Few topics felt the Covid-19 tailwind more than delivery. In India, the category’s share of foodservice sales doubled to more than 15 percent and even as delivery catches its breath, the veterans expect 2022/2023 to usher in a fresh era of growth, with sales sticking 40 to 80 percent above 2019 figures in nearly every major market. As always, though, delivery isn’t a simple numbers game.

There’s little confusion why delivery swelled in 2020, with domestic channel sales climbing nearly 75 percent: Dine-in exited the picture. As did many restaurant concepts that couldn’t sustain operations, or decided to wait it out. Fewer options in a suddenly less saturated field.

According to several reports, 90 percent of customers said they changed delivery behaviour as a result of Covid-19. Just in terms of adoption, the category exploded out of the trough. In the year ending March 2021, restaurant digital orders ballooned 124 percent compared to the prior year. Digital orders for carryout, which represented 62 percent of all digital transactions, jumped 130 per cent. Digital orders for delivery lifted 140 percent. Even quick service, a segment responsible for the major chunk of the industry’s share of digital mix pre-coronavirus, realized triple-digit growth.

Understanding the present, imagining the future

“Cloud kitchen is playing a role of 'Major Lifeline' for the whole F&B sector from last year. The concept has been there for quite some time but it got more popularity during this pandemic as people were not stepping out and deliveries were in huge demand, shared Chef Harangad Singh, Chef and Founder at Parat by adding that the pandemic has brought out the importance of cloud kitchens.

Chefs are also coming up with creative ways to bring the gourmet experience at doorsteps with all the safety measures. With Covid-19, the future of dine-in restaurants is uncertain while Singh believes that cloud kitchen is the safest and best alternative for many people now.

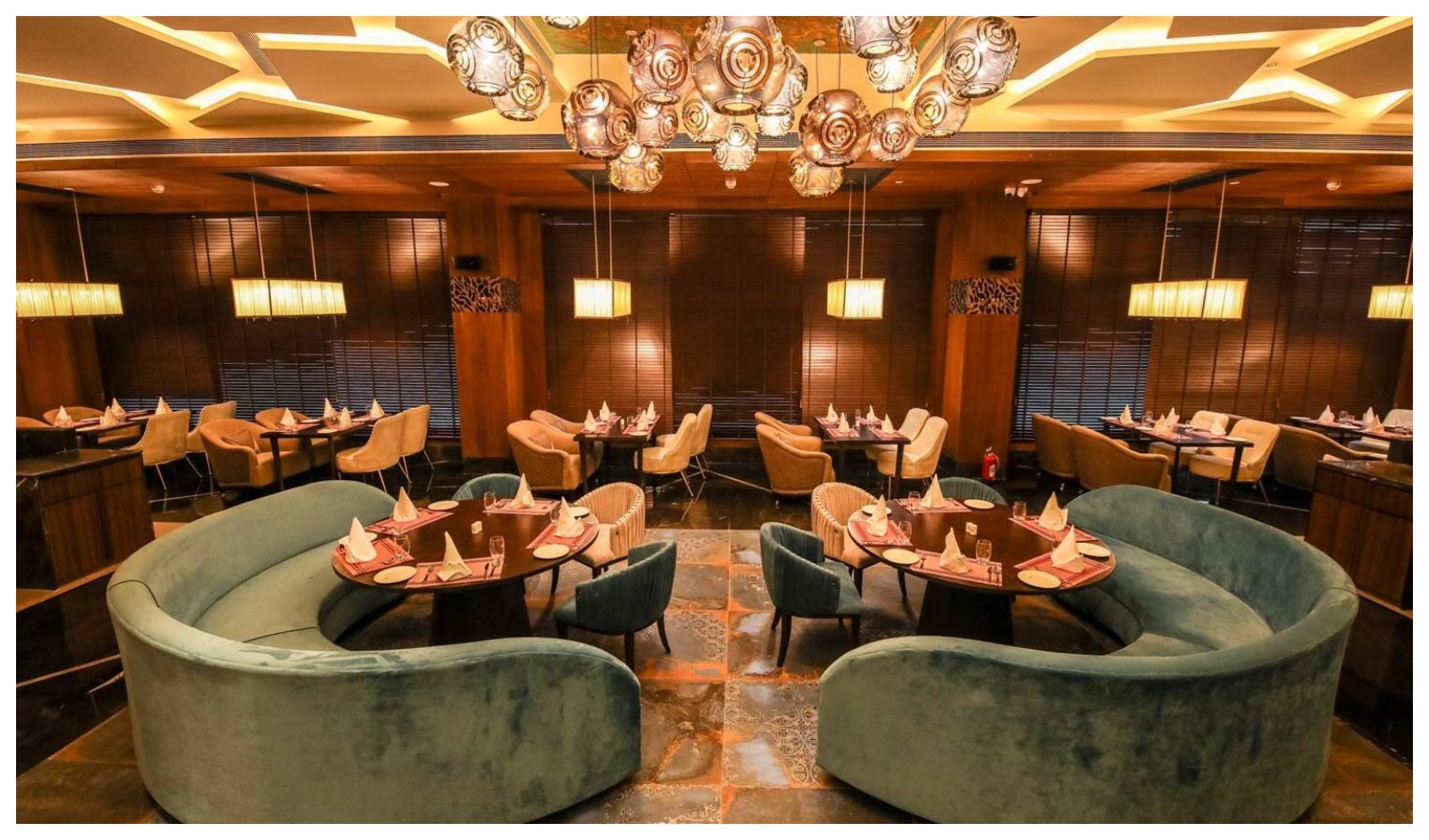

In full service, particularly fine dining, opportunities for social interaction will limit delivery penetration to a certain extent. Meanwhile, the prevalence of cheaper off-premises channels, like pickup and drive-thru also beneficiaries of Covid’s clamp on dine-in will curb delivery’s growth across counter service. Convenience is the great equalizer. The economics for take-away and drive-thru win out for restaurants as well, and efforts to foster them will balance the future.

Commenting on the same, Debashish Yadav, CEO, Licorne Hospitality said, “The pandemic has given a booster shot to the dine-at-home movement. Indian households have warmed up to the idea of ordering in as they devote more time to either work or leisure at home. Further, the consumer has matured and is now demanding a better food experience at home from restaurants and cloud kitchens. The industry has responded with premium food offerings to alleviate the dine-at-home experience.”

At Lattu Biryani and Rocket Pizza, the company plans to integrate board games with the food packaging to allow users to spend quality time together. The majority of the food delivery consumers who were added due to the pandemic will remain active users even after the pandemic subsidies, thus, adding to the overall industry revenues. “While people will be back in restaurants, the propensity to consume restaurant food at home has definitely increased and is likely to remain high even after the pandemic,” Yadav opined.

Considering the factor that deliveries have always been a very important parameter to the entire food industry, Prasuk Jain, owner of Pink Wasabi in Mumbai commented that the only difference for before and after Covid is that there could be a rise in direct sales with walk-in and deliveries would go down by 20 percent but not more.

Not completely replaceable

This subjects an important questions. Will delivery drive incremental growth? Before Covid, global foodservice sales increased at a compounded annual growth rate (cagr) of three to four percent over the last three, five, and ten years, respectively. This is a relatively consistent line, even as delivery growth accelerated from an 11 percent CAGR between 2013 and 2016 to an 18 percent CAGR between 2016 and 2019, doubling delivery’s share of total sales from 4.2 percent in 2013 to 8.4 percent in 2019.

Pre-coronavirus, traffic and on-premises sales were going in the opposite direction, perhaps at the expense of this growth. The category’s share declined consistently from 73.8 percent in 2013 to 68.6 percent in 2019. It was 52.8 percent in 2020, a strange year to measure against.

Another major factor to be considered is that food delivery does not appear a serious substitute for home-cooked/ready meals from supermarkets. Not unless the price of a meal delivered drops to a comparable level. The rise of larger, well-capitalized delivery platforms/aggregators and better packaging might improve the overall experience and attract new and repeat users.

For easy and quick money, yes!

There are scenarios as well where delivery lowers barriers to entry for new competitors and startups by limiting initial CapEx. No need to invest in a site with seating space and worry about prime real estate, as evidenced by COVID breaking the dam on virtual concepts and ghost kitchen expansion. An entrepreneur can now just rent a small space and get to work.

Labor costs are lower. No wait staff. Further, the absence of a pre-established physical presence is less of a headwind today thanks to how customers find food. Guests are far more adept at search and quality-control strategies using third-party platforms, social media, and online reviews.

Additionally, back to the ghost kitchen lure, some established operators have incorporated delivery-only brands to their offering and from their existing sites. In other cases, operators with established concepts extend their catchment area beyond historic reach via delivery.

Covid has surely forced the delivery hand for a lot of restaurants. Brands jumped in because they had no other lifeboat. It went behind the fear of ceding share; it was the only outlet. Sign up, figure out the profitability later.

