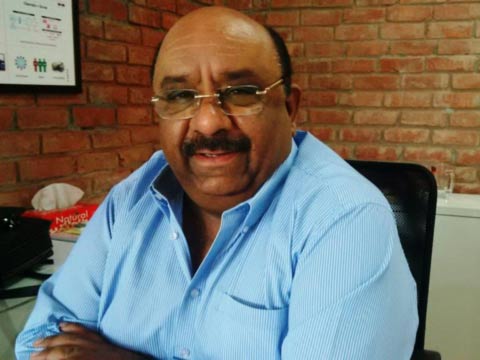

Realizing the fact that restaurants just make money for rentals while observing that cheaper burgers have been destroying the market, Mumbai Based Nishant Joshi has launched his own restaurant chain called ‘The Burgery’ that serves premium quality burgers with rich and healthy ingredients. While marking its presence in the market, the brand is also offering variety of burgers along with fries, sides and iced lattes through its two kitchen and two restaurant franchisees operating in different locations of Mumbai. Further it is planning to open around 18-24 restaurants through franchising across Mumbai in the next four years. Thus, talking about his business model, investment and future expansion plans, Nishant Joshi, Founder, The Burgery spoke to Restaurantindia.in.

What inspired you to start The Burgery restaurant?

Before The Burgery my money was in few other restaurants, but soon I realized that in a city like Mumbai where rentals are going higher, the restaurants make money for the rentals and there is nothing like a profit. Restaurant is not just to do with your electricity or kitchen or rent, but all these things make major outlook towards overall business. When one opens a restaurant he/she has to make sure that the land is his/her own which makes sense. Ultimately in the market there should be certain amount of understanding towards rentals and the kind of income restaurant would earn.

What is the gap that you found in the burger space?

Market is there for burgers anyways but the right kind of burgers is not there. The whole process of making cheaper burgers has destroyed the market. The leading burger brands are selling burger like they are selling low price Pepsi bottles where margins are always on mass turnovers. But, we are selling burgers with higher quality and rich ingredients at premium price and even our small turnover gives higher margins.

What kind of burgers you offer?

We offer full meal tenderloin, chicken, lamb, fish and vegetarian burgers along with fries, sides and iced lattes. The Burgery is here to question your appetite with humongous burgers that are specially crafted to delight your cravings.

Please tell us about the ingredients that you inculcate in burgers?

We have vendors for our sauces. We have burger buns coming from the same bakery. We make the patty in place itself because we are giving recipes and it’s cheaper for them. We are making fresh burgers for consumers. Its organic and other things are also mix with it so the cost is bit higher. We have seven burgers and four fries including cheesy fries, masala fries, pesto fries and regular fires. Further we are going to expand our menu. Our USP is revolving around burgers and fries.

We have tied up with a company called Cool Story which is also a part of our franchisees restaurants and provide them the slushies and the manpower to make those slushies. They give flat percentage over their sales to The Burgery franchisees. So the franchisees don’t have to invest in Italian machines, raw materials and staff and it’s a co-branding thing where they do the drinks and we do the food which works well for all of us. We don’t do alcohol.

What is the franchisee model?

We have two models, one is kitchen and other is the restaurant model which we franchise. Kitchen model is more of ordering kind of a system where one can order through Zomato, Swiggy or any of these apps. And in restaurants we offer quality full meal burgers to the consumers. We are giving kitchens, backend for all the recipes, trained staff and an onboard head chef.

It’s a royalty that we charge from franchisees. In inventory as such franchisees have to take 500 burgers first in the beginning and after a month and a half when they get settle then they start making it within the place itself. We just want to give back to people whoever wants to get into hospitality business but in the right way.

How have kitchen formats been doing?

It’s doing well, because rentals are down and they can keep it open for 24 hrs. People in Mumbai want more and more night deliveries and nobody is doing burgers in the night kitchen, so it’s easier for us to attend that market.

What is the investment for kitchen and the restaurant?

We are charging 15 lakhs for kitchen and Rs 15 lakhs plus interiors for restaurant module. For a restaurant to run one needs 500 sqft of area and only backend kitchen needs 250 sqft of area. We are charging Rs 50K as franchisee fee for five years. We want to make money for the franchisees while self sustaining for years and serving the best taste.

What is your current presence and the future expansion plans?

Presently we have two restaurant franchisees in Malad and Bandra and two kitchen format franchisees in Vile Parle and Andheri in Mumbai. We are planning to open around 18-24 restaurants only in Mumbai in the next four years. We want to be at high streets and inside the commercial buildings. Zomato contributes good orders and soon Swiggy and Foodpanda will be onboard. We want to be on everything that will bring us the orders.

India is a melting pot for diverse global cultures, flavours and experiments. Most recently Korean music, TV shows and food have been the talk of the town. As an example, Vincenzo has been trending on Netflix, the BTS hype, or even Korean skincare and clothing have taken the country by storm. Similarly, Bubble Tea and Korean burgers have been the talk of the town in recent years.

The success of bubble tea and Korean burgers in India is not just because of a differentiated taste. The rise of K-Pop Burgers and the enduring popularity of bubble tea showcase the fusion of Korean and Indian tastes but also reflect a broader trend of embracing global flavours and innovative dining experiences. As Indian consumers continue to embrace new food innovations, the stage is set for a flavorful journey that bridges cultures and delights taste buds.

Catering to the Indian Palate

The fusion of Korean cuisine with the Indian palate has brought about a rarely seen food transformation. The blend of traditional Korean flavours with locally loved ingredients is a major driver of growth. The key to this success truly lies in creating dishes that appeal to the Indian palate while keeping authentic flavours at the centre of menus. One great example of this fusion is K-Pop Burgers. These burgers, inspired by vibrant Korean pop music (K-Pop), are a culinary delight that combines the best of Korean and Indian flavours. Imagine a tasty Korean-style fried paneer patty topped with a tantalising combination of Korean Hot Sauce, melted cheese, refreshing Korean Slaw, and a zesty Chipotle Mayo. Experience the perfect harmony of flavours as the crispy paneer patty meets the sweet and spicy sauce, enhanced by the creamy cheese, crunchy slaw, and a touch of heat from the Chipotle Mayo. Indulge in a culinary masterpiece that brings together the best of Korean and Indian influences.

Growing Fondness for flavours

Korean cuisine in India is also linked with an increasing love for bold, complex flavours and is known for its wide range of tastes, from spicy and savoury to sweet and tangy. This diversity allows for endless culinary experiments, making Korean dishes popular among those who seek unique and tasty meals.

Bubble tea, another star of this culinary revolution, has also contributed to the growing fondness of flavours among Indian consumers. The customisable nature of bubble tea, with options to choose tea bases, sweetness levels, and add-ins like boba pearls and jelly, appeals to individuals looking for personalised and innovative beverages.

The Growing Popularity of Bubble Tea

Bubble tea has emerged as a popular choice for beverage enthusiasts across India. The allure of bubble tea lies in its playful textures and customisable flavours. From classic milk teas to innovative fruit blends, bubble tea offers a refreshing and indulgent experience that appeals to a wide audience.

The growing popularity of bubble tea can be attributed to several factors. Firstly, its Instagram-worthy appearance and colourful aesthetics make it a visually appealing beverage, perfect for social media sharing and generating buzz. Secondly, the ability to customise sweetness levels, tea bases, and add-ins allows consumers to tailor their bubble tea experience according to their taste preferences. This customisation aspect has contributed to the beverage's widespread appeal among diverse consumer segments.

Capturing Cultural Trends

The success of bubble tea and K-Pop Burgers goes beyond just culinary excellence; it captures larger cultural trends and societal shifts. The rise of Korean pop culture, characterised by its vibrant music, fashion, and entertainment, has played a significant role in popularising Korean cuisine and flavours globally.

