Global convenience store market has been growing rapidly along with te rising income and improving lifestyle across the globe. Convenience stores in India are still at a nascent stage, providing huge untapped market potential for future growth. Currently, convenience store market is approximately valued at INR 1 bn and is expected to grow at a CAGR of 2% to INR 3 bn in 2018.

In 2012, India´s central government approved retail reforms and these market reforms paved way for retail innovation and foreign direct investment in single- and multi-brand retail. Today unorganised retail (independent local stores) still amounts for over 90% of the market and the typical Indian retail shops are very small. In fact, over 14 million outlets operate in the country and only 4% of them being larger than 500 sq ft in size. However, according to PWC organised retail is growing by 15 to 20% per year and there are multiple brands driving this development – also in the convenience retailing space.

The prediction has been realized, but convenience stores, not large supermarkets, are the favored channel.

How Convenient It Is?

Market analysts have found that consumers now prioritize convenience when choosing shops. They are no longer excited about the opening of new hypermarkets as they were in the past, but often prefer to shop at convenience stores near their houses.

Supermarkets and hypermarkets impress people with colourful opening ceremonies and good interior design, but the products displayed are nearly the same. Instead of spending time driving to large supermarkets and paying for products she does not need, it is better to go to convenience stores nearby. Convenience stores offer the most essential goods, so she avoids wasting money on unessential items.

Samir Modi, Promoter, 24*7 is passionate and serious about his ambitions for India convenience retailing. They have an innovative app with product specific loyalty and couponing mechanics. He says,” We appeared to 7-Eleven in the Nordics as a global best practice on mobile marketing and the team is setting the standards for digital customer engagement in the Indian market.”

"We have changed our technology across the stores. We have invested Rs 30 crore last year on technologies like point of sale, analytics, syncing online and offline and empowering the manager”, Modi added.

If convenience stores want to compete and grow, they will need to increase their share of the food-service market, including adding healthier options.

Pros

Younger consumers (ages 18-34) are overwhelmingly more favorable toward convenience stores than other age groups. Convenience stores have become the preferred shopping destination for the Indian urban consumer demanding for convenience, quality & service. Unlike other options, the ease of grabbing food with an array of display pertaining to the likes & dislikes of the consumers is considered to be the most preferable one.

Consumers are also more aware of the convenience store industry’s efforts to provide fresh, healthy food. Mostly scattered around the towns, consumers are trying their hands on products in the most convenient way possible, with more speed and easily portable.

As compared to sales & penetration, hyper markets are losing the game to convenience stores, as more and more people, especially the young ones are highly favorable of this emerging channel.

Lagging Behind

Convenience stores in India are only 75% as efficient as stores in the US in terms of display, accessibility & service. Convenience stores are expensive as compared to other local stores. With variety of options under one place, the prices are high i terms of the quantity & quality. Food products expire, even if they are well-preserved. You can limit these losses somewhat by stocking snacks and drinks that have extended sell-by dates, but it can never be completely eliminated. Even when your customers are purchasing popular products on a regular basis, all it takes is one lull in the action to have an entire inventory purchase go bad on you.

Caring about the people who frequently visit the store will give it a strong reputation in the neighborhood. Once you achieve that, you can begin building a foundation for long-term success.

Shashwat Goenka, Chairman, RP Sanjiv Goenka Group says,” Grocery modern trade itself was a nascent industry at the time and both consumers are retailers were grappling to find a suitable business model. Some of the key learnings I had early on were the unpredictability of retail, and that India is extremely diverse from a consumer preference standpoint, and one size does not fit all.”

Influencing Consumers

In India, the digitally connected younger generation is driving the trend for increased visits to convenience stores. These smaller households are focused on shopping for what they need over the next couple of days, and they’re heading to smaller stores to get it.

When asked about the consumer demands, Goenka said,” The Indian consumer is gaining more exposure through easier modes of travel to other parts of the world, as well as through social media and the internet. Hence, their demands for more global products and more refined products to meet their specific requirements are also increasing.”

The increased availability of fresh and healthy products in convenience has changed significantly over the last two years, and c-store retailers have continued to invest in refrigeration to meet growing consumer demand—but there is still significant room for growth in this area.

“Our stores offer an international shopping experience stocking wide variety of products and provide an array of services, round the clock”, Modi said.

Being India’s largest importer of fresh fruits, IG International supplies high-quality produce in India. The global import and export giant has been investing in infrastructure to establish its position as a leader in the imported fresh fruit industry. It handles volumes to the tune of 2000-4000 feet refrigerated containers from over 22 countries across the globe. In India, the brand has facilities in Mumbai, Chennai, Bangalore, Jaipur, Chandigarh, Theog and Amravati. IG International also manages the distribution of the goods through its 28 wholesale outlets spread across India and has become a leading marketer and distributor of nutritious, high-quality fresh fruits in the country.

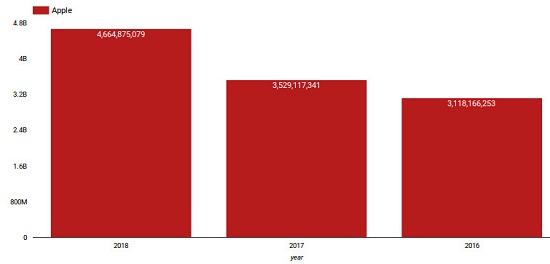

The fruit importing brand has an association of over ten years with Stemilt Growers, the Washington-based leading organic fruit growing, packing and shipping company. Keeping in mind that apple consumption picks up in winter, IG International recently announced to import seven varieties of apples from Stemilt Growers.

IG International aims to import 20,000 MT of apples in the new season.

In an interview with Restaurant India, the president of Stemilt Growers, West Mathison speaks about the brand’s association with IG International and India as the market for imported apples.

Association with IG International

West Mathison, President of Stemilt Growers

We are associated with IG International for ten years now, and it gives us immense pleasure to have contributed to their growth journey. IG is our largest export customer and we see the further potential to serve IG as they grow their distribution across the country.

Imported Apples Market in India

Stemilt Growers is renowned for its commitment to growing high-quality fruits organically. The Indian market has always been a very attractive market in terms of business as we only offer superior-quality, fresh and great-tasting fruits which find ready acceptance with discerning Indian consumers. With the start of this new season, we look forward to serving more Indian customers with the choicest and freshest fruit varieties.

Consumption Trends among Indian Consumers

Globally, the apple industry has seen new varieties and flavours. As a result, the global supply has increased to serve the growing demand around the world. Stemilt is very interested in India because it is an apple-eating country. The local production of Indian apples has built demand for apples and, therefore, the quick acceptance of imported apples. We also see an opportunity to bring these new apple varieties to the discerning Indian consumers.

Data on apple consumption in India as shared by Stemilt Growers

We aim to send 20,000 MT of apples in the new season. There will be seven different varieties of this fruit being imported in India–Red Delicious, Royal Gala, Granny Smith, Pinata, Pink lady, Honey crisp, the organic variety with the first two will be the primary varieties. Organic apples will cater to the health conscious Indians.

With the increase in the effective cold chain, the Indian market can serve more exotic fruits to more cities. As a result, the demand for exotic fruits is exploding in India. Quality drives consumption and IG’s broad distribution network is creating demand around the country.

Product Pricing

We see a strategic advantage in the diversity of India’s economy. There is a demand for higher-priced organic fruit and new flavour varieties. Still, the majority of the Indian market is value driven for sweet crunchy apples. We see growth opportunity for both the higher end and value-driven categories.

