Devyani International Limited, the largest franchisee of Yum Brands in India, is proposing to open the Bid/Offer Period in relation to its initial public offering of Equity Shares (the “Offer”) on Wednesday, August 4, 2021.

The bid period will close on Friday, August 6, 2021.The price band for the offer has been fixed at Rs. 86– Rs. 90per Equity Share.

The operator of Pizza Hut, KFC, and Costa Coffee stores, and the selling shareholders, may in consultation with the lead managers, consider participation by anchor investors in accordance with the SEBI Regulations, 2018, as amended (the “SEBI ICDR Regulations”). The Anchor Investor Bid/Offer Period shall be one working day prior to the Bid/Offer Opening Date.

Also Read: Devyani International to launch IPO on Aug 4

Devyani is the single largest quick-service restaurant (QSR) company in India to be listed on Swiggy and was among the largest QSR companies in India to be listed on the Zomato platform in 2019 and 2020, shared a spokesperson during a press meet today.

The IPO comprises a fresh issuance of equity shares aggregating to Rs. 4,400 million by Devyani and an offer for sale of up to 155,333,330 equity shares by the selling shareholders, namely, Dunearn Investments (Mauritius) Pte. Ltd and the promoter selling shareholder, RJ Corp Limited.

The offer includes a reservation of up to 550,000 equity Shares for subscription by eligible employees of the company.

The Company proposes to utilise the net proceeds towards repayment/prepayment of all or certain of the company’s borrowings; and general corporate purposes.

Devyani also operates home grown brands such as Vaango, Food Street, Masala Twist, Ile Bar, Amreli and Ckrussh Juice Bar.

Devyani’s business from the core brands (India and Internationally that comprises of Nigeria and Nepal) accounted for 94.19 per cent of its revenues from operations.

Also, the brand focused on digital adoption and revenue and sales from delivery grew from 51.15 per cent to 70.20 per cent this year.

It also opened 109 stores across its core brand in the last six months and has acquired 73 stores from Yum! Brands in last 2 years.

Kotak Mahindra Capital Company, CLSA India, Edelweiss Financial Services and Motilal Oswal Investment Advisors are the investment bankers appointed to the issue.

McDonald’s has launched a new outlet at Spectrum@Metro in Noida, strengthening its quick service restaurant (QSR) presence in one of the city’s busiest commercial and retail hubs.

The newly opened location is designed to cater to a wide demographic, including shoppers, working professionals, and families visiting the integrated retail destination. The store incorporates modern infrastructure, such as digital self-order kiosks, and offers a menu aligned with Indian consumer preferences.

Ajendra Singh, VP, Sales and Marketing, Spectrum@Metro said, “We are delighted to welcome McDonald’s to Spectrum@Metro. This launch adds a globally loved food brand to our evolving tenant mix and enhances the mall’s appeal as a complete lifestyle destination. We are confident that McDonald’s will become a favourite hangout for our visitors, offering them both quality and convenience.”

The opening of McDonald’s adds to the growing mix of food and beverage outlets at Spectrum@Metro, which is positioning itself as a multi-use destination for retail, dining, and social interaction in Noida.

French frozen yogurt chain Yogurt Factory has entered the Indian retail market in collaboration with FranGlobal, the international business arm of Franchise India. The partnership aims to introduce the brand’s low-fat frozen desserts and broader menu offerings to a growing base of health-conscious Indian consumers.

Founded in 2011 by Ouriel Hodara and Emmanuel Tedesco, both alumni of HEC Paris, Yogurt Factory began with a single outlet in Paris and has grown to more than 85 locations across ten countries, including France, Belgium, Spain, Morocco, and Malaysia. The brand’s Indian expansion marks a significant step in its global growth strategy.

Gaurav Marya, Chairman of Franchise India Group, said, “As Indian consumers increasingly seek mindful indulgence, Yogurt Factory is the perfect brand that blends wellness with joy. With 0 percent fat, unlimited toppings, and a cheeky, fun format—it’s the dessert of the future. At FranGlobal, we’re proud to launch a brand that speaks to both foodies and franchisees alike.”

The Indian operations will feature Yogurt Factory’s core offering of zero percent fat frozen yogurt, which customers can personalize with unlimited toppings at a fixed price. Options include a mix of fresh fruits, cereals, sauces, brownies, cookies, and global brands such as Oreo, Kinder, and Speculoos.

In addition to frozen yogurt, the brand’s Indian menu will include:

- Smoothies made with fresh fruit combinations

- Thick milkshakes in various flavors

- Liège and bubble waffles with customizable toppings

- Bubble teas and iced teas

- Freshly pressed juices

FranGlobal is targeting entrepreneurs with investment options between Rs 30 lakh to Rs 60 lakh, offering multiple store formats from kiosks to flagship outlets. The franchise model includes full support in areas such as location selection, store design, training, marketing, and ongoing operations.

The first Yogurt Factory location in India is scheduled to open later this year, with plans to expand across major metropolitan cities and high-footfall mall locations.

Bengaluru’s HSR Layout has become home to a new entrant in India’s growing specialty café segment with the launch of Tribes Coffee, a concept café built around wild-grown beans, tribal farming practices, and a menu of globally inspired cuisine. The brand positions itself as India’s first and only terroir-based coffee company, focusing on sourcing directly from indigenous growers and promoting sustainable, traceable supply chains.

Founded by Kiran Nerlige Gowda, Tribes Coffee seeks to spotlight the role of tribal communities in India’s coffee heritage. The café offers a curated selection of coffees from regions such as Araku Valley, Koraput, Paderu, Nimmagedda, Daringbadi, Similiguda, and Paduwa—each known for distinct soil compositions and climate conditions that shape flavour profiles.

To commemorate the opening, the café hosted four women from Nimmagedda village in Andhra Pradesh—Seedarapu Gangamma, Buridi Asha Latha, Buridi Munisha, and Addakatla Gennu—who were honoured by the Prime Minister in 2022 for their work in tribal farming. These women were the chief guests at the event, reinforcing the café’s focus on celebrating indigenous growers.

Kiran Nerlige Gowda said, “With Tribes Coffee, we’re not just serving coffee — we’re offering a taste of untold stories. This café is a tribute to the true guardians of the bean — the tribal women and communities who have, for generations, nurtured the land.”

The 1,400 sq. ft. outlet features an earthy, immersive design inspired by tribal architecture and culture. The interiors use curved walls, hand-painted murals, boulder-like furniture, and natural materials like wood, clay, and stone to reflect the landscape from which the coffee is sourced.

From a business model standpoint, Tribes Coffee emphasizes direct procurement from tribal communities, ensuring both authenticity and fair pricing. The company has committed to reinvesting 10 percent of its annual profits into the same communities, with a focus on education, healthcare, livelihood support, and cultural preservation.

Gowda added, “Urban health through tribal wealth is our mantra. The more we procure from them, the stronger their future becomes.”

The café’s menu integrates terroir-specific brews with global food offerings, designed to complement the coffee’s natural profiles. The range includes bold sun-dried roasts and forest-grown beans, marketed as rare and complex.

Tribes Coffee’s retail presence signals a growing shift in India’s hospitality and café sector, where storytelling, traceability, and community impact are increasingly becoming part of the consumer experience.

High Ultra Lounge, located on the 31st floor, is rolling out a curated series of hospitality events throughout June, combining themed evenings with skyline views and beverage-focused promotions. The venue’s weekly and month-long programming is designed to draw midweek and weekend footfall, leveraging experiential formats that tap into nightlife and culinary trends.

Ladies' Night – Every Wednesday

Targeting midweek business, High Ultra Lounge is hosting "Vibe Higher" every Wednesday evening. The offering includes complimentary cocktails for women from 9:00 PM to 11:00 PM, accompanied by happy hour pricing and a rooftop ambiance geared towards a younger demographic. The initiative aims to boost Wednesday night attendance and beverage sales.

Retro Night – Every Thursday

Every Thursday, the lounge activates "Retro Night," featuring music from past decades and a 50 percent discount on select drinks from 6:00 PM to 8:00 PM. A special menu has been curated for the evening, aiming to enhance consumer engagement with nostalgia-themed dining and beverage service.

Viva la Vista – All of June

Throughout the month, the venue is also running a Latin American-themed program titled "Viva la Vista." The offering includes Latin-inspired food and cocktails, incorporating elements such as tacos and tequila-based beverages. Accompanied by Latin music and a skyline backdrop, the initiative positions the venue as a lifestyle and entertainment hub with rotating experiential concepts.

These curated evenings reflect a broader hospitality trend toward theme-driven F&B experiences designed to create repeat visits, especially in urban rooftop venues competing for consumer attention in metro cities like Bengaluru.

Yeti – The Himalayan Kitchen has reopened in GK-2 Market, South Delhi, marking a return to the location where it first gained recognition for its regional culinary offerings from Nepal, Tibet, and the North Eastern hills of India.