In India, the growing influence of K-Pop and Korean dramas has sparked curiosity and admiration for Korean culture among younger demographics. This cultural exchange has transcended entertainment to encompass food, fashion, and lifestyle choices. As a result, Korean food and beverages, such as bubble tea and K-Pop Burgers, have found a receptive audience eager to explore new tastes and experiences.

The Role of Innovation

Innovation has been a driving force behind the success of bubble tea and K-Pop Burgers in India. Local eateries and startups in the ecosystem have embraced creativity, experimenting with unique flavour combinations, presentation styles, and marketing strategies to capture consumer attention and create memorable dining experiences.

For instance, some establishments offer themed K-Pop Burger nights, complete with K-Pop music playlists, vibrant decor inspired by Korean pop culture, and limited-edition burger specials that celebrate Korean flavours in innovative ways. This immersive approach not only attracts food enthusiasts but also creates a sense of community and excitement around Korean cuisine.

The Future of Korean Cuisine in India

As the love for Korean food and beverages continues to grow in India, fueled by factors like cultural exchange, global culinary trends, and consumer curiosity, the future looks promising for this culinary revolution. The fusion of Korean and Indian flavours, exemplified by dishes like K-Pop Burgers and customisable bubble teas, is a testament to the evolving palate of Indian consumers and their appreciation for diverse culinary experiences.

Looking ahead, we can expect to see further experimentation, collaboration, and innovation within the Korean food scene in India. From gourmet food festivals showcasing Korean delicacies to fusion food trucks offering creative twists on classic dishes, the possibilities are endless.

From ramen burgers to chicken katsu burgers and truffletake burger, restaurateurs and chefs have been experimenting a lot with this humble food. Forgot about some veggies/ chicken along with a processed cheese slice between the buns, burgers have become ‘gourmet’ and ‘healthy’ these days with chefs and restaurateurs known for serving fine-dining style food all playing with a ‘messy’ burger; all thanks to the consumption and sales of burgers that went up by around 9 per cent as per recent survey.

Must Read: Bun to Double Roti: How Indian 'Homegrown' burger brands are competing with global chains

A ‘gourmetlicious’ affaire

If we look internationally, Chef Robbert Jan de Veen of De Daltons diner in Voorthuizen, Netherlands has created a burger for 5,000 euro, which is close to Rs 4.5 lakhs. Called as ‘The Golden Boy’, the burger has all the expensive ingredients that one would dream of eating. Similarly, if we look at Indian burger scenario, restaurateurs like Riyaaz Amlani, Zorawar Kalra who have redefined the casual dining and fine-dining scenario respectively have launched a burger brand all catering to the gourmet diners.

“Our burgers at Bun & Only have been developed keeping the taste preferences of the clients in mind. The elements that we use in our burgers such as - homemade ketchup, in house breads, various sauces and salsas - teriyaki, homemade bbq, guacamole, buffalo sauce, burnt butter bacon mayo and blue cheese crumble elevate the burger eating experience. We also offer peri peri fries and truffle parmesan fries which accompany our burgers,” shared Sameer Uttamsingh, Co-Founder Bun & Only that was born a year ago when they saw a gap in the market for wholesome, gourmet burgers.

After Chef Akriti Malhotra finished her culinary education in the US, she saw the gap in a fast-casual gourmet burger place that serves great quality food in a fast-food format. “We were one of the first ones to start in January 2018 to serve gourmet burgers made from fresh ingredients with all our patties, sauces being made in-house and it somehow clicked. People appreciated the relaxed fast-casual vibe concerning dine-in and connected with the brand as authentic, young, and energetic and they loved it,” added Malhotra of AKU’s -The Brrgrr Co. that is a home-grown fast-casual brand, synonymous with good food served quickly. Known for their juicy and meaty burgers, delivering fresh food made with real ingredients.

Must Read: 'बर्गर' ट्रेंड: 'गॉरमेट' नया मूलमंत्र क्यों है?

On the other hand known for their Asian delicacies duo Chef Seefah and Karan Bane introduced a burger menu comprising of subtle Thai and Japanese for those with gusto for meat and Asian seasoning.

Driven by customer need

As stats says it all, the Quick Service Restaurants (QSR) market in India is projected to grow at a CAGR of over 18% during 2021-2025 due to increasing urbanization, rapid expansion in food delivery services, expanding young & working population, growing number of dual-income families and rising disposable income in the country.

The culture of binge-watching while also enjoying your favorite thing to eat and burgers that is believed to be that one favorite food-item because they aren’t very heavy and hence can be eaten at multiple times while doing office work or while catching up on a movie or a show. A lot of time, consumer’s hand is believed to be the reason behind the rise in the consumption of light yet tasty food option like a burger.

“Our target market is the well travelled and connoisseurs of good food. We see that there is a large market of people who know great food and ingredients,’ added Singh by pointing that gourmet burgers are here to stay. It's a different experience to have this quality of burger in the comfort of your own home. The brand is also aiming at at opening another kitchen in South Bombay within the next two months and a third kitchen in the suburbs by the end of the year.

May Interest: Chinese and Burgers saw an uptake in the last 3.5 months, report

“We always wanted to keep it simple. The focus has always been on quality and what is readily available and work with those things through the year and then introduce specials such as the Truffle Shroom Burger ( Portobello with Truffle Oil ). We have stuck to our motto of ingredients taste better,” added Malhotra who focus on customers who enjoy good quality food served quickly. She also sees a huge potential for AKU's in every Tier 1 and even Tier 2 city.

How many of you crave for the perfect cheese burger experience when you are stuck at home during these unprecedented times? Burger in India has taken many forms with passing of years. From creating the quintessential, crave-worthy cheeseburger experience, to the patties being freshly grilled, the way the burgers are carefully assembled; the main focus of all brands remain same, delivering authentic international flavours that hit the spot every single time. India tasted its first foreign burger in the late 1980s when UK-based QSR chain Wimpy entered Indian market by opening its first restaurant in Connaught Place, Delhi; and since then there is no turning back as we have seen brands like McDonald’s ruling Indian market like none other. From top global brands like Wendy’s, Carl’s Jt, Burger King to name a few to our very own home grown burger brands like Burger Singh, Wat-A-Burger, The Burger Club and Burgerama to name a few, burger has become Indian’s favourite go-to and grab on-the-go food item.

Must Read: Delhi tops in eating burger

Sailing through the pandemic

The pandemic has taught every single brand, restaurant ways to innovate and methods to keep them ahead of the trend. “We feel that brand trust and transparency of communication will play a huge role in influencing consumer’s choices and loyalty. We have already seen quality & hygiene having a deep impact on buying decisions and we feel this will lead to a period of consolidation in the industry. Only those that are straightforward, transparent, consistent and uncompromising in their brands will survive,” shared Kabir Bose of Burgerama that was started by three childhood friends Vivek Prakash & Viraaj Badhwar and Kabir Bose who share a common passion of good food.

The brand completely revamped their menu flow; by adding some incredible new dishes by making sure that the food is able to add just a little bit of joy to their customers’ days.

Though, the brands were sure that this is historically a period of adversity as these times will definitely yield some of the most groundbreaking ideas and businesses.

“We have been focusing more on tech integration in our operations. The pandemic has highlighted the much-needed tech transformation of the food and beverage industry. Also, at a QSR tech implementation plays a major role in the quality of service and management of the operations. Inventory softwares like Supplynote where we can keep live track of our inventory help us a lot,” pointed Farman Beig, Co-founder & CEO of Wat-a-Burger that is spread across 22 cities and 9 states serving 8,000+ delicious burgers on a daily basis.

The NCR-based burger chain with an idea to provide customers with burgers that are based on their preferred dish or flavor, for example, Tandoori Chicken makhani Burger, Aloo bechara, or Desi Street 2.0. “There are many brands in the market offering burgers, however, the products that we are serving are completely based on Indian taste,” added Beig who together with Rajat Jaiswal started Wat-a-Burger in 2016 with a sole mission to take fresh, delicious, yet affordable burgers to people.