There is no denying that the Millennial demographic groups are very much on the radar of the hospitality industry at the moment. Whether they’re staff or potential customers, they really are becoming a priority across the whole sector.

Understanding the need of the consumers and millennials in particular is the need of the hour. Millennials are vocal and this differentiates them from the customers. With the amplification of social networking, every consumer is a potential broadcaster. Unstoppable forces of demographics, changing values and hyper connectivity will be changing the rules of consumption in the near future.

Commenting on the same, Sanjay Sharma, CEO, MTR Foods said,” As a legacy brand, getting to the mind of the millennials is what our brand is focused on. One may not be able to personalise the product but certainly the experience.”

What Will We Be Eating?

Millennials eating habits are very different from their parents. They have a strong prefernce for convenience an eat at restaurants more than any other generation. What is surprising is that unlike other age groups, millennials continue to eat prepared foods even as they grow richer.

Brands earlier used to be inspirational in nature. With the millennial drive in the industry, they have changed this theory. “Be associated with brands that has responsibility towards its people”, added Sharma.

Millenials can recognize the changes and act accordingly with their tastes and preferences. Today, you can individualise and conceptualise your products which was earlier not possible. “At MTR, we try to recognizes these changes and cater to the needs of the millenials”, said Sharma.

The Surrounding Challenges

Just as consumers change, brands too have to change. The emergence of millenials is going to change India. The change has to be rapid with the change in consumer norms. Talking about the Food Industry, Sharma said,” The change will be dramatical.”

“Earlier generation used to spend more time in the kitchen whereas Indians today are unable to mange with the fast moving world. I have been craving for consumers to say convenience”, added Sharma.

Moving to the Values

FMCG companies should work more closely with retailers. In India, access to information is a revolution in itself. Everybody has an access to real time information. Undoubtedly, influencing is more important than communicating. Big players in the industry should create experience and maintain the balance.

Vikram Agarwal, MD, Greendot Health Foods said,” One person’s outlook is thousand people’s experience. “

Mass Markets of the future will be driven on 3 fundamentally different principles: trust, values and personalization. Consumer brands and retailers can appeal to future consumers and leverage new technology-enabled ways to influence and sell.

“Today, it is difficult to understand who are your consumers and to whom are you selling your products”, added Agarwal.

The inputs were taken at the FICCI Annual Summit ‘MASSMERIZE’ conference.

How the idea of starting a venture of your own came into your mind?

The company is in existence since past fourteen years. The brand is three years old as we were largely into export. Now considering the health aspect of peanuts, we are the creators and largest exporter of value-added peanuts from India since couple of years now. The main focus is to provide world-class product to Indian consumers. Even before starting something like this, we used to work with farmers. When Fredrick came to India, he came to my office where we shared mutual goals towards contributing for the farmers. We collaborated and this how the idea came into my mind.

How does your brand contribute for the farmers?

After the collaboration with Fredrick, we decided to have a Fredrick brand which will be making a profitable business sense with inclusiveness. Farmers will get direct benefit from the brand success. This is how we are contributing to the farmers in our own way.

What made you do something for the farmers while running a brand of your own?

After being into the same business for fourteen years now, you reach a stage where you want to do something for the society. Helping the farmers for me was my own way of returning things to the society. That was the whole idea about how can I give back to the society and I came up with this conclusion. People who really work hard should get their money. That was the thinking behind doing something for them.

Why name your brand Nutty World?

We as a company aspire to be the largest nut based company in India in the next decade. That is the reason we wanted connections with the nuts so that the whole team stays focused. That’s how Nutty World came.

Tell us something about your distribution network.

Currently, our brand is very famous in Russia. We have started with the North India distribution and are looking forward towards making it a success. We are having 22 super stockiest and nearly 80 distributors in North India. After Russia, India is the second country where we are very famous. South India will be having around 100 distributors in the upcoming time. Our aim is to have 2000 distributors in the next five years.

Who are your target group?

Urban consumers who want a quality product out of nut are our target group.

What is your expansion activity right now?

Currently, we have got one small factory in Vijayawada. We are currently planning to come up with three more factories in the future.

Venturing into residue farming space

I used to enjoy my visits to home stay farms and that’s where the inspiration to start Earth Food came from. We realised that residue free vegetables were difficult to acquire in the local market and hence decided to opt for residue free farming. The produce is much healthier and cuts the risk for any type of allergies that arise from vegetable residue. In the coming future we wish to expand our range of products and also venture further in residue free fruits. We have 40 vegetables and we want to increase numbers significantly. We have also acquired 200 acres additional land around 40 km from Malthan. Our objective is to provide fresh and residue free fruits and vegetables first in Pune market and by next year enter Mumbai and Bengaluru. We have already signed contract with SGS for GLOBAL GAP CERTIFICATION.

Working on ‘Farm to Fork’ concept

Farmed in a natural way, Earth Food, a product of VTP Foods, offers produce reaching the end-user in the most hygienic, healthy way possible. Earth Food offers a wide range of fruits and vegetables that are grown in the purest form without using harmful chemical fertilizers or pesticides and they are sold to the customers without adding preservatives and synthetic food enhancers. The produce are residue free and our philosophy of ‘Farm to fork’ aims to minimize human handling of the produce to ensure high quality. We have established complete supply chain from farm to customer.

A wide range of products

We have a wide range of products at EarthFood and we are constantly working to get new line of products with a shelf life of seven days. Currently we have 36 products which are available for purchase. Our produce consists of the Iceberg Lettuce, Capsicum, Aloe vera, Broccoli, Gawar, Methi, Red Cabbage, Bharta Brinjal, Coriander, Cherry Tomato, Green Chili, Thai Chili, French Bean, Lemon Grass, Sponge Gourd, Basil, Bitter Gourd, Pak choi, Bottle Gourd, Celery, Lady finger, Parsley, Beet Root, Zucchini, Tomato, Green Roman Papaya, Oregano, Curry Leaves, Thyme, Green Pea, Mint, Drum Stick, Rosemary, Colocasia. We are also planning to introduce hydroponics technique.

Serving on quality

Quality has always been our USP. We believe in minimum use of hand touch in our farm to maintain hygiene. We also have a certified quality control team which is taking care of the product at the pack house and then again it is checked at distribution center. We have a detailed end to end process to maintain health and hygiene of every product that reaches to our consumers.

Health wave is driving the biz

People are becoming more and more conscious and prefer sustainable and organic food. The behavioral change is slow but steady. We expect the current demand to rise in the future leading the way for more organic farming. Also, VTP Earth food offers residue free vegetables and fruits, meaning they are extremely safe to consume. We follow a farm to fork philosophy with minimum human handling that ensures superior quality. That is what differentiates us from our competitors.

Expansion plans

Currently we have 100 acres of land and we are planning to expand from 100 to 1000 acres in the year 2017-2018. We have 8 acres of land which is dedicated to green house and 7 acres will also turn into green house. In our expansion plan, we will dedicate 60% land to fruit plantation and 40% to vegetable. Additionally, we have recently started our online delivery services to make our customers life faster and easier. Recently we have acquired 200 acres of land at Belwandi, which is 100 km away from Pune. The purpose is to increase the production and add new variety to Earth food. And, in coming 3 years, we have planned to expand the production from 300 acre to 1000 acre of land for more and more supply.