The relaunch includes a menu of Himalayan dishes such as Jhol Momos, Ema Datchi, Thukpa, Sel Roti, and the Yeti Special Thali, prepared using traditional techniques and spices native to the region. The new outlet continues the brand’s focus on serving food that reflects the home-style cooking of the Himalayan belt.

Joy Singh, Partner of the brand said, “We’re thrilled to bring Yeti back to GK-2, where our journey began for many food enthusiasts in the city. Our guests have always resonated deeply with the authenticity and soul of Himalayan cuisine, and this new outlet is a homecoming of sorts.”

The outlet features interiors influenced by Himalayan design elements, including Tibetan and Nepali artifacts, wood finishes, and earthy tones that aim to reflect the cultural roots of the cuisine.

The return of Yeti to GK-2 strengthens its presence in Delhi’s hospitality landscape and caters to an audience looking for authentic regional cuisine within an urban dining setup. The brand continues to attract diners seeking traditional dishes with a consistent approach to quality and heritage.

Mumbai’s Colaba has added a new entrant to its dining landscape with the launch of Otoki, a restaurant rooted in Japanese culinary traditions. Drawing from the ethos of Japan’s izakayas and adapted for a modern dining audience, Otoki introduces a menu shaped by precise technique and seasonal ingredients under the leadership of Chef Mohit Singh.

Singh brings global experience to the kitchen, with previous roles at Kikunoi Honten (Kyoto), Indee (Bangkok), and Boury (Belgium). At Otoki, the focus is on an ingredient-led approach, where each preparation—from Kozara (small plates) and sashimi to hand rolls, ramen, nigiri, and robata-grilled proteins—emphasizes clean flavors and traditional Japanese methods.

The beverage programme is curated by Maia Laifungbam, India’s first certified sake brewer, and features a broad selection of sake, including sparkling and dessert variants. The menu is designed to introduce and deepen diners’ familiarity with sake across different taste profiles.

The restaurant’s design mirrors the minimalist aesthetics of Kyoto while aligning with Mumbai’s urban context. The result is an intimate and functional dining space intended for immersive hospitality.

Otoki has been launched by hospitality entrepreneurs Anurag Katriar and Pranav M. Rungta, who aim to create an experience that prioritizes storytelling through food and ambiance.

“Otoki is born out of our deep admiration for Japanese culinary culture—its simplicity, precision, and soulfulness. We wanted to create a space that offers more than just a meal; it's an invitation to slow down, share meaningful conversations, and experience the depth of traditional Japanese dining,” said Katriar.

“In a city as dynamic as Mumbai, we felt there was space for a concept that blends craftsmanship with approachability. Otoki brings the warmth of an izakaya together with fine culinary detail—it's where timeless Japanese traditions meet contemporary Mumbai dining,” added Rungta.

The launch of Otoki highlights a continued trend in Mumbai’s hospitality sector, where global culinary formats are increasingly being localized for the urban Indian diner.

The Kachori Story, a quick-service restaurant concept co-founded by Jai Agarwal and Yash Chandak, is redefining how traditional Indian snacks are served in a modern dining format. Built around the culinary and cultural legacy of the kachori, the brand draws from decades-old regional recipes and brings them into contemporary quick-serve settings.

The idea emerged during the pandemic when the founders, along with advisor Deepak Agarwal, began researching regional kachori styles across India. After three years of extensive development, the brand curated a diverse menu highlighting different kachori traditions—from Rajasthan’s moong dal variants to Bengal’s hing-laced urad fillings and Uttar Pradesh’s hearty stuffings.

Chef Vineet Manocha, who brings over 30 years of experience from establishments like The Oberoi, Hyatt, and Radisson, has led the culinary development. The focus is on offering consistent quality while maintaining regional authenticity. Every menu item reflects a deliberate effort to retain traditional flavours while adapting them to a QSR format.

“The Kachori Story is deeply personal to us. Growing up, kachoris weren’t just food, they were tradition, memory, and identity. With this brand, we set out to honour that emotion while reinventing the experience for today’s India,” said Agarwal and Chandak.

The brand appeals to a wide demographic: Gen Z customers interested in regional authenticity, millennials drawn to nostalgic flavours, and families seeking hygienic versions of traditional street food.

Each outlet functions as a gateway into India's regional snack heritage through a structured, quick-service model.

Café Delhi Heights, the homegrown casual dining chain, is marking 14 years in the Indian food service industry. The brand, which launched in 2011 with a single café in Delhi, now operates 46 outlets across 16 cities and plans to expand to 50 by the end of the current fiscal year.

As it enters its 15th year, the company has laid out an ambitious growth strategy that includes scaling up to 120 outlets and achieving Rs 500 crore in revenue by 2028. The expansion plan targets new markets, particularly Tier ll cities, while focusing on menu innovation and experience enhancement.

The brand currently operates in cities such as Delhi, Mumbai, Gurgaon, Noida, Chandigarh, Lucknow, Ludhiana, Amritsar, Srinagar, Dehradun, Patiala, and Raipur. It is preparing to launch new outlets in cities like Meerut and Jaipur as part of its ongoing expansion.

Vikrant Batra, Founder of Café Delhi Heights said, “Our mission has always been to build spaces where food, warmth, and conversation come together effortlessly. The next chapter is about reaching new cities and communities while keeping our spirit intact.”

In addition to growing its primary café model, Café Delhi Heights is diversifying its portfolio through new ventures. These include:

- Sarava – a coastal dining format inspired by regional Indian coastal cuisines.

- Ikigai, Iki and Gai – a concept rooted in Japanese philosophy, developed by Sarthak Batra, offering an experiential culinary experience.

- JLB (Juicy Lucy Burgers) – a fast-casual concept focused on gourmet burgers.

- Comfort Bakehouse – a bakery and delivery platform offering ready-to-eat gourmet baked items.

These formats are designed to align with evolving consumer preferences, while maintaining the brand’s focus on comfort food and consistent service.

The company’s expansion strategy continues to center on emerging metros and Tier ll cities, with an emphasis on scalable, sustainable growth and consistent guest experience. As Café Delhi Heights enters its next phase, the brand aims to maintain its identity while adapting to the shifting demands of the hospitality market.

Little Caesars, the world’s largest family-owned pizza chain, is set to enter the Indian market, marking its 30th country of operation. The company will launch its first outlet in Delhi NCR in June 2025, introducing Indian consumers to its HOT-N-READY pizza concept, known for affordability, speed, and consistency in quality.

The brand’s expansion into India reflects its broader global growth strategy, targeting markets with increasing demand for international dining options. The Delhi NCR restaurant will be the first in a planned series of launches in the country.

Paula Vissing, President, Global Retail said, "Launching in India marks an exciting milestone for Little Caesars as we expand into our 30th country. With our delicious pizzas and unbeatable value, we're eagerly anticipating introducing a unique menu that we believe will captivate India. Our mission has always been to offer delicious, high-quality food at exceptional prices, and we can't wait to introduce Little Caesars to families, students, and busy professionals throughout India."

To cater to the Indian market, Little Caesars has developed an exclusive menu combining its global offerings with localized flavors. This India-specific approach aims to align with local preferences while maintaining the brand’s focus on convenience and value-driven pricing.

The franchise rollout in India will be led by Harnessing Harvest, a local partner with nearly nine decades of experience in the Indian food and hospitality sector. Backed by a parent enterprise recently valued at over a billion dollars, the group brings deep insight into consumer behavior and evolving food preferences across India.

Little Caesars’ international expansion has included recent launches in Cambodia and Kuwait. The brand’s India entry follows a similar model, blending global systems with local adaptation. The company aims to integrate into the Indian hospitality ecosystem by becoming a convenient and cost-effective dining option for urban consumers.

As rising incomes and exposure to global cuisine shape dining trends in India, Little Caesars sees an opportunity to serve a wide customer base ranging from students and working professionals to families seeking quick-service restaurant options.

CYK Hospitalities has announced the launch of Via Bianca, a regional Italian restaurant located in the N Block Market of Greater Kailash I, New Delhi. The concept is led by Chef Kamalika Anand, a Le Cordon Bleu, London, and ALMA, Italy alumna, who brings years of international experience in Michelin-starred kitchens to the venture.

The restaurant is built around traditional Italian regional cooking, reflected in both its menu and layout. The design includes an open kitchen, a pasta shaping station, and a wood-fired oven. Dishes such as Strata Bianca di Zucchini, Spaghetti all’ Assassina, and Tigelle ‘Nduja form part of a menu intended to balance regional authenticity with broad appeal.

Chef Kamalika Anand said, “Via Bianca has lived in my head and heart for a long time. It’s more than a restaurant—it’s a tribute to the Italy I studied, lived, and loved. CYK Hospitalities didn’t just consult; they helped me channel a dream into something real. Every inch of Via Bianca carries a piece of my journey and hard work, backed by their strategic brilliance.”

CYK Hospitalities supported the operational and conceptual development of the restaurant. This included back-of-house layout, guest experience design, and integration of workflow systems intended to align with the brand’s narrative.