Betting big on Delivery

Since, 2020 became the year of tech-innovation and delivery, not just brands like McDonald’s and Domino’s who are doing a big chunk of sale through delivery, home grown brands are also relying on delivery to catch the bigger segment in the market.

According to reports, the consumption and sale of burgers went up by 9% pointing towards the culture of binge-watching while also enjoying your favorite thing to eat. Burgers are believed to be that one favorite food-item because they aren’t very heavy and hence can be eaten at multiple times while doing office work or while catching up on a movie or a show. A lot of time on the consumer’s hand is believed to be the reason behind the rise in the consumption of light yet tasty food option like a burger.

Also Read: Chinese and Burgers saw an uptake in the last 3.5 months, report

“We built a strong product and kept the quality consistent without any compromise throughout that lead us to better numbers and our sale went up just the sale construct kept fluctuating between dine in and delivery but the overall numbers kept growing,” said Jatinder Gill, Director, The Burger Club for whom delivery has become an important part mostly during lockdown. Also, for him being dependent on third party for delivery was bit difficult to maintain the same quality but his team worked very well to serve the best to customers.

Meanwhile, Wat-A-Burger that has become the fastest homegrown burger brand in the country claims that it is 2nd to Dominos in terms of delivery area coverage in Delhi/NCR with 76% visibility. “We knew from the beginning that online delivery is going to be the main driver of the business for us. We have associated with all the major online restaurant aggregators and delivery partners including Zomato, Swiggy, Dotpe. In Delhi NCR, where we have a major presence, we cover almost 70 % of the area through online delivery platforms,” added Beig who get 30 percent of orders through walk-in and 70 percent through online delivery/orders.

Well, before pandemic could hit us, Burgerma was clear that delivery was the best possible way for their kind of a product to reach customers. “It was quite apparent in 2018 that restaurant footfalls were on a downward trend and the food delivery market was growing quite quickly especially when compared to any other segment in the food & beverage industry,” added Bose who get around 70% repeat users and is targeting 20k orders a month.

Flying High

As stats says it all, the Quick Service Restaurants (QSR) market in India is projected to grow at a CAGR of over 18% during 2021-2025 due to increasing urbanization, rapid expansion in food delivery services, expanding young & working population, growing number of dual-income families and rising disposable income in the country. These chains are also planning to expand their wings by looking at newer markets, areas.

“After a being a well established and one of the best burger brand from top three burger brands in Delhi, we are planning to expand 50+ stores”, added Gill who is planning to enter Chandigarh, Kanpur, Hyderabad and Lucknow by the end of 2021.

Burgerama that has raised a seed round of funding from group of entrepreneurs and strategic investors who share same passion and vision for the brand. They are using the capital to build their backend capacity and systems and further expand Burgerama across Delhi/NCR. “We are set to open our Noida outlet this month and plan on adding several more stores over the next 12 months. After NCR we hope to expand in the North region and then replicate the model in the West, South and East of India,” added Bose.

Similarly, Wat-A-Burger that has 60+ outlets in India is targeting to cross 100 outlets by the end of the current financial year. “At this moment, we are working on expanding our chain across Karnataka and Maharashtra,” added Beig who is witnessing around 4000 orders per day.

May Interest: How QSR Industry Has Immense Offering to People Looking For A Career

Hence, we can say that the fast, made-for-delivery, easy to grab and most importantly loved by we Indian, the burger concept may see more explosion with more tailored-made menu and taste for the Indian market.

Owners of McDonald’s west and south in India, Westlife Development Ltd, revenues for Q3FY21 zoomed to 85-90% of pre-COVID levels with December revenues almost back to pre-COVID levels.

Hardcastle Restaurants that owns the franchisee right for the brand is also planning to expand the QSR chain by adding more stores to its network.

Also Read: McDonald's opens outlet at Mumbai-Terminal 2

“The company plans to open three new stores in this quarter and then resume its growth journey of adding 25-40 stores every year from the next fiscal,” shared Amit Jatia, Vice Chairman, Westlife Development.

"Convenience channels are here to stay. For occasional use for the restaurants, where people used to come for hang-outs and celebrate, this was not being met and that need is coming back. It would not take away (business) from the convenience channels," he added.

Westlife Development’s strong sales performance in the quarter was driven by the Ccompany’s omni-channel strategy. It started its recovery journey in October when its biggest market – Maharashtra finally opened up for dine-in.

"The business has gone up month after month. In December, we were almost 97 per cent of the pre-COVID-19 sales. Even Ebitda margin for the month of December was 13.1 per cent, which gave us a lot of hope, as we are moving up month on month. I feel it is here to stay," added Jatia.

In December, despite substantial regulatory restrictions in several of its markets, the Company saw a phenomenal uptake in sales with revenues coming back to 97% pre-COVID levels. Dine-in recovered 75-80%, even with night curfews and the 50% capacity constraint. McCafé recovered over 80% vis a vis pre-COVID levels. At the same time, sales from convenience channels accelerated to 120% of pre-COVID levels in the month, again notwithstanding the night curfews in some of its key markets.

The Company also got back on its growth path and added three new McDonald's restaurants and three new McCafés to its portfolio.

Currently, Westlife Development operates 304 McDonald's stores in 42 cities of the western and southern India.

May Interest: Hardcastle Restaurants opens 300th outlet of McDonalds India

"Around 60-70 per cent of new stores would come in the six key cities - Mumbai, Pune, Ahmedabad, Bengaluru, Chennai and Hyderabad; and the rest 30 per cent into smaller towns," he concluded.

Akshay Jatia is the Director- Information Technology and Brand Extensions, Hardcastle Restaurants Pvt. Ltd. (HRPL) and is responsible for spearheading brand extensions, digital innovations and IT for the company. A digital maven, Akshay has been pivotal in setting up the digital team and leading many digital led innovations across the business. He played a key role in consolidating and growing the company's brand extensions - McDelivery, McCafé and McBreakfast.

Akshay joined HRPL in 2014 and since then have been working cross-functionally to understand the nuances of strategy, operations, marketing and IT to be able to synergize them to grow the brand. He also spent a year working across McDonald's restaurants operated by HRPL to get first-hand learning of what goes behind running great restaurants.

In an interview with Restaurant India, Akshay Jatia, Director- Information Technology and Brand Extensions, Hardcastle Restaurants Pvt. Ltd. (HRPL), speaks about innovation McDonald's has brought in the past few years.

The Digital Innovations Growth Story of McDonald's India

We are a brand that is always listening to its customers. We started McDelivery, our food delivery platform, more than 10 years ago, which was then operated through our call centers. In 2013-14, we leveraged technology to launch our own mobile app and website to engage with as well as get them to transact on our McDelivery platform. That was one area, where we immediately took the first step forward and innovated digitally. Further to this, we saw the brand evolve as the delivery category had accelerated in the country. We were among the first restaurants to take advantage of this trend.

Another example of digital innovation is our "Experience of the Future" restaurant. As the name suggests, these are our futuristic restaurants with a host of technology elements to make whole experience of eating at a McDonald's restaurant memorable. We offer customers world-class amenities such as air chargers, order trackers, gaming tablets and Self-Ordering Kiosks which take customer convenience to the next level. In fact, we have got some excellent feedback from customers for our new restaurants.

Digital Innovations in 2018-19

We launched about 25 Experience of the Future restaurants last year. The new restaurant format with self-ordering kiosk, digital menu board and wireless chargers have been a huge digital innovation for us. Another digital innovation has been around the launch of our McDonald's app, a unique platform that gives our customers personalized offers, based on their order preferences, every day. With the new app, we have reinforced our brand promise of value and convenience.

The Revenue Growth

Last year, we grew our revenue by around 25%.Business has been on an upswing with 15 consecutive quarters of positive same store sales growth. . We've been constantly innovating and finding different ways toconnect withthe consumers, do menu innovation as well as give them anoutstanding experience through our restaurants. And this has resulted in fantastic growth for McDonald's.