Value for money pricing

We have sensitized the pricing according to the Pune grocery market. We are highly affordable for all the classes. Though, these kinds of products usually cost up to 0.5% to 2%. It is a better option than the regular vegetable that we find in market in terms of health. We are cost effective and our pricing justifies that it will not get affected by the flexibility of the change in market price

Market trend

India is a huge market for residue free fruits and vegetables. Though, the residue free/organic food market in India is growing at 25-30 per cent, but the awareness about this kind of farming is still low in India despite huge spending. The government has also been supporting, according to the recent study which projected that the domestic organic food market would touch $1.36 billion mark by 2020.

Talk to us something about your company?

Kitchenrama is a Delhi based company and I am heading it as a Director. I have been in the industry from 1987 and I started my company in 2001. Prior to this, I used to run a similar company by the name Fast Food Systems. And, since we were targeted as a company who only deals in fast food equipment, I had to re-name my company.

What is your market presence?

I have three verticals- Concession equipment and Supply that is cinema kitchen equipment and supply. We do HORECA which is hotel and restaurants and retail refrigeration where I do refrigeration for retail which is used in companies like Food Hall and Big Bazaar.

Which is the biggest vertical in terms of revenue?

Concession is the biggest vertical in terms of revenue where we have 99.9 per cent market share. We have supplied to every single cinema in India.

Which are the countries you are exporting your equipments?

We are exporting to the US, Europe and we fabricate a little bit here in India.

Who are your major clients in restaurants and hotels?

Café Delhi Heights, Nando’s is our major client in restaurants, whereas, Lemon Tree Hotels and Redfox hotel are in hotel industry.

What is the growth you are seeing in the segment?

There is tremendous growth coming in the segment. And, the growth says that food market is growing at somewhere between 18-20 per cent. Delhi alone has 97000 restaurants. Trend is healthier. Everyone is today trying to eat out. If people get food at convenient prices. The industry is bound to grow at double the prices we are sitting from now. It is on a bigger growth path.

Which your main targets focus in terms of getting business?

My focus is on refrigeration. We are one of the top sellers of Japanese refrigeration. We also sell Dish Washers and other such equipment. In HORECA my majority of the sale comes from Dishwashers and Refrigeration.

How are you pricing the equipment?

In terms of pricing available, Japanese technology refrigeration is available at a price of Indian made refrigerators. The electricity consumption on those refrigerators is half than what Indian manufacturers are today making it.

Our two door refrigerator would cost around Rs 75000-80000.

Are you also importing to other countries?

We are importing to countries like South East Asia, Indonesia, Cambodia and Thailand amongst others.

What is your expansion plan?

We have just launched the under counters. We are looking at doings bottle coolers, glass door units, sandwich units. And, these are the newer products that are coming up.

When did you start Choudhery cheese Bazar?

Choudhery Cheese Bazar was started by our Chairman, Mr. Sushil Choudhery, during 1986.

What are the product categories?

We are serving a wide variety of cheese, cottage cheese and other cheese products.

How do you decide on pricing?

Pricing is decided depending upon the climate and availability of milk & other ingredients etc.

From where did you source the raw material?

We source the raw materials partly from Haryana and U.P.

Are you also supplying to Restaurants and Hotels? Name some?

Yes. We have been supplying to many Hotels and Restaurants like The Surya, The Taj Group of Hotels, Sky Chef etc.

What about your retail presence?

Yes, we are starting retail presence in Delhi at about 800 Retail Outlets. We have also tied up with Spencer’s Retails Limited at 5 locations and 180 Retail Outlets of Easyday.

Where do you sit in terms of Revenue?

We do not disclose Revenue generation as a company policy.

What is the expansion plan?

We have an ambitious expansion plan as presently we are making only Cheese but are now focusing on Futuristic products and are going to introduce Butter, Ghee, Paneer, Permeate Powder, Dahi Paneer and Whey Protein Powders etc.

How many cities you are present? Are you also exporting to other countries?

We are present in major cities all over India and are planning to go more interior in small stations. Our export branch is opening up in next six months.

What is the growing challenge in the business?

Milk scarcity and increasing trend of raw material prices are the growing challenge & threat.

How is your cheese different from others?

We use very premium quality of cow/buffalo milk. We have dedicated team to source rich quality of milk and, therefore, our cheese is different from others. We have ISO HACCP Certified Plant and all ingredients we use in our cheese products are very rich in nature. We don’t compromise on quality as our company’s motto is offering quality and not quantity.

What was the idea behind starting Nature’s Hut?

I started Nature’s Hut in 2008. We are making our products from fresh ingredients and we don’t preserve the raw materials. We use chemical free raw materials. We supply the raw materials from Kandi forest area, the unit we have in Himachal belt.

What is the product range?

We have some exclusive products like fruit barfi. The concept is that the traditional sweet has khoya, sugar, ghee and oil and it all have adulteration and we are making sweets without all these ingredients. And, our barfi is made up of fruit pulp, almonds and brown sugar which have a shelf life of four months. Apart from that we have some natural anti-oxidants, unique teas from amla, crushes. We are organic certified. We have apple cidar vinegar, jamun cidar which is different from other cidar because we are making it from fruit juices and not extracts.

What is your market presence?

We are not commercial; instead we are selling products through our retail outlets. We have 25 outlets, 14 in Himachal, 4 in Uttrakhand and 6 in Rajasthan.

Who are your target customers?

We are targeting upper middle class crowd. We are not focusing on masses because our product is a high end product. We give small quantity with high quality. For ex: we make sweet lime pickle and if you taste that pickle you will find that it has many herbs and it solves every digestive problems. So, with people we are selling the finest products and that’s why the rates are not competitive. Our client is happy with the product and the reputation is very good.

Which are the places we can find you?

We are selling at tourist places only. We are not selling at plane areas. We will cover entire India tourist places. By 2020 we will open 250 outlets at these locations.

What is your expansion plan?

We are working on a strategy to cover tourist places first and we will cross 250 stores by the end of 2020 that time we will approach Hyper city, Big Bazaar and more in metro cities to provide us a space to open our brand. The rental is very high at these markets and that way it’s not possible to cover the ROI that we get presently.

We are also working on some good products. Gluten free products and good quality wine.

What is the average footfall at your outlets?

Foodtfall depends on area to area and season to season. This is a tourist season so we are getting around 80-100 footfall at a single outlet daily.

Do you have any franchise outlet? What is the average cost for a franchise outlet?

We are company owned outlets. It costs around Rs 15-20 lakh on an average to own our outlets.

Where is the manufacturing unit located? Which is the top selling product?

We are having two manufacturing unit- Talwara and Patiala. Barfi is the highest selling product.

Tell us about your business in FMCG?

We are 100 per cent exporters poised to give quality. We have over 2000 FMCG products. We are trying to give the same quality in India that we are exporting to the international market. Our focus is on food because people today are more conscious about their health. What they are eating is adulterated or not. So, they know the quality, they know the pricing. We are trying to give value for money products.

What made you enter into the FMCG business?

There are lots of issues arriving in last few years. Some of the MNCs are having problems in quality products and we saw something negative in the quality. So, to cater to the quality we entered into the business. We work on the principle of quality.

What is the supply chain process?

We are basically running on three formats, general distribution- we have launched 100 plus products, for retail stores Marya Day is opening its own retail stores. Meanwhile, we also supply to restaurants and hotels into institutional sale.

How many outlets you are planning?

The first outlet is opening on 5th of June. We are opening three stores in Bareilly, one each in Moradabad and Aligarh. So, we are opening first five on the same date. And, we are already targeting 100 outlets by end of 2016.

What is the contribution of food in your overall business?

We are getting around 72 per cent of business from food only.

