Restaurants and food spaces have become one of the exciting spaces to be in. From an expert in the industry to a layman who is opening a restaurant out of passion and love for food is cashing in on growth. Here are the few segments that seem happening to own a restaurant:

The bistro and cafe moment

Restaurants have grown in numbers over the last five years. Cities like Baroda, Nagpur, Coimbatore and Patna amongst others which used to see maximum 5 restaurants opening in a year. Now these cities are witnessing 5 restaurants opening in 10 days. One of the most popular trends is the cafe as a lot of people are entering into cafe business. “Lots of change is happening in smaller cities as restaurants business is no more restricted to metro and tier I cities,” says Kaizad Modi, Senior Partner, Reise Hospitality which is running Goodies Cafe in Baroda.

Rebirth of regional cuisine restaurants

Home grown and traditional cooked foods have their own charm. With lots of knowledge about ingredients and spices people are going back to the roots and there is a demand for local and regional delicacies. Restaurateurs who were known for doing global and modern foods are introducing lots of regional spices and ingredients in their menu. “We are doing lots of micro green products which is already very popular in western world though it was all Indian products which people used to be conscious about. When I was doing this research for six months I was surprised to know that India has so much to do. People from outside know more about our ingredients than we Indians,” shares Vimal Verma, Director of Food & Beverage- Anna Maya which is serving aloe vera sandwich with western dressing of orange and micro greens along with aloe vera.

Casual dining is growing

its casual dining age says experts who have seen an upsurge in the growth of informal restaurant formats in last few years. Growing at 21% at a CAGR, casual dining is second largest food service market segment in India with almost 33% market share. Known for their quality food, varied menu, attractive presentation and uniqueness it has become the latest love for investors in the industry. “"With SodaBottle OpenerWala, we give you a concept that is unique to India; the dying legacy of the wonderful chaotic, crowded, bustling, colourful, quirky, cluttered, eccentric and so real world of an Irani café. Our way of reviving the love for the edu and the disappearing race behind the cafes,” shares AD Singh, MD & CEO- Olive Bar & Kitchen who is running some of the high end restaurants in the casual dining space.

Pubs and nightlife glam

Gone are the days when people would go out to eat food. These days they look out for best drinking places and food is just an addition to set the tone. Places like Social, Tamasha, HighSpirits, Lord of the Drinks have taken the night life scene at par with global food destinations. This is not only encouraging domestic players like The Bar Stock Exchange to come up with an innovative concept but global fame like The Stables which has already hit the Dubai market enter India. Places like Hauz Khas in Delhi, Sector 29 in Gurgaon, Bandra and Khar in Mumbai, Indranagar in Bengaluru have become a nightlife hub thanks to cities growing NRI culture. “Today’s consumer, being global in nature, look out for a lot more than food and cocktail. They look out for places to socialise, communicate, meet new people, exchange ideas, and expand their friend circle. The Stables as a brand simply facilitates these requirements,” points Gautham Shetty of The Stables.

QSR is here to stay

Being one of the largest contributors in the food service game, Quick service restaurants sits tall at 45% which is expected to reach 48% market share by 2021. Driven by affordability and value for money pricing and easy to grab meals, this segment is one of the most competitive segments in the Indian market with highest rate of failures as innovation is the key for retaining growth in this ever demanding market. “With a focus on evoking memories and nostalgia by presenting local delicacies which people miss the most from the place they belong to, Masala Trail was born to savour the street food in its original form,” shares Osama Jalali owner at Masala Trail.

So, the next time you go to your favourite restaurant, there is no harm in asking to speak to the owner and broaching your interest in investing in his business.

While in the early stages of designing your restaurant, you may find it hard to think past the first year, but it's critical to think further down the road.

Even before you get to that point, a good business plan should factor in the worst case scenario.

According to a study, over 94% of new businesses fail during the first year of operation. Lack of funding turns out to be the most common reason. Money is the bloodline of any business. The long painstaking yet an exciting journey from the idea to revenue generating business needs a fuel called capital. That’s why at every start of the business, entrepreneurs are found asking questions relating to financing their business.

Good Signs to Invest

A large market that’s getting organised and moving towards higher value-added products has sparked investors’ interest in the F&B space where there’s rising demand for better, healthier, affordable and easy to access products, paving the way for entrepreneurs to jump in and build next generation brands.

Niranjan Sheshadri, Founder, Last Mile Ventures says,” There is a secular move in rating out the formally organized space to the branded space be it QSR, CDS or the Fine dining space.”

Colliding with several ups & downs, Sheshadri continues,” This trend will benefit almost every sector in the F&B space. The shift from unorganized to organized will continue to rise and the new era of Entrepreneurs is going to add value, creating brands which are likely to open 30 to 40 outlets across Tier 4 cities.”