India’s restaurant industry is expanding rapidly, powered by a growing dining-out culture and digital payments. However, a recent tax investigation has uncovered alleged misuse of a “bulk delete” feature in a popular billing software. Originally designed to correct billing errors, the tool reportedly enabled users to wipe large volumes of sales data in some cases, up to 30 days of transactions, potentially concealing crores of rupees from the tax system.

What the investigation uncovered

The Income Tax Department’s Hyderabad unit began the probe with a biryani chain and expanded it nationwide. By comparing billing screen data with backend logs, officials found large-scale manipulation, including cases where bills like ₹2,784 were allegedly reduced to ₹27 to cut tax liability.

Three features were flagged i.e. individual bill deletion, bulk deletion and post-bill modification. After reconstructing actual sales and matching them with GST and income tax filings, authorities found widespread suppression in Andhra Pradesh and Telangana, with thousands of entities underreporting turnover.

Transparency is Critical for Expansion

Restaurateurs across segments said that the probe is a wake-up call, stressing that transparency, digital records and strict compliance are essential for sustainable growth and investor trust.

“We use billing software called Lucid to manage inventory and track everything that comes in and goes out. We keep our books clean and pay taxes properly because transparent records are crucial, especially when we are planning to raise funding and expand.Tampering with bills is unethical,” shared Suresh DC, Chef-Partner, Tuya by adding that compliance norms exist for a reason. “Our CAs conduct regular audits and any bill mismatch is unacceptable. With investors coming on board, we must clearly demonstrate accurate sales turnover. Digital records are essential for GST rebates and audit compliance.”

Cash-Heavy Outlets are more vulnerable

“Data or bill tampering is largely seen in smaller restaurant chains and standalone biryani outlets, especially those operating in a traditional, cash-driven format. In such setups, manipulation is far more common than in fine-dine or organised casual dining spaces. In our case, bill deletion is not possible. If there’s a table runaway, the bill is formally converted into a complimentary entry,” said Hemender Reddy, Founder of Sribhog Hospitalities.

Explaining further, he noted, “For us, 95% of the payment comes from UPI, 5% payment from cash. And we are focused on expansion and getting more investors on board, for that we need higher turnover as it drives revenue, brand visibility and credibility. This helps in repeat customers and boosting brand value while targeting more customers.”

AI and data forensics in action

Given the huge volume of records, tax authorities relied heavily on forensic tools and AI systems, including generative AI, to analyse billing data. AI helped differentiate genuine billing corrections from suspicious edits. It was also used to map GST numbers to restaurant entities by scraping publicly available information and cross-checking bills uploaded online by customers. Around 15,000 GST numbers were mapped, allowing investigators to establish links without waiting for formal responses.

“From day one, Sapaad has been built as an ethical, audit-ready platform. We are 100% tax compliant and do not support any form of transaction deletion. Tax authorities typically require safeguards such as no hard deletion of financial transactions, immutable invoice records, timestamp integrity, the ability to reconstruct full transaction histories, sequential invoice numbering without gaps, and data retention for 5–7 years — all of which are enforced in our system by design,” said Vishnu Vardhan Madabhushi, Founder & CEO, Sapaad.

“As scrutiny increases, this episode reinforces a simple truth: restaurants need tamper-proof audit trails and ethical-by-design software to operate transparently. We believe compliance-first technology will become the global standard,” he added.

What’s next?

The case has raised concerns over billing software governance with authorities likely to push for stricter audit logs, tamper-proof systems, and closer GST integration. As restaurants go digital, the episode shows that technology without safeguards can be misused. The probe is a clear warning: compliance is not optional, and weak systems pose serious regulatory and reputational risks.

The modern Indian hotel no longer thinks in terms of rooms and banquet halls. It’s all about yield per square foot. Rooftops, bakeries and work lounges are being positioned as independent brands with separate identities, social handles and revenue targets.

Hotels are designing these spaces for non-resident revenue first and resident revenue second. The overall market revenue is projected to cross ₹1 lakh crore (₹100,000 crore) in FY 2026 and continue robust growth through FY 2027.

Making Under-Utilised Assets Profitable

The shift in India is moving toward an "Asset-Right" philosophy where every square foot is engineered for productivity. This shift alone expands the addressable market exponentially. The lobby is no longer just a check-in space; it functions as a revenue engine. The smartest hotels are not rebuilding, they are reframing. Structural change is expensive, while conceptual change is powerful.

“An underperforming lounge can become a member only bar. The key lies in defining the behavioural use case of a space and aligning pricing, programming and narrative accordingly. Diversification is not about adding more, it is about extracting more from what already exists,” said Jyotsna Kanwar, Director of Sales and Marketing, The Ritz-Carlton, Bangalore.

Hotel that activates lobbies report 12–18% higher non-resident footfall and 8–15% increase in overall F&B billing.

Commenting on the same, Suhas Sharma, Commercial Director, DoubleTree by Hilton Bengaluru Airport said, “Brew33 Express Lobby integrates concealed self-service specialty coffee machines, smart storage, and accessory displays into the design, enabling high-quality output with minimal staffing intervention. This approach drives incremental ancillary revenue (projected 5–10%) while insulating the hotel against occupancy volatility typical of airport markets.”

By diversifying into quick-service coffee, bakery retail, and impulse grab-and-go, one can create consistent non-room income streams that operate independent of room demand cycles.

Growth of Various brands in lobbies

The modern lobby is being designed as a monetised meeting arena. Hotels understand that lobbies are where business discussions, creative exchanges and social introductions happen. Instead of letting that energy remain commercially passive, they are structuring the space to convert interaction into revenue. The strategy is behavioural and revenue led.

Branded coffee in hotels priced at 250–450 per cup in metros. Grab-and-go bakery counters can generate 1.5–3 lakh per month per 100 sq ft in high-footfall properties. Lobby retail pop-ups can earn rental yields of 2,000-5,000 per sq ft per month in prime metros.

Highlighting this, Kanwar said, “Some hotels create persona-based zones with differentiated seating, scent profiles and sound design so guests instinctively choose where they belong.”

The lobby is no longer a cost centre. It is an all-day yield engine built around one truth.

Structuring Monetization Models

The structure is built on a tiered engagement model designed to capture different types of spend.

Adding to this, Shivram Verma, FnB Manager, Hilton Bangalore Embassy Golflinks pointed, “First is the "Transactional Tier," focusing on high-volume F&B sales from the café for walk-ins. Second is the "Subscription Tier," where we have special rates for techpark employees to ensure recurring revenue. Third is the "Event Tier," where specific nooks or semi-private pods within the lobby can be rented by the hour for small meetings.”

The Business Impact

The impact is structural. First, revenue diversification increases resilience. Hotels reduce dependency on occupancy cycles. Second, brand equity compounds.

When a hotel owns recurring intellectual properties, it builds long term recall rather than short term revenue spikes. Third, external audience penetration increases.

“A nonresident guest who visits for a wellness sunrise or a cultural talk becomes part of the database. Over time, this expands banquet, dining and stay conversions. Most importantly, the hotel transitions from being a service provider to being a cultural institution within the city,” mentioned Kanwar.

While, Sharma shared, “Brew33 Express Lobby alone is projected to contribute close to 10% incremental lobby-based ancillary revenue while reducing dependency on the main restaurant for quick beverage requests. Future rooftop experiences are expected to generate up to 2x margin compared to traditional indoor outlets due to premium pricing and experiential positioning.”

Overcoming Challenges

The biggest challenge is balancing making money from every corner with keeping the warm, welcoming feeling of a hotel.

“We know that if we push this too hard, by making guests feel like they are on a timer or charging for every little thing, we lose their trust. We solve this by focusing on value rather than just fees. By keeping the atmosphere relaxed and the service friendly,” shared Verma.

The future of the hotel lobby is "Phygital"—a seamless blend of physical luxury and digital convenience. The lobby will no longer be an entrance; it will be the destination that defines the hotel's identity.

In the last decade, India’s dining industry has shifted from instinct-led cooking to data-driven menu strategy. With the rise of digital ordering, reservations, apps, and delivery platforms, restaurants now generate massive data and those using it are redesigning menus, pricing, and promotions smarter than ever.

Data is no longer just numbers; it is a key business ingredient driving customer satisfaction, efficiency, and revenue growth. In a 5.5–6 lakh crore market growing at 10–12% annually, survival and scale increasingly depend on how well restaurants use data.

Why Data Matters?

India’s restaurant industry is increasingly shifting toward analytics-driven menus, accelerating alongside the rapid growth of delivery platforms like Zomato and Swiggy.

With food inflation fluctuating between 6–8%, metro rentals consuming 12–20% of revenue in prime locations and frontline F&B attrition rates touching 70–100% annually, margins remain tight. With organised dining EBITDA margins at just 10–18%, even small menu inefficiencies can impact profits making data-driven decisions essential to minimize risk.

