesses predict footfalls and demand –thus leading to efficient business management. AI business intelligence tools forecast industry shifts and help make proactive changes to the company’s marketing, merchandising, and business strategies. This impacts supply chain planning, as well as pricing and promotional planning.

Similarly, kiosk is a concept that has been adapted by QSRs, who are now investing in improving the customer experience along with streamlining their employee task. As per the latest research conducted on the QSR diner, 47 per cent of them preferred to opt for a self-service technology such as a kiosk for customising their orders. The kiosk is ultimately the new-age technology that can help firms manage their workforce by reassigning employees to more value-added tasks like ensuring happy customers and improving their experience.

Likewise, at the backend digital food safety measures are helping avoid food safety disasters. Digital tools help restaurant owners serve fresh food with quick temperature probes, automated temperature monitoring, and food and date labelling. Digital food safety helps restaurants be compliant. Technology in food packaging has revolutionized the shelf-life of food industry including QSRs.

The deployment of chatbots helps the QSRs to manage the payment received from various channels for tax and receivable’s purposes. As payments are received through multiple channels like banks, cheques, Paytm, Bhim Pay, Phone Pay, Cred, and many others --- it needs dedicated software to organize and account for the money

Summing Up

As QSRs are fast-moving eateries, it is pertinent that they have to be efficient in order to survive. Technology at all levels—chatbots for accounting to AI for business predictions to food safety measures all are functions of Smart Tech in today’s world—not to mention tech-enabled quality maintenance and inventory management. Infrastructural investments like Smart supply chains and automated sensor-driven food displays will become the future of every food industry.

Choice and deployment of ‘Competent Technology’ is going to be the next phase of the challenge with too many tech choices for the business owners for distribution, product line maintenance, and customer experience. As the backend integration of payments and receivables continues through smart bots, it will leave a fairly good time for business owners to focus on customer experience and comfort, thus ensuring business expansion.

The rich tapestry of India's culinary traditions is undergoing a remarkable transformation, all thanks to the innovative strides of food technology. With the Indian food-tech market projected to soar from $3.1 billion in 2020 to a staggering $20.2 billion by 2025, the landscape is witnessing a flavorful revolution.