Pulkit Arora, Director of CYK Hospitalities added, “Via Bianca is a reflection of meaningful collaboration. We saw Kamalika’s passion and aligned it with a solid framework, from planning to execution. This project shows how soulful cuisine can meet market-smart strategy without compromise.”

Via Bianca represents a model of regional dining formats developed with structured planning and operational precision. CYK Hospitalities’ involvement is positioned to ensure the restaurant maintains both experiential appeal and business sustainability in a competitive Delhi hospitality market.

Curefoods has announced the launch of its flagship Sharief Bhai Food Plaza in Frazer Town, Bengaluru. Located on Mosque Road, the new outlet brings together four distinct Dakhni cuisine formats under one roof—Roz, Sharief Bhai Biryani, Dastarkhan, and Dawat-e-Falak. This expansion marks the brand's 68th outlet across India.

The store spans two levels, catering to various dining preferences. On the ground floor, Roz by Sharief Bhai will offer street-style items such as shawarma, grilled meats, kebabs, and beverages aimed at customers seeking quick-service options. This floor will also feature Sharief Bhai Biryani, focusing on traditional slow-cooked biryanis and signature Dakhni dishes.

The mezzanine level is dedicated to Dastarkhan, a fine-dining space highlighting a curated selection of Dakhni cuisine. Next to it is Dawat-e-Falak, a chef’s table format offering a structured tasting menu that incorporates storytelling alongside each course.

The Food Plaza is located approximately 150 metres from the brand’s original Frazer Town outlet. By opening on Mosque Road—a location known for its food scene and association with Ramzan celebrations—Sharief Bhai aims to connect traditional culinary practices with modern hospitality formats.

“Our new Frazer Town flagship store, Sharief Bhai Food Plaza, is a complete experience of Dakhni cuisine, from quick bites at Roz to the exclusive Dawat-e Falak chef's table. This is our most ambitious venture yet, bringing the richness of our heritage to the heart of Bangalore's food scene,” said Navaj A Sharief, Founder of Sharief Bhai Biryani.

The space has been designed to accommodate various dining styles, combining natural light with detailed interiors and formal elements like chandeliers to support both casual and premium experiences.

With this launch, Curefoods continues to diversify its offerings in the hospitality segment while strengthening Sharief Bhai’s footprint in the Indian foodservice market.

Aditya Birla New Age Hospitality has launched Supa San, a Japanese izakaya concept in Mumbai’s Bandra Kurla Complex (BKC). The establishment draws inspiration from the imagined perspective of a fictional manga-obsessed artist, creating a space that blends Japanese street culture with contemporary dining.

The term “Supa San” translates to “super fan” and reflects the venue’s theme—an immersive dining experience layered with visual references to Japanese pop culture and manga. From the interiors to the menu, every detail is influenced by Tokyo’s izakaya scene.

The culinary program is led by Chef Hideki Hiwatashi, who brings dishes such as hand-rolled ramen, kamameshi cooked in traditional iron pots, and a variety of tempura preparations. These offerings reflect authentic Japanese techniques, focused on simplicity and depth of flavor.

At the bar, Head Mixologist Trisha has developed a cocktail menu centered on Japanese ingredients. Guests can expect variations like wasabi-infused Picantes and interpretations of the classic Chu-Hi.

Beyond food and drink, Supa San incorporates manga-style wall art, signage, and themed design elements that reference Japanese underground fandoms. According to the team, the goal is to deliver an experience that’s not just culinary but also visually and culturally engaging.

The team said in a statement, “Supa San is a neighbourhood izakaya designed for discovery—where Japanese culinary craft meets the layered chaos of Tokyo’s backstreets and underground fandom. We channel the obsessive spirit of a fictional manga artist to create a dining experience that’s bold, immersive, and always a little unexpected.”

With this launch, Aditya Birla New Age Hospitality continues to expand its presence in the premium dining segment, adding another concept to Mumbai’s growing lineup of global culinary formats.

Gaurav Narang, founder of Coffee Culture, has introduced his latest hospitality venture with the launch of Morjim Culture, an all-day beachfront venue located in Morjim, Goa. This marks Narang’s 34th outlet in the hospitality sector and introduces a multi-format experience that spans a café, sundowner lounge, and speakeasy bar.

Situated directly on the beach, Morjim Culture is designed to transition across dayparts, beginning as a café offering a curated selection of slow-brew coffees and all-day breakfast items, evolving into a sundowner venue by evening, and transforming into a speakeasy bar by night. The venue aims to cater to a wide demographic including residents, remote workers, and leisure travelers.

The daytime café menu includes a range of slow-brewed coffees such as 24-hour Cold Drip, PourOver, and iced beverages like Mont Blanc (featuring mascarpone foam and orange zest) and The Oat Life (an espresso mixed with jaggery and oat milk). The venue also features Dirty Matcha in its cold coffee lineup.

Breakfast and light meal options include the Dragonfruit Smoothie Bowl, Tofu and Chimichurri Bowl, Overnight Oats, and Toffee and Nut Brittle — a coffee beverage made with in-house dark toffee syrup and mascarpone foam. The House Cold Brew, blended with single-origin Ghana cacao, is positioned as one of the core offerings.

By sunset, the venue pivots to a sundowner format offering beachside dining with dishes such as Vietnamese Beach Bowl, Smoky Lamb Urfa, Smoky Chicken Urfa, and Shore Seafood Herb Salad. Other highlights include Golden Kataifi Prawns, Tempura Sushi, Jackfruit Adana Kebab, and Sunkissed Butter Garlic Rice. Pasta-based options like the Shrimp Island Tortellini are also available. Desserts include the Apollo (coffee, Baileys, pistachio cream, finger biscuit) and Marble Cheesecake.

Signature cocktails are crafted to suit the beachside atmosphere. Drinks include Irish Maid (whiskey-based), Hey Honey (gin and grapefruit), Blueberry Julip, Mexican Murder (tequila, Aperol, jalapeño, red wine), Pepino Picante (cucumber and coriander), Matchatini (vodka, yuzu, matcha syrup), and Malibu Coconut Cosmo.

Morjim Culture also houses Unculture, a speakeasy bar concealed behind an unmarked entrance. Here, guests can select their mood from a board, allowing bartenders to tailor drinks to individual preferences. Standout cocktails include the Spro’groni — a variation of the Negroni with a coffee base — and the Frisky Raw Mango Picante, which blends tequila, raw mango, and jalapeño.

Morjim Culture includes additional lifestyle elements such as morning yoga sessions on the beach and communal spaces for casual gatherings. The venue’s interior features earthy textures and minimalistic design, with a structure that transitions seamlessly between indoor and outdoor areas.

Speaking on the philosophy behind the venture, Gaurav Narang emphasizes that the space is designed for travelers rather than tourists — aiming to foster a sense of community and deeper engagement. “It’s not for tourists; it’s for travellers. For those who come not just to visit, but to feel,” Narang said.

With a concept that merges hospitality formats within a single venue, Morjim Culture reflects a growing trend in India’s coastal hospitality sector — one where venues are designed to provide multiple experiential touchpoints across the day. The opening adds to Gaurav Narang’s expanding portfolio in India’s café and restaurant scene.