The Next Plan of Innovation for McDonald's India

We are a customer obsessed organization and are always trying to anticipate our customers' needs.

McDonald's India's journey has been marked with innovation. We started our delivery business way back in 2005, we were the first QSR restaurant to introduce an exclusive breakfast menu, we re-engineered our food to make it more nutritious and wholesome and launched Whole Wheat Buns,and democratized great coffee through McCafé.

Going forward, we will continue to leverage technology to enhance customer convenience and do menu innovations to bring international flavours to our customers at an affordable price. Our innovation efforts will also be focused on enhancing the in-store customer experience.

Another area we will be focusing greatly on will be sustainability. We are committed to growing in a way that is not just good for the business, but also for the people, the community and the planet. We will be introducing processes and practices that will help us moderate our carbon footprint while giving a boost to our profitability.

Trends in the Fast Food Industry in the Next Two Years

In the fast food industry, digital and technology enablement is something that will be a key trend in shaping the future of the industry.With customers getting more and more conscious about the construct of their food, we will also see menu innovation and re-engineering.

Tips for Restaurateurs in setting up their Digital Team

Digital is an evolving platform and hence it is important to have a team that is agile and open to learning. It also helps to have people who are quick to understand numbers and spot trends and are well versed with platforms such as Google analytics and other social media platforms.

McDonald’s India has posted its first profit during year-to-March 2018 amid a long-drawn legal dispute with one of its key licensee partners.

The global burger giant posted a net profit of Rs 65.2 lakh during FY17-18, compared with a net loss of Rs 305 crore a year ago, according to its latest filings with the Registrar of Companies.

McDonald’s India is operated by two partners in the country; Westlife Development by Jatia’s which is master franchisee for West and South and Connaught Plaza Restaurants (CPRL) that looks after North and East operations of the burger chain.

“The company has not only been able to stem any further erosion of its net worth, but has also been able to successfully reverse the trend of erosion through the infusion of fresh capital,” mentioned McDonald’s India in its latest regulatory filing. Total income which it earned mostly through royalty, grew 8% to Rs 119.6 crore.

During the year, the company allotted shares worth Rs 71 crore to the parent company and also increased authorised capital by Rs 50 crore to Rs 458 crore.

Last week the American burger chain has included the much loved Aloo Tikki burger on their international menu. McDonald’s Chicago is dishing out the humble potato cuttle burger by giving it a vegan tag abroad. This has clearly made a lot of customers happy as many are posting pictures of their vegan meal on Instagram.

The modified McAloo Tikki meal consists of a toasted bun filled with a veggie patty made with potatoes, pea and seasoning reminiscent of samosas. It is then topped with fresh red onions, tomato slices and eggless creamy tomato mayo.

“Customers have expressed interest in items from McDonald’s restaurants located in India and we’re excited to offer them the opportunity to try the longtime vegetarian favourite, McAloo Tikki,” said Nick Karavites, McDonald’s Operator in an official statement.

In the last 2-3 years eating out market has seen a continuous 10% annual growth with QSR segment capturing the bigger pie of the market. Growing urbanization, footfalls at malls where 10-20 per cent spaces are allotted to f&b brands has posted a high growth of these kinds of brands.

Tell us about your operations in India. How is the response so far?

Johnny Rocket as a brand has done well for a year and half in India and even the response is also good. Now we are looking at pan India expansion, but not an aggressive expansion because our focuses is getting the right location and working on outlet and making it profitable. Unlike other chains that grow aggressively, we grow slowly and our location should be ideal. We want the restaurant to be profitable and we are working on that and other aspects like product or service delivery. We are happy with all our developments.

We have seen lots of food brands entering under the same segment. Do you see any threat from any of the brand?

When a brand enters any market, there is competition, and we are under casual dinning segment. I don’t see any threat because I am very confident about our product which we are selling. It has an edge over others on which we have really worked hard. All the products and even the menu are American but at the same time it is developed with 100 percent local ingredients. There are just one or two sauces which we have imported but now I am working on it. I have been a part of this restaurant as an operator for two years.

What are the legalities involved in bringing a global brand to the Indian market?

When you bring a brand in a country, you have to look into a number of things. From legal aspect, I really don’t think the local authorities have any issue of brining a brand into but legalities in terms of company, will it invest with you or not. In India, this company is owned by us. The three partners Vishal Chawdhary, Sachin Goyal, Gurav Sharma, owned the brand and they tied up and brought it here.

You have to pay royalties, new store opening free etc. We also compile to all legal laws which are associated in operating a restaurant.

What according to you, the contribution of a good menu in a restaurant business?

This is one of the most important aspects to bring a menu which connects with the people according to their palates and a good mix of varieties. Menu is very American in our case. It has developed a lot of vegetarian options keeping the taste profile in mind with original taste. We tried to bring specific dishes of Indian taste like Tandori Flavor or Indian in nature but have not done well in our menu.

If you go to Johnny Rockets, you will want to experience it, a new image American operation. We call it “American express”, typical American operation and that we have managed.

As you are operating under the casual dining segment. What is your view on the current trends in restaurant industry? Which trend is getting hot these days?

If u looks around, lot of non industry people entering the market and that in a way is very good as they are coming with a very fresh perspective and approach. It is a very nice work and they want to do in a specialized line and give you vibrancy and the music is contemporary. They are contributing a lot in the overall development of the restaurant industry. Seasoned players are also opening with new concepts.

What is the contemporary food you make, especially for Delhites?

The word contemporary has many interpretations. So when we say contemporary, we don’t do. We work on aspects like making it healthier like using natural flavors and use 100 percent meat. Most of the company who are in this trade can sell a burger much cheaper than us because the protein they use is only 30-40 percent and rest other things is only fillers. So they can sell cheaper. Our protein or shakes are 100 percent pure.

It is said “Quality comes with price”. The entire cooking medium in our organization is all Trans fat free and that comes 30 percent more expensive than the regular brands in the market. These initiatives which we have taken up will carry us further.

What is your expansion plan, as we can see that Johnny Rockets is going very slow when it comes to throwing number of outlets?

Like earlier I said, we want to go really slow and cautious and make sure that in each outlet we put enough effort to enhance everything that we want to create till we reach 100 percent.

Along with that we are working on cost down and brand specific equipments which we have to procure from US. The amount of taxation and import duty is very high and we are also exploring as of now. Currently initial development is in mall only and then we would like to go high street and restaurants.

As per your observation and experience, how international cuisines are helping the Indian restaurants to grow manifolds?

Beauty of this well established concept from developed countries is very well formatted; right from their supply chain is formatted. The operation, the way they run operation is well documented and everything is defined. When they want to enter in the market like India or countries which are not developed that much, it helps us to format ourselves. The children or people, who will work with us, will get the exposure.

Considering the global trend, don't you think you are entering India a bit late? Or do you think it is the right time?

We don't believe we are late. India is a very big and very deep market. The level of penetration in India is low when you talk of international food chains, and other consumption led brands. The market is far more mature today than it was a decade ago and there is so much ground to be covered here.

Brands like McDonald's, Burger King, Johhny Rockets and Dunkin' Donuts are already here. What strategies you are likely to pursue to get a share in a tough competitive market?

India is a very price conscious market, very competitive and sensitive. We try to stand with few legs here which really are the differentiators for us.

We have a menu unlike any other brand. We have a very large range of vegetarian offerings, most of our menu is culinary driven and is not coming straight from the factory. We’ve worked hard to create an ambience which is seen a notch above what the market has seen so far from QSRs. We’ve focused on things like different seating formats, the music we play, lighting etc. to ensure we offer a better food experience. We serve our food in proper crockery along with table service and all our food is cooked only when you order it. So, there are several differentiators which will make us stand out.

How much time have you taken to sign the deal and introduce Wendy's to Indian market?