What is your focused food category?

We are selling mustard oil- pure kacchi ghani, salt, iodine salt, noodles, snacks, spices amongst others and that will be our focus for this year.

Where is manufacturing unit located?

We have different plants around India- we are having plants at Bareilly wherein we are manufacturing bakery, confectionery, atta, snacks, and spices plant is in Noida. We have two metric tonne of spices production daily, we produce around 6000 litres juices per day, and we have around 150 litres of mustard oil and 300 kg of noodles production daily.

What is your view on FSSAI law?

FSSAI law is very apt. If government has set some standard manufacturers should follow it in order to deliver quality products.

How about your market presence? What is expansion plan going forward?

We are present in 19 states in India. We are exporting to Middle East, Africa, America and other global markets. We are targeting rest part of India, Africa.

How was the idea to start ‘Nutty Gritties’ conceptualise?

Our family started the business of dry fruits in 1887 and my family was the trader of Californian almonds in a big way. I have always seen people in the business and I made my business plan while I was studying in California. I read about the concept, thoroughly planning to make it a healthy product. I got great experience abroad working with couple of companies. I came in 2009 and launched Nutty Gritties and initially we started with couple of basic products like almonds, cashew, pistachio and then we did little bit innovation with packaging, making it more convenient for customers in 20 gm, 25 gm packaging. Over the years we have really innovated our products, packaging and we try to offer customers a new experience. We really want to keep customers in our product and we really care want their engagement.

How often do you innovate your products?

We are constantly working on new innovations and new products. We also supply lot of products to the catering segment. And, if a customer comes to us and asks for a customise product, we also do that. But for the retail market, once a year we come up with a new product.

How about your supply chain network?

We are not supplying to hotels and restaurants right now, but we are working on a ratio to partner with them. They can either pair to put it as a product in their premium bar or to serve with coffee. With our products we really want to satisfy them that they are getting something really delicious and it is healthy too and we are working on such products to cater to this segment. In terms of HORECA we are supplying to railway channels and couple of airline channels and in the past we have supplied to cinemas and right now also we are supplying to some cinemas- M-cinemas, Taj catering for some international airlines.

How about your retail presence?

For retail segment right now we have over 100-150 premium stores in Delhi- modern trade has been a major channel for us. We supply to Big Bazaar, Aditya Birla Retail, Nature’s Basket, Le Marche, and Modern Bazaar amongst others.

How friendly you’re to e-Commerce segment?

Online segment has made the world a small place. On online segment we have our own e-Commerce website plus we are supplying to other e-Commerce website as Snapdeal, Amazon, Flipkart and we have been getting orders from interiors of Andhra Pradesh, UP, North East and even tie II and III cities.

What is the ratio of orders from all channels?

Most of the orders come from modern trade, followed by institutional segment and e-retail and online.

What new can we see at Nutty Gritties?

We are coming with a healthy snack which is delicious and also healthy. It is on line of something on-the-go.

How do you get the supplies of all the products?

We export most of the products ourselves and since our family business is one of the largest importers of dry fruits in India, we do not want any kind of contamination in product quality.

When did you entered into the refrigeration business?

Elanpro started its journey in October 2011; we started small as a strategy that we will only work with our own brand because most of the company want to promote the global brands. We realised that in India if you really had to grow and want to become big you can’t promote multiple brands. And, when the global company enters India they take you for making the product big in the region and when the product becomes big they either appoint multiple companies or directly enter into the business.

How has Elanpro grown over the last five years?

We are today one of the fastest growing and among most of the profitable company. Elanpro is today a reliable product in the refrigeration industry. We are associated with something which has quality.

What are the different segments you are catering to?

We are only focusing on refrigeration. Our major focus relies on- HORECA, Retail, Life Science. On the HORECA and retail side we strongly focus on beverages, beer company, milk company, Pepsi company and now we are introducing a product from Italy that will be for frozen beverages and frozen carbonated beverages.

Which is your top revenue generating segment?

Retail gives larger revenue because customers like Pepsi, Coca Cola, beer companies who are placing themselves in retail. And, for us retail is a bigger market. Retail has the major growth. Almost 55 per cent revenue comes from retail, 35 per cent from HORECA and the rest from the life science.

Can you share some of the top hotel and restaurants where you are supplying Elanpro’s refrigeration?

We work with almost all the hotel chains. We work with Taj, ITC. We work with brands like Cafe Coffee Day and Travel Food Services (TFS). We work with The Beer Cafe. We also give equipment to people like Pepsi, Coca Cola, Kingfisher, Foster.

Which are your major countries in terms of importing the machines?

We have major imports coming from Italy, China, Turkey, Spain, USA, Latin American countries.

How about the competition in market?

There is no one single competition there are multiple competition. When I look at retail, I have competition from Voltas, Blue Star carrier, but they don’t have upright. If I look at HORECA segment we may have competition from Electrolux, Foster or other big companies which are there. But not many companies are present in bar refrigeration. They are into icing. We have segment vice competition and not a pan competition. In our entire segment we are a leading player.

What is the major challenge growing your business in India?

We are heavily affected by the change in exchange rate because that deteriorates our entire profit.

Do you have a target to focus on refrigeration or we can see you entering into other segments?

We need to focus on refrigeration. We are closing 40-45 per cent growth as compared to last year. We see refrigeration as a huge potential and India being the hot climate and most of our restaurant, dhaba and bars do not have proper refrigeration equipment. So, we see a huge potential in the Indian market.

What is your expansion plan?

Our expansion is going to be in two ways- we are going to penetrate more and more in B and C cities town. East is becoming a major area for us. We are entering northeast. And, on the product category we are getting more and more into HORECA segment product catering more to restaurants.

Brief us about your product?

Vini’s sauces is a brand that caters fresh sauces market segment. We make fresh pizza, pasta and other sauces without using any preservatives.

Currently, we have 14 kinds of sauces in our product line. We started with four flavours in 2013 and today we have expanded to 14. Our products include six types of red and white pasta sauce, basil pine nut pesto, salsa and mango salsa, hummus and periperi hummus and Greek dips.

From where do you source the products?

All our products are self-made, under my supervision.

What is the major challenge you faced in retailing?

Distribution is the biggest challenge for today. As a product is made fresh and there is no added preservative, it has a shorter shelf life. Distribution needs to be done in a day or so, making the sauces and delivery to be under controlled temperature conditions. Currently, I have a delivery system that is made in the morning and sent out in next 24 hours.

How do you decide pricing for the Indian market?

Pricing is very subjective and has nothing to do with the cost of making the product. It is more of a perceived value. In our case, the price of ingredients are fluctuating based on season and produce in a particular season. We absorb these fluctuations and not let the customer feel the heat. While our end product is an artisan product–hand made at a smaller scale, our pricing is more for the masses. We want masses to taste global flavours at prices that are easy on the pocket and they don’t have to think twice before spending on our products.

What do you do to ensure the quality of food going out to the customer?

I am 200 per cent involved in the manufacturing process, so I ensure all is being done to maintain the quality and taste of the product. I also believe that a good product can only be made if the base ingredients are of great quality. When we started, I myself use to go and pick up the best ingredients from the market. Now, we have tie ups with vendors who provide us with the best vegetables and herbs.

You also supply to restaurants and hotels. Please name some?

There are restaurants like Hungry Lion, which uses our Pizza Sauce. A café called Tea Brew, which uses hummus. It is supplied to Big Basket also.

What is your expansion plans?