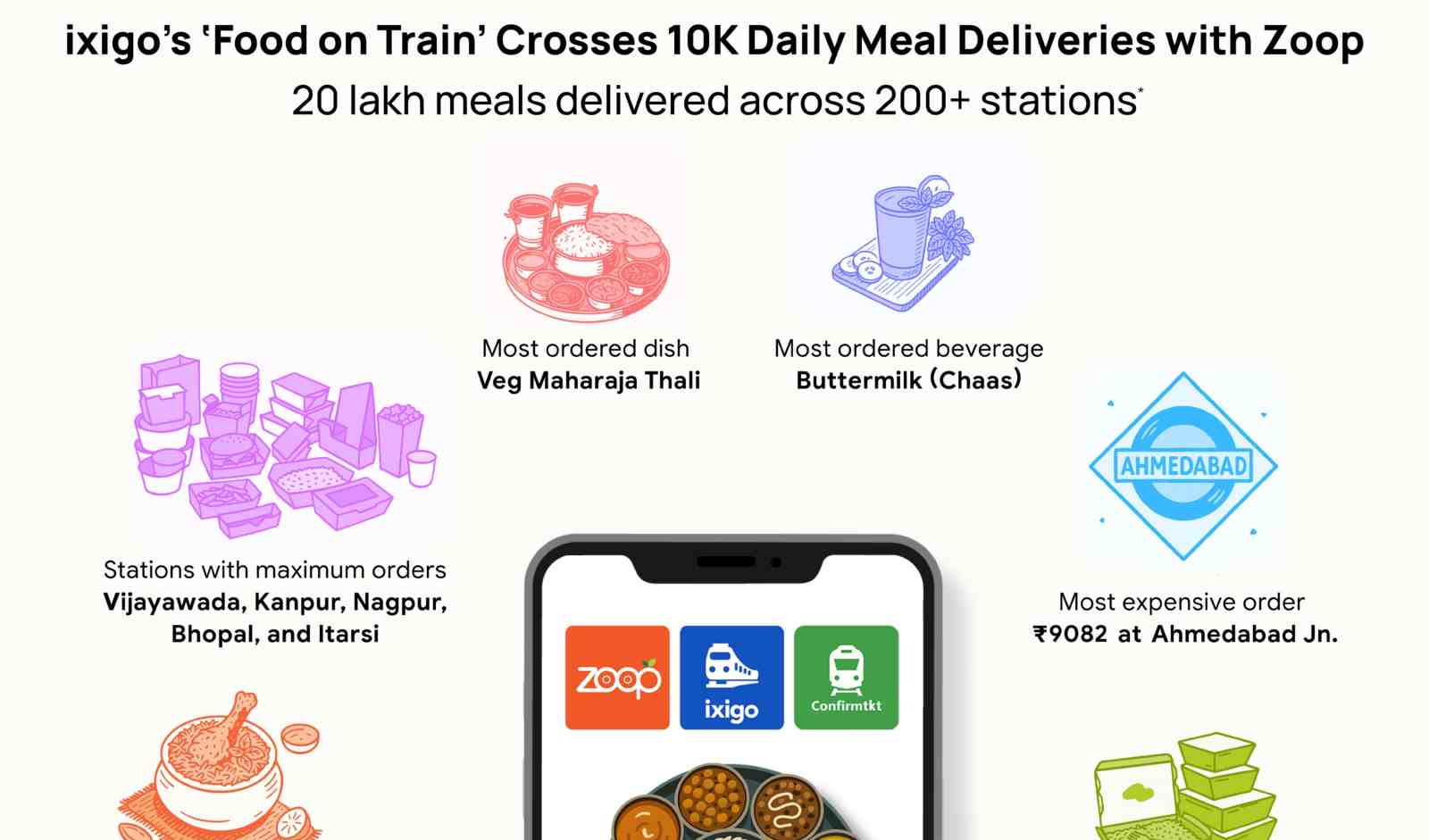

ixigo’s in-app food delivery service for train passengers has crossed a key operational benchmark, delivering over 10,000 meals daily in collaboration with Zoop. Since its rollout in October 2024, more than 20 lakh meals have been served through the platform across more than 200 railway stations in India.

The ‘Food on Train’ feature, available on the ixigo Trains and ConfirmTkt apps, enables passengers to access curated menus, place food orders from partnered restaurants, track deliveries in real-time, and receive meals directly at their train seats.

In the last six months, the service has registered notable consumer trends in ordering behavior. The Veg Maharaja Thali emerged as the most frequently ordered item across all routes, while buttermilk was the most preferred beverage. On specific routes, Chicken Biryani was the top choice among passengers traveling between Patna and Delhi, whereas the Jain Mini Thali saw higher traction on the Delhi-Mumbai and Delhi-Lucknow routes.

The platform also logged some high-value and bulk orders. The costliest single order placed amounted to Rs 9,082 at Ahmedabad Junction on the Shri Ganganagar Humsafar Express. Separately, the largest group order was placed by one customer who ordered 43 Veg Mini Thalis for delivery at Lucknow Junction on the Gangasatluj Express.

The five railway stations with the highest meal order volumes were Vijayawada, Kanpur, Nagpur, Bhopal, and Itarsi.

Aloke Bajpai, Group CEO, and Rajnish Kumar, Group Co-CEO of ixigo said, “At ixigo, our endeavour has always been to make travel more convenient, accessible and enjoyable. With over 10,000 daily meals now being delivered through our ‘Food on Train’ feature, powered by Zoop across our apps, we have expanded our scope of services for the 54 crore annual active users we serve. We are now solving for both the travel and food needs of Indian travelers pan-India with our network of 200+ stations.”

Puneet Sharma, Co-Founder and CEO of Zoop added, “With the broader reach of ixigo and ConfirmTkt, we have successfully scaled our business to become a Top-3 e-catering partner for IRCTC. From regional favourites to bulk orders, the diversity of food preferences we’re seeing across the country is pretty exciting and reflective of Bharat’s unique travel culture and the diversity of food offered by our restaurant partners. We intend to double down on this growth by adding more restaurant chains and integrating more deeply inside the ixigo and ConfirmTkt apps."

SALT, a restaurant brand with a presence in Chennai, Bengaluru, and Hyderabad, has entered the Maharashtra market by opening a new outlet in Pune. The restaurant is located in Kalyani Nagar and marks the brand’s first foray into the city’s competitive hospitality scene.

Known for its contemporary approach to Indian cuisine, SALT introduces a menu that spans dishes from various regions across India. The Pune outlet aims to cater to diverse dining preferences, from family gatherings to corporate lunches.

Chef Balaji Balachander, speaking on the new launch, said, “Location is key when we want to reach more customers. Pune is home to discerning food lovers who value authenticity and innovation, something which describes our ethos perfectly. At SALT, we don’t reinvent Indian food—we rediscover it. Every dish is rooted in something personal and nostalgic, yet plated in a way that’s clean and contemporary. Pune, I believe, is more than ready for this kind of celebration.”

The restaurant’s offerings include a curated list of dishes such as Charcoal Chicken Tikka, Galauti Kebabs, Parda Jhinga Kebab, Tokri Chaat, and Gunpowder Potatoes. For mains, items like Alleppey Fish Curry, Ras-Bhari Kofta Curry, and Special Dal Makhani are available. Desserts include Gulab Jamun Brûlée, Chironji Makhana ki Kheer, and Kesar Kulfi.

SALT also features a bar menu with cocktails inspired by Indian spices and ingredients. Notable options include the Nut Khut Bourbon, which combines hazelnut, rosemary, apple juice, and Bourbon, and Bagh, which blends gin, lemongrass, curry leaves, and ginger ale.

The Pune location has a seating capacity of 80 and is designed to reflect a blend of Indian design elements with a contemporary aesthetic.

Sahara, a Mediterranean-themed restaurant, has officially opened in Wakad, Pune, offering a global fusion dining experience. The restaurant accommodates between 150 to 200 guests and is positioned as a venue for casual meals, group gatherings, and social events.

The space was conceptualized and designed from the ground up by owner Girish Shedge. From handpicked furnishings to custom interior elements such as wall décor and lighting, the design reflects a clear vision rooted in Middle Eastern influences. The venue features handcrafted design elements including chandeliers and decorative rugs intended to create a cohesive thematic environment.

The restaurant is a collaborative venture between Girish Shedge and Navin Patrick, Director at NV Hospitality. Patrick, who brings over 25 years of experience in the hospitality sector, has been involved in the operational planning and execution.

“We are excited to present Sahara in the heart of Wakad to Punekars. The restaurant's design aesthetics and food tastes are inspired by my travel experiences. Our vision is to provide true luxury to my guests by providing the best in food and drinks. We look forward to welcoming more people from the vicinity and beyond to visit and share their experience at Sahara,” said Shedge.

The menu features a blend of Mediterranean and international cuisines, with a focus on fresh ingredients. Dishes emphasize traditional Mediterranean flavors, developed over centuries through cultural exchange and global trade. The beverage selection includes mocktails made from fresh fruits, and desserts incorporate visual presentation techniques intended to enhance the dining experience.

Sahara’s launch adds to Pune’s evolving foodservice landscape, especially in the Wakad area, which has seen increasing demand for experiential dining venues.

Zypher’s, a new entrant in Pune’s hospitality market, has opened in the residential locality of Wakad. The bistro is led by the mother-son duo Rohan and Ruchita Juriasinghani and has emerged as a focused hospitality project that brings together globally sourced ingredients, specialty coffee, and an emphasis on thoughtful interiors.

Launched in a township with limited direct food and beverage competition, Zypher’s is already building a dedicated customer base. The venue emphasizes product quality, sourcing coffee beans from Sumatra, cocoa from Indonesia, vanilla from Madagascar, and other ingredients from Japan and Thailand. The curation of raw materials reflects an intentional focus on ingredient origin and premium sourcing.

The café’s beverage program includes signature offerings like the Tiramisu Latte (with espresso, mascarpone, and cocoa dust), Blue Pea Iced Latte with honey, and the Iced Cocoa with java flakes. Additionally, Zypher’s has introduced a non-alcoholic beverage range under its “Spritesfree” menu. This includes blends such as Valley of Flowers (elderflower, lavender, grenadine) and Devil in Disguise (passion fruit, lychee rose, bird’s eye chilli, and sparkling water).

In terms of food, the menu includes a mix of nostalgic and globally inspired options. Items such as the Railway Cutlet and Toast, Mushroom Parmesan Toast, and Burrata with Sundried Tomatoes serve as comfort offerings, while the Korean Mushroom Cheese Mandu, Edamame and Truffle Dumplings, and Gochujang Mac and Cheese Balls cater to more experimental palates. Their sushi menu includes items like Tom Yum Chicken Sushi, highlighting the brand’s cross-cultural culinary positioning.