On similar terms, Krishna Vinjamuri, Principal, Lightbox Venture Capital says,” With a growth of 10% every year, about 33% of the industry trends are slowly getting organized. Taking this as an advantage, we can build larger brands with multiple outlets.”

Reducing Risks

To an aspiring restaurateur, the challenges of funding a business can seem overwhelming. “The growth of the market will continue over the next 10 years with a 15% growth, which is sufficient for an investor to invest and create large-scale business in the long run”, adds Sheshadri.

While such companies don’t exist today, certainly the entrepreneurs are there in the field, raising capital and positioning themselves to get good returns.

Most of the Restaurateurs will move away from the mainstream to malls. In terms of customer experience, the changes are not significant enough and will continue the way expansion is handled and the way supply chains are built.

It is always better to go for a partnership in the restaurant business as it not only makes investment easier but also reduces the risks in business by sharing the future profit and loss. If it’s your first restaurant venture, try to look for a partner who already has some experience in the restaurant business.

Innovation is Major

In an industry where standing still means falling behind, innovation is the defining factor for most successful brands.

Roughly speaking, the industry has received close to about 5000 crores of funding in the last 4 years which is half the money that was invested in this industry in the last 20 years.

There is not much expectation in terms of innovation relating to the customer experience. A lot of innovation is expected around standardising processes to make sure that a brand can go from 20 outlets to 50 outlets without compromising on the experience.

“The most important development that is going to happen in the IPO market is going to be favorable towards successful chains”, Sheshadri adds.

There are changing business models actually helping people not just dine out but also at home.

Commenting on the invasion Krishna says,” Technology is helping people discover the restaurants with distribution platforms like Zomato, Swiggy, UberEats that are helping these restaurants maximize their potential by being able to offer to customers in giving them convenient food options.”

“There are elements of the supply chain that is relevant for larger size restaurants where technological innovation is playing a key role in ensuring that the inventory levels are done right”, Krishna added further.

Investment scenario in food business has become tougher over the last three years. From being guardian investors to mentoring the brand from the scratch investors today look out for value addition in the brand. It’s not just about the model but overall aspect of the business; how different is the concept, how much are customers liking the brand, what the cash flow is and how much money they can get in return. It’s not just about raising funding but how you utilise it and maximise that funding.

Breaking the myth

If you are opening a restaurant or a cloud kitchen today you need to understand that you will not be able to raise funds on power point presentation. You really need to show proof of concept which means that you will need to open the restaurant, put the equipment, get the customers in, run it for about 6-8 months and show that you are unit positive before you look for an investor. “Proof of concept has become very important and a positive unit economics. Your idea is really solid, your food concept stands apart in the city, you are able to pull the crowd, you are able to do digital marketing right, and you are able to get your catchment area, operation, sourcing right,” shares Sumit Sinha, Angel Investor, Terrals Holdings adding that there are multiple requirements in food business and each need to be right before you actually go out and see funds. One needs to make sure that they are cash positive before they look out for an outside partner.

“You need approach 30-40 investors before you raise fund. But the important thing is you need to be realistic. The money which is coming into the business should be utilised in the plan that the group has made. You buy everything in credit. You do not hold the inventory and you collect everything on cash,” adds Biju Jose Thomas, Director & COO, Vasudev Adigas Fast Food Pvt. Ltd.

Food-tech is no more exciting

The food-tech industry has been harsh. There was an uptake in 2015 but since then there is lots of pressure on food-tech companies. In food-tech one need to touch upon 200 investors before they actually get the funding. “Gone are the days when the angel investor would be your guardian investor who has signed your first check because they like you,” points Kailash Nath, Innovation Fellow, Bharat Innovation Fund. Things have changed a lot in early stage ecosystem where angel investors also ask questions. But they really want to look into the outlook that the brand brings into the business. It’s not about quantum of money but how this money would help the brand make a difference in their growth plan and what’s it that they are adding to in the ecosystem.

It’s More Than Just Food

These days the whole market has divided into two segments. One the restaurant or the one who prepares food and delivers it or serves it at a place verses the ancillary business. There is a downside if you are running a cloud kitchen. But a lot of ancillary businesses which are into analytics, servicing these businesses or into the HORECA model which supplies the raw materials to these models are really doing well. And, investment is really picking up. Both angel and VC community is looking favourable at this sector. “The whole game is about your revenue and the top line and how you are able to sustain it for a longer period and it depends on three factors- your customers, the volumes and the ticket size,” points Anadi Charan Sahu, General Manager & Regional Head, SIDBI, Bengaluru.

The market size of chain outlets is projected to grow to INR 33,250 crore (USD 6.5 billion) by the year 2018. All credit goes to the angel investors, Private Equity (PE) and venture capitalist (VC) firms, across various realms of the market.