Currently, we are only looking for organic growth. Our USP is “Fresh no preservatives” product, we do not want to get into industrial scale production yet. We are still working on how to expand without losing the “Fresh“ tag on our product line. May be in next couple of years, we will look at expansion by franchising to other metros.

What’s the source of funding? Are you looking for any investment or fund raising any time soon?

At present, we are self funded and looking for more funds, once we are ready for expansion in two years.

Brief us about your product?

The product range includes idly and dosa batter of one and two kg parotas, which include Malabar and whole wheat parota and whole wheat chapati. All these are made from fresh ingredients and absolutely no chemicals or preservatives for people to enjoy healthy, traditional home-style food, just the way they make it at home.

From where do you source the products?

All ingredients, raw materials that go into making our products are of premium quality. It’s sourced from across the country and from trusted partners who have been with us for long.

What is the major challenge you faced in retailing?

Like other FMCG brands, retailing is very crucial for us. Our products are replenished on an every-day basis to retain the freshness and reach the consumer.

The major challenges we face are in making the product visible amongst the clutter and the actual available physical space at stores and chillers. To maintain our quality, it is very important for us that our products be stored in proper chillers with the right temperature. Another challenge is to ensure that fresh products reach the stores every day. The logistics and the sheer traffic on Indian roads today is one of the biggest challenges we face every day.

What do you do to ensure the quality of food going out to the customer?

iD follows good manufacturing practices and uses state of art equipment’s. All food products are prepared in ultra-hygienic factories. The products are tested by the management before it goes to the market. And as mentioned above, we replenish our stock at the retail store almost every single day.

How do you decide pricing for the Indian market?

Pricing decisions are based on the category we operate in and a balance between internal costs and what customers are willing to pay.

You also supply to restaurants and hotels. Please name some?

Yes, we do cater to restaurants and hotels. There are a large number across the country, which ranges from super premium locations to mass Darshini kind of outlets.

What is the supply chain process at your end?

We have a cohesive and seamless supply chain process. All products are made fresh and sent to the market on the same day. We start our supply in the morning around 4am and see that they reach shelves at stores latest by 12 noon to maintain freshness.

Since the products are highly perishable, our team visit’s each store every day. We work on a zero inventory model, where the products are discarded post the shelf life.

What are your expansion plans?

We are planning to diversify in many cities primarily in south and the UAE. Also, new dishes like idly rava batter, vada batter and value added dairy products would be introduced.

What’s the source of funding? Are you looking for any investment or fund raising any time soon?

Funding is needed for expansion to newer territories, marketing and investment in new plants. We are in the process of evaluating various options that’s available.

How and when Twiss came into existence?

Twiss was launched in UK in 2011. It is a combination of two fruits or herbs Complementing each other and giving new twist to its delivery in taste and that’s why we call it as great Twiss. Mango itself is a great testing food, but by adding lime we just made it taste better. This is how the whole idea took place and we launched the brand. The brand is now widely accepted and doing reasonably well in UK.

Tell us about your brand and the flavors it offers?

In the sparkling fruit juice category we have launched four products namely mango with lime, passion with orange, lemon with mint and apple with blackcurrant in 250 ml can priced at Rs 40. The shelf life of our drink is 18 months.

We will not say we are organic. There is a small niche of consumers who are talking of organic, but the mass consumer still consumes the normal products. Our products contain Argentinean lime, it’s not very limy, but it’s a very smooth. We have got our established product range existing in UK. We have got a pipeline of more quirky flavors meeting Indianised requirement.

Who are your target customers?

We probably target 16 to 28 years old. Primarily students from colleges, universities who have certain amount of disposable income or pocket money, which they easily shell out. As per our research the acceptability for our flavor and taste among youth is high.

What inspired you to launch Twisss in India?

We think that the market is much bigger outside in terms of innovation, then we looked at India. We have done lots of research and found that in the sparkling drink category India has colas and flavored carbonates like Mirinda, Coke, Sprite, 7up among others, but the concept of sparkling fruit juice did not exist. There is only brand in the sparkling drink category that is Appy Fizz. This is the reason we thought that in India there is a good opportunity where no one is present and we felt we have something which is really good.

What about producing in India?

The question was where do we get it manufactured, eventually we decided to get it manufactured in India, so that we would have some cost advantages and it would be perfectly fitting with Make In India, Made In India and Made For India concept.

We source our fruits, which are quite global in nature. Mango is very much local product, but passion has grown in many places like Kerala and North-East region and we would like to explore the opportunity of getting it locally, which would save us on a lot of prospects. Around 70 percent of our products are domestically sourced and 30 percent are imported.

How healthy is the drink for diabetic prone Indian consumers?

It is a choice of consumer to drink or not. . Advice is, you drink everything in moderation and then you have your exercise ready to keep sugar in control. It’s refreshment drink.

Which are the cities you are primarily looking to target and what are your future expansion plans?

We are looking at cities like Mumbai, Pune, Bengaluru, Chennai, Hyderabad and Delhi.

We have identified about 50 towns; the metros, tier I, II and III. We would like to tap almost all A and B category of retailers. Also, we are exploring the opportunity to tying up with some of the QSR's and ethnic local food chains where they serve spicy and aromatic food, which needs this kind of sparkling drink to go along with.

Internationally we are looking to venture into Gulf and Middle-East region.

What about your online presence?

We are excited about the big proliferation of e-commerce in India, especially in online grocery. Coming summer we will be dealing with Groffers.com and Bigbasket.com.

Any plan of launching your own e-commerce portal?

No not as of now. We will launch the consumer engagement app, but not the commercial app availing purchase option as we only have soft drink. Consumer engagement app will be launched to gain ideas on how to engage with consumers from a marketing perspective.

How do you see the Indian beverage market three years from now?

The market will get more innovative with appeal by PM Modi to the soft drink players to add two percent of fruit juice. More players will get into the market and will grow the category. There will be place for everyone.

Beverage market has grown by almost 14 to 15 percent since last three to four years. I expect that the growth will continue with more players coming in.The market is around Rs 14000 cr to Rs 15000 cr in India.

What is the target revenue?

On an average we are targeting Rs 20 cr of turnover by the end of the year.

Gourmet Delicacy offers a speciality sauces, dips, seasonings and marinades of overseas origin. We develop and supply Mediterranean, Lebanese, Mexican, Italian and American cuisine products and supply to HORECA and retail channels.

Brief us about your product?

We at ‘Gourmet Delicacy’ manufacture Nut Butters and Speciality Sauces. Our flagship product is Tahini (a Mediterranean dip used in almost every Arabic, Lebanese or Greek cuisine).

We also offer variety of Peanut Butter and Mediterranean, Mexican, Italian and American sauces, seasonings, marinades and dips.

From where do you source the products?

We procure our products from domestic market. We also rely on importing few of our ingredients that are not native to the country.

What is the major challenge you faced in retailing?

Major challenges faced by us were finding the right distributor/super-stockist to carry our products.

How do you decide pricing for the Indian market?

Every manufacturing company follow a set formula for setting the price for products. We do products and pricing surveys from our competitors, check with pricing and inflation trends and derives the pricing of our products. We also ensure that we have room for offering sales and discounts to our customers.

What do you do to ensure the quality of food going out to the customer?

We follow the best manufacturing practices to ensure the quality of our products is maintained very well. Right from procurement, processing, packaging to dispatch, we ensure that safety and hygiene parameters are followed.

You also supply to restaurants and hotels. Please name some?

Our primary consumer-base is HORECA segment. We sell to chain restaurants such as RollaCosta, Al-Zaitoon and Falafel’s. Currently, we serve close to 40 restaurants in Mumbai.