The space itself integrates natural materials and earthy design elements such as bamboo ceilings and hanging plants, curated to offer a relaxed dining environment. The venue aims to cater to both casual meetups and long-format brunch experiences.

Rohan Juriasinghani, Founder of Zypher’s said, “Zypher’s isn’t just a bistro for me; it’s a passion project that blends my love for great coffee, quality ingredients, and creating a space where people can truly feel at home. Every dish, every cup, every corner of this place has been meticulously crafted by the team to offer a warm, welcoming experience.”

Zypher’s is positioned as a hospitality-driven venture that integrates global food sourcing, experiential coffee, and a design-centric approach to dining, serving as a case study in independent restaurant growth within Tier-I suburban markets.

Essensai067, a community-driven retail enclave in Whitefield, Bengaluru, has launched its in-house hospitality venture, Barnhouse—a vegetarian culinary space that integrates sustainability and mindful dining practices into its operations. Positioned within the larger cultural hub of Essensai067, Barnhouse is focused on delivering an environmentally conscious and inclusive dining experience.

At the core of Barnhouse is a zero-waste kitchen, where ingredients are used without surplus, ensuring that nothing is carried forward to the next day. This approach supports the brand’s commitment to environmental responsibility. The restaurant also features in-house hydroponic systems, allowing for soil-free, pesticide-free, water-efficient farming that produces fresh ingredients throughout the year.

The menu at Barnhouse features globally inspired vegetarian dishes prepared using fresh, seasonal ingredients. Each component is selected with an emphasis on nutritional value and balance.

The restaurant’s physical structure reflects its commitment to sustainable design. Constructed using untouched quarry rocks, handcrafted wooden furniture, and Red Agra sandstone tiles, the space incorporates traditional materials. A signature pizza oven, built with Achikal bricks, blends artisanal methods with modern utility. The building’s passive cooling, natural light integration, and landscaped greenery are designed to reduce energy consumption and offer a calm atmosphere.

Haresh M Mirpuri, Founder of Essensai067 and Barnhouse shared, “At Essensai067, we believe that food is a powerful connector— As a community-first enclave where food, fashion, art, and music converge, Essensai067 is dedicated to fostering meaningful connections and creative expression. Barnhouse is our vision of what dining should be—a celebration of sustainability, flavor, and togetherness. We invite our guests to experience food in its purest form, connect with each other, and become part of a community that values both the earth and the joy of sharing a meal.”

In alignment with the inclusive philosophy of Essensai067, Barnhouse is accessible to children, the elderly, people with disabilities, and pet owners, with a layout and environment designed for comfort and usability across demographics.

With its integration of sustainable practices, inclusive design, and a focus on conscious eating, Barnhouse is emerging as a distinctive addition to Bengaluru’s evolving hospitality and dining landscape.

Thyme & Whisk under Trinetra Venture announced their new outlet launch in Whitefield, Bangalore. The innovative pure vegetarian restaurant chain, Thyme & Whisk has unveiled its fifth outlet in Bangalore, marking a significant milestone in its expansion journey. Located in Whitefield, this new establishment continues the brand's commitment to offering diverse and globally inspired vegetarian cuisine in a sophisticated setting.

Founded in 2018 in Vadodara by Chef Bobby Patel, Tapan Patel, Parth Gheewala, and Dharti Gheewala, Thyme & Whisk has rapidly grown to 16 outlets across India.

The brand distinguishes itself by redefining Vegetarian Dining in the country by blending Indian culinary traditions with international flavours, catering to a wide range of dietary preferences, including Jain, vegan, and gluten-free options, all under one Roof.

"Thyme & Whisk is more than just a restaurant; it’s a movement. Our vision is to celebrate the vibrant flavours of vegetarian cuisine while nourishing both the body and soul. We aim to inspire a generation of diners to embrace the vibrant world of vegetarianism and experience the joy of delicious, wholesome food,” shared Bobby Patel.

The Whitefield outlet boasts a chic boho theme and an inviting ambience, making it an ideal destination for family dining. The extensive menu offers over 350 dishes spanning various cuisines, from Pan-Asian and Mediterranean to Indian and Continental.

With a capacity of more than 80 covers, this outlet is set to become a landmark dining destination in Whitefield, Bangalore.

The group is also planning to expand to over 50 outlets in the next 5–7 years, bringing its unique culinary philosophy to more cities across India.

Reach 3Roads, a mixed-use open-air retail destination in Sector 70, Gurugram, has added Kake Da Hotel to its tenant portfolio, further expanding its food and beverage offerings. The legacy North Indian restaurant joins a range of brands already present at the location, including Samsung, Zudio, Misbu, Starbucks, and Croma.

Founded in 1995, Kake Da Hotel has served notable personalities over the years, including former Prime Minister Atal Bihari Vajpayee, ex-Railway Minister Lalu Prasad Yadav, and public figures like Dara Singh and Daler Mehndi. The restaurant is known for its signature dishes such as dal makhani, rara meats, kebabs, and tikkas, made using proprietary spice blends and traditional preparation methods.

The restaurant’s new outlet at Reach 3Roads features an open layout with both indoor and outdoor seating, designed to align with the centre’s retail environment. The space also includes traditional clay tandoor kitchens, offering a view of the live cooking process.

Nandini Taneja, Regional Director – Leasing, Reach Group stated, “We tirelessly curate our tenant mix to serve both daily essentials and memorable experiences for our community. Kake Da Hotel’s storied legacy and commitment to authenticity resonate deeply with our vision of creating a true destination for all ages. We look forward to seeing guests gather, connect, and celebrate life’s moments here.”

Hemant Kumar Jha, Franchise Owner – Kake Da Hotel said, “KDH brings India’s rich heritage to life, built on the belief that great food fosters lasting connections and cherished memories. Joining Reach 3Roads allows us to bring North Indian warmth to a modern, open-air environment where families and friends can come together. We are excited to serve both our loyal patrons and new guests at this vibrant Gurugram landmark.”

Reach 3Roads continues to position itself as a retail destination that combines essential services with leisure and dining options, catering to a growing urban population in Gurugram.

Dubai’s culinary landscape marked a major milestone with the release of the 2025 MICHELIN Guide Dubai, which has now grown by 72.5 percent since its debut in 2022. The latest edition features 119 restaurants, up from 69 in the first year, underscoring the city’s fast-growing and diverse food scene.

This year’s edition introduces a historic moment for Dubai and for global gastronomy—the city is now home to two restaurants awarded Three MICHELIN Stars for the first time. The distinction is reserved for establishments offering cuisine “worth a special journey.”

Trèsind Studio, led by Chef Himanshu Saini, became the first Indian restaurant in the world to be awarded Three MICHELIN Stars. The restaurant had previously earned one star in 2022 and two stars in 2023.

FZN by Björn Frantzén, helmed by the acclaimed Chef Björn Frantzén, also entered the three-star category. Frantzén now holds Three MICHELIN Stars at three separate restaurants globally, making him the only chef to achieve this distinction simultaneously. His other venues—Frantzén in Stockholm and Zén in Singapore—have also received the Guide’s highest rating.

MICHELIN Guide Dubai 2025 Highlights:

- 2 restaurants with Three MICHELIN Stars (1 promoted, 1 new)

- 3 restaurants with Two MICHELIN Stars

- 14 restaurants with One MICHELIN Star (including 2 new additions)

- 3 MICHELIN Green Star restaurants

- 22 Bib Gourmand restaurants (5 new)

- 78 MICHELIN-selected restaurants (15 new)

The selection features 35 types of cuisines, showcasing the city’s wide-ranging culinary offering. The inclusion of both international and homegrown names reflects Dubai’s strategic efforts to establish itself as a global gastronomic destination.

According to His Excellency Issam Kazim, CEO of the Dubai Corporation for Tourism and Commerce Marketing, the Guide’s growth and the recognition of top-tier restaurants illustrate the city’s ambition and investment in its F&B industry. “Just as three MICHELIN stars signify a restaurant that is ‘worth a special journey’, so the same applies to Dubai as a destination,” he said.

Gwendal Poullennec, International Director of the MICHELIN Guide noted, “Dubai’s rapid transformation into a global culinary hub is testament to its diversity and excellence… Dubai embraces a rich tapestry of flavors that reflect the world’s gastronomic passions.”

For Chef Himanshu Saini, the recognition is tied to Dubai itself. “Trèsind Studio can only be Trèsind Studio in Dubai. It cannot be the same in any other city in the world,” he stated.

Chef Björn Frantzén called the honor “an incredible moment,” acknowledging both his team’s work and the support of the Atlantis Dubai team in launching FZN.

Now in its fourth edition, the MICHELIN Guide Dubai aligns with the emirate’s broader tourism and economic goals. According to the Dubai Gastronomy Industry Report 2024, Dubai ranks second globally, after Paris, as a gastronomy capital, and is among the top 10 destinations for food lovers.

The city hosted 7.15 million international overnight visitors between January and April 2025, reflecting a 7 percent year-on-year increase compared to the same period in 2024.