Broad Data Streams: Internal & External

Menu decisions are increasingly fed by two broad data streams: internal operational data and external market signals. Internal data includes sales velocity, food cost percentages, wastage levels, preparation time, staff efficiency, and inventory turnover. If a dish sells well but slows kitchen throughput, it may be reformulated or removed.

Kashish Dang, Director of Maya at 787 said, “External data includes consumer behaviour shifts, search trends on delivery platforms, social media engagement, competitive benchmarking, and regional taste preferences. For instance, delivery analytics may reveal growing demand for comfort bowls or regional flavours in urban markets.”

Many mid-sized Indian chains report 5–12% improvement in gross margins after structured menu engineering, primarily by eliminating low-performing SKUs.

Performance Metrics

Performance metrics such as contribution margin, menu mix, repeat order frequency, and customer ratings now shape menu strategy. Underperforming items are rotated into seasonal specials instead of permanent fixtures.

“We rely on structured metrics such as contribution margin, popularity index, repeat purchase rate, and menu mix analysis. A dish that is popular but low in margin is optimized. A high-margin dish with low demand is repositioned or redesigned. Strategy is guided by measurable performance, not assumption,” mentioned Zorawar Kalra, Managing Director, Massive Restaurants Pvt Ltd.

Dang noted that real-world data-backed results reduce guesswork, improve consistency, and support faster decision-making in high-attrition environments.

What Feeds Menu Decisions?

Menu decisions are informed by a combination of guest feedback; sales performance, kitchen inputs, and plate return analysis.

For Vikrant Batra, Director & Co-Founder, Batra Bros Food & Beverage Pvt. Ltd what’s equally important is on-ground observation. Direct engagement with guests and teams often reveals nuances that numbers alone cannot capture. “Floor feedback and human interaction still provide context that analytics alone cannot. The strongest decisions come from combining digital intelligence with real-world observation,” he said.

“Ultimately, predictive demand forecasting based on historical trends and real-time data helps optimise procurement, reduce waste, control food costs, and improve sustainability, making data central to both profitability and operational resilience in India’s evolving restaurant ecosystem,” shared Dang.

In cities like Ahmedabad, vegetarian dishes can make up over 60% of total sales. In Hyderabad, non-vegetarian items generate the majority of restaurant revenue. Restaurants localise their menus based on detailed city-wise sales data.

Kalra stressed that the biggest trap is "Analysis Paralysis." If you over-standardize, you kill the chef’s creativity. My philosophy is to use data as a guardrail, not a cage. We give our chefs the absolute freedom to innovate and dream, but we use data to validate those dreams before we take them global.

Power of Digital Menus

Digital menus and QR-based ordering systems further enhance insight collection by tracking dwell time, clicks, modifications, and upsell acceptance rates.

Dang said that this behavioural data allows restaurants to refine descriptions, pricing psychology, and bundling strategies. Indian restaurants have reported a 10–20% increase in average bill value after adopting digital or QR menus.

Batra believes that digital ordering has become dominant in India, offering real-time insights into browsing behavior, customization patterns, drop-offs, and repeat purchases. “It helps us understand guest preferences at scale and optimize menu design, pricing, and placement with precision.”

With UPI payments at restaurants growing by around 34%, billing is faster and table turnover has improved. It has to be noted that digital data cannot capture emotions, hesitation, or nuanced guest reactions.

Importance of Real-world data

The Indian palate isn't a monolith; it evolves every 100 kilometers. Real-world data removes bias and emotional attachment from decisions. Restaurants using historical POS + weather trend data have seen 15–25% reduction in stock-outs, 8–18% drop in food wastage and 10–20% increase in festive campaign revenue.

“Data helps us decode "geo-demand"—it’s why a Farzi Café in London leans into warming spices while Dubai stays light and zesty. We use predictive analytics to respect nature’s clock, shifting our menus before the guest even realizes their cravings have changed,” pointed Kalra who further added that it’s about being leaner, greener, and more relevant.

Batra said, “Data validates ideas through measurable outcomes and ensures long-term sustainability. In a competitive market, disciplined decision-making is critical.”

The Power of Personalization

In 2026, "one-size-fits-all" is a relic. Knowing a guest’s favourite corner table or their preferred spice level transforms a meal into a memory.

Addressing his views further, Kalra said, “Personalisation is the ultimate loyalty tool; when a server suggests your favourite cocktail before you ask, and it builds an emotional bond. Technology should be the invisible force that makes the guest feels like the only person in the room.”

Impact on the Bottom Line

The results are immediate. Smart menu engineering can boost margins by 15–20%. Sharing further, Kalra said, “This helps us spot "menu fatigue" early—if repeat orders dip, we refresh. It also empowers our staff to make intuitive recommendations, naturally driving up the Average Per Cover (APC) by pairing the right dish with the right guest.”

With this, we can surely see a cultural shift in the kitchens where chefs work alongside with the data analysts, supplychain managers and tech partners to understand the change menu review meetings now includes sales dashboards, heat maps and cost trend graphs.

As AI becomes more deeply embedded in POS systems and CRM platforms, Indian restaurants will increasingly adopt predictive demand forecasting, dynamic pricing optimization, highly personalised menu suggestions, and real-time menu updates linked directly to inventory availability.

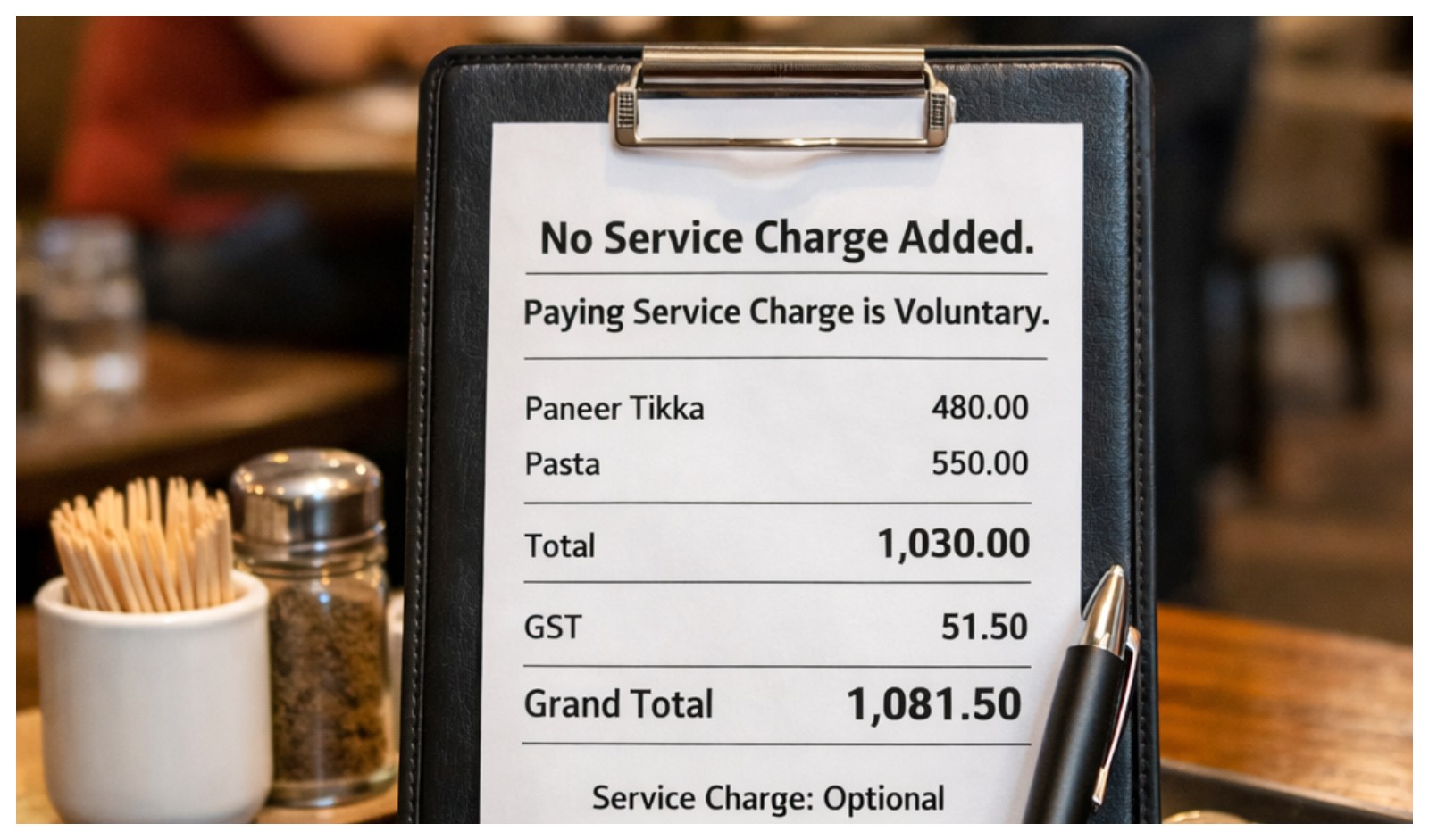

In a significant win for consumer rights, the Delhi High Court has ruled that restaurants cannot automatically add a service charge to customers’ bills, making it clear that any such charge must be voluntary and paid only with the customer’s explicit consent.