What is the supply chain process at your end?

We utilize the services of hotel supply distributors in Mumbai and Bangalore to dispatch products to our customers.

According to you, where does seafood industry stand today in India?

With exposure to international cuisine and awareness through media and TV shows featuring seafood, the seafood industry is set to grow at a very good rate in the coming years. Indian seafood exports have also grown at a very good rate due to advancement in seafood cultivating and harvesting techniques and support from the government.

What are your expansion plans?

Our plan is to increase product range, expanding products and services to new territories and team building.

What’s the source of funding? Are you looking for any investment or fund raising any time soon?

The company is self-funded; and we will be seeking investments for expansion and capacity development.

Started in 2001 in Pune, is one of the market leader in Indian Pickles industry. And, as it sits on profit today, the group has now decided to enter into food business services. Selling a varied product range of Pickles, Condiments, Blended Spices, Papads, Appalams, Curry Pastes, Curry Powders, Ready to Cook Spice Mixes, Ready to Eat meals, traditional Chutneys-Mango Chutneys, Ethnic Chutneys, Canned Vegetables and Mango Pulp, the brand is all set to hit the online presence.

Where does the brand sits today?

Sitting at an annual turnover of more than 200 crores, the brand has entered the double digit growth in only 10-12 years. They have maintain a consistency by keep on adding new products like ready to cook products, cooking paste, instant mixes, traditional chutneys in the range. In cooking paste range we have added onion paste, tomato paste to it.

Mother’s Recipe has three verticals, in modern trade outlets- “we are the market leaders in all the categories. We are strong in modern trade business and planning to expand in west, Pune, Delhi, Bombay,” shared P. Rajan Mathews, VP, Mother’s Recipe.

Strong distribution network

Sharing more on the distribution network, Matthew shares, we have 150,000 retail outlets covered by 500 distributors across the country. They cater in diverse formats ranging from Mom & Pop Stores (General Trade), Modern trade outlets, Multi-functional outlets, Cash & Carry outlets, Fruit & Vegetable stores, Defense Canteens, Police Canteens, Indian Army and to HORECA. They have 25 plus market share in all the categories. In normal retail, they have two lakh outlets, 600 distributors. This is the reach to the retail customers.

The products are made from natural ingredients- fresh ingredients. While, other brands use the dehydrated products as the dry products have larger shelf life and Mother Recipe products have gravy which remains for long time. And that is the consistency in their product and they even don’t add any preservatives.

As there is so much competition in the market but when the consumers buy the product they understand the difference. For instance, “in ginger garlic paste we use chopped one unlike other brands which contains water in it. Then they can understand better” said P. Rajan Mathews, Vice President at Mother’s Recipe.

“Many a times it is disadvantage for us but we stick to the quality of the product. But our main aim is to provide our customers with quality products made with the best quality ingredients that meet market demands. We are committed to provide customer satisfaction and believe in continuous improvement”, he added.

The main target is to reach to the correct customers on time. They also ensure the best product as the target customers are domestic households.

Major challenge

In India the cuisine has different form according to the range and region, similarly every region has its own taste for instance north Indian people want north Indian pickle, and Maharashtra people need Maharashtra pickle. Every region has different taste. Thus, the main challenge is how to give right taste to the right customer.

“If a south Indian person living in Delhi wants south Indian pickle, it is difficult for us. The challenge is to sell in different parts of the country which we are learning. We also have two months pickle festival in which we invite customers, showcase our complete range of products. Here, national brand of pickles available across the country”, shared Mathews.

Growing trend

Today, Horeca sector wants something like readymade products as labours are at shortage, chefs are at shortage li. So products like gravy mix are coming up and this is the latest trend in the industry. Mathews says on these lines, “Now, we are supplying readymade products which do not require chefs to the restaurants. These products are present and relevant in abroad but now it is coming in India also, it has been started”.

The latest acquisition of Mother Recipe with Elamc was because Elmac is very strong in the Horeca segment and it will also add strength to them also. Elmac has wide varieties like sauces, kent food, ketch ups etc.

Mother recipe plan is to grow in terms of organic and inorganic products. And at the same time they are expanding in sauces, mnemonics and other products in this range.

The initial investment was 25 crores in buying the brand and added five crores in upgrading the infrastructure. So, now the target is to reach 70 crores in next two years as even Elamc total turnover is 12 crore. “So, we want a growth of 25 per cent turnover”, Mathews said.

Thus, the future of the food suppliers in India is going to expand only. Today, we have so many restaurants, QSR, fine dining which are growing continuously. So the demand of food supply will also grow with the same.

Tell us something about your company? How long has your company been in the business?

BMS Enterprises was established in 1998 as the importers of Spring Roll Pastry from Tee Yih Jia Manufacturing Pte. Ltd., Singapore. Spring Roll Pastry was a unique introduction in the hospitality industry. Initially, very few Indian Chefs wanted to graduate from the conventional hand-rolled pastry to a machine made fine, thin and crisp pastry. Later on after successful test trials, Chefs recognised the quality and value of the product and introduced it in the hotels, restaurants and catering.

Today, BMS Enterprises has complete modern infrastructure for frozen food. It has cold storage facilities at all major destinations pan India, to store at minus 18 degree Celsius, which caters to complete storage solutions. The company offers complete logistics to deliver the products efficiently.

What packaging techniques do you use to preserve freshness and purity of products that you supply?

We use State of Art Packaging to preserve the freshness of the products that we distribute. In fact we have Cold Storage facilities at all the major destinations Pan India to store at minus 18 degree celsius. The company offers complete logistics to deliver the products efficiently.

How do you get your payments? What are the return policies at your end?

There is a set Payment cycle in the Food Industry and we are also part of the chain. Though most of our customers are dealing with us for a long time now but occasionally we do face problems in timely realisation of our payments.

Though we do take back the genuine returns like material which gets damaged in transportation or if there is product expiry problem but otherwise we have a very straight forward policy of providing the material in a best possible state.

How do you decide pricing for the Indian market?

The pricing depends upon various factors such as competitors, consumption etc. Also the imported products are comparatively costlier than the ones manufactured here due to duty, quality and transportation etc.

From where do you source the products?

We are importing food products from various parts of the world like Vietnam, Australia, Norway and Singapore.

What is the supply chain process at your end?

BMS has complete supply chain process with modern infra for frozen foods. The product comes in Refer Containers then transported to our cold storage facilities pan India through refer trucks and from there distributed to the customer points.

Brief us about your products and name some of your clients?

Our Top of the Line products is TYJ Spring Roll Sheets from Singapore which come in “Spring Home” Brand, “Antoniou” Fillo Pastry from Australia, Basa Fish from Vietnam, “Kings Delight” Australian Lamb from Australia, “Kings Delight” Norwegian Salmon both Smoked and Fillet from Norway, IQF Prawns from Andhra Pradesh (India), and “Kings Delight” Dimsums manufactured in India by BMS.

We are selling these products to the leading Hospitality Chains like ITC, Taj Hotels, Oberoi etc. leading Food Service Providers, Modern Trade like Food Hall & Godrej Nature’s Basket.

What are your branding, marketing and expansion activities?

Our branding activities basically comprise of making our product available at the right places which cater to the availability of quality products for the customers. For Long BMS products are synonymous with quality and our customers in the HORECA segment are well versed with our quality that comes with branding. We are constantly marketing our products through new and existing markets. We make sure that our products are visible, sold and appreciated by our customers by regular merchandising. Wherever necessary we take up with the concerned for sampling of the new and existing range of our products for customer awareness.

