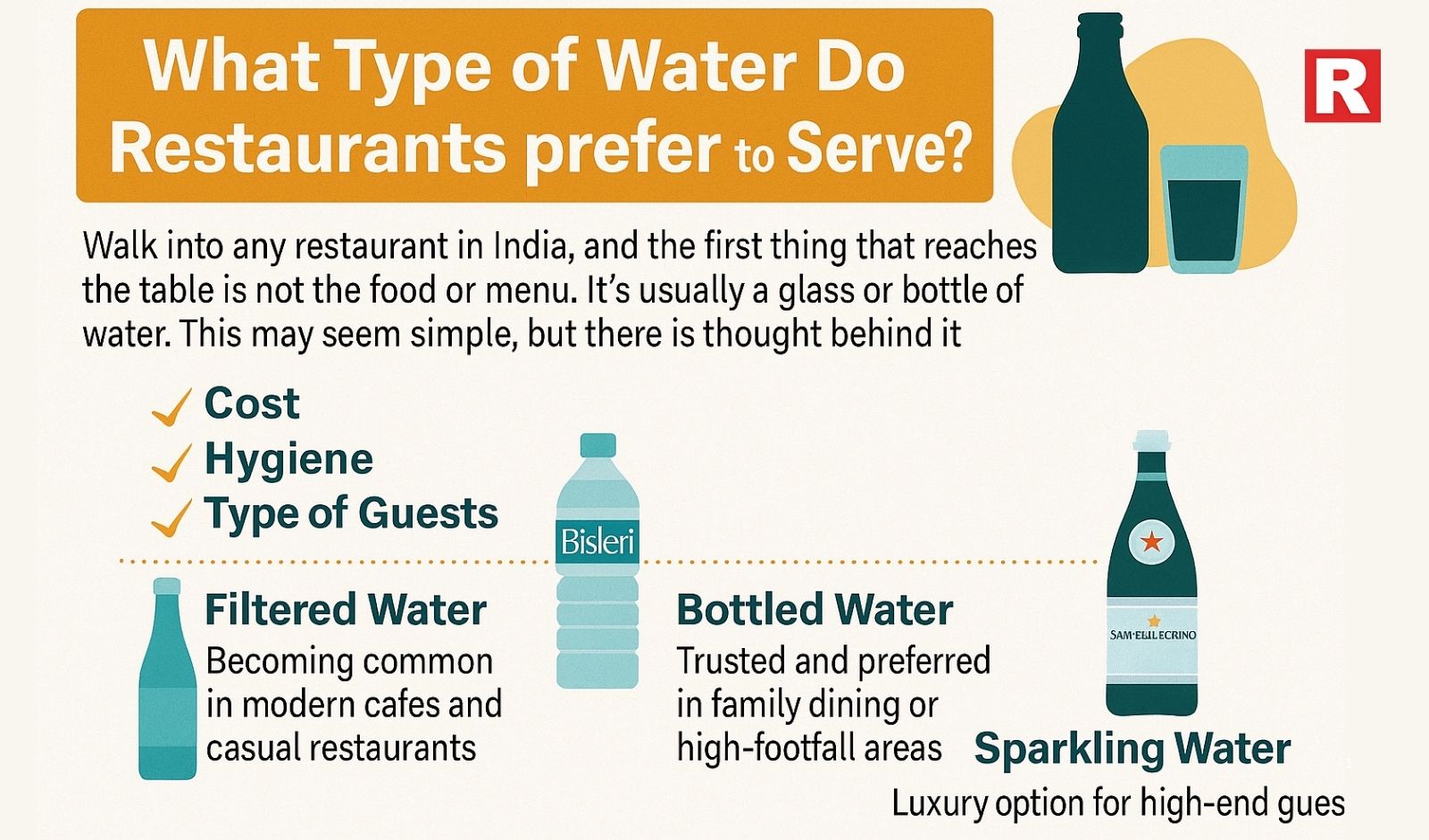

Walk into any restaurant in India, and the first thing that reaches the table is not the food or menu. It’s usually a glass or bottle of water. This may seem simple, but there is thought behind it. The kind of water a restaurant serves is not chosen by chance. Restaurants make this choice based on many factors. These include cost, hygiene, the type of guests they expect, and the kind of image they want to show. Some places serve filtered water from in-house systems. Others choose well-known bottled brands like Bisleri or Kinley. In premium places, guests may be offered Himalayan or even imported sparkling water like San Pellegrino.