The court’s March 2025 order upholds guidelines issued by the Central Consumer Protection Authority (CCPA), which had earlier been challenged by restaurant industry bodies. The ruling reinforces that forcing diners to pay a service charge amounts to an unfair trade practice under the Consumer Protection Act.

According to the court, restaurants cannot add a service charge automatically, collect it under another name, or pressure customers into paying it. Any mention of service charge must clearly state that it is optional and discretionary.

The Ministry of Consumer Affairs confirmed that the CCPA has already acted against establishments that continued to levy service charges by default despite existing guidelines. In one case, Barbeque Nation was directed to stop collecting the charge after a customer complained about an additional fee on the bill.

Officials said that during inspections, several restaurants were found to be adding a flat 10% service charge without seeking customer approval. In many instances, GST was also being calculated on this amount, increasing the total bill further. After complaints were lodged through the National Consumer Helpline, restaurants were instructed to refund the collected sums and remove the automatic service charge feature from their billing systems. So far, the CCPA has fined 27 restaurants for non-compliance.

Dining Becomes Affordable

For diners, the ruling translates into tangible savings and greater transparency. Industry estimates suggest that removing mandatory service charges can reduce the final bill by 10–15%, depending on the establishment.

Col. Manbeer Choudhary, CMD, Noormahal Group, explained that on a ₹5,000 bill, a 10% service charge would earlier add ₹500 over and above 5% GST. Now, GST applies strictly to the base amount₹250 on ₹5,000 at 5%and any gratuity is entirely voluntary. “This can translate into savings of 10–15% per visit,” he shared.

“Previously, GST was often calculated on the subtotal that included the service charge. With the new clarity, GST applies only to the base food and beverage value. For a family spending ₹5,000, the shift could mean savings of upwards of ₹600, a meaningful difference that could encourage more frequent dining out, "added Aashita Relan, Founder of Royal China.

Beyond monetary benefits, hospitality leaders say the ruling strengthens trust. “Guests have clarity on what they are paying for and retain the freedom to reward service at their discretion. Hospitality is built on goodwill, and voluntary appreciation carries far greater meaning than a mandatory levy,” said Choudhary.

However, the decision also presents challenges for restaurants, particularly in safeguarding staff welfare. Service charges have traditionally supplemented employee compensation and incentive pools. Without them, establishments may need to explore alternative models that communicated “service-inclusive” pricing structure.

Under the current rules, customers have clear rights when it comes to service charges. They can ask restaurants to remove any service charge that has been added without their consent. Customers also have the right to refuse to pay the charge altogether. For many mid-to-premium restaurants, service charge collections formed a meaningful portion of monthly inflows. It has been said that in busy outlets, service charge pools ran into several lakhs per month, particularly in fine dining formats.

On the revenue front, experts anticipate short-term fluctuations. Relan acknowledged that while there may be a temporary dip in top-line revenue, the long-term outcome could be more positive. “A diner who feels respected and uncoerced is a diner who returns. That is the only true way to drive sustainable growth,” she said.

Under the current framework, customers now have unequivocal rights: they can ask for any service charge added without consent to be removed and can refuse to pay it altogether. With the court’s backing, India’s dining landscape is poised for a shift—one that prioritizes transparency, choice and trust at the table.

High attrition is driven by persistent staff turnover, talent migration, and ongoing labour shortages. This is no longer a temporary disruption for the restaurant industry. It has become a structural challenge that is fundamentally reshaping menu design, service models, team structures, and technology adoption. What began as a post-pandemic staffing crisis has evolved into a new operational reality, forcing operators to rethink the core mechanics of how restaurants function.

Designing Kitchen for Faster Training

Globally, workforce turnover in restaurants often exceeds 60–70% annually, depending on the segment and market. In India, the challenge is particularly sharp.

National Restaurant Association of India reported that attrition rates range between 10–40% per month in food service sector, with nearly 75% of QSR employees staying less than three years in a role. In the QSR space, 36% of staff stays only 1–2 years and total turnover is often above 40% monthly.

Pointing this, Deepak Chhabra, Director, SILQ said, “High attrition has pushed us to rethink how we design our menu. Earlier menus were often dependent on specific chefs or specialised skills. Today, we focus on creating dishes that are consistent even when teams change. We design menus that respect craftsmanship but are also structured and process driven.”

“Indian kitchens are leaning heavily into modular formats 2–3 core mother gravies powering multiple mains, standardised marinades for tikkas and kebabs, pre-portioned spice blends, and clearly defined SOPs making execution easier even when new cooks join. At the same time, high-skill live cooking, complex plating, and labour-intensive formats are being scaled back in favour of batchable items like biryanis and gravies, cross-utilised prep across multiple dishes, and pre-batched elements finished at the pass. The result is a menu engineered not just for flavour and margin, but for staffing realities, faster training cycles, lower wastage, and smoother delivery peaks,” commented Anil Kumar, Co-Founder of Singh Sahib.

Where Process Replaces Memory

India’s hospitality sector sees over 50% annual turnover, with hourly staff attrition often exceeding 70%, far higher than most industries.

With labour instability now the norm, restaurants are redesigning operations to function seamlessly even with junior or temporary hires. Roles are simplified, tasks are modular, and menus have become operational tools rather than expansive culinary statements.

“Operational resilience now matters just as much as culinary excellence. Pre-batching and prep work have become essential, with less reliance on chef memory and more focus on repeatable systems rather than recipe-learning tactics,” pointed Shantanu Yadav, Co-Founder, Atmanam.

Kumar noted, “Kitchen layouts are also being streamlined around flow and resilience, with central prep stations handling sauces, spice blends, and bulk cuts, and pull-forward finishing stations near the pass to manage peak hours.”

Importance of Menu Simplification

Restaurants are simplifying menus not just for efficiency, but for survival in an environment where staff instability and rising costs are very real. When teams change frequently, complex recipes break down, consistency suffers, and training becomes repetitive and expensive making simplified menus essential to reduce skill dependency, speed up onboarding, and minimize execution errors.

As per data, many restaurant employees said that they feel overworked and stressed, with about 34% reporting heavy workloads and 37% identifying stress as a major concern.

“At the same time, large menus mean more SKUs, higher perishability, greater waste, and increased COGS, a risky equation in markets like Delhi-NCR where rentals and GST pressures already squeeze margins. Tighter menus reduce storage needs, improve stock rotation, strengthen purchasing leverage, and ultimately protect profitability,” highlighted Kumar.

Tech is no longer Optional

Technology is no longer a support system; it is part of the strategy. As per reports, 81% of restaurateurs pointed that technology helped them in retaining the employees. While 61% acknowledged that tech helped them in coping up with the staffing challenges, 42% restaurateurs use digital solutions to improve retention.

“From reservations to inventory to guest data everything is connected. At SILQ we use technology to understand guest preferences manage costs better and ensure smoother service. It helps us reduce wastage improve planning and personalise experiences. In today’s world if you are not using tech wisely you are already behind,” shared Chhabra.

It was also stated that 58% restaurateurs/brands are using tech to alleviate labor shortage is a primary strategy. Yadav added that data will drive targeted guest and regional marketing while guiding decisions based on demand and trends. “Technology will strengthen training for new team members, support staff growth, improve revenue projections, and increase profitability through smarter planning. Most importantly, these systems allow restaurants to deliver a consistent guest experience and scale without compromising operational standards.”

Importance of Labour-smart production systems

Labour-smart production systems are becoming essential for restaurants aiming to stay consistent and scalable in high-turnover markets. By breaking dishes into modular, repeatable steps, brands reduce skill dependency and enable even junior staff to execute confidently ensuring operations remain stable even when key team members exit.

These systems can cut manual labour dependency in repetitive tasks by 50–60% and reduce labour management time by up to 80%. More importantly, they unlock scalability—whether for a second outlet, cloud kitchen, or delivery expansion—by making SOPs, training modules, and production logic easily replicable.

The business impact is clear: stronger cost control, sharper data-led decisions, and improved guest loyalty. The rulebook is being rewritten—and those who adapt will lead.

Smaller kitchens today are less about limitation and more about smarter planning. Many casual dining businesses are shrinking their kitchens, simplifying menus, and redesigning operations for efficiency and sustainability. What once was seen as constraint is fast becoming a strategic advantage.

With rising rents and ingredient costs, compact kitchen setups significantly reduce overheads often by 20–30%.