Tell us something about your company? How long has your company been in the business?

Our company got established in 1895 as a joint family venture. At that time our company was into import and export of walnuts and morels. We are situated in New Delhi. We have a widespread network of retail business in over eighteen states. We import food from all over the world mainly USA, Mexico, Chile, Europe and Thailand. In 1997 we started importing olives and fruits. We are the first company to bring pasta and olives in India and our first customers were pizza hut and dominos.

What are the payment terms and return policies?

Today, as the competition is increasing, I don’t think payments do matter here. We try to build healthy relations with our clients by providing them the best possible offers and terms. Sometimes, if payments are delayed, so we have to put interest charges in that case.

How do you decide prices for Indian market?

This remains one of the most difficult and important aspect. We try to provide the most competitive prices in the market. There are several factors on which the prices on goods in Indian market depend. Firstly, we calculate the interest cost on our capital, landing cost, running cost, delivery cost and then our 10% margin which is our right. So it contributes around 40% hike in the prices for Indian market.

Brief us about your products and name some of your clients?

Today we import olives, different varieties of olive oil, pastas, tomatoes, Italian rice, variety of mushrooms from France, different varieties of sauces, coffee syrup, cheese, herbs & spices, Mexican popcorn, Mexican pepper, Spanish pickle, a wide range of Lebanese products, corn and Thai products. We have all major restaurant chains and retail stores as our clients. Also QSR chains like Pizza hut and Dominos are among our clients.

What is the supply chain process? Do you supply the products outside India also?

We have distributors in all areas who supply our products to the end customer. We have a very widespread network. We supply the products to every state and city of India, apart from that we also export to Bangladesh, Sri Lanka and also we are getting orders from Pakistan.

Do you have online shopping available?

Yes, we have some of our products available online through Snapdeal, Flipkart and Amazon. Usually, people don’t buy food products online as there remains a doubt of authentic and fresh product, but we have several other products which are available online to them, authentic and fresh.

Do you provide discounts as per volume, early payment, and cash?

Yes, we do provide discounts to the customers. If the customer orders a particular volume or in bulk with cash payments, usually we provide 2% discount in that case, but it may vary depending upon the order.

Are all the funding from your end or you are looking for any external boost?

We don’t have any particular investors and funding agencies. We have lent money from banks in the form of loan.

What are your branding, marketing and expansion activities?

We launched 3-4 new products every year. We focus on bringing healthy food products to Indian market. We are also planning to launch olive pickle which has lots of health benefits and people can enjoy them with meals. We have our own media company who do all the marketing and promotions for us. We advertise through banners and hoardings at public places, metro and airport, through social websites and other such activities.

From where did you source the turkeys for Dancing Turkeys?

We grow our own turkeys through contract farming to give the best quality turkeys to our clients in farms close to Bengaluru.

What is the supply chain process at your end?

From the farms we source fresh turkeys through a distributor channel and convert them into meat. We process the product and parcel them to our distributors in Bengaluru via channels like air, road and railways.

Are you listed with HORECA?

Yes, we are an active HORECA member and we currently supply our farm product across the country and follow the guidelines mentioned by HORECA.

Who are your clients? Can you name them please?

We have clients from restaurants and hotel industry, including Oberoi, JW Marriott and many other big hotel chains. We also supply turkey to other leading fine dine restaurants depending on the demand and need as Indians are still not much familiar with turkey.

What do you do to keep you products fresh and authentic?

Most of our products are made on demands, we do not believe in packing our products for so long. Hence, the freshness is maintained.

What is the investment scenario? Are you looking for any external accruals?

We are in touch with some people in food processing sector and direct investment communities and in a very short span of time we are planning to raise funds and investments in our favour.

Who do you think is your competitor in this category?

There is no player other than us in this sector who provides turkey and we specialise in providing a high grade of turkey so we don’t have any competitor who specialises like us in this sector.

What is your expansion plan?

We will probably go cheaper further. We are also planning to tie-up with health care, hotels, and hospital chains to make it a part of the nutritional meal.

Are you looking to tap the international market?

Yes, we are seeing a great potential in the Central Asian market, Northern African market, Central African market and a part of Southeast Asia.

In a candid chat with Franchise India, Pawan Raj Kumar talks about the Technological advances, the supply chain management process, uniformity and the value position in the market place.

How can technological advances be smartly integrated into existing setup to improve the efficiency and profitability of a restaurant?

I think they should be included into a kitchen because the world is changing very fast; the Indian demography is changing very fast. We are very young country so people want things very fast and this can happen only if you have new technology. There is always new things happening and this is only possible if you smartly integrate the existing setup.

What is the supply chain management process at your company?

It is very obvious that the supply chain management process at my company is very different. We have got very good supply chain management process at the company. Some of them are really very big QSRs and we have to go through lots of audit and certification which are against the quality of product, consistency of product and also manage our own people. We have to submit the reports regularly and of course the quality is something which is checked by everybody. Even for consistency of the product, how we manage the consistency, how we incorporate hygiene into our design we have to get certification. We have to give enough information about how much cleaning we are providing to our own people and how much we are managing their problem.

How can the company like yours say, Continental India can maintain supply chain uniformity in product, price and Quality?

Quality is something which is a very big name. Quality means adhering to specifications, adhering to time of delivery, adhering to the requirement of the customer. We do this kind of things by maintaining proper spreadsheets and by giving proper training to the people; we have to keep proper stock of the things. We have to have some kind of planning predicting the demand of the customer. We work very regularly with our customers to understand their clients for future and work backwards and get ready for the actions.

How do you maintain the value position within the market place?

Value is maintained by first of all doing the cost engineering. That is one aspect about the price-the cost of the customer. However, there is another aspect of providing more value to the same rupee spent-how much capacity of value you may provide, how much more efficiency less energy consumption you can do and also how much you can make your product versatile. The same product can be used for many things. So it is a result of consistent research and development which allows us to give more and more value to the same product that you are giving to the customer.

What should one look for in the right distribution partner and process?

We actually do not have a channel or partner. When we supply to our customer, we supply directly to the customer, to the end user. I think a distribution network should be such that the distributor is allowed to provide good service.

How did you feel getting accolades at the IRC?

It is always exciting as well as humbling because it is a very tough market and you are recognised by your customer in this way. It is very encouraging and helps us to get excited about what we are doing.

Please tell something about your company and your journey as I think your company was the first to get NCF certification?

Our company is more than 30 years old now. Since our company was started there was one basic philosophy we followed. We wanted to be the leader and to stays like that it is not about doing the business but also staying in the industry. So, our goal was always to do something new and become better at what we have done before. We did a lot of things which were first in the country. NSF is the latest one where we were the first one to do joint venture and fee certification, iso certification and various things. We are the first company to have launched our own brand of refrigeration, known as Frostline. This is the only product in our country which is of international standards.

Are you expanding in International markets also? Who all are your clients?

Yes, we do provide our equipment to national and international chains. We are providing equipments to KFC in Africa and many other chains like that. We also have distributors in South Asia and Middle East.

In the restaurant industry, we work mostly with the QSRs like Pizza Hut, Domino’s, Cafe Coffee Day and Haldiram. Nando’s is also a very big customer of ours. Then there are lots of standalone restaurants where we supply our equipments.

Suppliers are the most significant contributor in the development of any restaurant. With help of innovation and ingredient, they create new products. Experts say that there is a real need to connect with food suppliers. A strong relationship is important for any business, especially in the restaurant industry.