Need for Capital

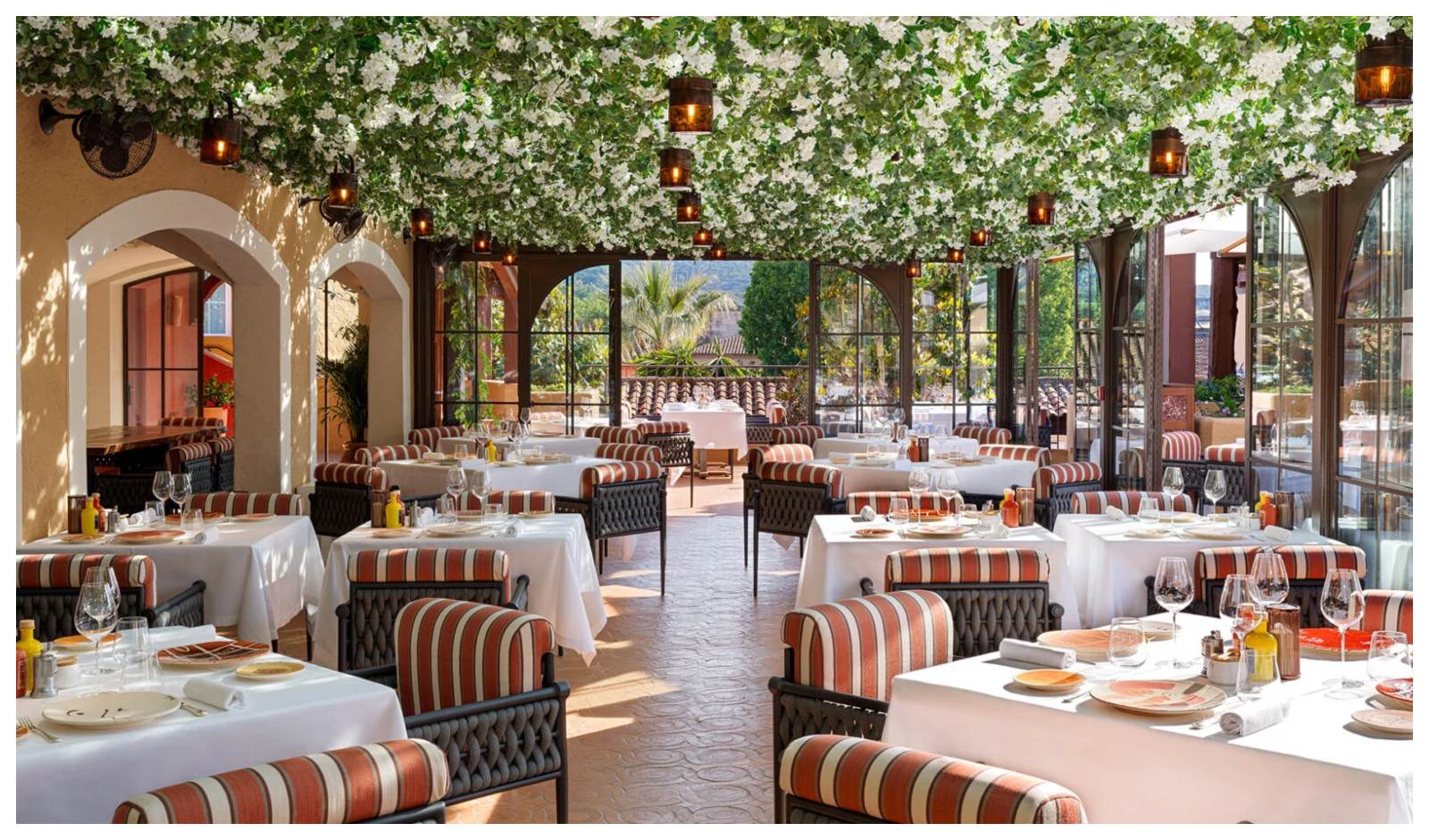

To meet the growing, dynamic consumer needs in the food service market, players need to constantly delight customers through a wide range of products offerings and cuisines, clubbed with distinct flavours and a good ambience. This requires an expansion of business across different formats and locations (given the high real estate costs) and also a smooth supply chain (currently fragmented in India).

Further, the capital- intensive nature of business, together with long gestation periods, inhibits growth in the food services sector in the absence of sufficient funding. Adding to the problem is the difficulty in raising funds from government institutions. Organizations like the Small Industries Development Bank of India (SIDBI) provide financial support only to Micro, small, and Medium Enterprise (MSME), and that too in the form of fixed schemes to meet long-term financial requirements, making it difficult for businesses to use the funds optimally. Even the process of obtaining funds is extremely complex with stringent eligibility criteria.