Filtered water is becoming common in modern cafes and casual restaurants. It’s clean, affordable, and better for the environment. Bottled water is trusted and preferred in family dining or high-footfall areas. Sparkling water is a luxury option for high-end guests. Every restaurant has its own reason. But in the end, the water served gives guests their first feel of the place. It says something even before the food arrives.

Read more: 12 Delicious High-Protein Foods to Eat Daily for a Healthier You

6 Benefits of Drinking Black Coffee

Types of Water Served in Restaurants

Restaurants usually offer one or more of the following types of water:

- Filtered Water (Tap or RO/UV Purified)

This is the most commonly served water in mid to high-range restaurants. It is usually filtered in-house using Reverse Osmosis (RO), UV treatment, or both. It's stored in reusable glass bottles, sometimes with restaurant branding. Many restaurants opt for this method as it's affordable, eco-friendly, and meets hygiene standards. You may find this in cafes, bistros, and casual fine dining spaces.

Bottled Mineral Water

Bottled water is still the most widely preferred option across India. Brands like Bisleri, Kinley, and Aquafina are household names. Customers recognize and trust them, making it a safe bet for restaurants. Especially in family restaurants, quick-service chains, or places where hygiene concerns are high, bottled water is usually offered upfront or available on request.

Sparkling Water

This is commonly served in fine-dining restaurants, wine bars, or luxury hotels. Sparkling water like San Pellegrino, Perrier, and Schweppes is considered a premium add-on. It's often paired with cheese platters, steaks, or wine-tasting menus to offer a refined experience.

Know more: 6 Unexpected Benefits of Eating Jackfruit (Kathal) – Nature’s Spiky Surprise!

Why Filtered Water Is Becoming Popular

Many modern restaurants are switching from packaged bottled water to in-house filtered water for several reasons:

- Cost efficiency: Installing a filtration unit and using reusable bottles is cheaper in the long run than buying bottled water daily.

- Sustainability: No plastic waste, no transportation footprint. It aligns with eco-conscious dining.

- Control over quality: Restaurants can maintain and test their own systems for consistency.

- Aesthetic branding: Some places now serve water in elegant glass bottles with their logo, making it part of the restaurant’s identity.

Restaurants like Blue Tokai, Olive Bar & Kitchen, and Sly Granny in India have adopted this model successfully.

Which Water Brands Do Restaurants Prefer?

Here’s a breakdown of commonly used bottled water brands in Indian restaurants:

Brand | Type | Where It's Used |

|---|---|---|

Bisleri | Still | Pan-India, popular in casual dining |

Kinley | Still | Widely available, used in chains/QSRs |

Aquafina | Still | Preferred by fast-food and retail chains |

Himalayan | Still | Premium restaurants and hotels |

Vedica | Natural Spring | Used in fine dining and luxury resorts |

San Pellegrino / Perrier | Sparkling | High-end wine bars, 5-star hotels |

Note: Most high-end restaurants give customers a choice between still and sparkling water. Many offer imported water to elevate the dining experience, especially when paired with gourmet food.

What Do Customers Prefer?

Customer expectations also influence what restaurants offer. In general:

- Budget diners prefer free filtered water.

- Families or groups often choose known brands like Bisleri or Kinley for trust and familiarity.

- Premium diners may choose Himalayan or sparkling water for the experience.

- Gen Z and millennials are increasingly looking for eco-friendly, non-plastic options.

Aesthetics play a role too. If the bottle looks premium, customers often perceive the water as higher quality, even if it's just filtered in-house.

Also check: These 7 Foods Can Help You Cool Your Stomach in Summer

The Legal Side: Free Water is a Must

According to Indian health and hospitality guidelines, restaurants must serve free drinking water upon request. Even if a restaurant sells bottled water, customers can always ask for safe, filtered water at no cost.

This has led many eateries to invest in high-quality filtration systems to meet this requirement without compromising on taste or hygiene.