We have taken a lot of time; and done so consciously and deliberately. We have been working with Wendy's US for almost two years to bring them to Indian market and it's almost one and half years since we have signed the agreement with them. We’ve spent a lot of time on working out on what will be our product offerings, what will be our service module, what will be the customer experience etc. All this has taken time but has helped us transform from the conventional and traditional QSR to what we are calling a QSR Plus.

What is your expansion plan, cities in your radar? Are you planning to tap tier-II cities as well?

We are planning to open over 20 outlets in first two years. Initially we will focus on NCR and North India, of course we will be going out of the capital region and covering the full country but for the first two years North India will be the focus.

What segment of market you are focusing most in India and why?

Frankly speaking I would say, every segment is our target segment. We are placing our offering in front of consumers who are looking for quality products, who prefer good service and who realize the difference between what fresh produce and products are. If I have to define our target segment, its people who want to have a differentiated food experience rather than defining it just by an age group.

What are you doing to make your product suitable for local customers?

We have spent over a year on product development to ensure our products are relevant to the Indian consumer. We’ve worked out an extensive vegetarian menu to suit the Indian palette. So, yes I would say we have tailor-made the menu. We have engaged a culinary team which has worked with us in different capacities in our restaurants in our food businesses. It's a team of chefs who have worked with various casual dining chains. And there was very active participation from US Wendy's team to help us develop the same.

How do you view the competition from local entrepreneurs as you have also acquired brand like Barista and Kylin in India and you are also in talks to bring Jamie's Oliver to India?

India is at the cusp of the food retail explosion today, the consumer is far more mature, aware and therefore we see a lot of potential for different cuisines, formats that can come to India. We are bringing Jamie's Italian in a different format to India and we feel that it fits into a different space or mindset as compared to Wendy's and so does our cafe chain Barista and Pan-Asian chain Kylin.

How has been the response so far?

The market has received us very warmly. We are extremely excited and are planning to roll out 10 more restaurants this year and another 10 next year. While we have aggressive growth plans, we want to continue keeping the focus on our product quality and experience and don’t want to jeopardize the same for the sake of numbers.

You have opened 14 outlets in four months. What is your next big plan for Indian market?

We will continue to build outlets in Delhi-NCR, Mumbai and Pune and we are already building it. But our next big plan in India is to enter Punjab and Bengaluru market by entering cities like Chandigarh, Amritsar, Jalandhar and Ludhiana. We have restaurants in Delhi which are under construction; we are going into a pipeline of restaurants which will continue to grow in Mumbai, Delhi and Pune in the months to come.

What is the number of outlets that you will be opening at these locations?

One of the things that I don’t do is throw out numbers; more important is to build good restaurants, the restaurant needs to be convenient to people, the rents too need to be convenient, and the economies need to be in place that helps it to grow properly rather than be just growing. So, for me, the definition of growth is growth that is profitable. And we will build as many restaurants as we can. People have already seen what we have done in the last 90 days, so we do not need to give numbers to show our growth.

Are you planning to enter other markets as well?

First, we will grow in these markets and then we will tap other markets to grow like in Chennai, Hyderabad, Kolkata, Kochi, Kerala and Ahmedabad and into the eastern market and also open our outlets at airports. We are in talks with different markets; the concrete plan is really Punjab and Bengaluru. But we will continue to talk with other areas as well as we want to build a pipeline. Whether it will be the end of this year or the beginning of next year will be determined as we grow.

Are you facing any price war from players like McDonald’s, KFC and Dunkin’ Donuts operating in the same segment?

Our strategy is about everyday value pricing, so if you look at our stunner menu, a complete veg combo is for Rs 69 and we have non veg combo at Rs 79 and the sandwich alone is for Rs 35 and non-veg sandwich is Rs 49. We have cravers starting at Rs 25 and we have good pricing of all our premium products. We have the stunner menu and the cravers menu. So, we have items that we are selling at every price points. However, competition is there all around the world. We are all working in the same sector and everyone has a USP for the business that they sell. There is enough business in India for all of us (QSR players). If one looks at global markets, there the trend is much more penetrated. But here, there are a few McDonald’s and KFC outlets, but for us the penetration has not yet been started. And we all will be fighting in the same race because that is the nature of the business and we all are in the same area. And, I think, we are in at the best of the times, as the infrastructure is strongly set up and the clients are well versed on QSR formats now.

You have done a lot of research before entering into the Indian market. Why so?

We came here and started from scratch. All the 13 sandwiches and cravers and all other offerings have been done from scratch over here. So, it is very home built, all are suppliers are Indians, all our food is not imported it is from Indian market. There is some equipment that we buy from abroad because it is not manufactured here in the country. We are buying from McCain, Vista Foods, Venky’s, FieldFresh amongst others to keep our products fresh and of high quality.

You have opened 10 restaurants in 52 days. Was it the BK brand that made it possible or the team effort?

Last year we started on November 9 and opened 10 outlets by December 31st. It is always everyone put together. We work with Ever Stone Capitals, which is one of the top companies in Asia. We have a very strong team. My team is made of the cream of the crop with top professionals in India. We had great support from the Burger King brand in APEAC. But in the end, it comes down to the energy level.

Which according to you is the best item in your menu?

I am biased towards a lot of products, but my top picks are Tandoor Grill, mutton whopper and then the burger which is not talked a lot but is a favourite of mine, in our Royale series.

We have seen negative as well as positive vibes on Social Media. What is your view?

Most of the negative comments that we are getting through social media are from people who want the beef and pork item that Burger King sells out of India. We have decided not to sell beef and pork in any of our restaurants in India. The qualities of all the products are of BK standards as we have pushed the standard that Burger King has laid out in its global markets. We have also no-trans fat in any of the products or the cooking oil. We have low MSD products and that was the conscious choice that we made. And the work that India has done in building these products has been recognised by the Burger King system all across the world and these products are now going to grow in other countries. And this is for the first time in sixty years of history of this brand and they have never done the kind of research which is done in India.

California-based burger chain Carl’s Jr known for its authentic American and premium-quality charbroiled burgers and freshly prepared, flavourful menu is entering India by January 2015 in partnership with Sam Chopra led CybizCorp. Michael Woida, Senior Vice President, International at CKE Restaurants, in a conversation with Nusra, outlined his strategy for the Indian market and the reason for choosing CybizCorp as franchisee partner.

Considering the global trend, don't you think you are entering India a bit late? Or do you think it is the right time?

We believe that it is an opportune time to enter India for several reasons; India is now experiencing a renaissance of sorts in the introduction and exposure of western QSR and casual dining brands that are dramatically contrasting the one or two legacy QSR players that we’re early entrants. The young, heavy QSR users in India, having been introduced to QSR in the late 90’s and early 2000’s are now seeking a more sophisticated, mature, and premium option for their lunch and dinner occasion that still offers value and affordability. They’re ‘graduating’ in a way from the venues they frequented as children to venues and flavor options that are more closely aligned to their current lifestyles and income.

You are already present in markets like Brazil, Canada, Costa Rica, Denmark, Ecuador, New Zealand and the Bahamas. Why India so lately?

Our India entry was strategically timed to meet Carl’s Jr expansion timelines into key developed markets. For long, our team was researching and understanding the taste of Indian consumer and market as it contemplated the most effective menu conversion and enhancement from a premium beef hamburger restaurant to a credible quick casual restaurant in India that offers premium Veg offerings as well as unique chicken options (No Beef).

Why CybizCorp as a master franchise partner? You must have been in talks with others?

CKE has been prioritized India research and menu development over the identification of specific franchise partners - once completed; CKE has engaged several franchise candidates that have the business acumen, infrastructure and real estate network that could effectively develop an identified territory within India. CKE selected CybizCorp based on its tremendous success operating and franchising in the real property sector as well as its food & beverage consulting practice and its existing infrastructure of business professionals.

Brands like Mc Donald’s, Johnny Rockets and Dunkin’ Donuts are already here. What strategies you are likely to pursue to get a share in a tough competitive market?