Shrinking Cost Pressures

In many markets, labour expenses have surged as wages rise and staffing becomes harder to secure, forcing around 62% of restaurants to hike menu prices just to stay afloat.

Expressing his views, Chef Hitesh Shanbhag, Head Chef for Loco Lane said, “Compact layouts reduce equipment and utility expenses, shifting the focus toward a more centralized kitchen approach.”

“We have seen that smaller kitchens help control wastage, improve consistency, and reduce unnecessary costs. It forces you to design menus that are thoughtful and executable rather than overly ambitious,” commented Arjun Jaiswal, Co-founder of Como Agua.

For Navin Kumar, Co-founder of Gladia Brewery & Kitchen who has streamlined the kitchen by 30% which directly reduced utility bills and food waste mentioned that lower space requirements mean reduced rent, lower energy consumption, and tighter control over inventory making the back of the house more cost-efficient and predictable.

Restructuring Cost Inflation

Casual dining margins have always been thin. With the rising costs of rent, ingredients, utilities, labour, operators are forced to reduce kitchen sizes, cut menu complexity and focus on high selling dishes. As per reports, 69% of consumers now choose to eat at casual dining restaurants which were 63% last year. More diners are also returning to in-restaurant experiences and 65% now prefer dining in. The market is moving towards profitability per outlet.

Menu Simplification

A streamlined menu isn’t just aesthetic—it’s operationally transformative. This enables restaurants to reduce inventory complexity, improve kitchen execution, and increase service speed and customer satisfaction.

Jaiswal pointed that a clear, focused menu allows chefs to maintain quality and helps operations run smoother, especially in high-volume casual dining environments.

Menu simplification doesn’t make restaurants redundant; it actually helps build a stronger identity.

“While the impact is less significant than often assumed, simplification can reduce the personal touch of traditional service. This results in fewer opportunities for upselling due to limited interaction with guests,” highlighted Shanbhag.

Kumar noted that by eliminating complex, low-performing dishes and focusing on versatile, high-margin items like shareable tapas and craft cocktails, operations become more efficient and adaptable without compromising the guest experience.

Helps in Sustainability

Smaller kitchens also support sustainability by reducing food waste, energy usage, and overstocking.

“With tighter inventories and better forecasting, kitchens operate more responsibly while maintaining freshness and quality. In terms of flexibility, compact formats allow restaurants to adapt quickly, test new locations, and scale with lower risk and investment,” said Amit Jambotkar, COO, Mirah Hospitality & Gourmet Solutions Pvt Ltd.

Kumar added that smaller kitchens contribute directly to sustainability by lowering energy use and reducing food waste ours dropped by 25%.

Demand Leaner Operations

Labor shortages necessitate the use of automation, optimized peak scheduling, and multi-skilled teams to manage volume efficiently.

With ongoing labour shortages, leaner operations are no longer optional. Kumar shared, “Smaller kitchens require fewer staff and allow teams to be cross trained for multiple roles. We have also leveraged technology such as POS integrations to automate order flows, reducing manual dependency and improving speed and accuracy.”

The Business Impact

The business impact is tangible: higher profitability, faster service, and better adaptability. Kumar shared that our margins have improved by 15% with this model.

While Jambotkar emphasized that smaller kitchens lead to reduced capital expenditure, improved operational efficiency, and faster break-even timelines.

Going forward, success in casual dining will depend less on how large a kitchen is and more on how efficiently it operates. Restaurants that are able to balance creativity with operational discipline will be the ones that sustain long term.

QR menus and UPI payments may have changed how customers order coffee, but they haven’t really changed how cafes are built and run so far. But now, a real transformation is unfolding along with technology, say cafe owners. Behind the counter, technology is rewiring how cafés manage inventory, staffing, training, and even menu strategy, redefining what efficiency and scale look like in a category built on human interaction.

Industry data reflects the scale of the shift. Digital menus alone have been linked to a 10–20 per cent increase in average check value, while contactless ordering systems have reduced staffing costs by 12–18 per cent and cut order errors by nearly 38 per cent across India’s food sector. Yet many café operators argue that these metrics only scratch the surface of what technology can truly enable.

Thinking Beyond QR and UPI

“There is a movement towards tech adoption, and everyone is looking at it seriously, but the real question is what you want to get to the bottom of. QR menus, for example, are very shallow-level tech,” said Manan Chowdhry, CEO & Founder, Koby’s Coffee.

According to Chowdhry, consumer-facing technology in cafés largely falls into two buckets: engagement and convenience. Most brands, he added, have stopped at enabling online ordering and digital payments. “Beyond that, no meaningful layer of convenience has really been envisioned yet,” he said.

One exception, he noted, is self-ordering kiosks. “When customers punch in their own order, there’s less confusion and fewer errors. It’s a smoother, more private flow. From restaurant’s perspective, kiosks reduce manpower dependency and training requirements, and they minimise clerical and manual errors.”

Frictionless Habits, Not Replaced Experiences

For large-format operators, technology’s role is less about spectacle and more about habit formation. A spokesperson for McCafe, the cafe segment of McDonald’s India (W&S), said, digital adoption has quietly changed how coffee fits into daily life.

“Technology today, particularly for Gen Z and millennial is about subtly removing friction from everyday habits. Thanks to app-based ordering, UPI payments, and loyalty-driven programs, consuming coffee now feels more flexible and integrated into daily routines rather than a planned visit,” he mentioned.

The response to McCafé’s app-exclusive coffee subscription highlights this shift. “It reflects a clear shift from coffee as an occasional indulgence to a repeat, multi-occasion habit,” the spokesperson adds, driven by ease, transparency, and value.

Crucially, the brand sees digital tools as support systems rather than replacements. “Digital today will not replace the café experience but rather support the café experience by reducing decision fatigue and making the visit feel effortless.”

Quiet Tech, Human Spaces

For mid-sized and experiential cafés, the emphasis is on invisibility. Kaustubh Sawardekar, Beverage Manager, Yazu Hospitality, shared, technology at KICO Bangalore is intentionally designed to stay in the background.

“With the introduction of Air Menu and QR-enabled digital menus, guests can browse, order, and place repeat orders seamlessly from their phones,” he said, adding, “Digital ordering helps reduce wait times and supports a more relaxed, self-paced experience, something Gen Z and millennial guests increasingly value.”

At the same time, he is clear about boundaries. “Technology at KICO is not intended to replace human interaction. Instead, it works quietly in the background, supporting convenience while the focus remains on community, comfort, and connection.”

Loyalty, Data and Consistency at Scale

For multi-city café brands, technology increasingly determines consistency. Vikrant Batra, Co-Founder, Café Delhi Heights, added, digital tools were never adopted for trend value alone.

“From the very beginning, our focus has been on delivering a seamless and welcoming guest experience, not chasing trends,” he said. “Our loyalty programme has been in place since day one, allowing us to build long-term relationships rather than transactional visits.”

Operationally, data visibility has changed how teams’ function. “Technology has meaningfully improved operational clarity. This allows teams to focus more on hospitality rather than processes,” Batra explained, adding that technology cannot replace service culture. “Cafés are, first and foremost, social spaces.”

Platforms that help cafés improve speed and ease without compromising ambience are gaining traction. Abhishek Bose, CEO & Founder, My Menu, added, cafés are now competing on how effortlessly guests move through the experience. “Cafés today are no longer just competing on coffee and ambience, they’re competing on speed, ease, and how effortlessly a guest can move through the experience,” he said, adding that the goal is to let technology work quietly in the background while keeping the experience human.

Where Tech Actually Changes the Business

If front-end tools improve flow, back-end systems redefine economics. “Where tech truly adds value is on the back end,” sharedChowdhry. “Inventory management, consumption tracking, wastage control, recipe compliance, order planning, roster management, hiring, and training, this is where technology can be a real game changer.”

AI-driven analysis is already reshaping decision-making. “When we entered the coffee business, the assumption was that coffee meant hot beverages. But what we discovered was that nearly 65 per cent of our beverage sales are cold beverages,” he noted, adding that international data showed similar patterns. “AI helps you look deeper into seasonality and uncover trends that are almost invisible.”

Automation is also entering training. “I recently came across a system where training happens without human intervention. Such systems can cover 60–70 per cent of soft-skill training and around 50–60 per cent of hard-skill training without human involvement.”

As we all know, affordability is a key driver of success in the restaurant business because it builds trust and repeat visits. It’s not about lowering prices, but about delivering strong value. 25–30% of restaurants make affordability a core positioning, while 35–40% treat affordability as a competitive necessity and 60-70% restaurants focus highly on this. So, let’s have a look on what all point’s restaurants targets on.

Driving Higher Footfall

When customers feel they are getting good value for money, they visit more frequently, bring larger groups, and are more open to trying add-ons. This repeat behaviour fuels volume-led growth where higher table turns; faster throughput and consistent demand compensate for thinner per-unit margins.