Why Some Restaurants Charge for Water

Restaurants that charge for bottled water usually list the brand and price clearly on the menu. This is common in:

- Fine dining restaurants

- Airport lounges

- High-end cafes

- Luxury resorts

However, charging for regular filtered water is generally frowned upon and could land restaurants in trouble with consumer rights groups.

Is Sparkling Water Gaining Popularity in India?

Yes, especially in metro cities. Sparkling water is no longer seen as a foreign trend. Urban diners are now open to trying it, especially when dining out at premium places. Some Indian brands have even started offering their own sparkling options to meet this demand.

In restaurants, sparkling water is typically offered as:

- A refreshing palate cleanser

- A non-alcoholic alternative to cocktails

- A stylish addition to fine dining

Though still a niche, it’s a growing category in India’s urban hospitality scene.

Check more: Why Should You Soak Mangoes Before Eating?

A Guide to Different Breads and Their Nutritional Value

The Cost Factor: What's Cheaper for Restaurants?

Here’s how the economics of water service looks for restaurants:

Water Type | Cost to Restaurant | Price to Customer | Margin |

|---|---|---|---|

Filtered (in-house) | Very low (₹0.50–₹1/glass) | Free / Included | Low or zero |

Bottled (Bisleri/Kinley) | ₹10–₹20/bottle | ₹30–₹60 | High |

Premium (Himalayan) | ₹35–₹50/bottle | ₹80–₹120 | Medium |

Sparkling (Imported) | ₹100–₹200/bottle | ₹200–₹500 | High |

This cost-benefit analysis is one of the main reasons restaurants prefer filtered water when possible.

The Shift Toward Sustainability

With increasing awareness about plastic pollution, restaurants are making an effort to move away from disposable water bottles.

Some restaurants are:

- Using refillable glass bottles

- Installing advanced RO and UV filters

- Printing QR codes to show water test reports for transparency

- Training staff to explain water choices to guests

These changes reflect a broader shift in the food and beverage industry toward sustainable hospitality.

Closing Thought

The type of water a restaurant serves speaks volumes. It reflects the place’s values, pricing, and the people it wants to attract. Some choose simple, filtered water served in glass bottles. Others prefer premium brands like San Pellegrino to create a luxe feel. But every choice is made with purpose. Customers may not always notice, but water sets the tone. It’s the first thing on the table. A quiet but clear message. Is the restaurant focused on sustainability? Is it about luxury? Or is it built around trust and hygiene?

Restaurant owners should think carefully. The kind of water they serve can shape a guest’s first impression. Knowing your audience, cost plan, and brand image is key. Water may seem small, but in dining, it speaks loud.

Kolkata’s F&B scene is ever-growing; all thanks to the foodies that the city boast of that makes it more vibrant and fertile for the restaurants and beverages brand to expand and grow.

Despite the challenges faced by the overall F&B market, the Kolkata-based F&B players have been experiencing an impressive upsurge in expansion.

From legendary outlet Aminia that is known for its delectable delicacies, home-grown momo chain Wow! Momo to beverages brand like The Yellow Straw and newly opened coffee player like Craft Coffee amongst others are brewing success.

Aminia recently opened a new outlet in Kolaghat, showcasing their commitment to bringing their authentic flavours to new markets. The brand is also targeting to launch two more outlets by the end of the year, solidifying its position as a leading player in the Kolkata F&B landscape.

“In the last fiscal year, Aminia achieved an impressive annual turnover of approximately 80-100 crores. Looking ahead, we envision a strong growth trajectory over the next five years, driven by unwavering love and support of our customers. As part of the plan for 2023-2024, we aim to open several more outlets in Kolkata and explore opportunities in the overseas markets, particularly in the UAE. Additionally, we plan to expand our presence locally by adding another outlet in Kolkata by the end of this year,” shared Azra Asher Ather, Director of Sales, Aminia.

Growing on popularity, The Yellow Straw grown from one outlet to its 14th outlet at South City Mall. In the fiscal year 2022-23, The Yellow Straw achieved remarkable financial success, generating a revenue of 601.78 lakhs. With an impressive EBITDA of around 11% and a consistent upward trend in EBITDA margin over the past three years.