The MICHELIN Guide, celebrating its 125th anniversary this year, remains a key culinary authority. Its star system is one of the most recognized benchmarks in the food industry, complemented by the Bib Gourmand for affordable high-quality dining and the Green Star for sustainability-led establishments.

Cedar Clubhouse, located in Delhi’s Tolstoy Lane near Janpath, is emerging as a notable player in the capital’s dining and nightlife segment. Operating across the ground and mezzanine floors, the venue is structured to accommodate both private gatherings and high-energy social events. The layout includes widely spaced tables to ensure privacy, two dedicated private dining rooms, and an active bar area that draws significant footfall during weekends.

The hospitality strategy behind Cedar Clubhouse integrates entertainment as a core component. A DJ-percussionist performs every Saturday, with plans to introduce live music acts to further enhance the weekend experience. This dual approach aims to capture both the casual diner and nightlife-focused crowd.

The food and beverage program at Cedar Clubhouse spans global comfort dishes alongside regional staples. The menu includes Mediterranean platters, khow suey, fish and chips, flatbreads, stroganoff, and Indian dishes, catering to varied consumer preferences. The bar features a cocktail program designed for the urban consumer, with offerings like the Cedar House Punch—a blend of bourbon, herb liqueur, citrus, and hazelnut—and a butter-washed Old Fashioned.

Cedar’s business model reflects a growing trend in the urban hospitality industry: combining upscale dining with curated nightlife experiences. With plans for live performances and continued focus on experiential dining, the establishment is positioning itself as a multi-functional venue for both social and private events in central Delhi.

Chicken Inn, a longstanding North Indian restaurant in Delhi, is marking its 65th year with a new outlet in Gurgaon. The expansion represents the brand’s first move beyond its original location on Pandara Road, which was established in 1960 by Shri Asanand Arora.

The restaurant, known for its North Indian offerings including Butter Chicken, has been a fixture in Delhi’s hospitality sector for decades. It has served a wide range of guests, including public figures and long-time family patrons.

Now led by third-generation entrepreneurs Aman and Ridhi Arora, the brand is continuing its legacy while adapting to new consumer expectations. Aman, who joined the business at the age of 19, has introduced new dishes such as Kakori and Galauti Kebabs and launched a full-service bar, a first on Pandara Road for the brand.

Aman and Ridhi said, “The opening in Gurgaon feels deeply personal. It’s more than a new location, it’s a way of passing our story forward. Chicken Inn is about comfort, authenticity, and a sense of belonging. We want people in Gurgaon to experience not just our food, but the heart behind it.”

The Gurgaon outlet will offer the core menu items that define Chicken Inn, alongside additional features such as a Private Dining Room, an Organic Cocktail Bar, and packages tailored for private gatherings. The menu also includes select Chinese dishes that have become popular with regular customers.

This move is part of Chicken Inn’s strategy to expand its presence while maintaining the brand identity that has sustained it for over six decades. The new location combines the familiarity of its longstanding dishes with updates in format and experience to cater to a broader audience.

McDonald’s India – North and East has opened its first restaurant in Gorakhpur, located at Nayak Enclave, Basharatpur, Ashok Nagar. The launch marks the brand’s expansion into a new city, adding to its footprint across North and East India. The newly launched outlet spans 3,604 sq. ft. and offers seating for up to 113 guests.

Rajeev Ranjan, MD, McDonald’s India – North and East said, “It fills us with immense joy to open our doors in Gorakhpur, a city known for its deep-rooted culture, vibrant youth, and welcoming spirit. Through our new restaurant, we wish to be part of the everyday celebrations of residents of Gorakhpur, offering global menu, great tasting delicious food that’s not just quick and convenient, but also pocket friendly. We are hopeful of our restaurant becoming a go-to place for the residents of the city – from coffee breaks to family treats and student hangouts.”

The Gorakhpur outlet features contemporary interiors and globally inspired design. Customers will have access to digital self-ordering kiosks, table service, and guest experience leaders to support their dining experience.

The menu includes McDonald’s core offerings such as the Maharaja Mac, McVeggie, McChicken, McAloo Tikki, Chicken McGrill, McCrispy Chicken, McSpicy Burgers, Special Wraps, and Kebab Rolls. Also available are French fries, beverages, and desserts.

To meet different customer preferences, the restaurant provides dine-in and takeaway services, catering to a wide audience that includes students, families, and working professionals.

McDonald’s India – North and East currently operates close to 245 restaurants and employs over 6,000 people. With the Gorakhpur outlet, the company plans to generate employment for local youth, particularly from underprivileged communities, as part of its McDonald’s for Youth program. This initiative supports the brand’s broader goal of contributing to regional economic development.

Omny Kitchen and Bar, the latest venture by Chef Vicky Ratnani, has opened its doors in Gurugram, aiming to offer a globally inspired dining experience grounded in Indian culinary traditions. The casual fine-dining restaurant blends global cooking techniques with regional Indian flavours, marking a new chapter in Chef Vicky's hospitality career after extensive international exposure.

Chef Vicky’s culinary philosophy, shaped by working alongside 35 different nationalities on ships and seven global culinary tours, finds its expression in Omny’s menu and design. “After spending a lot of time touring the world, I realised that every cuisine has something unique to offer; that there are overlaps in seemingly different cuisines… every dish I create is an opportunity to merge what I’ve learned globally with the soul of Indian cooking and ingredients,” he said.

At Omny, the concept integrates an open kitchen and bar, a lounge-style dining layout, and interiors designed with a mix of bamboo and aged steel, creating a space intended to reflect both industrial and natural aesthetics.

Priykant Gautam, Director of Omny Kitchen and Bar, described the space as a collaboration of culinary precision and inclusivity. “It’s an exquisite balance between culinary vision and no-nonsense experience,” he noted, highlighting the accessibility of the space to a broad customer base.

Menu Highlights and Grilling Focus

Grilling plays a significant role at Omny, with two dedicated grill setups supporting techniques ranging from direct-contact grilling to cast iron plate cooking. Signature items from the grill include Gambas Al Ajillo and a smoked reinterpretation of Filipino Chicken Adobo.

The menu features globally inspired yet locally rooted dishes, including Caesar Salad on Fire, The Bazaar (a rotating dish based on market availability), and handcrafted pizzas and pastas. Chef Vicky’s Sindhi heritage informs items like Tridali Dal served with lentils, black garlic, cumin, chutneys, papads, and Braised Sindhi Lamb Shanks paired with lotus stem bhuggal chawar. Other regional and international comfort dishes include Millet and Barley Khichdi, Burmese Veg Curry, and Jammu Tawi Burger featuring Jammu Kalari cheese — part of “The Burger Project by Vicky Ratnani.”

Dessert and Beverage Collabs

The dessert menu was created in collaboration with Chef Vinesh Johnny, co-founder of Lavonne Academy of Baking Science and Pastry Arts. Signature offerings include Tiramisu Baba au Rum, Mango Falooda, and Masala Chai Flan.

The coffee programme has been curated by Mithilesh Vazalwar, founder of Corridor Seven Coffee Roasters, featuring beans sourced from sustainable farms worldwide. The selection includes espresso, cappuccinos, and cold brews, aiming to complement the diverse menu.

Bar Programme and Mixology

The drinks menu, developed by mixologist Varun Sudhakar, reflects Omny’s global outlook through cocktails using local ingredients, exotic spices, and international techniques. The bar programme spans influences from Asian street food flavours to European classics and Latin American infusions, aligning with the restaurant’s cross-cultural approach.

Omny Kitchen and Bar positions itself as part of the evolving hospitality landscape in India, responding to consumer demand for globally relevant experiences paired with regional authenticity, particularly in urban markets like Gurugram.

In a development that blends fashion, food, and culture, Escape, the lifestyle destination curated by designer Ritu Beri, has partnered with Miguel’s, a well-known establishment in Fontainhas, to unveil a new hospitality concept in North Goa. The collaboration has resulted in Escape with Miguel’s, a garden bistro and cocktail bar set within the heritage property of Escape in Socorro.

Positioned as a hospitality venture where design and cuisine intersect, the project draws on the individual strengths of both entities—Escape’s creative environment and Miguel’s reputation for comfort-driven dining and beverage curation. The partnership marks a notable move in the evolution of Goa’s high-end hospitality landscape, especially as it continues to attract hybrid formats that merge lifestyle, food, and design.

“Escape with Miguel’s” includes a blend of handmade dishes and culture-forward cocktails, all served in a landscaped setting that merges indoor-outdoor sensibilities. The venue also features an Indo-Western Baroque-style bar intended for curated evening experiences, including music and cultural programming.

With Goa evolving as a year-round hospitality destination beyond seasonal tourism, this collaboration highlights a larger trend of immersive dining and lifestyle spaces that cater to a discerning consumer base. It’s the latest example of how established names in lifestyle and F&B are forming synergies to respond to shifting consumer expectations in India’s premium hospitality segment.