“Brands that balance quality, consistency and sensible pricing become part of the customer’s weekly routine and not just an occasional indulgence. That repeat behavior is what builds sustainable businesses,” shared Saniya Puniani, Co-founder of Como Agua Goa.

Understanding Cost Control

Effective cost control comes from disciplined sourcing, waste reduction, and efficient kitchen operations. At the same time, affordability requires constant market adaptation understanding customer spending behavior and evolving menus as conditions change.

“When guests feel comfortable dining more often, affordability increases footfall and enables volume-led growth, improving efficiency, purchasing power, and long-term sustainability,” added Chef Gurmeher Sethi, Founder Tranzit.

Cost control underpins affordability. Tight inventory management, vendor consolidation, seasonal sourcing, and standardised recipes help keep food costs in check.

“Restaurants that offer dependable quality at accessible prices tend to retain customers while premium-only concepts struggle,” added Puniani.

Menu Engineering

Affordability-led brands succeed because they understand changing consumer behavior and respond with smart menu engineering, disciplined cost control, and thoughtful innovation. Smart menu highlights high-margin, popular dishes, controls portion sizes, and limits unnecessary complexity in ingredients.

Pointing further, Puniani said, “We actively design menus around contribution margins, kitchen efficiency and ingredient overlaps. Cost control today goes beyond procurement as it includes portion control, reducing wastage, optimizing prep processes and smart vendor partnerships.”

A clearly engineered menu is where 60–70% of sales come from high-margin items. Instead of discounting, smart menu design nudges customers toward dishes that offer both value to them and profitability to the restaurant.

Budget Constraints & Price Sensitivity

Today’s customers are highly value conscious as they are increasingly prioritizing quality over quantity.

Commenting on this, Abhishek Bahety, Franchise Owner, Farzi Beach Goa said, “We have defined by offering high-quality food and thoughtfully curated experiences at price points that feel accessible and justified.”

Guests experience a restaurant emotionally before they evaluate it financially. “Guests absorb the music, the mood, the flavours and the energy of the room. Budgets exist, but when the experience feels thoughtfully composed, people feel at ease spending. When it feels forced or transactional, even modest pricing feels heavy,” mentioned Khushank Arora, Founder & CEO, Kingcraft Group.

Market adaptation ensures affordability stays relevant. Restaurants gain more customers by 45-60% when following the market demand.

Focusing Profitability

Profitability is driven through strategic menu engineering, efficient sourcing, and disciplined cost management, while remaining uncompromising on food quality. Bahety added that operational efficiencies play a critical role in supporting sustainable margins.

“From how a menu is curated to how ingredients are sourced and handled, everything has a cost and a consequence. When these decisions are made with clarity and restraint, profitability becomes a byproduct rather than the objective,” pointed Arora.

Ensuring Consistency with Affordability

Consistency is maintained through standardized processes, quality benchmarks, and continuous team training. This ensures a dependable, value-led experience across every guest interaction.

Highlighting further, Arora said, “Systems, training, and strong vendor relationships ensure that the experience remains familiar yet exciting every time. Once that foundation is stable, affordability becomes natural and sustainable, allowing the brand to evolve without losing its soul.”

Not just this, around 20–30% of restaurants manage to strike a strong balance between affordability and profitability over the long term. Another 40–50% operates in a survival zone, while remaining 20–25% struggle significantly.

Hence, over time, scale benefits kick in with better purchasing power, improved operational efficiency and stronger brand recall. So, affordability is not about being cheap; it is about delivering the right value at the right price.

As the Union Budget 2026 approaches, voices from across India’s hospitality, restaurant, food, confectionery, food-tech, and renewable energy sectors are converging around a common theme: the need for stability, simplification, and long-term policy thinking to support sustainable growth.

Industry leaders say the coming budget will be critical in determining whether businesses can move beyond survival mode and confidently invest in people, capacity, and innovation.

For the hospitality and alco-beverage sector, the ask is clear—recognition, predictability, and skill development. Teja Chekuri, Managing Partner at Ironhill India, shared the sector needs a budget that “backs skills, stability, and sensible policy that will let hospitality do what it does best—create jobs, experiences, and long-term economic value.”

Chekuri highlights the chronic shortage of trained talent across kitchens, service teams, brewing, and bar operations, calling for targeted skilling programmes developed in partnership with industry bodies. He also stresses the importance of predictable, multi-year excise and licence fee frameworks, which would allow brewpubs and alco-bev operators to plan capital-intensive investments with confidence.

“Another key demand is granting infrastructure status to large hospitality projects of ₹25 crore and above, unlocking longer-tenor and lower-cost financing. Simplifying GST compliance—especially for bundled offerings across events, catering, rooms, and food and beverage—is also high on the wishlist to reduce disputes and compliance burdens,” he added.

From the confectionery space, Jacob Joy, Founder of Jakobi Chocolatier and Director at JJ Confectionery Pvt. Ltd., is seeking tax stability and manufacturing support to help Indian chocolate brands scale sustainably. “Maintaining the 5% GST rate for the next few years would give MSMEs the confidence to invest, scale manufacturing, and build brands sustainably,” he shared.

Joy points to global cocoa price volatility as a major risk, urging the government to rationalise customs duties during price spikes and explore a commodity stabilisation mechanism. He also advocates accelerated depreciation on food-grade equipment and targeted capex incentives for mid-scale investments

“Chocolate is a high-employment, women-led MSME category with strong export potential,” he noted.

At the ground level, rising costs are squeezing food businesses. Aashi Gupta, Co-founder and Marketing Head at Salt Noida, outlines the mounting pressures faced by operators today.

“From higher prices of dairy, vegetables, cooking oil, LPG, electricity, and imported ingredients to steep rentals in metro and tourist locations. These challenges are compounded by increasing property taxes, CAM charges, high commissions charged by food aggregator platforms, and growing digital marketing spends,” she added as she hopes the budget will acknowledge these realities and offer meaningful relief, particularly through rationalisation of energy costs and a fair cap on aggregator commissions, to help the sector operate sustainably without compromising on quality.

Echoing the need for structural reform, Pulkit Arora, Director at CYK Hospitalities, said the industry is optimistic about long-pending changes. “The restoration of Input Tax Credit, the recognition of the hospitality sector as an industry, and the simplification of the licensing process can significantly strengthen operational viability,” he mentioned adding that such measures would allow food companies to focus on quality, innovation, and consistency instead of navigating inefficiencies.

Sustainability and clean energy are also firmly on the pre-budget agenda. Dhinesh Kumar, Director of Finance at Sheraton Grand Chennai Resort & Spa, underscores the importance of a strong policy push for solar energy. He calls for continued rationalisation of duties on solar modules and components, incentives to boost domestic manufacturing, and measures to improve grid readiness and storage support. Access to low-cost, long-tenure financing, he says, will be vital to accelerate adoption and reinforce investor confidence in India’s renewable energy ambitions.

From the food-tech ecosystem, Sanket S, Founder of Scandalous Food, is looking for GST simplification and more balanced tax rates on processed traditional foods to ease pressure on MSMEs and encourage formalisation. He also highlights the need for increased spending on cold-chain infrastructure and steps to improve household purchasing power to drive demand. In line with Atmanirbhar Bharat, he believes targeted support for food-tech automation and smoother access to credit will be key to helping homegrown brands scale and position India as a global hub for preserved traditional foods.

Together, these industry voices underline a shared expectation from Budget 2026: less short-term firefighting and more long-term vision. Whether through tax stability, infrastructure recognition, skilling, or sustainability-focused incentives, stakeholders are looking for a policy framework that enables growth, resilience, and global competitiveness across India’s food, hospitality, and energy sectors.

In today’s competitive dining landscape, customer experience has become as important as food quality. Modern restaurants are no longer judged only on taste or ambience, but on how guests feel at every touchpoint—from booking a table to post-meal follow-ups. Improving customer experience in restaurants today is a mix of thoughtful service, smart processes, and well-trained people. To stay relevant and build loyalty, restaurants are adopting structured strategies that combine people, processes, technology, and data. Here are the key strategies to focus on:

Focusing on Experiences

Restaurants improve guests experience by focusing on making SOPs, consistent training, and constantly upgrading operational processes. To run a successful operator the great experiences must be constant and should not vary as per the staff.

For a great experience restaurant tracks the guest from the time they entre at the concierge desk, dining and the exit.

Commenting on this, Prashant Chandra, Co-Founder, Amicii said, “SOPs are set for welcoming the guest, attending the table, speed of service such as food and cocktails, and bidding farewell. This are followed consistently to make sure guests receive the standard service in every visit.”

Personal touches as attending to the guest complaints immediately, proper communication, and attention to details further improve satisfaction and loyalty.

Employee Training as Core

Team training is centered on understanding the personality of each space, whether it is the brewhouse, terrace or high energy social zones, so that service feels intuitive and aligned with the guest’s mood.