“We take pride in our strong position as the dominant player, holding over 75% market share in Eastern India's juice and salad industry. With juice, shakes, and salads contributing to about 80% of our revenue, we are well-positioned to capitalise on the projected 50% growth rate in the juice industry for the next 7 to 10 years,” pointed Vikram Khinwasara and Piyush Kankaria, Co-Founders, The Yellow Straw.

These developments not only showcase the resilience of the F&B industry in Kolkata but also present an array of prospects for collaboration and partnerships.

Milee Droog, a popular establishment that successfully reopened its doors after the COVID-19 pandemic, is already setting its sights on expansion. Alongside plans for their second outlet, Milee Droog is also venturing into a new bakery section, exploring exciting opportunities to cater to the growing demand for their delectable baked goods.

“We, at Milee Droog, started our operations last November, after the COVID-19 pandemic. As we haven’t yet completed a full year of operations, it will be a little difficult to provide precise details regarding our annual turnover. Speaking of Milee Droog’s prospects over the next five years, well it looks quite promising. We are well-positioned to attract and retain a loyal customer base,” Rohan Sarkar, Managing Partner, Milee Droog Coffee & Bistro.

The brand has set sights on metropolitan areas and aim to target major cities that appreciate progressive food, especially the ones from the Slavic regions over a glitzy ambience.

As Kolkata’s culinary scene continues to evolve, these brands anticipate a favourable environment for the cafe’s future growth and success.

Recently opened Craft Coffee that has recently opened its second outlet in Salt lake is planning to expand their footprint.

“Well, the key revenue drivers for Craft Coffee typically include cafe dine-in sales, the sale of merchandise related to specialty coffee, and the supply of roasted coffee beans and blends to other cafes and markets. Additionally, as we have developed our e-commerce presence, online sales may become another important revenue driver for us. These revenue streams have contributed to the brand’s overall turnover and financial performance,” mentioned Abhinav and Dipraj, Co-Founders, Craft Coffee.

The brand growth goals for the next 3-5 years entail mostly expansions. It aims to expand to 8 to 10 cities and have approximately 100 outlets. The expansion plan includes a mix of tier-1 and tier-2 cities.

The city's food culture is thriving and now is the perfect time to align with these pioneering players to leverage their success and contribute to the vibrant culinary scene.

Globalisation has significantly influenced various aspects of Indian society, including a change in the food habits of Indian consumers over the last two decades. Aided by several economic developments, increasing spending power and openness to new diets and lifestyle habits, the development of production, processing, distribution and marketing of the FMCG and F&B industry has seen tremendous growth in India.

One of the major shifts in the food industry is the increasing number of Indians shifting to a non-vegetarian diet despite India having been known largely as a vegetarian nation. According to the sample registration system (SRS) baseline survey 2014, released by the registrar general of India, 71 per cent of Indians over the age of 15 are non-vegetarian. India consumes close to US$30 billion of meat annually, of which 90 per cent is handled by the unorganised market.

In this fast-growing industry, a prodigious shift has been seen towards consumption of fresh and chilled, ready-to-eat meats including sausages and cold cuts. The Indian market for non-vegetarian products has been primarily dominated by frozen ready-to-eat meat products, unlike international markets where fresh, ready-to-eat non-vegetarian products are more prevalent with decreasing sales of frozen meats. Fresh meat products (including sausages & cold cuts) are superior in taste, nutritional value and texture. Due to these reasons, in most developed countries, the focus is on fresh products with very few brands available in the frozen range.

Also Read: Four Top Trends in Cold Cuts and Deli Meats

However, a shift towards consuming fresh sausages, deli, ready-to-eat products are increasing with consumers in their 20s and 30s, in particular, and that is driving the change in the frozen food business since they have grown up in an era of heightened awareness about nutrition, intense scrutiny of the food industry, and the advent of the internet and social media to fuel that fire. Consumers are becoming more aware of the food ingredients and look for "better-for-you", high-quality ingredients. TV shows like Master Chef, easy cook recipe books and columns appeal viewers for pre-chopped vegetables/meat or other prepared meal components that aid them to cook fresh meals quickly.