Restaurant Brands Asia Limited (RBA), formerly Burger King India Limited, reported steady growth in both store expansion and financial performance for the fourth quarter of FY25, which ended on March 31, 2025. The company’s standalone revenue from operations reached Rs 4,898 million, reflecting an increase of 11.5 percent compared to the same period last year.

Earnings before interest, tax, depreciation and amortization (EBIDTA) for the quarter rose to Rs 749 million, marking a 36 percent year-on-year growth. The EBIDTA margin improved to 15.3 percent, an increase of 2.8 percent over the previous year’s corresponding quarter.

Same-store sales grew 5.1 percent, supported by a strategic push on value offerings. RBA expanded its total Burger King India restaurant count to 513, adding 58 locations over the last 12 months. Additionally, the number of BK Café formats grew by 113 during the year, bringing the total count to 464 across its portfolio.

Rajeev Varman, Whole-time Director and Group Chief Executive Officer of RBA stated, “I am proud of the efforts of our teams who helped drive growth in sales and another quarter of improved profitability. We have introduced attractive value offerings that helped our performance, especially in dine-in traffic and sales. We aim to leverage our strong customer value proposition and stride ahead with our restaurant growth strategy.”

Looking ahead, the company is targeting a significant expansion of its footprint. “From a development standpoint, we will continue to expand our footprint across the country and increase our Burger King restaurants in India from 513 to around 800 by FY29,” added Varman.

RBA’s focus remains on operational efficiency, value-centric offerings, and aggressive store development as it scales its presence in India's highly competitive quick-service restaurant (QSR) segment.

After a 15-year absence, Red Box, the well-known Mumbai-based restaurant and bar brand, has reopened under the leadership of the China Gate Group. The brand, which originally operated in Bandra from 2006, has now returned with a new location in Juhu, aiming to re-establish itself in the city’s competitive hospitality market.

The newly launched Red Box Cafe and Bar spans approximately 3,000 square feet and introduces an updated concept, featuring a mix of bakery, café, restaurant, and bar formats. With evolving consumer expectations in mind, the venue combines flexible seating, a curated food and beverage menu, and live music programming to appeal to a broad demographic.

Krishna Tamang, Founder of China Gate Group and Red Box stated, “We’re beyond excited to bring Red Box back. Mumbai made it clear they wanted this, and Juhu’s energy is the perfect stage. It’s everything people loved about the original, turned up a notch for today.”

The layout includes a bakery section offering items such as croissants, artisanal breads, and puff pastries, alongside a dessert station featuring lemon tarts, cheesecakes, and other pastries. The full-service bar stocks a wide selection of Indian and international spirits, including Glenfiddich 12 Years, Jack Daniels, Bombay Sapphire, and Sula Satori Merlot, along with cocktails, mocktails, and non-alcoholic beverages.

The food menu targets a diverse customer base with vegetarian, vegan, and gluten-free options clearly marked. Offerings include items like Avocado Corn Quinoa Salad, Spaghetti Aglio Olio Peperoncino, and a range of Chinese starters, sushi varieties such as California Sushi and Asparagus Tempura Uramaki, as well as sizzlers like Red Box Special Sizzler. The menu also includes items catering to breakfast, lunch, and dinner dining preferences.

The bar program is structured to support both casual and premium consumption habits. Beverage options include wines such as Jacob’s Creek Chardonnay and Sula Brut, beers like Hoegaarden and Kingfisher Ultra, as well as classic cocktails and zero-alcohol drinks such as Red Ice-Box.

Red Box plans to maintain consumer engagement through regular live music performances, community events, and food festivals, further embedding the venue into Juhu’s hospitality scene. The China Gate Group has confirmed that seasonal menu updates and a second outlet are already under consideration.

Krishna Tamang added, “Red Box has always been about connection. We’ve taken that spirit, given it a fresh edge, and created a space that’s pure Mumbai—lively, welcoming, and unforgettable.”

With the backing of over 30 years of hospitality experience, the China Gate Group aims to position the revived Red Box as a multi-format venue tailored to evolving consumer behavior in Mumbai’s urban dining sector.

In a major employment push, McDonald’s and its franchisees are set to hire up to 375,000 workers across the U.S. this summer. The move comes as the fast-food chain plans to open 900 new restaurants nationwide by 2027 and readies itself for increased customer traffic during the warmer months.

For decades, McDonald’s restaurants have functioned as a starting point for many Americans entering the workforce. Roughly one in eight people in the U.S. have worked at a McDonald’s outlet, gaining experience in areas such as teamwork, responsibility, and customer interaction. In addition to employment, the company also provides education-related benefits through its Archways to Opportunity program.

Joe Erlinger, President, McDonald’s USA said, “I often think about the time I spent working in our restaurants as a General Manager, and it was immediately clear that crew members are the heart and soul of this brand. They go above and beyond to take care of our customers, and it’s our job to take care of and create opportunities for them. When you put on an apron for a shift at McDonald’s, you’re building skills you’ll carry with you for life.”

The Archways to Opportunity initiative, introduced in 2015, has seen McDonald’s and its participating franchisees invest over $240 million. The program has supported more than 90,000 employees in earning their high school diplomas, receiving tuition assistance, improving their English language skills, and accessing career and education guidance.

Michael Gonda, Senior VP and Chief Impact Officer, North America said, “Seventy years as a brand, and ten years into Archways to Opportunity, we’re reminded that one of the greatest impacts we can make is providing access to opportunity. Behind every counter and Drive Thru window is a story of someone building skills, pursuing education, or working towards their future ambition. These stories--in thousands of communities across the country--reinforce that McDonald’s is more than a restaurant: it’s an open door for so many getting their start and a place where potential takes root."

The hiring drive and expansion efforts are part of McDonald’s long-term workforce and infrastructure growth strategy in the U.S., positioning the brand to meet evolving consumer demand while deepening its community impact.

Baskin Robbins has introduced a new range of packaged ice cream products in India, responding to shifting consumer preferences and the growth of quick commerce platforms. The latest offerings are part of the brand’s strategy to position ice cream beyond traditional consumption patterns and into the all-day snacking segment.

The company has launched a diverse collection of products tailored for General Trade stores, supermarkets, and quick commerce platforms. The range includes chocolate-based items, fruit-themed options, and Indian-inspired flavours, alongside ready-to-drink Belgian chocolate milkshakes. Notable products include the Super Strawberry Surprise Cone with chocolate swirl and milk choco-chips, The Original Triple Chocolate Stick, the Very Blueberry Ice Pop, and Traditional Malai Kulfi Slice topped with Iranian pistachios.

A new addition to the product lineup is the “Minis” pack, featuring four smaller-sized ice cream sticks in Mississippi Mud and Almond 'N Caramel flavours. Additionally, the brand has launched Belgian Chocolate Milkshakes in Milk, Dark, and Hazelnut variants. These milkshakes contain 30% less added sugar and are made without artificial colours or flavours.

Mohit Khattar, CEO of Graviss Foods Limited said, “The way consumers enjoy ice cream is evolving, and our new retail range is a reflection of this shift. Last year, we introduced innovative formats aimed at positioning ice cream as an anytime snack rather than just a post-meal indulgence. This year, with the rapid rise of quick commerce and the increasing demand for premium treats at home, we are taking that vision forward by expanding our retail presence. Our goal is to ensure that Baskin Robbins’ signature experience is available in more convenient formats, making it easier than ever for consumers to enjoy their favourite flavours whenever and wherever they choose.”

Following notable growth across retail channels in FY25, including modern trade and quick commerce, Baskin Robbins is reinforcing its distribution network in anticipation of continued demand in FY26. The company is also working to deepen its collaboration with quick commerce platforms to improve accessibility across Indian markets.

Biryani Blues, a Quick Service Restaurant (QSR) chain focused on dum biryani, has raised $5 million in a pre-Series C funding round led by Yugadi Capital, a new fund from Carpediem Capital, with additional participation from other investors.

The company stated that the funding will be allocated toward network expansion, talent acquisition across operational and corporate roles, and upgrades in logistics and backend operations.

Raymond Andrews, Co-Founder of Biryani Blues said, "We are poised to accelerate our expansion by opening over a 100 new brand stores over the next three years, in popular High Street markets and malls across north India."

Founded in 2013 by Aparna and Raymond Andrews, the brand operates under Thea Kitchen Pvt. Ltd and currently has 68 outlets across North India and Bengaluru. It runs an omni-channel model serving both dine-in and delivery customers and processes over two lakh monthly orders. The company reported an Annual Recurring Revenue (ARR) of approximately Rs 100 crore.

The management confirmed that recruitment will run in parallel with expansion efforts, targeting roles in operations, delivery, and corporate support, to ensure scalability is matched with sufficient manpower.

Andrews added, "After optimizing operations and turning profitable over the past year, the company has set itself distinctly apart from competitors in this space. We believe that the food business is a long-term play, and increasing our lead in North India, before expanding to other regions remains our first priority."