“Our teams undergo structured onboarding and regular skill building sessions covering menu storytelling, beverage knowledge, and service pacing and crowd management. Strong SOPs and technology enabled order management help streamline operations reduce bottlenecks and ensure smooth service flow even during high footfall periods,” said Sharath T. Gowda, Founder of Arena Brewhouse who also pointed that their strategy focuses on seamless coordination, clear communication and high service agility.

For Yuki, the focus is on creating a seamless dining journey where guests feel welcomed, understood and cared for at every touchpoint.

Moving further, Priyesh Busetty, Co-founder, Yuki added, “We invest significantly in staff training, ensuring our teams are well versed not only in menu knowledge and service protocols, but also in guest engagement and problem solving. Regular training sessions, preservice briefings and hands on mentoring help maintain service standards across shifts.”

Power of Personalization

Personalisation comes from observation and memory — remembering preferences, adjusting flavours to known palates, and offering thoughtful off-menu suggestions when appropriate.

Flexibility is encouraged as long as quality is never compromised. Busetty said, “Our teams are encouraged to remember preferences, recommend dishes based on past visits and adapt service styles to suit different guest profiles.”

Importance of Feedback

Customer feedback directly influences menu refinements, service training and overall experience enhancements. Loyalty initiatives and repeat guest recognition further strengthen our relationship with customers, helping us deliver experiences that feel thoughtful, familiar and genuinely engaging.

Divya Kadam, Founder, Baliboo & Bodega 39 said, “Feedback is taken seriously, not emotionally. We listen on the floor and online, identify patterns, and act fast. This directly influences service pacing, menu tweaks, and team retraining when needed.”

Busetty shared that actively collect inputs through in person conversations, online reviews and repeat guest interactions, and regularly review this feedback to identify areas of improvement.

Restaurants also check on the feedback trends on how often and repeated complaints on service or food to address the concerns and train or rectify the issues. Chandra noted that addressing the guest feedback by responding and taking immediate actions and corrective measures builds guest trust and loyalty.

Tracking Guest Experience Metrics

Restaurants use guest metrics such as repeat visit rate, complaint resolution time and online rating trends. Operational metrics such as table turnover, and order accuracy together with interactions, feedback and metrics improve the turn’s great service into a measurable and repeatable.

“We track guest sentiment and experience patterns to refine offerings, improve service touchpoints and enhance overall ambience. Loyalty programs, curated experiences and repeat guest recognition allow us to build lasting relationships while delivering experiences that remain dynamic, engaging and memorable,” highlighted Gowda.

Standard Operating Procedures (SOPs)

Restaurants use clear Standard Operating Procedures (SOPs) for tasks such as order flow, table turnover, billing, and cleaning. Technology like POS systems, kitchen display screens, QR menus, and inventory tools reduces errors and improves coordination between front and back of house. Regular reviews meeting and performance metrics help identify bottlenecks and drive improvements.

Chandra noted that the restaurant you excel in guest experience and satisfaction often has good work culture, training standards and processes making flawless operations and great guest experience.

“However, data helps us make informed decisions, but hospitality remains a human business first,” shared Kadam. Busetty pointed that these reduce wait times, ensure consistency in food quality and maintain a calm, attentive service environment even during peak hours.

From butter-laminated croissants in urban patisseries to daily bread from neighbourhood bakeries and the scale-driven output of industrial units, India’s bakery segment is in the midst of a quiet transformation. Consumer appetite for premium, fresh and indulgent baked goods has never been stronger. Yet behind the inviting glass counters and aroma of freshly baked bread lies a complex set of challenges that continue to test the resilience of bakery businesses across formats. The industry is growing at a CAGR of 9-10%, it is projected to surpass $30 billion by 2033.

Let’s focus on the key challenges pertaining in the bakery segment.

Volatile Raw Material Costs

The issue is cost volatility. Baking by nature is ingredient-intensive, and even small fluctuations can ripple through the balance sheet.

Sandeep Deshmukh, Executive chef of The BlueBop Cafe & BlueBop Bakes said, “The bakery segment today faces multiple challenges, including rising raw material costs, skilled labour shortages, intense competition, and rapidly changing consumer expectations. Ingredients such as butter, cocoa, dairy and nuts have seen significant price volatility, directly impacting margins.”

For bakeries operating on tight margins, managing these unpredictable input costs has become a constant. “Today, the biggest challenge in the bakery segment is managing rising raw material costs, especially dairy and chocolate, while keeping our product prices stable. The real test is absorbing these increases without compromising on quality or experience. Scaling delicate desserts is equally demanding, as precision and consistency are critical at every stage of production,” commented Chef Amit Sharma, Co-Founder & Chef Poetry by Love & Cheesecake.

Maintaining Freshness

Freshness draws customers into the bakeries. Clean-label, preservative-free products are now a key expectation, especially in premium and artisanal spaces.

Deshmukh shared, “To manage this, bakeries are focusing on smarter procurement, minimizing wastage, seasonal menu planning, and selective price adjustments while maintaining product quality.”

Focusing on Hygiene & SOPs

Hygiene remains a non-negotiable priority. Adding further, Deshmukh stated, “Strict SOPs, adherence to FSSAI guidelines, regular audits, staff training, and controlled kitchen environments are essential to ensure food safety and consumer trust. Maintaining consistency across batches while scaling operations continues to be a key operational challenge.”

Without clearly defined standard operating procedures, maintaining uniform taste, texture and visual appeal across batches and locations can be difficult. For brands looking to scale, the absence of documented recipes and technology-led controls can become challenging.

Getting skilled workers

Skilled bakers and pastry professionals who come with right craftsmanship and consistency is still a challenge. Sharma added, “With skilled labor shortages, we focus on building and retaining talent through structured training and long-term development. In a highly competitive and regulated environment, compliance strengthens our systems and reinforces customer trust.”

Most of the learning still happens on the shop floor, driving up training costs and extending ramp-up periods. Long working hours, physically demanding roles and limited career progression contribute to high attrition, making retention as difficult as recruitment.

“The shortage of skilled bakery professionals has led brands to invest heavily in in-house training, recipe standardisation, and process-driven systems to reduce dependence on individual skill sets,” mentioned Deshmukh who also focused on automation and semi-automation which play an important role in improving efficiency and consistency.

Not Focused on Trend

When there is trend for eg: matcha or kunafa, everybody/every brand does that rather than innovating something new in the same. There is hardly any creativity. When creativity meets innovation, brands curate a diverse offerings and taste which makes the customers wanting more.

Harsh Shah, Co-Founder of Dessert Therapy said, “We believe that brands should be a trendsetter, rather than following a trend. The major challenge in following the trend is it’s same everywhere. There is no uniqueness, so customers won’t be curious to try the brand when it becomes too common.”

With increasing competition, differentiation through fresh, in-house production, signature offerings, and strong brand storytelling is crucial. Deshmukh said, “At the same time, bakeries must stay agile to respond to changing consumer preferences, including demand for healthier, artisanal, and premium products.”

Use of Social Media

These days, everyone is so active on social media, and every brand wants to promote them through influencers. “And because of this, the primary face of the video or the first focus will be the influencer, and then the secondary focus will be on the food. Like, food takes backstage. And some influencers don’t even show much of the food of that particular brand,” said Shah.

Changing Consumer Preferences

Changing consumer preferences towards balanced sweetness and mindful indulgence push us to innovate responsibly, while supply chain disruptions are managed through diversified sourcing and forecasting. Sharma highlighted that our challenge is balancing cost, consistency, creativity, and quality to build a sustainable and trusted dessert brand.

Price Sensitive

There is also an inherent tension between premium ambition and price sensitivity. While consumers increasingly gravitate towards sourdoughs, croissants and gourmet desserts, many hesitate when it comes to paying premium prices. This disconnects between perceived value and willingness to spend limits pricing flexibility and makes sustainable growth difficult for quality-driven bakeries.

Shah pointed, “There are ingredients which is not available throughout the year. So, we import them from various countries and for that we pay a huge chunk of money. But we can’t ask our customers to pay extra for consumption.”

Supply Chain Disruptions

Supply chain disruptions are addressed by diversifying vendors, maintaining buffer stocks, and building strong supplier relationships. Deshmukh noted that adaptability, innovation, and operational discipline are key to long-term success in the bakery industry.

Use of Technology

Technology, often seen as a solution, remains unevenly adopted. While digital tools can dramatically improve forecasting, inventory management and production planning, smaller bakeries often lack access to affordable, bakery-specific systems. Hardly 20-30% of small brands are investing in tech, while big giants are already using technology and investing more in it.

With this, we can surely say that in an industry where margins are thin and expectations are high, resilience, adaptability and operational discipline are becoming just as important as what comes out of the oven.

Dining today is being reshaped by convenience, data, and experience. Guests expect seamless discovery, faster service, transparent menus, and frictionless payments. Technology is no longer behind the scenes — it directly influences how people choose where to dine, how long they stay, and how often they return. On an average, restaurants invest 20-25% in technology in a year.