First of all, we believe that in relative global terms, India does not offer any unique competitive challenges. We in over 70 years of operation has been a favourite place for premium ‘Char-Grilled’ burgers and chicken sandwiches using the best quality ingredients with a history of best-in-class product innovation, unique service systems, all-you-can-drink beverage bars, and contemporary and comfortable in-restaurant décor’s catering to our target market.

What segment of market you are focusing most in India and why?

Our communication, menu development, and restaurant are designed specifically to be the ultimate fast food burger destination for aspirational 18-34 year old young hungry guys and girls with the disposable to frequent QSR venues on a regular bases and are seeking a premium lunch or dinner experience.

What are you doing to make your product suitable for local customers?

Our India menu will consist of both Carl’s Jr favourites including Char-Grilled chicken sandwiches, side items, and desserts as well as a an assortment of All-Veg burgers specifically custom crafted for the India market. Our char-grilled cooking process will also allow for Carl’s Jr to offer non-deep fried burger and chicken options that will have both new and familiar flavors.

Tell us about your operation in the Indian market, number of outlets and expansion plans?

Carl’s Jr, through its exclusive franchise developer will be developing 100 restaurants initially in North and Western India and CKE envision growing to 1,000 restaurants in India over time given the growing QSR market size that exists.

What will be your strategy on the products that you will offer in India?

To offer great tasting, premium burger, sides and desserts to satisfy our young and aspirational consumer. We will source and offer the best quality ingredients in its innovative burgers and other menu items with very strong emphasis on a reliable supply chain, the highest levels of food safety, and our guests’ assurance of the absolute quality in the segregated preparation of its Veg and Non-Veg products.

As the word innovation has become the new ‘in’ in the food service market. Global burger chains like, McDonald’s, Wendy’s, Burger King are playing hard to innovate with their menu.

According the industry as people are no more addicted to the same old taste, these fast food chains are bound to renovate and tweak their menu to make customers coming to them.

Burger chains like Burger King which entered into Indian market last November has almost tweaked the menu according to taste and palate of Indian customers. And this was the first time in the brands history that it has brought changes or played extra with flavours to fit it according to the Indian palate.

And going on the same lines, McDonald’s is globally renovating its menu to bring back its lost customers. Recently the burger chain has launched a burger with ground chicken in Tampa Bay area.

The new chicken burger is made from a blend of white and dark ground chicken, the Tampa Bay Business Journal reports and can be ordered in two varieties: "classic," with red onions and ranch sauce; and "tangy," with grilled onions and a tangy "signature sauce,".

The sandwiches, which are each under 400 calories, also come with lettuce and tomato on a new "gourmet" potato bun

The burger chain has debuted this burger in all its 202 outlets in the Tampa Bay area. The sandwich was created in part by Blake Casper, who owns more than 50 McDonald's restaurants in the Tampa Bay area, according to the Tampa Bay Times.

"The whole chicken burger market is growing; you're seeing it more in restaurants," Casper told the Times. "This isn't a chicken sandwich, but a chicken burger - there's a real difference in its bite."

Casper worked with the Pennsylvania-based McDonald's supplier Keystone Foods to bring the burger to market.

McDonald's Corporation has announced the appointments of Robert Gibbs as Executive Vice President, Global Chief Communications Officer and Silvia Lagnado as Executive Vice President, Global Chief Marketing Officer.

Both will report to McDonald's President and CEO Steve Easterbrook.

"Robert and Silvia are both highly-respected, talented leaders who will bring a wealth of experience and outside perspective to McDonald's as we build a more modern, progressive burger company," said Easterbrook.

According to the release both, Robert and Silvia -- with their respective teams -- will play critical roles in bringing this strategy to life.

In his new role, Gibbs will lead McDonald's corporate relations group, which manages internal and external communications and government and public affairs.

He will lead McDonald's in communicating clear, coordinated messages to internal and external constituencies, enhancing the brand and supporting corporate strategies.

Gibbs joins McDonald's from The Incite Agency, a strategic communications advisory firm he co-founded in 2013. Prior to that he held several senior advisory roles in the White House, serving as President Barack Obama's press secretary during his first term, then as senior campaign advisor during his re-election campaign. He will replace Bridget Coffing who announced her retirement earlier this year after 30 years with the company.

In her new role, Lagnado will be responsible for all aspects of global brand management for McDonald's, including global marketing, menu and consumer insights.

Lagnado was most recently chief marketing officer of Bacardi Limited, where she was responsible for setting the marketing vision for multiple brands. Prior to that she spent 20-plus years in positions of increased responsibility at Unilever, including serving as executive vice president of the Savoury business unit. She also created Dove's "Campaign for Real Beauty" -- one of the most awarded advertising campaigns in history. For the last two years, she has served as non-executive director on several boards in the UK, Brazil and the U.S.

Lagnado has been recognized by Ad Age as one of its "100 Most Influential Women in Advertising" and by the Wall Street Journal as one of the "Top 50 Women to Watch." Her appointment fills a position previously open due to organizational changes.

McDonald's is the world's leading global foodservice retailer with over 36,000 locations serving approximately 69 million customers in over 100 countries each day.

More than 80 per cent of McDonald's restaurants worldwide are owned and operated by independent local business men and women.

Westlife Development Limited owner of the Master Franchisee of McDonald’s restaurants in West & South India has announced the introduction of Focaccia buns as an option to their regular burger buns, reiterating their diligent efforts towards providing wholesome and customized menu choices to customers.

Focaccia bread contains the goodness of extra virgin olive oil and is packed with high levels of antioxidants. Focaccia is also a rich source of Vitamin E and is a culinary delight for its inherent full bodied aroma and flavour.

The introduction of Focaccia Bread by McDonald’s is in response to a recent growing trend of customers demanding varied bread options especially in the whole wheat and multigrain bread segment (6 per cent in 2013-14).

“McDonald’s, as a brand, has always been committed to developing our menu to reflect evolving customer tastes. We are focussed on creating modern menu options and work towards empowering the customer in making wholesome food choices when dining at McDonald’s, by ensuring that our products are aligned to the nutritional benefits that customers seek,” said Amit Jatia, Vice Chairman, Westlife Development Ltd.

Focaccia Buns get their flavour from fragrant herbs such as oregano, basil, rosemary along with a sprinkling of savoury chilliand garlic.

McDonald’s has added ‘Soy Flour’ for which increases the protein quotient in the bun and the fact that sugar content in Focaccia buns is minimal helps uplift its wholesomeness. The Focaccia Buns are dusted with Cornmeal for added zing and fibreand make the delectable buns more visually appealing.

Continuing the emphasis on local sourcing, the Focaccia buns are sourced from Mrs. Bector’s state-of-the art facility in Khopoli, which follows stringent measures to maintain hygiene and food quality that are in sync with the McDonald’s philosophy.

“With Focaccia Buns we will provide customers the option to customise their burgers for the first time since McDonald’s inception in India. We aim to offer good food choices and personalization options, which are the key drivers for customer preferences in today’s competitive QSR space,” added Jatia.

Customers can now customise their burgers by opting for Focaccia buns instead of the original bun for an additional cost of Rs 15.

Focaccia Buns will be available for a variety of popular burgers such as McVeggie™, McAlooTikki™, McChicken™, Chicken McGrill™, McEggas well as the McSpicyand Masala grill range.

Focaccia buns are available across McDonald’s restaurants in West and South India for a limited time starting from May 1st up to 30th June 2015.

Ever since global brands have entered the Indian market, they have something lucrative to offer to the hungry Indian customers. And with competition getting tougher at the fast food segment, these brands are coming up with value added offers to shower on customers.