“Suppliers and supply-chain management are of extreme importance to any establishment, whether new or old. If both, the suppliers and restaurateur work with the common agenda of giving the patron the best price-performance ration, there is no chance of anything going wrong” shared, Nishek Jain, Owner, 29.

Building a strong relationship

In the current scenario, relationship between restaurateur and supplier is changing. Both restaurateurs and suppliers have a common objective to get hold of customers. So, both have to handle the situations smartly with a different approach. Engaging a supplier is not a task, although bargaining is the real challenge for restaurants. In this case the restaurants need to understand the problems of suppliers.

On this note, Alka Kukreti, Owner of Cafe Marigold stated, “The supplier is the most important part for running a restaurant and without their co-operation no food business can function. And, a Cafe like us where we are totally dependent on the supplier to deliver our provisions on a daily basis on time. For us the quality of the provisions and timely delivery matter the most. Our role is to make sure that all bills are promptly paid. A cordial relationship between the supplier and restaurant owner is of utmost importance, only then will the business run smoothly”.

Way Ahead

Today, when restaurateur’s completely rely on digital India for marketing and communicating ideas to customers. Suppliers help restaurant owners to get traffic, loyalty, manage critical costs like labour and food, increase efficiency and run a profitable business.

For a food to taste good, the ingredients are important. Food is the most critical product to supply in a restaurant. In addition, suppliers are the one who handle operating details like price paid for products, payments, how products will be distributed and even selection of products or service offering.

“We believe the supplier is one of our core partners and a key stakeholder in the business and we honour this relation as much as we honour any of our other stakeholder relations including community, guests and of course, our human capital”, pointed Prahlad Sukhtankar, Owner of The Black Sheep Bistro.

As a result, it is important to build a rapport with suppliers. It also enhances the overall efficiency and profitability of the business.

Supply chain management is important for any industry; and for food industry it is most important to run the business successfully.

Supply chain management does not only mean the logistics activities but to understand a customer need and do necessary implementation on that is what it holds. Suppliers are the one who are in relation with products, processes and customer base. So, they have to use their expert knowledge to deliver the maximum level of safety in their operations.

The Challenge

Every restaurant face challenges in supply chain like the operational challenges, pricing, food packaging, and to meet those demand everyday is a difficultly for the owner to meet. So, effective flow of the supply chain processes is what the industry demands today.

According to a latest research, it has been found that many food companies routinely dilute the nutritional content and value of the foods products. Most of these fillers can cause potential allergens, mainly in children.

Simran Jeet Singh, Strategy Analyst, Jux Pux says, “We use every possible means to maintain the temperature of the drinks and sandwiches keeping in mind the healthy and nutritious part doesn’t get deteriorate”.

But the main problem remains the same in the restaurant industry, i.e. it faces dearth of good infrastructure to store the product and a lack of skilled manpower that can reduce the inventory losses while dealing with the supply chain issues.

Inadequate technologies and non-integration of the food value chain are other key factors leading to nearly 30-40 percent food wastage across to supply chain. So, the ordering should be optimised and should also generate automated alerts when an order quantity outside normal limits is entered, avoiding potentially expensive mistakes.

In addition, if the efficient and proper cold chain is not available one cannot import small quantities. As well the premium foods items cannot be imported in container because it is in too much quantity.

“We have to fixe suppliers of all the required raw materials present in the available market so we procure from them in collaboration with the company”, pointed Singh.

Future Growth

Now, there are ranges of applications for adhesives in food packaging covers. From the breakfast cereal boxes and packaging for frozen food through to glossy potato chip packets and foil and film pouches for perishable goods like meat and cheese. On the same note Raj Kumar Bhalla, Founder-Director, Shakuntla Nutratec Pvt. Ltd. says, “It’s our commitment at every step and with every employee. We have ISO 22,000 work in progress”.

To address challenges like slow economy, supply chain professionals have to look at the controlling costs as it is the key area in foodservices. For instance, one-third of sales in a restaurant go toward food purchases, so managing those costs can have a strong impact on a company’s bottom line. Different stakeholders have different priorities and supply chain players have to navigate those waters carefully to balance company’s interests with building consumer trust in their food.

Meanwhile, Akshay Gokalgandhi, CEO-Founder, Indian Eateries speaks, “Indian Eateries provides a unique set of strengths to the restaurants as we come in with an experience from various avenues and field and help these outlets with a 360 approach for their problems. We do research and submit statistical reports & surveys with regards to various elements. We also help the latest trend analysis and get them help to manage user reviews on Social media platforms”.

Therefore, managing the supply chain issues has become an important for any restaurant and food service industry. Supply chain management has to enhance the quality and safety of the product with the reducing costs at the same time. That is why today so many restaurants have been fast adopters of efficient supply chain that deliver product with a good value and services to the industry.

Del Monte has recently added Pomegranate Coolada to its premium range of Fruit Juices.

Pomegranate has been seen as a healthy fruit with a rich source of Iron and anti-oxidants.

This new flavor not just comes with the benefits of the fruit pomegranate, but also contains the sweet twist of strawberry bits.

The juice is packed seeing the convenience for the new age customers as it comes in a Can that’s easy to carry and consume.

The newly launched drink is refreshing & unique and is priced at Rs 30 for a 180ml can.

At present the juice is available across all Superstores and Retail shops across top cities including Delhi-NCR, Mumbai, Bengaluru and Pune.

Mr. Virender Kumar, Restaurant Manager, Chi Kitchen Restaurant & Bar, says “We have different suppliers for our products, we get sea food from Spice foods, and some of our stuff from Folk Puff, Jor Bagh. He added that to find a good supplier it is very important to do a marketing research before you go for a supplier and then once he is appointed you need to check and recheck and if he is not capable of his work then we withdraw our contract with him.”

Mr. Kumar further adds that the suppliers are appointed on an yearly contract. Talking about the difficulties, he mentioned, “The main problem that we get here in Delhi is transportation. During a rainy day due to narrow roads and the traffic, the supply is delayed.

On the other hand Mr. Chetan, Partner, RPC Foods, says “We supply food to the restaurant in a very designed and modified supply chain management process. The products are supplied to the distributor on a weekly or fortnightly basis and then the distributor distributes those products to the restaurant. On talking about how restaurants know about the suppliers, he said that it is through marketing or word of mouth. RPC foods are the supplier of imported food products from all over the world. Some of its clients in restaurant industry are Hyatt Regency, ITC Hotels, Taj Group of Hotels, Olive bar & kitchen, Ruby’s Bar & Grill and many more five star restaurants and chains all over India.

So what all are the points to be kept in mind before you approach a supplier? Read on to report by Dummies, here are a few tips to find a good supplier for your restaurant:

Make a list: Before finding a supplier for your restaurant make a list of supplies that you will need for your restaurant including the equipment, dinnerware and furnishing. Once you have your wish list and budget in hand, the next step is looking for supply sources. The best place to begin is your industry association.

Speak with fellow food truck and restaurant owners in your area: These professionals have been in the business long enough to have found the most proficient suppliers in your area and can make recommendations that are based on the experiences they’ve had and learned from.

Search online for local food and restaurant suppliers: Almost every type of product you require can be found on the Internet. You can take advantage of online business directories that list suppliers or even search for suppliers based on the type of supplies you’re looking for.

Attend restaurant industry trade shows: At these trade shows, you can obtain information about various restaurant suppliers’ products and services. You have access to supplier literature and may be able to talk to restaurant supplier representatives.