Technology is expected to grow with a CAGR of 25-35% by 2030. India’s technology sector is projected to cross USD 280 billion this year. Let’s have a look at the new tech trends which are reshaping the dining scenario.

Smarter POS Integration

There is a clear shift towards systems that quietly enhance the guest experience through things like smarter POS integrations, real-time inventory tracking, or even hassle-free reservation systems that are quick and convenient and a life saver to those who get anxious or hesitant to make phone calls.

“We are integrated tech that supports our staff in a way that helps them spend more time ensuring the human touch with the guest experience is top notch and personalized,” said Avinash Kapoli, Co-Founder Kompany Hospitality who added that the focus is on efficiency, consistency, and better decision-making.

AI & Automation

AI and automation as backend enablers, forecasting demand, optimizing menus, contributing to content management is where AI adds the most value.

Commenting on this, Pankil Shah, Co-founder & Director at Neighbourhood Hospitality said, “AI and automation are largely used behind the scenes. We apply them to feedback analysis, demand forecasting, inventory planning, and internal reporting.” 60% of the restaurants are using AI as it helps them in forecasting and optimizing menus.

While Ranbir Singh Nagpal, Co-Founder & CEO, Yazu Hospitality uses automation and AI-driven insights to understand guest behaviour, optimize menus, track peak hours, and improve campaign targeting.

Use of Digital-first Operations

Digital-first operations help streamline processes, but hospitality must remain human-first, across all our projects.

Kapoli added, “We have always stayed true to the principle of keeping the consumer at the core of all decision making, and that is something that stays true here too. Tech should support teams so they can focus more on guests.”

Digital-first systems allow tracking performance across brands and locations, manage campaigns, and monitor key metrics centrally.

Sharing his viewpoints, Pankil Shah, Co-founder & Director at Neighbourhood Hospitality said, “For Woodside Inn, this means sharper operational control while preserving a warm, human-led dining experience. For our delivery brands, digital-first operations are foundational, as every touchpoint - from ordering to feedback is tech-enabled.”

“Digital-first operations help us stay agile from smarter inventory planning to marketing decisions based on real-time data rather than assumptions,” pointed Nagpal.

Focus on Hyper-personalisation

Hyper-personalisation today comes from understanding behaviour, what guests order, when they visit, and how often, which is something that our on-ground team does by building conversations and observing, rather than intrusive data use.

It isn’t about excess communication, but relevance. Nagpal ensured that whether its targeted offers, time-based menus, or curated experiences, we aim to respond to how guests actually use the space.

“Personalisation shows up through smarter recommendations, targeted offers, and communication based on ordering behavior,” noted Shah who emphasized that the aim is to feel right, not pushy.

New Revenue Systems & Data-Driven Decisions

The rise of new brands which are powered by these tech trends allows owners to launch new concepts with lower startup costs and reach wide customer base mainly through delivery apps.

Data-driven decisions and new revenue streams are game-changers for growth in hospitality. Data is about validating instinct.

“Across SOKA and Kalpaney, we closely track menu movement; ordering patterns, dwell time, and peak behaviour to understand what guests genuinely respond to. That insight allows us to build revenue streams that feel natural, for example, limited menus, seasonal drops, bar takeovers, and experience-led formats rather than constant expansion, mentioned Kapoli.

As per the survey, 60-70% of the restaurants in India focus on data-driven decisions. Although, they are not fully dependent on it but do take the valuable insights.

“Data allows us to experiment confidently — be it events, collaborations, day-part menus, or beverage-led experiences,” noted Nagpal who said that it helps identify what truly adds value and scales sustainably. For Shah, data uncovers chances for special menus, collabs, seasonal stuff, new setups. “We test, tweak, and roll out based on facts.”

Adding more, Kapoli stated that for SOKA, data helps us refine cocktails and programming without compromising creativity, while at Kalpaney it ensures the menu stays tight, relevant, and repeat-driven. Data gives clarity; decisions remain human.

Digital and self-service ordering

Digital and self-service ordering is seen majorly in QSR brands like Jumbo King, Burger King, McDonald’s and Dominos among others. It’s still new in India and there are 30-40% of restaurants in India which focuses on self-ordering.

One can scan the menu and order the food and beverages directly and you can receive the order in your table. It’s all about using technology where it enhances efficiency without removing warmth. Nagpal sees digital ordering as an enabler, not a replacement.

The future is a hybrid model — technology handling efficiency, while hospitality remains deeply human. “While digital tools can support operations in the background, we believe the future, especially for experience-led hospitality, is deeper personalisation through well-trained teams and integration of systems,” shared Kapoli.

The future lies in intelligent integration. It’s like that saying: Technology should be invisible to the guest and powerful for the operator.

The healthy eating trend, long established in the food and beverage sector, is now becoming more visible in India’s café space. Coffee conversations are shifting away from strength and intensity towards how a cup feels over time: on the stomach, energy levels, and daily routines.

This shift is playing out alongside a fast-growing coffee market. India’s coffee industry, valued at USD 1.82 billion in 2024, is projected to reach USD 2.85 billion by 2030, while the specialty coffee segment is expected to more than double to USD 6.28 billion, according to Grand View Research.

Operators say this growth is no longer driven by flavour experimentation or café aesthetics. “People are less obsessed with ‘strong’ now and more curious about how coffee makes them feel,” said Dhiraj Agrawal, Founder of Ground Zero Coffee Roasters.

Customers, he noted, increasingly describe their experience in physical terms: whether a cup feels acidic, jitter-inducing, or comfortably energising, signalling a more intuitive, body-led approach to consumption.

Wellness Without Label

While the global narrative often frames this shift under the umbrella of “functional coffee,” Indian operators remain cautious about adopting the terminology outright.

At Roastea, the focus remains firmly on taste-first comfort. “Our guests are not very coffee-specific or driven by gut health or energy-level considerations. They come here for comfort in a cup. Taste is what ultimately matters to them,” shared Karthikeyan NR, Head Barista Trainer, Beverages and Innovation at Roastea.

Yet, even as cafes downplay explicit health positioning, the broader consumer environment tells a different story. India’s functional drinks market is estimated at USD 3.79 billion in 2024 and projected to nearly double by 2030, while the functional beverages category could grow to USD 16.25 billion by 2033, according to IMARC Group.

So, it is clear that wellness is shaping choices, but quietly. “In India, it won’t be marketed loudly as ‘functional’. It’ll just become better, more balanced coffee,” Agrawal explained, adding that cafés succeeding in this space will be those whose offerings fit seamlessly into daily life without side effects or overt claims.

Rethinking Coffee

For some players, the answer lies not in adding ingredients but in rethinking coffee from the ground up. Shruti Ajmera Reddy, CEO of BeWild Coffee by Beforest, said customer awareness is increasingly tied to origin and processing rather than caffeine levels.

“Many consumers associate better-grown and well-processed coffees with fewer discomforts, even if they don’t articulate it in scientific terms,” she added.

Beforest’s approach centres on farm-level and post-harvest innovation, including controlled fermentation and anaerobic-style processing to improve balance and clarity in the cup. “If farming practices, processing, and fermentation improve balance and reduce harshness that aligns with our philosophy,” Reddy noted, emphasising that any experimentation must remain intrinsic to the coffee rather than layered on top. For her, credibility in wellness-aligned coffee comes from transparency and traceability, not from turning coffee into a supplement.

This philosophy reflects a broader sentiment among roasters that long-term scale will depend on improving drinkability rather than chasing novelty.

New Formats, Familiar Rituals

In the café ecosystem, operators are responding to these evolving preferences through format diversification. At Ground Zero, customer feedback from those unable to handle heavy espresso daily prompted a shift towards filter-forward brews and more balanced roast profiles. Agrawal mentioned that the intent was not innovation for its own sake, but to make coffee more sustainable as an everyday habit.

Roastea, meanwhile, has expanded beyond traditional espresso-based offerings to include barrel-aged cold brews and a wide range of manual brewing methods. According to Karthikeyan, this reflects both competitive pressure and a more informed customer base.

As Indian metros move firmly into what he described as the third wave of coffee, with early signs of a fourth-wave micro-niche, consumers are increasingly open to exploring how brewing techniques affect flavour, mouthfeel, and comfort.

These shifts are supported by rising domestic consumption, which reached 96,000 tonnes in 2024, up 5.5 per cent year-on-year, alongside plans by the Coffee Board to expand café outlets across the country.

Functional Coffee and Regulatory Guardrails

While ingredient-led functional coffee remains a small niche, its presence is growing. Mushroom-infused coffees, chicory-based blends, and low-acidity positioning are already visible in India, mirroring a global market where mushroom coffee alone is estimated at over USD 2.7 billion. However, operators are acutely aware of regulatory guardrails.