The company posted $10 million in revenue for the financial year ending March 31, 2025, and stated that the new round of funding raises its valuation to $30 million.

Arvind Nair, Chairman of Carpediem Capital said, "With this infusion, we reinforce our confidence in management’s ability to scale its decade-long success. We remain committed to supporting Biryani Blues and its strong market potential."

Biryani Blues previously raised $5 million in Series B funding from Rebel Foods in FY 2022, and $2 million in Series A from Carpediem Capital Partners Fund I during FY 2016–2017.

The company reiterated its long-term goal to lead the segment. "Think Biryani, Think Biryani Blues," the company said in a statement.

FunXtreme, positioned as one of India’s largest immersive gaming arenas, has launched operations in Kolkata, with a new facility spanning 8,000 sq. ft. located at Shakespeare Sarani. The venue integrates tech-enabled entertainment zones and a full-service café, targeting diverse age groups including children, teenagers, young adults, and families.

The facility has been divided into three dedicated areas: a Toddler Soft Play Zone, a Virtual Reality (VR) Zone, and a Full-Service Café. In addition to regular gaming and dining experiences, the venue offers customizable event packages designed for family gatherings and birthdays, with interactive visual displays that can be adapted based on individual themes and preferences.

Shruti Seth and Vidhi Khanna, Co-Owners of FunXtreme said, “We always believed that entertainment shouldn't just be about watching or playing, it should be about experiencing. We saw a gap in the market where people wanted more than traditional gaming or dining options. They wanted something fresh, something meaningful. That’s what we built - a complete entertainment and dining experience where people don’t just come to eat or play - they come to connect, laugh, and create memories.”

The concept aims to address a growing demand for hybrid venues that offer both recreation and dining within a unified space.

Tarak Thakker and Sunil Seth, Co-Owners, “At FunXtreme, we wanted to create more than just an entertainment zone - we wanted to build a space where excitement, innovation, and community come together. Our goal was to offer families and young adults a place where they can immerse themselves in technology-driven fun and also discover fresh, wholesome flavors, all in one unforgettable experience.”

The launch reflects a broader trend in the Indian retail and entertainment sectors, where experiential destinations are increasingly being integrated into urban commercial spaces. FunXtreme's entry into the Kolkata market adds to the evolving portfolio of mixed-use retail experiences in India.

CYK Hospitalities, a consultancy firm in India’s F&B sector, has partnered on the launch of Emotive Ale, a new restaurant and bar located in Civil Lines, Nishyam Kunj, Meerut. The project aims to set a new benchmark for independent hospitality ventures in Tier-II markets by introducing a locally rooted concept with operational and culinary depth.

Founded by Karan Singh and Kishor Kumar, Emotive Ale was created as an alternative to the growing dominance of franchise-led club models. The founders sought to develop a space that combines international sensibilities with community-driven values. “Emotive Ale is not another restro-bar; it is a vibe. We wanted to bring something unique to Meerut. CYK Hospitalities was our best find. They assisted us in bringing our ideas to life—from in-depth industry knowledge to systematic planning and operational finesse—smoothly,” said Karan Singh.

The first phase of the project introduces a restaurant and bar that features a multi-cuisine menu, including Indian, Continental, Chinese, Thai, sushi, and dim sum. A key focus is on sustainable operations, with wood-fired ovens used to prepare in-house pizzas. The venue is designed to accommodate both casual visits and special occasions.

Plans for a microbrewery in the next phase will expand Emotive Ale’s offerings. This addition will include small-batch, seasonal brews and interactive programming such as beer tastings and pairing events aimed at building a consistent customer base and enhancing guest engagement.

CYK Hospitalities managed the entire setup from concept to launch, including menu engineering, hiring and training of BOH and FOH teams, menu trials, and standard operating procedure (SOP) documentation. “With Emotive Ale, our mission was to co-create a new and nostalgic space—one that merges global palates with a hometown soul. Our team took on end-to-end responsibilities to shape this project from concept to operations. CYK thrives on turnkey solutions, and Emotive Ale is a perfect example of that ethos,” said Pulkit Arora, Director and Strategic Head, CYK Hospitalities.

Kishor Kumar added, “Emotive Ale resulted from our passion to create something from the ground up—a restro-bar that combines comfort with innovation. CYK Hospitalities grasped our vision on Day One and has remained our strategic partner every step of the way. Their involvement was more than consultancy; they became co-dreamers.”

This project marks CYK Hospitalities' continued expansion into emerging markets, with a focus on developing original F&B formats. Emotive Ale is positioned to influence the standalone restaurant model in Meerut, offering a blueprint for similar developments in non-metro cities.

Bengaluru-based pizza chain Brik Oven has opened its 10th outlet in the city, introducing a new concept called The Pizza and Coffee Shop. The store is located in HSR Layout and integrates multiple offerings, including wood-fired Neapolitan pizzas, coffee, house-made cheese, and an all-day breakfast menu, within a single space.

The format includes a mix of menu innovations such as Roman-style pizza slices, sourdough beignets, pretzel bagel sandwiches, and a curated 100 percent Arabica coffee program. The space also includes a slice counter dedicated to Roman-style pizza, the first of its kind in the city.

Design elements incorporate a wood-fired oven tiled in recycled mosaic, and furniture crafted by North Indian artisans. A long open counter allows customers to view the preparation process, reinforcing the brand’s emphasis on transparency and craftsmanship.

The store is also offering an all-day breakfast menu, currently available at the HSR, Manyata, and Bellandur locations.

Founders Anirudh Nopany and Sreeram Anvesh described the format as a “love letter to food and community”, highlighting the brand's focus on combining culinary variety with community-oriented design.

Brik Oven, which began as a two-person operation on Church Street nearly a decade ago, has grown into a citywide presence. The new concept marks a strategic shift toward creating multifunctional dining formats tailored to changing consumer behavior, especially around casual, flexible dining experiences.

The Malabar Coast has launched a new outlet at M3M Atrium, Sector 57, Gurugram, expanding its presence with a focus on South Indian coastal cuisine. Known for showcasing regional dishes from Kerala, Karnataka, and Tamil Nadu, the brand's latest restaurant offers a curated menu of coastal staples, seafood preparations, and traditional desserts.

The opening event attracted food influencers, culinary enthusiasts, and invited guests who experienced a menu built around regional specialties such as Ghee Podi Idly, Paneer Andhra Style, Chicken Kerala Sukka, Chettinad Chicken Tikka, and Sri Lankan Chicken Curry. Signature items like Thalassery Chicken Biryani and Coconut Payasam were also featured.

“We are elated to bring the soul of South India’s coastlines to the ever-expanding city - Gurugram. This outlet marks an additional chapter in our journey of celebrating regional flavours and offering our patrons an immersive cultural and culinary experience. With this new outlet, we aim to set a new benchmark in regional dining by offering a refined, authentic, and enriching food experience in the heart of the city,” said Satish Bhatia, Co-Founder, The Malabar Coast.

Situated on the ground floor of M3M Atrium, the restaurant’s design incorporates coastal-themed interiors, traditional South Indian motifs, and curated artwork. The ambiance has been developed to align with the menu’s regional identity.

To complement the food offerings, the launch featured live music, contributing to the guest experience. While the menu remains the central draw, the addition of music and interior detailing aims to deepen customer engagement with the cultural elements of the South Indian coastline.

With this opening, The Malabar Coast adds a strategic location in Gurugram’s Sector 57, positioning itself as a regional dining player in North India’s competitive hospitality landscape.

Chef Balasundaram Murugesan, popularly known as Chef Bala, has launched his new culinary venture, Anthara—a French-American patisserie located in Bengaluru’s Marathahalli area. The concept merges café culture, casual dining, and lounge elements into a single 2,400 sq. ft. outlet aimed at catering to a broad demographic seeking global flavours and contemporary formats.

Anthara operates through a hybrid model that transitions from a café by day to a dining and lounge space by evening. The offering spans across coffee and patisserie products to deli-inspired sandwiches and plated dishes. The beer and coffee pairing menu is part of its strategy to attract a varied customer base throughout the day.

Chef Bala said, "Anthara is the culmination of my passion for soulful cuisine and my belief in the power of hospitality to connect people. With Anthara, I wanted to create a space that feels personal yet refined — where food isn’t just consumed, but truly experienced. We’re bringing something fresh to Bangalore — not just in terms of flavours, but through ambience, service, and storytelling on every plate. This is just the beginning — over the next five years, we aim to expand across the city, reaching more communities with our distinct culinary offering and experience."

The brand’s culinary approach balances French pastry techniques with American deli influences. Its bakery offers a rotating selection of in-house baked artisanal breads and patisserie, including éclairs and macarons, while the food menu includes custom-styled sandwiches. Anthara’s operations are built on four principles: creative innovation, global quality standards, neighbourhood integration, and hospitality-driven service.

As the business establishes its footprint in Bengaluru, Chef Bala has outlined a five-year growth plan with aims to expand across the city and build a scalable brand in the premium casual dining segment.