The changing consumer demand is leading to major changes in the retail industry to tap into this demand and diminishing frozen sales. Even globally, Kroger Co. (the 2nd largest food retailer after Wal-Mart Stores Inc. in the US) said that their frozen sales have weakened over the past few years. At the center of the supermarket and the heart of kitchen convenience, freezer-aisle items are struggling today as consumers are shifting their tastes to fresh food that they realise is healthier. Retail stores have sought to capitalise on the desire for fresh meats, ready-to-eat and deli products by sprucing up the perimeter of the store with investment in Chillers and infrastructure to accommodate these as it could be the critical differentiator against competition.

Click To Read: This Meat Brand Focuses on Launching Minimum Two New Products Every Quarter

On the supply side, the challenge also remains given the complex nature of managing extremely cold temperatures, unlike frozen meats and ready-to-eat products and supply chain proves to be the hindrance in providing high-quality fresh food. With very few manufacturers having the expertise and technical know-how in the fresh meat and ready-to-eat products, creating high barriers for entry, leading to limited choices in brands to choose from. Also, the focus on infrastructure for fresh & chilled meats & deli products remains a major roadblock. Thankfully, retailers now understand the change and are moving towards Fresh meats.

The cold-cut retail/e-tail sector has experienced positive growth in Indian markets, yet there is considerable untapped marketing potential. The meat market is expected to reach US$65 billion by 2022. This reflects the appetite and high-interest level of meat lovers. It will be interesting to see what 2020 has in store; needless to say, more players are expected to join the race.

About the Author:

Lisa Suwal, CEO, Prasuma Meats & Delicatessen brand since August 2016.

As you are the largest providers of F&B services for travelers. What growth can we see in India?

As I said before I have seen that the growth is growing 20 percent in India. And our sale continuously going to increase and even Lite bite Foods has said that we want to target around 500 crores in 4-5 years from now. The real potential can’t be estimated. Airports are easier but railways have more potential. Even nobody is in highway, nobody know what sales will it bring. So, we want to take the first part of the call.

Which according to you is the best revenue generating location when it comes to travel?

Airports are the best location. Even in airports you have to see different sectors. I see mainly three sectors i.e. Location, location and location. We look at low fare airports, leisure airports and business airports.

Tell us something about your partnership with Lite Bite Foods. What all locations are you targeting in India?

We have many partnerships outside. Partnerships are always very existing part. We always team up with local partner, with family companies to marketise.

For example, two years back in Vietnam we started, now we are 6 airports and planning more outlets. We have three airports in Indonesia, all are local partners. We are targeting especially three sections i.e. airports, train stations and highways. Our primes focus will be airports. Second will be railway stations, if government does some changes, railway stations will have more potential than airports.

Which are some of the brands who are your biggest partners? Which according to you is the traveler’s choice?

I had just said that we have a very old concept for our company. I am reluctant to talk about any brands. Globally we have relationship with major brands like pizza, KFC etc. We look at market, democracy, consumers and then we decide what fit best for that.

Our company is in this business for more than 150 years. We see reliable partners and where we can see to extend our partnership, we do so. Travelers are of different types. There are travelers who travel twice or thrice in a week, for them it is natural. But when they travel with family, they make different choices. And the choice depends on different occasion and purpose of travel.

What are the unique experiences that make HMS Host different from any other service providers?

“We are seen global but act local”. Our company is known for the good management. We are also business provider, Food & beverages, hospitality and our biggest assets is our people our staff. We spend lot of time in interacting, training and educating our people. We also promote our people in turnover. We are unique because of our operational skills which focus expertise, right time, right number of staff, right concepts, right opening hours etc.

We also development skills, analyze airports, understand the need of the travelers, which concept should be use and where. 900 million people come every year in our restaurant. We understand the need of our customers.

What is your expansion plans?

We want our market share in Europe and in America. And internationally, China, Southeast Asia, India, UAE and Middle East.

Are you planning to sign any franchisee deal?

We have some plans of franchise in future. We are working on Italian concepts; Italian food and we are even doing some tests on them. I won’t exclude that opportunity.

Copyright © 2009 - 2025 Restaurant India.