Food giants like Domino’s, Pizza Hut, KFC, McDonald’s and Subway, amongst others, have come up with many such offers to overcome their same stores sales drop which has highly affected the QSR market in India. McDonald’s which was amongst the first global majors to tap the Indian market, entered India by opening its first outlet in October 1996 at Vasant Vihar, Delhi. Since then, it has seen several ups and downs in its operation in the last 19 years. The master franchisee for the brand in India, Hardcastle Restaurants (HRPL) serves approximately 185 million customers, annually, at its 202 (as of December 31, 2014) McDonald’s restaurants across 24 cities in the states of Telangana, Gujarat, Karnataka, Maharashtra, Tamil Nadu, Kerala and parts of Madhya Pradesh, and provides direct employment to over 7,500 employees.

But despite all these growth, the brand has to face repetitive fall in the same store sales, closing few of the outlets and coming up with various techniques to draw fair business from the Indian market. McDonald’s operates through various formats and brand extensions including standalone restaurants, drive-thru’s, 24/7, McDelivery, and dessert Kiosks in the Indian markets. Not only this, the brand included McCafe outlets at a few of its McDonald’s outlet, tapping the cafe customers in the market. The brand recently announced to open over 150 McCafes in 3-5 years by actively opening these outlets in South India. McCafe will take the expression “let's talk over a cup of coffee" to a whole new level with its aromatic coffees and flavoured teas that can be enjoyed in a relaxing ambience. The brand said in a release issued during the launch of McCafe in Bengaluru.

Commenting on the same, Smita Jatia, Managing Director - Hardcastle Restaurants, shares, “With the launch of McCafe, we will strengthen our beverage strategy and build our restaurants as a one-stop destination for all customers to enjoy across all day parts.”

On the other hand, Domino’s Pizza India which enters India in 1995, but began operation in 1996 is successfully running its outlets in the country. The brand which renamed itself as Jubilant FoodWorks in 2009 has also faced several setbacks in its same store sales. The brands sales in the same quarter, Q3 of FY-15, has seen a 1.9 per cent surge in same-store sales (2.6 per cent decline the year before), despite losses in Dunkin Donuts. Domino's operating in the same space as Yum Brand’s Pizza Hut is bombarding its customers with different offers to maintain its sales in the country. Having claimed that India is the largest market for Domino’s outside the US, the brand has lots more in its menu to offer to the ever rising demands of the customers.

On the same lines, Yum Brands which is struggling globally has announced to close its few outlets globally, operating brands like KFC, Pizza Hut and TacoBell in the country. Yum which competes with Domino’s in the pizza space may threaten Domino’s business speculates experts. On the other hand, its KFC business which has been cold in the last few months is seeing new items on the menu to beat the drop in sales. KFC, fresh off a campaign for a fiery brand of preparation, claims to have met with success with its menu innovations.

Earlier talking to a national daily, Dhruv Kaul, CMO, KFC India, shared, "There is a faster uptake of our menu innovations. In the past, our branded beverage Krushers and Fiery Grilled chicken have done well. Our legacy of consistent innovation is not a reaction to competition."

Meanwhile, the entry of other global competitors like Burger King, Wendy’s, Carl’s Jr in the same segment may give these iconic chains a stiff competition as these brands have spent a lot of time in researching about the Indian market to take on well established brands in the market. Thus, we can say that the fast food or the quick service space in the country will have lots of spice in their operations competing with each other in the same race.

With Western foods becoming more popular among Indians, brands like KFC, McDonald’s, Burger King and Dunkin’ Donuts, operating in the same segment are facing a price war amongst one another.

McDonald’s which is known for serving low-priced burgers and combo options has recently revised its burger prices selling its cheapest burger at Rs 27 which was earlier for Rs 25. On the other hand, players like KFC and Dunkin’ Donuts which are operated in India by Yum Brands and Jubilant FoodWorks respectively are selling their burgers a bit higher compared to the price being offered by McDonald’s. Dunkin Donuts is offering its cheapest ‘Potato Harsh Brown Burger’ at Rs 49 and KFC is offering ‘Potato Crisper’ at just Rs 29 which is all inclusive of taxes. The new entrant in the segment, Burger King is offering ‘Crispy Veg’ at Rs 35 which is its starting price for the Indian market. However, the chain has priced its product on every day value pricing. Burger King which entered with about 50 per cent of vegetarian menu is also getting good sales on its both vegetarian and non-vegetarian products.

“We have a sale per cent age of 50:50 shared between both non-vegetarian and vegetarian offerings. Both our products are doing an equal sale till now,” shares Rajeev Varman, CEO, Burger King India.

McDonald’s which used to sell its starting combos under ‘Econo- meal’ at Rs 79 has revised its price at Rs 109. Whereas its competitor Burger King is offering its combo ‘Stunner Menu’ at Just Rs 69 which includes crispy veg burger, fries and small soft drink. While KFC has its combos starting at RS 79 and Dunkin Donuts is not offering any combo on its menu so far. Thus, we can say that to retain the market for their brand, global chains have stuck into a price war, where each of them is competing with one another to deliver their best at an everyday value pricing.

“Our strategy is about everyday value pricing, so if you look at our stunner menu, a complete veg combo is at Rs 69 and we have non veg combo at Rs 79 and the sandwich alone is 35 Rs and non-veg sandwich is 49 Rs. We have cravers starting at Rs 25 and we have good pricing of all our premium products,” points Varman.

However, chains like Johny Rockets and Fatburger are struggling to compete with these brands as they have kept their burgers a bit highly priced as compared to these brands. Meanwhile, upcoming chains like Carl’s Jr and Wendy’s are yet to decide on their pricing keeping in mind the tough and demanding Indian consumer.

Talking to Restaurant India earlier, Ned Lyerly, President- International, CKE Restaurants said, “Our primary target demographic will be the 18-34 age bracket with aspirational ideals that have the disposable to frequent QSR venues on a regular bases and are seeking a premium lunch or dinner experience. Pricing will be with reach of consumers that currently frequent existing QSR and casual dining venues.” The burger chain is to enter India by June as per the latest information by its master franchisee in the country CybizCorp.

Hence, the competition in the fast growing Indian market is getting a bit tough for not only the two of the most celebrated Burger Chains like McDonald’s and Burger King, but also their ongoing competitor like American Doughnuts chain Dunkin’ Donuts and KFC which is so far serving best quality chicken products and donuts in the country respectively. Thus, we can say that Indian food industry is not only facing a price war but it also going through a burger war.

Burger King, which entered India with lots of bang, is betting high on the Indian market. The burger chain is planning to open 12 outlets in India within a year. After opening of its first store in Delhi, the brand will do subsequent launches in Mumbai and 10 other locations.

Burger King, the world’s second largest burger chain has opened its doors for burger lovers in India at Select CityWalk on November 9.

The burger chain has witnessed huge response among the locals with waiting queues and crowd outside the outlet.

The burger chain which has also partnered with e-commerce platform, ebay to sell it whoppers burger online has extended duration of ebay vouchers till 16th November.

The burger chain has also eliminated ‘Beef’ from its menu due to the religious reasons in India. The restaurant will be serving chicken, mutton and vegetarian burgers in the country priced almost same to the other competitors in the QSR segment.

Not only this, the world's second largest burger chain has kept the menu very reasonable targeting the middle class customer of the country.

Intense speculations are rife over probable locations of Burger King’s outlet in India, as Miami based company is all set to make India entry. However, its Indian foray is somewhat enigmatic. As frenzied media in India is relentlessly speculating its probable locations. Not only this, the media is also trying to solve the mystery of number of outlets that BK is planning to come up with.

Recently, a media report speculated that the chain will open 12 outlets in India. However, when Restaurant India examined the issue, a senior official requesting anonymity said there is no such number has been decided.

‘The burger chain will either open its first outlet in Delhi-NCR or Mumbai,’ he added.

’Rumours are also rife that the brand is planning to open its first outlet in Select CityWalk mall located in Saket, South Delhi.

Wall Street Journal in a recent report said, ‘it is unclear when, or how many outlets, the U.S. fast-food chain plans to open in India’. Burger King declined to comment ahead of the launch, the report added.