According to experts, the Private Equity space in India is changing, more and more entrepreneurs are asking very tough questions to investors’ particularly good entrepreneur and good businesses have multiple revenues to raise funds.

Sector Attractiveness

Over the past five years, the organised food services market has emerged resilient even in the face of recessionary pressures and has grown in double digits year-on-year. Many new brands, both Indian and international, have entered the space and are expanding through 3 courses-

- 1)New Cities: Cities beyond metros have now emerged as potential locations for food service outlets, providing volume and a wider customer base to players. Among the top 70 cities in India, ~90% are Tier 1 and tier 2 locations which represent an untapped opportunity for expansion beyond metropolitan cities.

- 2)New Formats: Players are looking to branch out through multiple formats, e.g. by establishing their presence in food courts, through express formats, Kiosks, etc. This enables them to cash in on the potential presented by these formats and, in addition, rationalise on costs, primarily rentals, which is one of the key P & L costs, primarily rentals, which is one of the key P & L cost for any outlet.

- 3) New Locations: With the developing travel infrastructure in the country, the prospects for the future expansion of food services outlets lie in exploring travel retail locations such as highways, airports, and stations. These locations give a captive audience, assure high footfalls and provide brand visibility. Apart from these, opportunities also exist in locations such as educational institutions, office complexes, fuel stations, and hospitals.

- 4)These trends along with the expanding consumer base, mounting disposable incomes, and ever rising drive to experiment, will continue to promote growth in the food services market and thus making it more attractive to investors. Investments have already started pouring into the market, with annual investments totalling INR 1,263 crore (USD 243 million) in 2011, up from INR 350 crore (USD 67 million) in 2010 as per Venture Intelligence.

Investment Opportunities

Over the short to long term, companies can expect to be a part of the food service growth story in different ways:

B2C Opportunities (Front- end)- Business to Consumer growth is the result of the favourable consumer dynamics, the Indian food services market has been on an exponential growth trajectory for the past few years, and generates opportunities in the business to consumer segment.

B2B Opportunities: Business to business opportunity is transaction between businesses, like between a manufacturer and a wholesaler, or between a wholesaler and retailer etc. This also called the back-end investment which exists for PE/ VC firms.

Year 2014-15 saw numbers of food-tech start-ups entering the Silicon Valley with lots of innovative concepts hitting the industry. Chef-driven food-tech aggregators, online food ordering portals, healthy food deliveries and the Ghar-Ka-Khana segments have highly heated Bengaluru during these periods.

The city appears to be a tech-imbued, and has welcomed technology with open arms and the pool of talent has helped make resources easily available and put some great minds together.

According to Compass Report, “Bengaluru boasts an incredibly youthful startup ecosystem, with the youngest average founders’ age of all the top 20 ecosystems.”

Along with IT infrastructure that brings large pool of techies and cosmopolitan culture, Bengaluru has other advantages in terms of educational and entrepreneurial institutes. But now Bengaluru has become a hub for food start-ups. And with some much opportunity, this city provides the best opportunity for home chefs, food experts to make their career.

“I think people are much more aware here about whole startup ecosystem. People here are willing to experiment new things. Bengaluru is an adventurous place, people frequently eat out. So, there is lot of demand. And there is also supply of people. People are early adopters of start-ups here,” shares Sai Priya Mahajan, Co-Founder of Eatlo.

In last couple of months, Foodtech startups in India especially Bengaluru have taken the spotlight, even overtaking the attention from the Indian e-commerce space. From expansion plans of brands like Eatlo, Swiggy, Dazo it seems a trend of not just customers but also VCs putting their money where their mouth is.

Not only this, because of the technical skill of the city, Bengaluru was ranked among top 10 favourite destinations for entrepreneurs and home to more start-ups than any other city in the Indian sub-continent. The tech hub aims to grow 1,000 start-ups in the next three years and also link them with international firms which will support the businesses to expand their operations in India.

Commenting on the same lines, Pushpesh Dutt, Co Founder & Managing Director, Tandurust Healthy Food Pvt. Ltd. says, “People are getting motivated from other startup that has set good examples for others, so that they can also do something. Bengaluru is a cosmopolitan city, so issues regarding good quality food and catering services are there. People come from different parts of country, so they want authentic food and this is the right time to experiment with their innovative ideas.”

Nasscom reported that most startups in Bengaluru are in the field of e-commerce, big data and analytics, enterprise resource planning and productivity and collaboration. 13 percent of the start-ups have been founded by people below the age of 36 years and are inviting investments from countries like China and Japan.

Hence, with a mix of innovative start-ups, aspiring entrepreneurs and food-lovers discussing on various aspects of the food and beverage industry in India, the city is really going to see some more tech-start ups in coming years.

Copyright © 2009 - 2026 Restaurant India.