The WSJ report said that the Indian media expecting the company to open at least 12 outlets over next three months in cities including Bangalore, Pune and Chennai.

A first outlet is due in New Delhi, according to Burger King’s Indian partner, Everstone Capital Advisors. But an Everstone spokeswoman chose to remain tight-lipped about the exact location,” the report further added.

The burger chain will enter India by November.

Photo Courtesy: Burger King

India is now experiencing a renaissance of sorts in exposure of new and global cuisines coming on its way where burger has become ‘Almighty Burger’. At the same time, Indian menus are being reinvented as fusion cuisines like Gujrati Mexican or Punjabi Italian to appeal to different palates.

The Burger War

Widely known as the most beloved food of Americans, burger now tops the preference chart among Indian youth, when they are eating out or feasting with friends and families. According to a recent research by Foodpanda, an online delivery and food ordering portal, Indian cities like Delhi, Pune and Mumbai have topped in burger consumption with 31 per cent, 30 per cent and 21 per cent respectively.

Witnessing a greater opportunity in the segment, major western brands like Johnny Rockets, FatBurger, Burger King, Wendy’s and Carl’s Jr are entering Indian market with a bang by localising their product to suit Indian palate.

Jhonny Rockets, which has already opened its two outlets in India, is looking to expand across the country within next two years. In an interaction with Restaurant India earlier, Duane Messerschmidt, Director-International Sales, Johnny Rockets, said, “India continues to emerge as a consumer-driven economy. It also represents the largest under-35 age demographic in the world and has a growing upper-middle class population. All three of these conditions are particularly attractive to retailers. Rural population moving into cities and newly established towns is also an advantage, which has created more concentrated economic development throughout the country. For restaurants, this means that more people with more disposable income are dining out much more often than before.”

Other brands like Burger King, Carl’s Jr, etc are set to open their outlets in future feel that the growing middle class and travelling Indians have given a way to the foreign cuisines into India.

Choosing the Franchisee Route

Expanding the brand in other geographical areas seem difficult to the western brands and hence, they feel that expanding via franchise is the best model to place their brand in other countries.

Jhonny Rockets, which entered India in February 2014, has chosen Prime Gourmet Private Limited as its franchisee partner in the country. On the other hand, Burger King is entering the country by opening its outlet in Mumbai and Delhi-NCR though a partnering with Everstone Capital. Carl’s Jr, which is set to open its outlet in January 2015, has signed a master franchisee deal with Sam Chopra led CybizCorp based on its tremendous success in franchise channel.

“CKE has prioritised India research and menu development through identification of specific franchise partners. Once completed, CKE has engaged several franchise candidates with business acumen, infrastructure and real estate network that could effectively develop an identified territory within India. CKE selected CybizCorp based on its tremendous success operating and franchising in the real property sector as well as its food & beverage consulting practice and its existing infrastructure of business professionals,” says, Michael Woida, Senior Vice President-International, CKE Restaurants.

Going ‘Desi’ is the Mantra

The brands are going desi with their offerings in Indian market. They are focusing more on localisation of their products by removing pork and beef burgers from their menu and including veg and paneer burgers at the same time.

“Though FATBURGER is famous for its freshly made burgers. We have so much to offer to our global fans in terms of variety and flexibility in our vegetarian and non-vegetarian flavour options,” says, Andy Wiederhorn, CEO, FATBURGER.

At the same time, Tanmay Kumar, CFO, Burger King, believes that going desi in India is the only solution to place your brand in the country. However, Burger King will be serving its authentic plus Indianised burgers in the country.

Target Customers

The burger chains are positioning their products targeting the young Indian crowds who are more open to try new foods and are regular visitors to QSR giants. However, brands like Johnny Rocket are open for all food lovers who enjoy eating American Burgers.

“Our primary target demographic will be the consumers in the age bracket of 18-34, that visit QSR venues on a regular basis and are looking for a premium lunch or dinner experience. Pricing will be within the reach of consumers that frequently visit existing QSR and casual dining venues,” elaborates Michael.

With such a wide swath of consumers in play, it’s strongly recommended that brands which haven’t already tested their concept or explored India’s potential should abandon their lingering reservations and start thinking big.

On cafe culture

There are various reasons. With increased awareness and social media, people of all age groups favour visiting cafes. Cafes are aspirational, offers an experience to enjoy and savor, a meeting place to meet your colleagues or carry out a business meeting. The trend is present in Tier 1and Tier 2 cities but the growth shows that will soon be present in Tier 3 cities too.

On expansion plan

We are present in 13 cities across India and have 20 cafes all over. We are opening a new cafe in Guwahati this year and so far have opened three outlets already in this year. By March 2014, we will have at least 2-3 more locations under different stages of opening. We have evolved the menu a lot over the last few years. We have more food options like pizzas, all day meals, alcohol in some locations, sizzlers etc.

Evolution from Indo-Tibetan looks to Mediterranean look

The initial Mocha were with the Arabic theme but now the cafes are more modern looking and each location is unique with its own distinctive elements. All locations look different and have their own individual identity.

On challenges faced

The backend is already in place as we are in existence for more than 10 years. With the recent spurt in the number of stores we have been able to deliver the correct product in all the cities.

On competitors

We are in a different space in the market as we are not a cut paste model. Each cafe has its own identity and individuality with live kitchens serving fresh foods and beverages. In some location, we serve alcohol as well.

On foreign brands looking into Indian markets

India continues to emerge as a consumer-driven economy. It also represents the largest under-35 age demographic in the world and has a growing upper-middle class population. All three of these conditions are particularly attractive to retailers, like Johnny Rockets. It’s also a benefit that rural populations are moving into cities and newly established towns, which has created more concentrated economic development, throughout the country. For restaurants, this means that more people with more disposable income are dining out more often than before.

Why India?

India continues to present franchising opportunities based on its large and rapidly expanding consumer market.

On selecting a location for your restaurant in India

Choosing the location for Johnny Rockets is something that we think as crucial as establishing success and growing the brand throughout any country. In India, the main cities of Mumbai, Delhi NCR, Bangalore, Pune, Hyderabad and Chennai will be the initial restaurant locations, based on a geographic point of view. In each city, the most prominent Mall/High street, with high foot traffic, will be most optimal – since our brand does extremely well in venues where people go to be entertained and have fun.

Challenges faced

The difficulties involved in opening a restaurant in a foreign country go well beyond the legalities; there are legalities to deal with even in the USA. The primary difficulties are more involved with logistics, timing and culture. Sourcing the correct building materials, equipment and food products can prove to be quite challenging when dealing with new countries. Once the proper products are sourced, establishing an effective supply chain is the next hurdle to overcome. Beyond these challenges are the challenges of ensuring that the Johnny Rockets brand will be culturally acceptable to the new country. This requires an extensive amount of consideration. In India, for example serving beef is not appropriate where we serve it around the globe.

On taking the franchisee route

All of Johnny Rockets international restaurants are operated by franchisees. We believe that this is the most effective business model for both our guests and for Johnny Rockets. For our brand to truly be accepted around the world, it is important for us to ensure that the people charged with operating the brand are attuned to the nuances of not only conducting business in each country, but also to the guests expectations and satisfaction with our brand. While we may consider ourselves to be experts in the Johnny Rockets business, we certainly understand that we are not experts in regards to conducting business in India. For these reasons, we have selected a team of expert Indian businessmen to represent the Johnny Rockets brand in India.

On target customers

Johnny Rockets has universal appeal across all age groups and lifestyles, which is why our brand succeeds in traditional mall locations as well as non-traditional venues that include casinos, airports, military bases, aquariums, theme parks and stadiums. To put it simply, Johnny Rockets combines the best elements from a century of American dining history to create an experience and menu that are relevant today and will be for decades to come. Our target customer is anyone who eats and wants to have an all-American dining experience.

Copyright © 2009 - 2025 Restaurant India.